Investment Banking in a common language can be understood as a part of a Banking System specialized in raising funds for an Organisation (or Individuals), Governments, and other entities along with providing financial aid in important decision-making like Mergers, Acquisitions, Diversification, and Reorganisation. Investment Banking also includes activities like initiating Initial Public Offering (IPO), Underwritings of new securities, guidance in the placement of stocks, conducting financial research, and so on.

Struggling to raise capital for your business? Need advice on issuing your securities in a stock market or assistance in financial management?

No worries, Investment Bank is a package of solutions to all your financial problems. Let’s understand Investment Banking Business in detail.

Every business plan needs a monetary investment and financial management for its execution. However, the owner and his team can arrange and manage finance for a small-scale business, but large-scale Start-Ups and well-established Corporate-Units (both Public and Private) require huge finance to run their business. The primary concern of big units is the Investment and Management of the massive Finance of these units. At this point, a concept of Investment Banking pop-ups as a solution to all the financial problems of big enterprises.

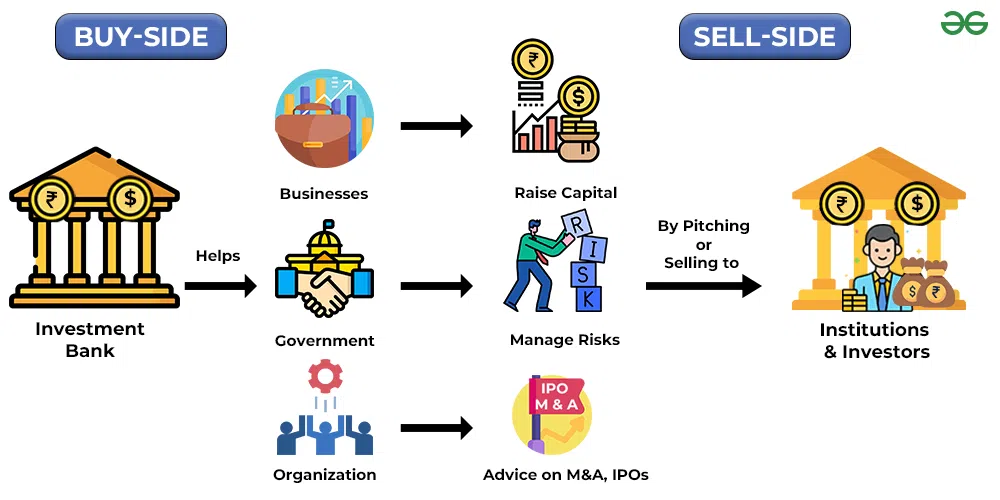

Investing Banking Business is divided into two parts:

- Selling Part: Under this Investment Banks analyze the financial market, promote and sell the debt and equity securities on behalf of their clients with a motive to arrange funds for their projects.

- Buying Part: Investment Banks buy the securities on a large scale for investing in Mutual Funds, Hedge Funds, Pension Funds, and Insurances for money management.

Investment Banks are financial institution that deals in massive and complex financial transactions. These banks are separate from Commercial Banks on the ground that Investment Banks don’t accept public deposits but rather works with a major objective to help their clients to raise capital for their project. These banks hire financial experts as Investment Bankers. Investment Bankers have a complete knowledge of the current economic affairs of the world so, they can make correct and appropriate recommendations to their clients about investments and other financial activities. Investment banking is a highly competitive business that requires expertise in finance, economic affairs, and business strategy.

Some of the World Wide Popular Investment Banks are:

Goldman Sachs, Morgan Stanley, Evercore, J.P. Morgan, Bank of America Corp., Citi Institutional Clients Group, and many more.

In India we have Investment Banks namely:

Axis Bank Ltd., HDFC Bank Ltd., ICICI Securities Ltd, Central Bank of India, IDBI Capital Market Services Ltd., etc.

What do Investment Banks Do?

When we think of the activities of Investment Banks, our thoughts revolve around one fact “Investment Banks help their client in raising funds for their businesses”. But, in reality, there are a number of financial services provided by these banks. Let’s talk in brief about them:

1. Advice on the Issue of new securities

Investment Banks conduct proper research and analyze the financial market conditions, economic affairs, and other business strategies to provide the best advice on the issue of both Debts as well as Equity securities to their client. They extend their recommendation on the pricing of the securities and also help in completing all the paperwork.

2. Raising Funds

When we talk about the business objective of Investment Banks, helping the clients raise funds for the project seeks our major attention. They help in the issue of securities which is the main source of capital for any institution and also suggest other sources of capital. Besides, it suggests the appropriate debt-equity ratio for the business after analyses of Market conditions.

3. Underwriting Facilities

Underwriting becomes important, especially in the case of IPO because, as per the Companies Act, 2013 no company can issue the shares without receiving a minimum of 90% of the subscription application. To avoid getting into such situations, Companies avail of underwriting facilities from Investment banks. As an underwriter, these banks buy the securities from the company directly and then sell them to the investors. They bear the risk of under-subscription for some commission.

4. Trading Securities

Investment Banks trade on debts and equity instruments on behalf of their clients or on their own accounts.

5. Guidance in Merger, Acquisition, and Reorganisation

Investment Banks’ advice about the worth and opportunities of the company in case of Merger, Acquisition, and Reorganisation. They extend their advice on valuation, negotiating terms, and structuring the deal.

6. Financial Advisor

Investment Banks not only extend their valuable suggestion and advice on above mentioned circumstances but serve as financial advisors for Institutional clients even in the case of Buy-Back of shares and Disinvestment. Investment banks assist companies in implementing share buybacks by providing advice on timing, pricing, and executing the buyback in the market. Similarly, helps companies with valuation, structuring the deal, and finding potential buyers for the assets in the case of Disinvestment.

How to get into Investment Banking?

Investing Banking business is one of the most complex and competitive structures of the financial sector. Before getting into Investment Banking, one should have a personal interest in finance, communication skill, interpretation and analytical skills, and personal attributes. However, the following points shall be taken into consideration for this purpose:

1. Obtaining relevant and appropriate degrees

Investment Banking jobs are competitive jobs with lots of complex activities. A proper high-level educational degree is required to enter this field. Some of such qualification includes BSc in Finance (Investments), Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), Certificate in Investment Management (IMC), and Portfolio Management.

2. Participating in an Internship

Degrees are not enough to get you a job to understand the complexity of the financial market, one should gain experience by participating in internship programs at Investment Banks, cooperative educational programs, or entry-level jobs in finance or accounting.

3. Working on strong analytical and communication skills

Investment Bankers have to deal with massive data every day. It’s important to work on analytical skills to understand complex financial data. Not only analysing and understanding is enough, one should have good communication skills to convey such data interpretation to their clients. Such expertise comes with practice, coursework, and extracurricular activities.

4. Building a network

Building networks and connecting to professionals is another mantra to grow in this career. Attending networking events, career fairs, and informational interviews are steps to building such connections. Besides, technology makes it easier by providing online platforms (LinkedIn) to connect with such professionals from any part of the world.

5. Interview Preparation

All the knowledge and experiences shall be executed to crack an interview. Be smart enough to answer technical and behavioural questions. Learn to communicate your skills and personal attributes along with justifying why such skills and attributes make you perfect for the job.

6. Continuous Up-gradation process

Investment Banking business is not just complex but also versatile due to the continuously changing nature of the financial market and economic affairs. So, to grow in this field person shall be open to the learning process and up-gradation courses to grab the opportunities coming on the way.

Share your thoughts in the comments

Please Login to comment...