Types of Crossing of Cheques

Last Updated :

20 Sep, 2023

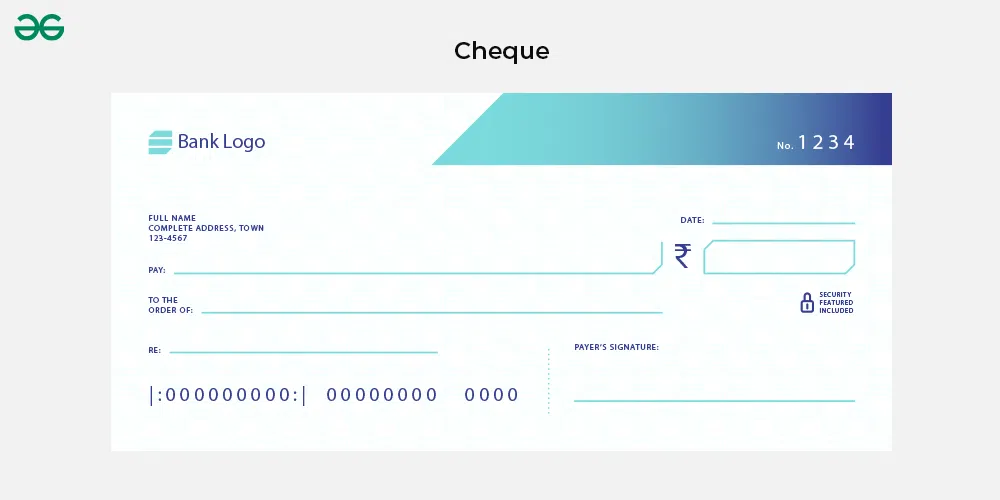

What is a Cheque?

A cheque can be defined as a document that instructs the bank to pay a specific amount to the person whose name is written on the cheque. A cheque is a negotiable instrument governed by the Negotiable Instrument Act, of 1881 i.e. it promises its bearer a payment of the specified amount on furnishing the document to the banker.

As Per Section 6 of the Negotiable Instruments Act, of 1881, “A cheque is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand and it includes the electronic image of a truncated cheque and a cheque in the electronic form”.

How Many parties are there in a Cheque transaction?

There are a total of three parties in a transaction facilitated by a cheque which includes,

1. Drawer: The person who makes and signs the cheque and promises to pay the debtor a specific amount.

2. Drawee: In the case of a cheque Drawee is always the bank on whom the cheque is drawn and it’s the responsibility of Drawee to make the payment.

3. Payee: The person in whose favour the cheque is drawn, his name is written on the cheque he is the person in whose name the cheque is endorsed.

Types of Cheques

There are two types of cheques available one is called Open cheques, and others are Crossed cheques.

1. Open cheque: Any basic cheque without crossing is an Open cheque. They can be presented to the Drawee i.e. the bank, and the holder of the open cheque is entitled to get the amount written on the cheque at the bank counter. However, if the open cheque gets lost and any stranger has an open cheque, he/she can claim the payment from the bank counter even though he/she is not the actual owner.

2. Crossed Cheque: When a cheque contains two parallel transverse lines, the cheque is called a Crossed cheque. The parallel lines can be drawn anywhere on the cheque but the general practice is to draw on the top left corner. Here the holder of a crossed cheque can not get payment on the counter.

What is the Crossing of Cheques?

Crossing is a unique feature associated with a cheque affecting to a certain extent the obligation of the paying banker. The crossing is like an instruction to the paying bank not to make payment on the bank counter rather payment shall be made through a bank account only so that no wrong person can take the payment to the said cheque. The crossing of a cheque is effected by drawing two parallel transverse lines with or without the words ‘and company’ or any abbreviation thereof. This ensures a level of security for the payer since it needs the funds to be handled with a collecting bank. Cheque writers can use crossed cheques to protect the amount transmitted from being cashed by an unauthorised person or stolen, as Crossed Cheques can only be paid through a bank account.

.webp)

Types of Crossing

1. General Crossing

When a cheque only possesses two parallel transverse lines without having anything written between them is called General Crossing, When a cheque possesses General Crossing the payee bank can only pay the said cheque to a banker. This protects the issuer of the cheque as the amount can only be credited to the bank account of either the named payee or an endorsee.

2. Special Crossing

Where the line of crossing has the name of a specific banker, then the payment can be obtained only by the said bank whose name is written between the crossing of lines. The drawing of two parallel lines is not necessary in the case of a specially crossed cheque. The object of special crossing is to direct the drawee banker to pay the cheque only if it is presented through the particular bank mentioned therein. This makes cheques safer.

.webp)

3. Account Payee Crossing

When the cheque has “A/c Payee” written between the crossed lines and “A/c Payee” is added to a case of general or special crossing then it is Restrictive crossing. In this case, the collecting bank has to credit the amount of the cheque in the payee’s bank account only. It is also considered the safest form of crossing and is widely used in the market.

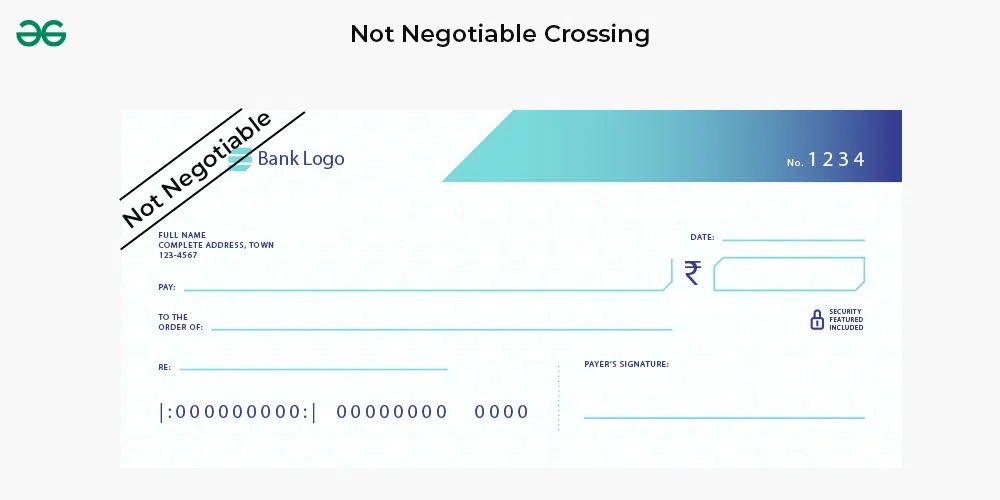

4. Not Negotiable Crossing

When “Not Negotiable” is written between the crossing lines, the cheque is said to be a non-negotiable cheque. The effect of this cheque is that the person accepting a “Not Negotiable” cheque shall not be allowed to pass the title of “Holder” to any other person i.e. a better title can’t be passed on to any other Party/Person. However, this crossing doesn’t affect the transferability of the cheque. A bank, therefore, should be extra careful in paying such cheques. The payment should be made only after he is satisfied that the person demanding payment is the person entitled to receive it.

Who may cross a Cheque?

A cheque can be crossed by three parties:

1. The Banker: Only an uncrossed cheque can be crossed by a bank, or a general crossed cheque can be converted into a special crossing for collection to direct another banker or any banking agent.

2. The Drawer: The drawer can cross the cheque by either General crossing or special Crossing.

3. The Holder: The holder can cross the cheque by general or special also he can add the word “Not Negotiable” and also make an uncrossed cheque crossed.

Share your thoughts in the comments

Please Login to comment...