What is Liquidity Ratio?

Liquidity ratios are the ones that determine the organisation’s ability to meet its short-term obligations by defining a systematic relationship between the amount of current/liquid assets and that of its current/short-term obligations.

Liquidity ratios assist analysts and investors in determining a company’s ability to meet its immediate financial obligations. One of the most popular liquidity ratios is the current ratio, which assesses a company’s capacity to settle its current debts with its current assets.

Liquidity ratios are an essential tool for businesses to assess their ability to meet their short-term financial obligations. These ratios provide insight into the company’s liquidity position and help investors and analysts determine its ability to pay off its debts and fund its day-to-day operations. There are various types of liquidity ratios used in financial analysis, but the two most commonly used ratios are the current ratio and liquid ratio.

Types of Liquidity Ratios:

The current ratio evaluates a company’s capacity to settle its short-term debts with its current assets. Current assets include things like cash and cash equivalents, marketable securities, accounts receivable, and inventories that can be turned into cash within a year. Liabilities with a one-year maturity date, such as accounts payable, short-term loans, and taxes payable, are categorised as short-term obligations. To calculate the current ratio, divide the current assets by current liabilities. A current ratio of 2:1 or higher is generally considered good, indicating that the company has sufficient current assets to meet its short-term obligations. However, a current ratio that is too high may also indicate that the company is not efficiently using its assets to generate profits.

Formula:

Where,

Current Assets = Cash in Hand + Cash at Bank + Short-term Investments (Marketable Securities) + Trade Receivables (Less Provision) + Inventories (Stock of Finished Goods + Stock of Raw Material + Work in Progress) + Prepaid Expenses

Current Liabilities = Bank Overdraft + Trade Payables + Provision of Taxation + Proposed Dividends + Unclaimed Dividends + Outstanding Expenses + Loans Payable within a Year

There can be three situations arising from the calculation:

If Current Assets > Current Liabilities, then Current Ratio > 1: This implies that the organisation would still have some assets left even after paying all the short-term debts and is a desirable situation to be in.

If Current Assets = Current Liabilities, then Current Ratio = 1: This means that the current assets are just enough to cover the short-term obligations of the firm.

If Current Assets < Current Liabilities, then Current Ratio < 1 This is not an ideal situation to be in since it implies that the company does not have enough resources to pay off short-term debts.

The liquid ratio, also known as the acid-test or quick ratio is a more stringent measure of a company’s liquidity position. This ratio measures a company’s ability to pay off its short-term obligations with its most liquid assets, such as cash and marketable securities, excluding inventory and prepaid expenses. By dividing the company’s liquid assets by its current liabilities, the liquid ratio is determined.

Generally, a liquid ratio of 1:1 is considered ideal, which means that the liquid assets should just be enough to cover the amount of current liabilities. An organization may or may not be able to maintain this ideal ratio at all times in the accounting period. However, necessary steps should be taken, so as to not deflect too much from the ideal value.

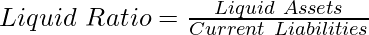

Formula:

where,

Liquid Assets = Cash + Accounts Receivable + Short-term Investments (Marketable Securities)

or

Liquid Assets = Current Assets – Inventory – Prepaid Expenses

Current Liabilities = Bank Overdraft + Trade Payables + Provision of Taxation + Proposed Dividends + Unclaimed Dividends + Outstanding Expenses + Loans Payable within a Year

There can be three situations arising from the calculation:

If Liquid Assets > Current Liabilities, then Quick Ratio > 1: This implies that the organisation would still have some assets left even after paying all the short-term debts, and is a desirable situation to be in.

If Liquid Assets = Current Liabilities, then Quick Ratio = 1: This means that the quick assets are just enough to cover the short-term obligations of the firm, and none would be left after all settlements.

If Liquid Assets < Current Liabilities, then Quick Ratio < 1: This is not an ideal situation to be in since it implies that the company does not have enough resources to pay off short-term debts.

Illustration 1:

Calculate the current ratio from the following Balance Sheet for GFG Ltd. for the year ending March 2022 and comment on the result.

Solution:

Current Assets = Stock + Debtors + Bills Receivables + Marketable Securities+ Prepaid Expenses + Bank

= 2,00,000 + 80,000 + 60,000 + 50,000 + 10,000 + 20,000

= ₹4,20,000

Current Liabilities = Bank Overdraft + Sundry Creditors + Outstanding Expenses + Provision for Tax + Proposed Dividend

= 40,000 + 90,000 + 10,000 + 40,000 + 20,000

= ₹2,00,000

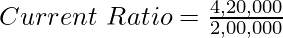

Therefore,

= 2.1 : 1

Comment: The current ratio of Geeks Ltd. is 2.1:1, which is slightly more than the ideal ratio. It implies that the short-term financial position of the firm is sound and it can meet its short-term liabilities well in time.

Illustration 2:

Calculate the quick ratio from the following balance sheet of Geeks Ltd. for the year ending March 2022:

Solution:

Liquid Assets = Debtors + Bills sent for collection + Marketable Securities + Cash and Bank

= 90,000 + 50,000 + 25,000 + 85,000

= ₹2,50,000

Current Liabilities = Bank Overdraft + Sundry Creditors + Outstanding Expenses + Provision for Tax + Proposed Dividend

= 90,000 + 25,000 + 5,000 + 10,000 + 20,000

= ₹1,50,000

Now,

=

Liquid Ratio= 1.67:1

Share your thoughts in the comments

Please Login to comment...