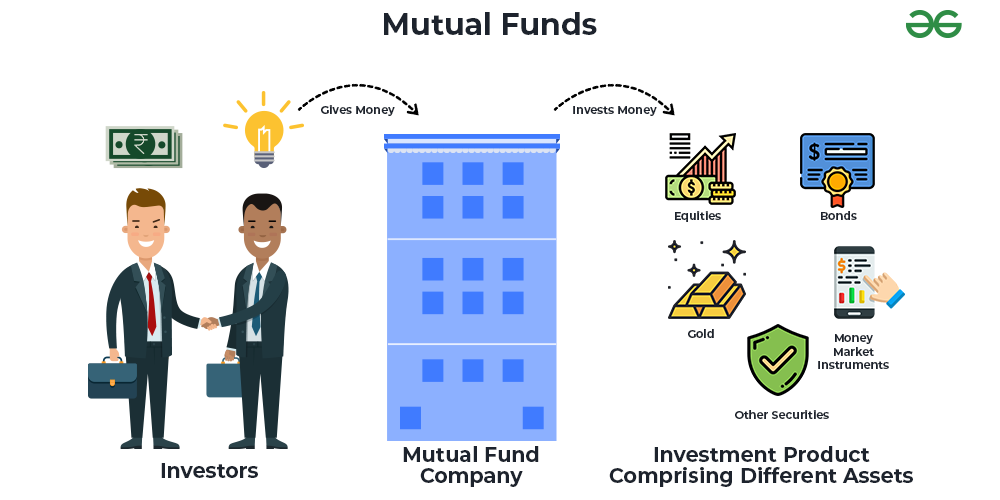

Mutual Funds can be defined as money pooled by a large number of people (Investors) having one common investment objective. The money collected under the scheme, usually run by an asset management company, is then invested in equities, bonds, money market instruments, and other securities by professional fund managers of the Mutual Funds. The portion of holding of the fund is provided as ‘Units’ to each investor in proportion to the amount invested by them. The income generated from the scheme is distributed among all the investors in proportion to their investment, by calculating Net Asset Value or NAV.

Who is Professional Fund Manager?

Professional fund managers are experienced and competent persons who have seen many economic cycles, business developments, and political & policy changes and are responsible for managing the funds and making profitable investment decisions on the investors’ behalf.

What is Systematic Investment Plan?

Systematic Investment Plan, commonly known as SIP is an investing channel initiated by Mutual Funds, under which one can invest a fixed amount at predetermined time intervals in Mutual Fund Scheme. Such an amount is generally invested every month, but it could be invested once a week, once in a quarter, half-yearly, or even annually. The system of SIP can be easily understood as a recurring deposit under which a certain fixed amount is deposited on a specific date for a predetermined time period.

What is Net Asset Value (NAV)?

Net Asset Value (NAV) denotes the performance of a particular scheme of a Mutual Fund. NAV can be defined as the market value of all the securities (equities, bonds, money market instruments, and other securities) held by the scheme. The money collected from investors under the Mutual Fund scheme is invested in various securities in the market. Since the market value of securities changes every day, the NAV of a scheme also fluctuates on day to day basis.

The market value of all the securities (equities, bonds, money market instruments, and other securities) of a scheme is divided by the total number of units of the scheme to find out the NAV per unit of the scheme on any particular date.

What is Extended Internal Rate Of Return (XIRR)?

Extended Internal Rate Of Return, commonly known as XIRR is an rate of return applied to every installment that happen at irregular intervals on an investment. XIRR is a method used to calculate returns on investments where there are multiple transactions happening at irregular intervals. XIRR is commonly used to find the returns on mutual fund SIP.

How do Mutual Funds Work?

The portion of holding of the fund is provided as ‘Units’ to each investor in proportion to the amount invested by them. The income generated from the scheme is distributed among all the investors in proportion to their investment, by calculating Net Asset Value or NAV. NAV can be defined as the market value of all the securities (equities, bonds, money market instruments, and other securities) held by the scheme.

For example, if a person invests ₹5,000 in a mutual fund with a NAV of ₹20, he will get 250 Units ([Tex]\frac{5000}{20}[/Tex]) of the mutual fund.

Now, NAV of a scheme fluctuates on day to day basis, i.e., if the market value of any security that a mutual fund invests in goes up, the same will reflect in the NAV of the mutual fund. So if the NAV of the mutual fund goes up to ₹30, then the value of 250 Units that amounted to ₹5,000 will now amount to ₹7,500. If the investor chooses to redeem their mutual funds on this date, they shall receive ₹7,500 against the originally invested amount, i.e., ₹5,000.

Types of Mutual Funds

Mutual Funds can be categorized on the basis of Asset Class, Types of Securities Opted, Investment Goals, Risk Factors, and so on.

