Expense Ratio | Meaning, Components, Restrictions and Examples

Last Updated :

18 Apr, 2024

What is Expense Ratio?

Expense Ratio is the annual fee charged by the asset management company for the management of funds. The expense ratio is a particular percentage of funds that is to be paid to the fund manager and it varies from fund to fund. Sometimes even when two funds have similar features and growth rates the deciding factor for net returns is this expense ratio. For any investor, the expense ratio is like the fees that have to be paid to AMC to hold their own funds.

Every business model has certain ways of making revenues and so do these asset management companies, they charge fund management fees for managing funds on behalf of their investors. Asset management companies have the overall objective of maximizing the returns to their investors and to do so they invest a handsome amount in hiring workforce like fund managers, fund analysts, heavy investment in advertisements & awareness, they even hire credit rating agencies, auditors, and even have to pay for government duties and taxes. In order to service all these financial commitments they charge their investors.

Also, SEBI (Securities and Exchange Board of India) in the interest of investors, has instructed the AMCs about the maximum expense ratio which can be charged from the investors to ensure there is no exploitation of investors and there are equitable and adequate financial resources available for AMC’s to administer funds.

Key takeaways from the Expense Ratio:

- They are charged at some fixed percentage of the total invested fund and they differ from fund to fund.

- The expense ratio helps asset management companies to service their fund management expenses. Examples can be to pay fund managers, to pay credit rating agencies, to pay experts, etc.

- A lower expense ratio will increase the return on the invested amount, and a higher expense ratio will lower the returns.

- The expense ratio is also dependent upon the total assets under management by the AMC, the higher the AUM lower the expense ratio as the expenses will be met from larger assets and similarly, lower AUM will lead to higher expense ratio.

- SEBI has imposed restrictions on the expense ratio and has directed that maximum 2.5% expense ratio can be charged depending upon the fund.

What are the Components of Expense Ratio

There are lot of components to expense ratio which adds together. These are basically all those expenses which the asset management companies have to incur in order to manage funds. As per regulations by SEBI asset management companies are required to disclose all these expenses to there customers in a period of every six months. Following are the main heads of components which are part of expense ratio:

1. Brokerage Fees: So there are two types of mutual funds one can be Regular and other can be direct. Under regular scheme of mutual funds the asset management companies transact all the funds through a broker and the broker is responsible for all the transactions of invested funds through regular scheme. In order to service the fund management by the broker, AMCs charge brokerage fees from regular scheme investors. However, direct scheme investor do not face this burden of brokerage.

2. Management Fees: The funds are required to be managed by people of great knowledge of investing and generating optimal returns to the investors in order to service the expertise hired to manage funds, AMCs have to compensate the experts, fund managers, and other managerial persons responsible which adds to the expense ratio and this is an important factor for expense ratio.

3. Administrative Cost: AMCs comes under the strict control of regulators, and they have to maintain all the necessary information and details as required by the relevant regulatory and legal requirements. AMCs maintain all the records of there investors, they have to set up customer redressal mechanism, they have to establish regular communication with investors and many more other miscellaneous administrative costs are incurred by the AMCs which adds to the expense ratio.

4. Marketing and Distribution Cost: AMCs hire intermediaries for the promotion and distribution of new mutual funds to new investors which adds to the marketing and distribution cost of AMCs, and this is also termed as 12B-1 fees. AMCs spend a decent amount on advertising and promotion to spread awareness about there new mutual fund products and hence adds to the expense ratio.

Restrictions Imposed by SEBI on Expense Ratio

Assets Under Management by the AMC (In crore ₹)

| Total Expense Ratio for Equity Funds (in %)

| Total Expense Ratio for Debt Funds ( in %)

|

|---|

|

0-500

|

2.25

|

2

|

|

500-750

|

2

|

1.75

|

|

750-2,000

|

1.75

|

1.5

|

|

2,000-5,000

|

1.60

|

1.35

|

|

5,000-10,000

|

1.50

|

1.25

|

|

10,000-50,000

| 1.5+ 0.05 (for every increase of ₹5,000 crores of daily net assets)

| 1.25+.05 (for every increase of ₹5,000 crores of daily net assets)

|

|

50,000+

|

1.05

|

0.80

|

How does the Expense Ratio impact Fund Return?

Expense ratio impacts your funds on basis of the category in which you hold mutual funds, some impacts can be applicable to all and some might differ case to case. Overall impacts are as follows:

1. Lower Expense Ratio is Favorable: Higher expense ratio suggest that your total returns earned from the fund will be lower as a proportion of your returns has been charged to pay off the expenses. So it is suggested that investors should look for lower expense ratio funds which will increase there returns.

2. Recurring Expense: Expense ratio is a recurring expense even if the investor earn returns or not, expense ratio will have to be paid to the AMC in order to pay off the cost of owning the funds. So even if you make a loss expense ratio will be charged on your total holdings.

3. Active Funds has Higher Expense Ratio: If your fund is an active fund then total expense ratio will be higher as it needs a full time fund manager who is actively engaged in managing the funds, whereas in case of passive funds the expense ratio will be lower as compared to the active funds as it won’t require a full time fund manager to manage funds.

Examples of Expense Ratio

Let us understand this concept of expense ratio with the help of some examples:

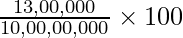

Q1. GFG investments has a total Assets under management worth ₹10,00,00,000 and total expenses of managing funds amount to ₹13,00,000. Calculate Total Expense Ratio (TER).

Solution:

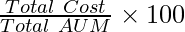

Total Expense Ratio =

TER =

TER = 1.3%

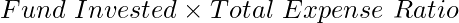

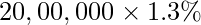

Q2. Suppose Mr. X invest ₹20,00,000 in the mutual fund scheme of GFG investments what will be the total cost incurred by Mr. X as expense ratio.

Total Cost=

Total Cost=

Total Cost = ₹26,000

Share your thoughts in the comments

Please Login to comment...