Working Capital Turnover Ratio: Meaning, Formula, Significance and Examples

Last Updated :

02 May, 2023

Working capital turnover ratio establishes a relationship between the working capital and the turnover(sales) of a firm. In other words, this ratio measures the efficiency of a firm in utilising its working capital in order to support its annual turnover. A high working capital turnover ratio implies that the company is very efficient in using its current assets and liabilities to support its sales. In other words, for every rupee employed or used in the business, it is able to generate a higher amount of sales. However, a lower working capital ratio means that the amount employed in working capital is higher and that the turnover is not up to the mark. In other words, the turnover is lower than the minimum levels as per the given amount of working capital employed.

Working capital turnover ratio is an important activity ratio in accounting theory and practice. Activity ratios can be described as those financial matrices which determine the efficiency of a firm in leveraging its assets to convert them into sales.

The terms net sales, cost of goods sold and working capital can be defined as:

- Net Sales: This is defined as the average sales made by a firm during its operating cycle, excluding all kinds of returns, discounts and other allowances.

- Cost of Goods Sold: In practical cases, it might be hard to ascertain the net sales made by the firm. In such cases, the working capital turnover ratio is calculated using the cost of goods sold.

- Working Capital: It refers to the amount that can be readily used by a firm to manage its day-to-day activities. In other words, working capital depicts a company’s ability to pay off its short-term obligations using its current assets.

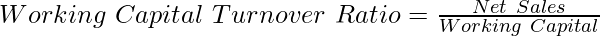

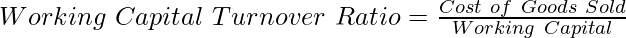

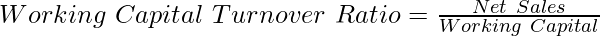

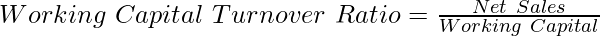

Formula:

or

where,

Net Sales = Gross Revenue – Sales Return – Discount – Allowances or,

Net Sales = Cost of Goods Sold + Gross Profit

Cost of Goods Sold = Net Sales – Gross Profit or,

Cost of Goods Sold = Opening Inventory + Purchases – Closing Inventory

Working Capital = Current Assets – Current Liabilities

Significance:

It is extremely useful for the management, as it helps them ascertain the firm’s ability to make use of its current resources in facilitating its turnover. A lower ratio implies that the sales generated are lower than they should be, considering the amount invested in the business by way of working capital. Hence, the management can take necessary steps in order to improve its sales and facilitate growth and development.

Illustration 1:

Compute the working capital turnover ratio from the following information:

Cost of goods sold ₹20,00,000; Gross Profit is  of revenue from operations; Current Assets ₹10,00,000; Current Liabilities ₹1,00,000.

of revenue from operations; Current Assets ₹10,00,000; Current Liabilities ₹1,00,000.

Solution:

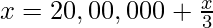

Let net sales be ₹x.

Revenue from operations (Net Sales) = Cost of Goods Sold + Gross Profit

Working Capital = Current Assets – Current Liabilities

= ₹10,00,000 – ₹1,00,000

= ₹9,00,000

=

= 3.34:1 or 3.34 times

Illustration 2:

Compute the working capital turnover ratio from the following information:

- Cost of goods sold ₹30,00,000

- Gross Profit is 1/3rd of C.O.G.S

- Capital Employed ₹8,00,000

- Fixed Assets ₹1,00,000.

Solution:

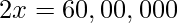

Revenue from operations (Net Sales) = Cost of goods sold + Gross Profit

![Rendered by QuickLaTeX.com =30,00,000+[\frac{1}{3}\times30,00,000]](https://www.geeksforgeeks.org/wp-content/ql-cache/quicklatex.com-e0721479b1429d6788a14ff668b73ab6_l3.png)

= ₹40,00,000

Since, Capital Employed = Fixed Assets + Working Capital

Working Capital = Capital Employed – Fixed Assets

= ₹8,00,000 – ₹1,00,000

= ₹ 7,00,000

=

= 5.71: 1 or 5.71 times

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...