Calculation of Share of Profit up to the Date of Death of a Partner

Last Updated :

05 Apr, 2023

A deceased partner’s legal executors are entitled to receive a share of the profit until the death date of the deceased partner. Such profits are calculated from the date of the last Balance Sheet of the firm till the date of the death of the partner. As per the Indian Partnership Act 1932, the accounting treatment of all the items related to the partners in the case of the death of the partner shall be done exactly as in the case of the retirement of the partner. Retirement generally occurs at the time of the closure of the accounting period, but death may take place at any point of time. The profit of the firm is calculated only when the books of accounts are closed, but since death may take place at any time, the profit under such case is estimated in either of the following ways:

1. Basis of time

2. Basis of Turnover of the Firm

Case 1: Profit ascertained on a time basis:

Whenever the profit is ascertained on the basis of time, its become necessary to take into consideration the time period for which the partner remained the partner during the current year (the year in which the death took place). Profit on the basis of time can be ascertained in either of the ways:

A. On the basis of last year’s profit:

When the profit is to be ascertained on the basis of last year’s profit, two aspects are to be taken into consideration i.e., the last year’s profit and the time period for which the deceased partner has been the partner of the firm.

Steps:

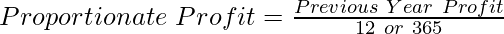

1. Firstly, calculate the proportionate profit up to the date of the death of the partner on basis of last year’s profit.

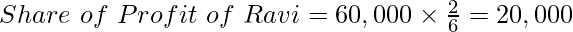

2. Secondly, calculate the share of the deceased partner on the basis of the profit-sharing ratio.

Illustration:

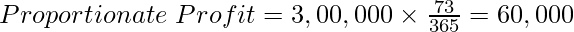

Ram, Ravi, and Mohan were partners sharing profit in a ratio of 3: 2: 1. Generally the books of the firm are closed on 31st March every year. Ravi died on 12th June 2022 and the profit of the firm till this date is to ascertain on the basis of the previous year’s profit which is ₹ 3,00,000. Calculate Ravi’s share in the profit of the firm and pass the necessary Journal Entries.

Solution:

Date of Death = 12.6.2022 i.e., 2 months and 12 days from the beginning of the year (1st April) = 73 days (30 + 31 +12)

B. On the basis of average profit of certain years:

Under this method, the profit of the firm till the date of the death of a partner is estimated on the basis of an average of the last few years’ profits. It is important to take into consideration the time period for which the deceased partner remains a partner of the firm.

Steps:

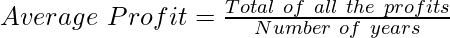

1. Calculate the average profit based on the profits of the last certain years.

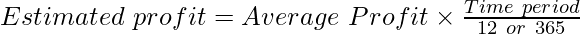

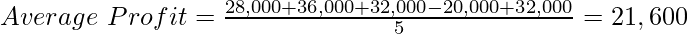

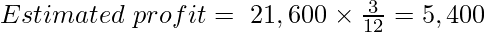

2. Calculate the Estimated profit of the firm till the date of death of the partner on basis of the average profit.

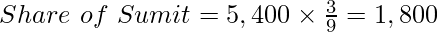

3. Calculate the share of the deceased partner.

Illustration:

Amit, Sumit, and Rajit were partners sharing profit in a ratio of 4 : 3 : 2 and closes their books on the 31st of every year. Sumit died on 30th June 2022 and as per the partnership deed, the share of profit of the deceased partner till the date of his death is to calculated on basis of the Average profit of the last five years. Calculate the share of profit of Sumit up to the date of death and pass the necessary journal entries. Profit for the last five years was: ₹ 28,000, ₹ 36,000, ₹ 32,000, ₹ 20,000 (loss) and ₹ 32,000.

Solution:

Date of Death = 30.6.2022 i.e., 3 months

Case 2: Profit ascertained on turnover/sales basis:

Whenever the profit for the current is to be calculated under this method following items are to be taken into consideration:

Previous year’s Profit and Total Sales.

Sales up to the date of the death of a partner.

Steps:

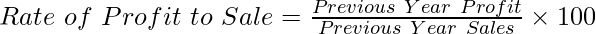

1. Calculate the Rate of Profit to Sale using the previous year’s balances.

2. Ascertaining estimated current year profit on the basis of Rate of Profit to Sale.

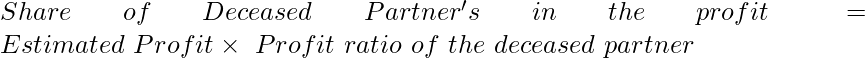

3. Calculating Deceased Partners’ share of Profit.

Illustration:

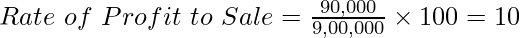

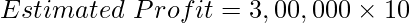

Soni, Moni, and Ranu were partners sharing profit in the ratio of 2: 2:1. They used to close their accounts on 31st March every year. Moni died on 31st August 2022 and the sales of the firm till this date amounted to ₹ 3,00,000. Calculate the profit share of Moni on the basis of sales, if the last year’s profit and last year’s sales were ₹ 90,000 and ₹ 9,00,000, respectively.

Solution:

Calculating the Rate of Profit to Sale.

Share your thoughts in the comments

Please Login to comment...