A. Based on Asset Class

1. Equity Mutual Funds: Equity Mutual Funds can be defined as a pool of funds collected from various investors and invested in a diversified portfolio of equities (stocks) across different sectors and market capitalisations. Equity mutual funds are a popular investment option that offers individuals the opportunity to invest in the stock market without directly buying individual stocks. It is consist of Multi Cap Funds, Large Cap Mutual Fund, Mid Cap Mutual Funds, Small-Cap Mutual Funds, Value Mutual Funds, Focused Fund, Dividend Yield Mutual Funds.

2. Debt Schemes Mutual Funds: Debt mutual funds are a category of mutual funds that primarily invest in fixed-income securities such as government and corporate bonds, treasury bills, commercial papers, and other debt instruments. These funds aim to provide regular income along with the preservation of capital. It is consist of Overnight Fund, Liquid Mutual Fund, Ultra Short-Term Mutual Funds, Low Duration Mutual Funds, Medium Duration Mutual Funds, Corporate Bond Debt Funds, and Gilt Funds.

3. Hybrid Schemes Mutual Funds: Hybrid mutual funds, also known as balanced funds, are investment vehicles that combine different asset classes within a single fund. These funds invest in a mix of both equity and debt instruments to provide a diversified portfolio that aims to balance returns and risks. It is consist of Balanced Fund, Aggressive Mutual Funds, Dynamic Mutual Funds, Arbitrage Funds, and Equity Savings Schemes Funds.

4. Money Market Funds: Money Market Funds (MMFs) are defined as a type of fund that offers investors an easily accessible way to manage their cash while preserving their invested capital.

B. Based on Investment Goals

Investment goals-based mutual funds are income funds that are known as a type of fund designed to provide investors with a consistent income flow.

C. Based on Maturity Period

Maturity period based mutual funds invest in funds which is consist of Open Ended Funds, Closed Ended Mutual Funds, and Interval Funds. These mutual funds best suited for liquidity preference, diversification seekers, short-term goals investors, low to moderate risk tolerence, unconventional assets seekers

D. Sector Mutual Funds

Sector mutual funds are equity investment plans that focus on a specific economic sector. Sector mutual funds are also known as sectoral funds, which can invest in stocks of firms with different market capitalisations and security classes. These funds enable investors to invest in the best-performing stocks of a certain sector. Utilities, energy, and infrastructure are examples of such sectors. It is consist of Index Funds, Global Mutual Fund, International Mutual Funds, Real Estate Funds, Multi-Asset Allocation Fund, and Exchange Traded Funds (ETF).

E. Other Funds

Other mutual funds are Commodity Mutual Funds and Hedge Funds. Mutual Fund that primarily invests in commodities and offers returns to investors based on the market performance of the commodity chosen by the AMC or fund manager. A hedge fund is an unregistered private investment partnership that brings together money from many people or groups to invest in different markets, strategies, and instruments.

Benefits of Mutual Funds

1. Diversification: Mutual funds collect money from multiple investors to buy a basket of securities, like stocks, bonds, or a combination. This instant diversification reduce risk by spreading it across various assets, reducing the impact of volatility in any one of them.

2. Professional Management: Skilled fund managers manage the fund actively, selecting and modifying investments based on market conditions and the fund’s objectives. Individual investors are no longer required to conduct study and analysis on numerous choices.

3. Lower Costs: Buying individual stocks often incurs high transaction fees like Equity Brokerage, STT (Securities Transaction Tax), Stamp Duty, Exchange Transaction Charge, SEBI Turnover charge, DP charge, Investor Protection Fund Trust charge. Mutual funds benefit from economies of scale, offering investors access to a diversified portfolio at a fraction of the individual cost. Mutual funds incurs charges like

- Entry Load: In the past, investing in a mutual fund sometimes meant paying an “entry load” fee – basically a charge for entering the fund scheme. This fee helped cover the costs of marketing and selling the fund. But since 2009, Indian regulations forbid mutual funds from charging entry loads. So, when you invest in a mutual fund today, you don’t pay any extra fee on top of your investment amount.

- Exit Load: When you invest in a mutual fund, you are purchasing fund units. However, if you need to sell those units before a specific period of time (generally one year), the fund company might charge you an exit load. This is similar to a fine for quitting early.

- Expense Ratio: Each year, the expense ratio deducts a small percentage (usually around 1% of your mutual fund investment). This charge covers the fund’s operating expenditures, such as the fund manager’s compensation, marketing, and administrative costs. Low expense ratio: 0.5% or less, Moderate expense ratio: 0.5% to 1%, & High expense ratio: above 1%.

- Transaction Charges: Transaction fee of ₹100 to ₹150 may apply to investments of Rs. 10,000 or more, regardless of whether it is a one-time investment or a SIP installment. Smaller investments of less than Rs. 10,000 incur no transaction fee.

