National Stock Exchange Fifty (NIFTY): Full Form, Calculation, Advantages and Disadvantages

Last Updated :

16 Jan, 2024

What is NIFTY?

NIFTY can be described as a market index introduced by the National Stock Exchange (NSE) to represent the performance of the top 50 largest and most liquid stocks listed on the NSE. It is a term that is used in the Indian share market introduced by the National Stock Exchange (NSE) on 21st April 1996 in India. NIFTY is one of the most widely followed equity indices after BANK NIFTY and SENSEX in India and serves as a key indicator of the Indian stock market’s overall health and performance.

NIFTY Stands for National Stock Exchange Fifty means it is an index that represents the growth of the top 50 largest companies in India. NIFTY changes on a daily basis depending upon the growth of the top 50 companies, so basically, changes in the NIFTY index reflect changes in the collective value of these 50 stocks in the Indian share market.

Top Companies that are listed under NIFTY

These are some of the top companies in the NIFTY index with their market cap and percentage in the index.

Company Name

| Sector

| Market Cap(in Crore)

|

|---|

| Reliance Industries | Oils, gas & fuel | 1645058

|

| Tata Consultancy Services | IT services | 1264404

|

| HDFC Bank | Banks | 1220018

|

| ICICI Bank | Banks | 675909

|

| Infosys | IT services | 608442

|

| Hindustan Unilever | Personal Products | 589043

|

| ITC | FMCG/Tobacco | 555861

|

| State Bank of India | Banks | 517003

|

| Bharti Airtel | Telecom Services | 508002

|

**as on 12th September 2023

How NIFTY is Calculated?

NIFTY index is calculated by using some unique methods on a daily basis in the share market, the methodology is known as “free-float market capitalisation-weighted method.” With the help of this method, some professionals manage the NIFTY index on a daily basis and maintain the index according to the top 50 companies’ growth of loss.

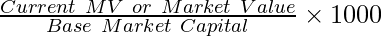

So, the formula for calculating the price index is:

Index Value =

Note: The base year taken to calculate the index value is 1995.

This formula is used to calculate the overall index of NIFTY, and this index is a benchmark standard against which all equity markets in India are measured, like SENSEX and BANK NIFTY.

Usage of NIFTY in the Indian Stock Market

Basically NIFTY is the backbone of the NSE and the Indian Stock Market. With the help of NIFTY, like index, trades are possible in the market. Some more uses of NIFTY are:

1. Asset Allocation: Asset allocation decisions are influenced by the NIFTY index. Investors may adjust their allocation to equities, bonds, or other asset classes based on their outlook for the stock market reflected in the NIFTY’s performance.

2. Investment and Portfolio Management: Investors and fund managers use NIFTY as a benchmark to evaluate the performance of their investment portfolios. They compare their returns to the NIFTY index to determine how well their investments are doing relative to the market. This helps them to maintain their portfolio in a better way.

3. Benchmark for Market Performance: As we have already seen, this is the most used index in the Indian Stock market, so NIFTY serves as a key benchmark for measuring the overall performance of the Indian stock market. It provides a reference point for investors, traders, and fund managers to assess how well the market is performing.

4. Global Investment: International investors use the NIFTY index as a gauge of the Indian equity market’s attractiveness. It helps them assess the risk and return potential of investing in Indian stocks.

5. Index Funds and ETFs: Exchange-traded funds (ETFs) and index funds are designed to replicate the performance of the NIFTY index. These investment products allow retail and institutional investors to gain exposure to a diversified portfolio of NIFTY-listed stocks with a single investment.

Difference between NIFTY and SENSEX

Basically NIFTY and SENSEX both are major indexes that are used in the Indian share market to see the graph of companies and market. So basically, they are the two of the most prominent stock market indices in India, and they represent different segments of the Indian stock market.

Let’s see some differences between NIFTY and SENSEX to understand both of them in a better way:

Basis

| NIFTY

| SENSEX

|

|---|

| Stock Exchange | NIFTY basically works on NSE, which is the National Stock Exchange of India. | SENSEX works on BSE (Bombay Stock Exchange). It is also known as BSE SENSEX. |

| Composition | NIFTY comprises the 50 largest and most liquid stocks listed on the NSE. | SENSEX consists of 30 of the largest and most actively traded stocks listed on the BSE. |

| Exchange of Listing | NIFTY-listed stocks are primarily listed on the NSE. | SENSEX-listed stocks are primarily listed on the BSE. |

| Size and Representation | NIFTY represents a larger size because it has 50 companies. | SENSEX has a smaller size than NIFTY because it has 30 companies. |

| History and Origin | NIFTY was launched on April 22, 1996, by the National Stock Exchange of India. | SENSEX has a longer history and was first compiled on January 1, 1986, by the Bombay Stock Exchange. |

| Calculation Method | NIFTY is calculated using the free-float market capitalisation-weighted method. | SENSEX, on the other hand, uses a different method called the “market capitalisation-weighted” method. |

Advantages of NIFTY

As we see, it is the index on which the almost complete market depends, so let’s see the major advantages of using the NIFTY index and trading in NIFTY:

1. NIFTY represents a diversified portfolio of 50 of the largest and most liquid stocks listed on the National Stock Exchange (NSE). So, it becomes easy to invest in it with less risk.

2. The NIFTY index includes highly liquid and actively traded stocks, making it easy for investors to buy and sell index-linked products like index funds and exchange-traded funds (ETFs).

3. NIFTY derivatives, such as NIFTY futures and options, are actively traded and are an effective tool for risk management.

4. NIFTY’s prominence in the Indian financial markets means that it receives global attention. International investors often track the NIFTY index as they consider investing in Indian equities, and it provides a sense of India’s economic and market stability.

5. NIFTY is used as a reference for various financial products, including structured products, mutual funds, and insurance policies. These products may be linked to the performance of the NIFTY index.

Disadvantages of NIFTY

1. Highly volatile: Sometimes, it becomes quite risky for investors to invest in the NIFTY index because of its nature of high volatility.

2. Large Market Cap: NIFTY is valued very highly in terms of market capitalization making it very difficult even for professionals to track and invest in it.

3. Overvaluation Risk: If the overall market or specific stocks within NIFTY become overvalued, investors may face a risk of a market correction or downturn that could lead to losses.

In conclusion, NIFTY offers numerous advantages to investors and traders, investors need to consider the potential disadvantages and risks associated with investing in the index or NIFTY-linked products. Diversification, careful analysis, and a clear understanding of one’s investment objectives are essential when using NIFTY as part of an investment strategy.

Share your thoughts in the comments

Please Login to comment...