Transfer Pricing Methods

Last Updated :

18 Sep, 2023

Transfer Pricing is an accounting and taxation practice that involves determining the cost of transactions between two or more related companies that are broadly operated by the same parent company. In order to calculate the transfer price between various entities, we have various methods. Methods of transfer pricing are divided into two categories, traditional transaction methods and transactional profit methods. Traditional Transaction Methods undertake individual transactions and cover the comparison of third-party transactions with that of the organisation. Transactional Profit Methods look for the overall company’s profit and do not consider individual transactions. These methods consider the overall profits of the business and then compare them with the profits of third-party companies.

What is Transfer Pricing?

Transfer Pricing can be defined as the determination of the cost of transactions of goods and services between two related companies owned and/or operated by the same parent company, often across international borders. Companies often use transfer pricing to avail themselves of tax benefits. Multinational companies avail the benefits of different tax regimes by practising transfer pricing. The main objective of transfer pricing is deciding the transaction costs of these intra-group transactions.

Methods of Transfer Pricing

I. Traditional Transaction Methods

1. Comparable Uncontrolled Price Method (CUP Method)

Comparable Uncontrolled Price (CUP) Method can be defined as the comparison of price and conditions of products/services of a controlled transaction with an uncontrolled transaction. Under this method, CUP needs to know the comparable data. So, uncontrolled transactions need to meet high-level comparability. In order to meet this requirement, the uncontrolled transaction must be similar to the controlled transaction. This method is considered to be the most suitable method and is suggested by the OECD to be used as and when possible. Also, there are two ways to determine the transfer price, internal CUP and external CUP. Internal CUP involves the transaction made between the organisation and an unrelated third party. External CUP involves transactions between two unrelated parties.

For example, suppose two companies, Company A and Company B are involved in the manufacturing of electric components. Company A is a subsidiary of a multinational corporation, while Company B is an unrelated third party. Company A purchases a specific specific electronic component from Company B and wants to determine the transfer price.

2. Resale Price Method (RPM)

The Resale Price Method (RPM) is one of the transfer pricing methods used by multinational companies to determine whether the prices at which they sell products/services to their related parties are at arm’s length. It means they are consistent with the pricing that would occur between unrelated parties in an open market. The RPM is often applied when a company purchases a product from a related supplier and resells it without significant value added. For example, Consider a multinational company, Company X and Company Y, in a different country. Company Y imports smartphones from Company X and then resells them in its local market. Company Y wants to ensure that the transfer price for these smartphones is at arm’s length to comply with transfer pricing regulations.

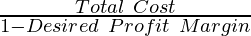

3. The Cost Plus Method (CPLM)

The Cost Plus Method (CPLM) is a pricing method used by businesses to determine the selling price of a product or service by adding a markup to the cost of producing that product/service. This method ensures that a company covers its costs while generating a desired level of output.

For example, Consider a small manufacturing company, Company XYZ, that produces custom-made furniture. Company XYZ wants to set the selling price for a new custom-designed dining table for a customer. The company needs to ensure that it covers the costs and earns a 20% profit margin on this product. First, Company XYZ needs to calculate the overall cost of producing the custom dining table. This will include all the direct and indirect costs. After applying the markup percentage to the cost price, the selling price can be determined. Assume Company XYZ have to incur $500 on materials, $300 on labour, and has indirect costs costing $200. Company XYZ wants a desired profit of 20%.

Total Cost = Direct costs (Materials and Labour) + Indirect Costs

Total Cost = $500 + $300 + $200 = $1,000

Given, Desired Profit Margin = 20% or 0.2

Selling Price =

=

Hence, Selling Price = $1,250

II. Transactional Profit Methods

1. The Comparable Profit Method (CPM)

The Comparable Profit Method (CPM) is a transfer pricing method used by multinational companies to determine whether the profits earned in a controlled transaction are consistent with what would be expected in an open market transaction between unrelated parties. CPM compares the profitability of the controlled transaction to the profitability of comparable uncontrolled transactions to assess its arm’s length nature. For example, Consider a multinational company, Company A manufactures electronic components and Company B assembles these components into finished products, which are then sold locally. Company A charges Company B for the supply of components. Company B wants to ensure that the transfer price for these companies is at arm’s length.

2. The Profit Split Method (PSM)

The Profit Split Method (PSM) is a transfer pricing method used by multinational companies to determine the appropriate allocation of profits among related entities involved in a controlled transaction. This method is often applied when multiple entities make unique and valuable contributions to a business activity, such as product development, marketing, or distribution. The PSM aims to ensure that each entity receives its fair share of the overall profits generated. For example, Consider a multinational company, Company XYZ, with two subsidiaries, Company A and Company B. Company A is responsible for product design and development, and Company B is responsible for manufacturing process and distribution. Both subsidiaries contribute significantly to the success of a new product, and Company XYZ wants to allocate profits fairly between them.

Share your thoughts in the comments

Please Login to comment...