4. Convenience: Mutual funds make it simple to invest and manage money. Investors can select from a wide range of funds based on their risk tolerance and financial objectives, make regular contributions with minimal effort, and conveniently track their investments using online platforms.

5. Liquidity: Most mutual funds offer high liquidity, allowing investors to easily sell their shares and access their money quickly, if needed. This flexibility comes in case of unforeseen expenses or changing financial circumstances.

6. Additional Benefits: Investors may benefit from tax advantages, automatic dividend reinvestment, and the possibility of recurring income in the form of interest payments, depending on the type of fund.

Risks of Mutual Funds

While Mutual funds offer multiple benefits, investing in mutual funds also comes with certain risks to consider:

1. Market Risk: Mutual funds are still subject to overall market fluctuations. Even with diversification, major market downturns can have a negative influence on the fund’s value.

2. Investment Risk: The specific investments chosen by the fund manager may underperform, leading to losses for investors. Careful research and understanding of the fund’s strategy and holdings are crucial.

3. Management Risk: The skill and decisions of the fund manager can significantly impact the fund’s performance. It is Important to choose a fund with a reputable manager with a proven track record is essential.

4. Fees and Expenses: Mutual funds charge various fees, including as expense ratio and transaction charges, which can reduce returns over time. Comparing fees and choosing low-cost funds is crucial for maximizing investment returns. if you invest in a fund which has high expense ratio then it will reduce your overall fund returns.

5. Tax Implications: When selling mutual fund shares, capital gains taxes may apply depending on the type of fund and investment income. Understanding the tax implications of mutual fund investments is best accomplished by consulting with a tax adviser.

How to Buy and Sell Mutual Funds?

Well, there are several ways to invest in mutual funds, and some of the most common ways are discussed below:

1. Asset Management Companies (AMCs): Investors can immediately approach AMCs to invest in their mutual fund schemes. AMCs provide application forms, which need to be filled out with the specified information and accompanied by the investment amount. Payments can be made via check, demand draft, or online modes. SBI Mutual Fund, ICICI Prudential Mutual Fund, HDFC Mutual Fund, and UTI Mutual Fund.

2. Online Platforms: Many online platforms and brokerages facilitate mutual fund investments. These systems provide a user-friendly interface and monthly browse and pick out the best mutual funds on the basis of funding goals, risk appetite, and past overall performance. Investors can complete the investment process online, making it handy and clear. Mutual funds online platforms in India such as Groww, Zerodha and Upstox.

3. Systematic Investment Plans (SIPs): SIPs allow investors to invest in a set amount at regular periods (month to month, quarterly, and so forth.) instead of lump-sum investment. This technique helps in averaging the investment value and reduces the effect of market volatility over time.

4. Systematic Withdrawal Plans (SWPs): SWPs enable investors to withdraw a fixed amount periodically from their mutual fund investments. This is appropriate for those who require a regular income stream from their investments while maintaining the major amount invested.

Buying of Mutual Fund

Buying of Mutual Fund can be done via your Bank, AMC, and Online Platform. You just need to fill their mutual fund application.

Step 1: Complete your KYC

Step 2: Choose your mutual fund scheme you want to buy

Step 3: Decide on investment amount for every month

Step 4: Place your order

Step 5: Monitor your portfolio

KYC Requirement:

- PAN card: Your PAN number is mandatory for your KYC.

- Identity and address proof: You can use any document in this regard, including your driver’s license, passport, and Aadhar card. You may also use your electricity bills as evidence of your address, but in that case, you’ll need to present an additional ID proof.

Past performance of any mutual fund scheme does not predict the future performance of the mutual fund Schemes.

Selling of Mutual Fund

Selling of mutual fund can be done your Bank, AMC, and Online Platform. You need visit your bank, AMCs office or online. Go to your broker website to sell your mutual fund holding.

Step 1: Log in to your account

Step 2: Select the fund and units which you want to sell

Step 3: Confirm the transaction

Make sure to check your fund exit load structure before selling. Calculate the tax liability before redeeming the mutual fund. Selling mutual fund units at a profit will be capital gains tax. Observe the market sentiment and how it might affect redemption value because your investment will compound in the long run.

When to Consider Selling Mutual Funds?

Mutual funds provide diversification, but timing is everything when it comes to selling the Mutual funds units. An exit could be driven by changes in the fund itself, such as a new fund manager or changed goals. Other good reasons are reaching your financial objectives, underperforming consistently, mutual fund overlap, or having a fund size that exceeds the allowed restrictions. Decisions may also be influenced by the need to face financial emergencies, rebalance your portfolio, or pursue tax benefits. Less frequently occurring incentives include market timing and changing investing preferences, but being aware of these gives you the power to choose your mutual fund holdings wisely. Remember that a calculated withdrawal may be just as important as a calculated entrance!

