Interest Coverage Ratio | Meaning, Formula, Calculation and Examples

Last Updated :

12 Sep, 2023

What is Interest Coverage Ratio ?

The Interest Coverage rate( ICR) is a fiscal rate that measures a company’s capability to pay interest charges on its outstanding debts. It is a key indicator of a company’s financial health and its ability to generate profits to cover its interest payments. The ratio tells us how many times the company’s earnings (before interest and taxes) can cover its interest payments.

If a company has an Interest Coverage Ratio of 5, it means that the company can cover its interest payments five times over with its earnings. This is generally considered a good indication of a company’s financial health because it suggests that the company has a significant margin of safety and can comfortably make its interest payments.

On the other hand, if a company has a low Interest Coverage Ratio, it means that the company is not generating enough earnings to cover its interest payments. This can lead to financial distress, as the company may struggle to meet its debt obligations and may be at risk of default.

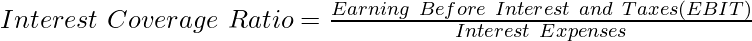

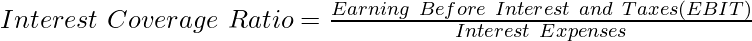

Formula of Interest Coverage Ratio

The formula for calculating the Interest Coverage Ratio is:

Where:

EBIT = Total Revenue – Cost of Goods Sold – Operating Expenses

Interest Expense = Interest paid on debt during the period

Explanation

The formula for Interest Coverage Ratio is quite simple. The numerator of the formula is the EBIT, which is calculated by subtracting a company’s operating expenses from its revenues. EBIT represents the amount of money a company earns before it pays interest and taxes. The denominator of the formula is the company’s interest expenses, which are the costs of servicing its debt.

By dividing EBIT by interest expenses, the Interest Coverage Ratio shows how many times the company’s earnings can cover its interest payments. For example, if a company’s EBIT is ₹1 million and its interest expenses are ₹2,50,000, the Interest Coverage Ratio would be 4. This means that the company’s earnings can cover its interest payments four times over.

Significance of Interest Coverage Ratio

The ICR measures a company’s ability to pay interest on its debt obligations. A higher ratio indicates that a company is more capable of meeting its interest obligations, while a lower ratio indicates that it may be at risk of defaulting on its debt. In addition to providing insight into a company’s ability to meet its debt obligations, the Interest Coverage Ratio is also useful for comparing companies within the same industry. For example, if two companies have similar debt levels but one has a higher Interest Coverage Ratio, it may be a better investment because it is generating more earnings to cover its interest payments.

Overall, the Interest Coverage Ratio is an important financial metric that provides insight into a company’s financial health and its ability to generate profits to cover its interest payments. It is a useful tool for investors and creditors who want to assess a company’s risk profile and potential for growth.

Illustration 1:

From the following information, calculate the Interest Coverage Ratio (ICR) :

|

| 10,000 Equity Shares of ₹10 Each | 1,00,000

|

| 10% Debentures | 50,000

|

| Long-term Loan from Banks | 50,000

|

| Interest on Long-Term loans from Banks | 5,000

|

| Profit after Tax | 75,000

|

| Tax | 9,000

|

Solution:

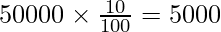

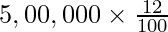

Interest on 10% Debentures =

Profit Before Interest and Tax = Profit After Tax + Tax + Interest on Debentures + Interest on Long-Term Loans from Banks

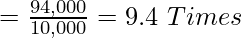

= 75000 + 9000 + 5000 + 5000 = ₹94,000

Total Interest Amount = Interest on Debentures + Interest on Long-Term Loans from Banks

= 5000 + 5000 = ₹10,000

Therefore, the interest coverage ratio (ICR) of the company is 9.4 times, which indicates that the company’s earnings are sufficient to cover their interest expenses 9.4 times over.

Illustration 2:

Suppose a company has a profit after tax (PAT) of ₹1,00,000, and it has a long-term debt of ₹5,00,000 with an interest rate of 12%. The company’s tax rate is 30%. Calculate the interest coverage ratio (ICR) of the company.

Solution :

To calculate ICR, we need to first calculate the earnings before interest and taxes (EBIT). We can calculate EBIT by subtracting the total interest expenses from the PAT:

EBIT = PAT + Total Interest Expenses

Total Interest Expenses = Long-term Debt x Interest Rate

Total Interest Expenses =

Total Interest Expenses = ₹60,000

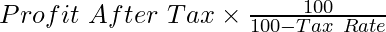

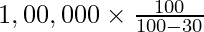

Profit Before Tax =

Profit Before Tax =

Profit Before Tax = ₹1,43,000

EBIT = Profit Before Tax + Total Interest Expenses

EBIT = ₹1,43,000 + ₹60,000

EBIT = ₹2,03,000

Now, we can calculate the interest coverage ratio by dividing the EBIT by the total interest expenses:

Therefore, the interest coverage ratio (ICR) of the company is 3.38 times, which indicates that the company’s earnings are sufficient to cover their interest expenses 3.38 times over.

Share your thoughts in the comments

Please Login to comment...