Profitability Ratio or Income Ratio: Meaning, Formula and Significance

Last Updated :

13 Apr, 2023

Profitability ratios or income ratios are financial ratios that assess a company’s ability to generate earnings in relation to expenses and costs. These ratios are widely used by investors and analysts to evaluate a company’s financial performance and profitability. The commonly used profitability ratios include Gross Profit Margin, Net Profit Margin, Return on Investment, Return on Equity, and Return on Assets. These ratios aid in assessing a company’s profitability and making informed investment decisions. However, it’s important to use these ratios alongside other financial ratios and metrics for a comprehensive understanding of a company’s financial health.

General Profitability Ratios:

General Profitability Ratios refer to a broader category of profitability ratios that includes multiple ratios that are used to evaluate a company’s profitability, such as Gross Profit Ratio, Operating Ratio, Operation Profit Ratio, and Net Profit Ratio.

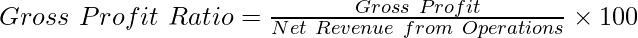

Gross Profit ratio is a financial metric which establishes a relationship between the gross profit of a company and its net revenue from operations. It is used to determine the profit earned by a firm after bearing all its direct expenses, i.e., the expenses directly tied to production. This ratio is used to determine the earning efficiency of the firm.

Generally, a higher gross profit ratio indicated an increase in the profit margin. Gross profit ratio can be compared with the previous year’s ratio of the firm or with similar firms to see if it is up to the mark.

- Gross Profit: It refers to the profit earned after deducting all the expenses directly related to production from the net revenue earned from operations. Such profit normally accounts for variable costs and not fixed ones.

- Net Sales: It refers to the revenue earned by the firm by selling its products after adjusting all kinds of sales returns, discounts, allowances to the customers, etc.

Formula:

Significance:

Some key significance are as follows:

- Assessing Profitability: The Gross Profit Ratio is a useful tool for assessing the profitability of a company. It indicates how much gross profit the company is generating from each unit of revenue. By comparing this ratio with industry averages, investors and analysts can gauge how well a company is performing in its industry.

- Evaluating Efficiency: The Gross Profit Ratio also helps to evaluate a company’s efficiency in managing its production and pricing strategies. A higher ratio indicates that a company is able to produce goods at a lower cost and sell them at a higher price, which is generally a positive sign.

- Identifying Trends: By tracking changes in the Gross Profit Ratio over time, investors and analysts can identify trends in a company’s performance. If the ratio is consistently increasing, it indicates that the company is improving its operations and generating more profit.

- Comparing Companies: The Gross Profit Ratio is a standard financial ratio used in comparing companies within an industry. By comparing this ratio between companies, investors and analysts can determine which companies are performing better than others.

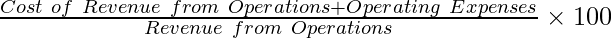

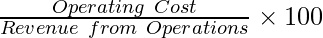

The main objective of all the business units is to earn profit. The efficiency of the business can be measured by the profitability of the business. The operating ratio is a type of profitability ratio. It is the comparison of a company’s cost of revenue from operation and operating expenses to its revenue from operations. Operating Cost (cost of revenue from operation + operating expenses) is sum total of all the expenses that are incurred in the operating activities of the business. All the non-operating incomes like interest received on investment, profit from the sale of fixed assets, rent received, etc., and all the non-operating expenses like interest on long-term loans and debentures, loss on sale of fixed assets, income tax, dividend paid, etc. are excluded in calculating Operating Ratio.

Formula:

Operating Ratio =

or

Significance:

Some key significance are as follows:

- Measuring Efficiency: The operating ratio formula provides insight into how efficiently a company is managing its operations. A lower operating ratio is generally viewed as a positive sign, indicating that a company is able to generate strong sales while keeping operating costs low.

- Identifying Cost Control Issues: An increasing operating ratio over time may indicate that a company is struggling to control its costs. This can be a red flag for investors, indicating that the company may be at risk of reduced profitability or financial distress.

- Benchmarking Performance: The operating ratio formula can be used to compare the performance of different companies within the same industry. This can help investors and analysts identify companies that are more efficient at managing their costs, and which may therefore be more attractive investment opportunities.

- Improving Decision Making: By providing insight into a company’s cost structure and efficiency, the operating ratio formula can help management make informed decisions about pricing strategies, cost-cutting initiatives, and investment priorities.

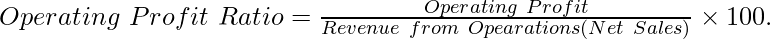

Operating profit ratio is a financial metric that establishes a relationship between the operating profit of a company and its net sales. It is used to determine the revenue earned by a firm after bearing all its operating expenses, i.e., the expenses necessary to run a business. This ratio is used to determine the earning efficiency of the firm.

Operating Profit Ratio is one of the profitability ratios in accounting theory and practice. Profitability ratios are the financial metric employed in order to measure a firm’s ability to generate earnings. Accounting ratios that are used to measure the profitability of the business are known as Profitability Ratios.

Formula:

Significance:

Some key significance are as follows:

- A higher operating profit ratio indicates that a company is able to generate more profit from its operations, which can be a positive sign for investors.

- A low operating profit ratio may indicate that a company is struggling to generate profits from its operations, which could be a cause for concern.

- Generally, a healthy operating profit ratio varies depending on the industry and can range from 5% to 20% or more.

- It is important to note that the operating profit ratio does not take into account other expenses such as interest, taxes, and non-operating expenses. Therefore, it should be used in conjunction with other financial ratios and metrics to get a more complete picture of a company’s financial health.

Profitability is the primary goal of any firm. Profitability Ratios are determined to examine a company’s earning potential, which is the result of how well its resources are used. Net Profit Ratio is based on the all-inclusive concept of profit. It shows the relationship between the net profit and net revenue from operations. It links operating revenue to net profit after operational and non-operational costs and incomes. Net profit refers to the profit after tax (EAT). Generally, a company with a high net profit ratio can successfully manage its costs and/or offer products or services for a price that is much higher than its costs. Consequently, a high ratio may be generated by: Optimal management, Low prices (expenses), Effective pricing tactics, etc.

Whereas, a company that has a low net profit ratio either has an inefficient cost structure or uses bad pricing tactics. Consequently, a low ratio may be formed by: Inadequate management, High prices (expenses), Poor pricing tactics, etc.

Investors should utilise the profit margin ratio’s figures as a general measure of a company’s profitability performance and, as necessary, initiate in-depth investigations of the factors that contribute to an increase or decrease in profitability.

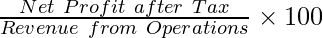

Formula:

Net Profit Ratio =

Significance:

Some key significance are as follows:

- Measure of profitability: The net profit ratio is a measure of a company’s profitability. A higher net profit ratio indicates that a company is generating more profit from its operations, which can be a positive sign for investors.

- Comparability: The net profit ratio can be used to compare the profitability of companies in the same industry. By comparing the net profit ratios of different companies, investors can determine which companies are more profitable and make better investment decisions.

- Efficiency: The net profit ratio is also an indicator of a company’s efficiency in generating profits from its operations. A higher net profit ratio suggests that a company is using its resources more efficiently to generate profits.

- Stability: The net profit ratio can help investors and analysts evaluate a company’s financial stability. A stable net profit ratio over time indicates that a company has consistent profitability, which can be a positive sign for investors.

- Improvement: By analyzing the net profit ratio, companies can identify areas where they can improve their profitability. For example, if a company’s net profit ratio is lower than its competitors in the same industry, it may need to focus on reducing expenses or increasing revenue to improving its profitability.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...