Why Should You Invest In Mutual Funds?

Some of the reasons that make mutual funds the best investment alternative are mentioned below:

1. Professional Expertise: Investing your hard-earned saved money in the market is a critical job to do. One needs to research the market and properly analyze the market and choose the best option available among the various investment alternatives. A significant amount of time and commitment is required to gain knowledge about the macro economy, different sectors, company’s financials, etc. before investing.

Investing in mutual funds can save individuals from all these because, in mutual funds, funds are managed by professional fund managers. Professional fund managers are experienced and competent persons who have seen many economic cycles, business developments, and political & policy changes and are responsible for managing the funds and making profitable investment decisions on the investors’ behalf.

2. Potential Higher Returns: Investing in mutual funds can give potential higher returns as compared to traditional investment options. Mutual funds don’t have fixed interest rates but are linked to the market’s performance. Market performing well guarantees a better return when invested through mutual funds. However, it can also negatively affect returns when the market does not perform well.

3. Diversification: In mutual funds, investment is diversified as the whole amount is not invested in one alternative but in various alternatives. Investing in a single asset is not preferable in any scenario, as there is a risk of loss if market crashes. With a diversified portfolio risk of loss is minimised. In mutual funds, professional fund managers include as many as 30 stocks across different sectors in a single fund. By choosing to invest through mutual funds, investors achieve diversification instantly.

4. Tax Benefits: Investors can claim a tax deduction of up to ₹1.5 Lakh under Section 80C of the Income Tax Act by investing in the Equity Linked Savings Scheme (ELSS). Equity Linked Savings Scheme (ELSS) is a specially designed scheme for individuals who want to save tax. It comes with a lock-in period of 3 years, i.e., one can only withdraw their money after the lock-in period ends.

5. Transparency: Mutual funds are transparent in nature. Scheme Information Document carries details about the holdings, fund manager, etc., and are easily available on the fund house’s website and other sources as well. Any investor can track the NAV of the fund anytime they want and take the decision about whether they want to continue with their investment or move to a different alternative.

List of Asset Management Companies

UTI Mutual Fund

| Tata Mutual Fund

| SBI Mutual Fund

|

LIC Mutual Fund

| Bajaj Finserv Mutual Fund

| WhiteOak Capital Mutual Fund

|

HDFC Mutual Fund

| PPFAS Mutual Fund

| Quant Mutual Fund

|

Motilal Oswal Mutual Fund

| Nippon India Mutual Fund

| Groww Mutual Fund

|

Kotak Mahindra Mutual Fund

| Franklin Templeton Mutual Fund

| Navi Mutual Fund

|

Mutual Funds vs. Index Funds vs. Exchange-traded funds (ETF)s

Difference between Mutual Funds, Index Funds and ETFs.

| Basis | Mutual Funds | Index Funds | ETFs |

|---|

Minimum Investment

| ₹100 or ₹500

| ₹100 or ₹500

| One Unit at market price.

|

| Expense Ratio(management fees) | High | Medium | Low |

| Demat Account | No Demat account required | No Demat account required | Yes Demat account required |

| Liquidity | It has high liquidity as more number of investors | It has high liquidity as more number of investors | It has Low liquidity as Less number of investors |

| Effort | Efforts are required to manage the fund | Not much effort is required to manage the fund | Efforts are required to understand the pricing |

Examples

| SBI Contra Fund, Axis Midcap Fund, Motilal Oswal Mutual Fund, & Edelweiss Mutual Fund

| Nifty Index Fund, S&P BSE Sensex Index Fund

| Kotak Gold ETF, Motilal Oswal Nasdaq 100 ETF,SBI ETF Sensex

|

FAQs

1. What are mutual funds?

Answer:

Mutual Funds can be defined as money pooled by a large number of people (Investors) having one common investment objective.

2. Is mutual fund good or bad?

Mutual fund has both good and bad sides for investors, good side includes diversification, professional management, lower costs, convenience, and liquidity. Bad sides include market risk, investment risk, management risk, high expense ratio, and tax implications. The investor has to decide which mutual fund scheme is right for him/her.

3. Is mutual funds safe?

Mutual funds are regulated by financial authorities and diversify your investment over multiple assets to lessen the impact of losses in any one of them. However, there are risk factors such as market volatility, fees, and fund-specific risks.

4. What is the difference between SIP and mutual fund?

Mutual funds are investment products, and SIPs are a way to invest in them.

5. How much should I invest in a mutual fund?

Experts recommend to invest 20% of your monthly income, but consider your goals, risk tolerance, and other investments. Make sure to invest in long run to get great returns.

Share your thoughts in the comments

Please Login to comment...