Adjustment of Interest on Deceased Partner’s Capital, Deceased Partner’s Share in Goodwill and Accumulated Profits and Reserves

Last Updated :

05 Apr, 2023

Similar to the case of retirement, the Executor of the deceased partner is entitled to receive the interest on capital up to the date of the death of a partner. The executor is also entitled to get a share of Goodwill and Accumulated profits and reserves.

1. Adjustment of Interest on Deceased Partner’s Capital:

Like any other partner, the representative of the deceased partner is entitled to receive the interest on capital till the date of the partner’s death.

Accounting treatment :

The interest is calculated on the amount of capital as per the last Balance Sheet. Such interest on capital is then credited to the deceased partner’s capital account.

Journal Entry:

Calculation of Interest on Deceased Partner’s Capital:

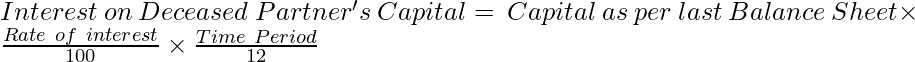

Interest on the Deceased Partner’s Capital is calculated using the following formula:

Illustration:

Anil, Sunil, and Akhil were carrying a partnership business with a profit-sharing ratio of 6: 1: 1, respectively. They close their Accounts on 31st March every year, and their Capital Balance as per the Balance Sheet of their firm on 31st March 2021 stood as Anil- ₹ 10,00,00, Sunil- ₹ 6,00,000, and Akhil- ₹ 5,00,000 respectively. On 31st December 2021, Akhil died and as per the deed is entitled to receive the interest on capital @ of 5% per annum. Calculate the amount of Interest on Capital to be paid to his legal representative.

Solution:

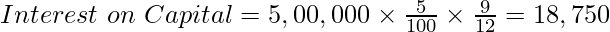

Number of months Akhil has been a partner in the firm = 9 months (From 1st April to 31st December)

Capital of Akhil as per last Balance Sheet =₹ 5,00,000

2. Adjustment of Deceased Partner’s Share in Goodwill:

Like a retiring partner, a deceased partner is also eligible to receive his/her share of goodwill based on the fact that such goodwill is earned by the firm at a time when he/she was a partner. The continuing partners (Gaining Partners) take over the share of the profit of the deceased partner for which they compensate the deceased partner (Sacrificing Partner).

Accounting Treatment:

- The existing goodwill appearing in the Balance sheet (if any), shall be written off by debiting the capital accounts of all the partners in their old profit-sharing ratio.

Journal Entry:

- Adjusting the share of goodwill of the deceased partner through a capital account of the gaining partner/partners.

Journal Entry:

Note: If any of the continuing partners also sacrifices his/her share of the profit, then he/she is also eligible to receive such compensation through the capital of the gaining partner/partners.

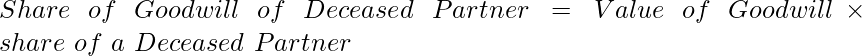

Calculation of Adjustment of Deceased Partner’s Share in Goodwill:

Illustration:

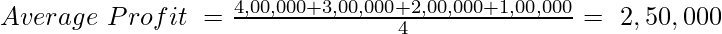

Ram, Sita, and Raman are partners sharing profits in a ratio of 4: 3: 1. Raman died on 1st November 2021 and as per the Deed is eligible to receive his share of goodwill. Goodwill is calculated on the basis of three years’ purchase of the average profits of the last four years. Profit of last four years were 2018: ₹ 4,00,000, 2019: ₹ 3,00,000, 2020: ₹ 2,00,000, and 2021: ₹ 1,00,000. Ram and Sita decide to continue the business in a ratio of 5: 3.

Solution:

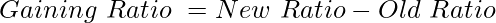

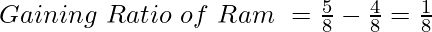

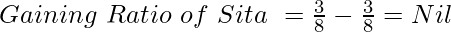

Calculating Gaining Ratio:

Calculating Value of Goodwill:

Calculating Share of Goodwill of Raman:

3. Adjustment of Accumulated Profits and Reserves:

If any Accumulated Profits and Reserves appears in the books of the firm, it is distributed among all the partners in their Old Profit-Sharing Ratio. Similarly, if any accumulated loss appears in the books of the firm, it is written off against the Capital account of all the partners.

Accounting Treatment:

Accumulated Profits and Reserves are distributed among all the partners in the old ratio by crediting their Capital Accounts.

Journal Entry:

- Accumulated losses (if any) are written off by debiting all the partner’s Capital Accounts in their old Profit-Sharing ratio.

Journal Entry:

Calculation of Accumulated Profits and Reserves:

Simply, distribute the value of accumulated profits and reserves among all the partners in the old profit-sharing ratio.

Illustration:

Addi, Sam, and Ravi are partners sharing profits in a ratio of 3: 2: 1. Ravi died on 1st August 2021. On this date, the following balances appeared in the books of the firm:

- General Reserve: ₹ 1,80,000

- Profit and Loss Account (Cr): ₹ 30,000

- Workmen Compensation Reserve: ₹ 24,000

Show the adjustments of these items and pass the necessary journal entries.

Solution:

Share your thoughts in the comments

Please Login to comment...