Journal Entry for Credit Sales

Last Updated :

28 Jan, 2024

When goods/services are sold in credit, the transactions are known as Credit Sales, i.e., when the customer promises to pay in future, credit sales occur. Credit sales journal entry is passed to show the sales transactions done in credit. There are mainly two types of credit sales:

- Sale of goods on credit

- Sale of an asset for credit

Credit Sales Journal Entry

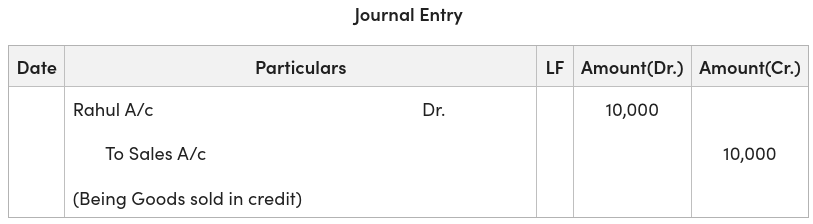

Journal Entry:

1. For the Sale of Goods in Credit: Sale of goods (in credit) to a creditor is a liability, so the Debtors (debit balance) being an asset increases, and the balance of the sales account being goods (credit balance) decreases.

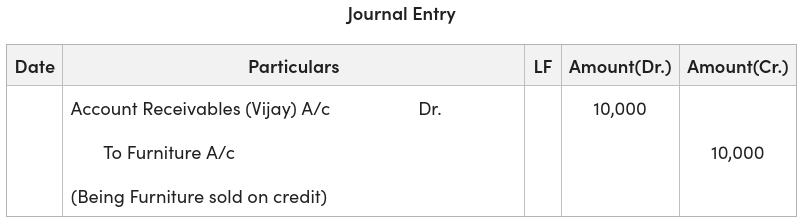

2. For the Sale of an Asset in Credit: For the sale of an asset in credit, the balance of the Account Receivables (debit balance) being an asset in nature increases, and the balance of the asset account will decrease due to the outflow of the asset.

Example 1:

Goods sold in credit for ₹10,000 to Rahul. Record the necessary journal entry.

Solution:

Example 2:

Furniture sold for ₹50,000 in credit to Vijay. Record the necessary journal entry.

Solution:

Share your thoughts in the comments

Please Login to comment...