Accounting Treatment of Partner’s Capital Account in case of Retirement of a Partner (Fixed Capital)

Last Updated :

05 Apr, 2023

A distinct account that records all the transactions between the Partnership firm and the partners to figure out the share of each partner in the firm at the end of the accounting period is known as the Partner’s Capital Account. Every transaction right from the initial capital investment to their earnings/expenses and gain/losses is recorded in the capital account to ensure transparency and accuracy between the firm and the partners and among the partners. Capital investments are credited, and drawings by the partners are debited. Similarly, the incomes and gains are recorded on the credit side, and expenses and losses are recorded on the debit side.

Methods of maintaining Capital Account:

The Capital Accounts can be maintained in either of the following ways:

1. Fixed Capital Method: Under Fixed Capital Method, the initial capital introduced by the partners remains fixed throughout the existence of the firm, except in the event of the introduction of additional capital and permanent withdrawal of the capital (drawings) by the partners. All other income or expenses and profits or losses like Interest on Capital, Interest on Drawings, Salary, Commission, Share of profit, etc., are recorded in a separate account known as a Current Account.

2. Fluctuating Capital Method: Under the Fluctuating Capital Method, the capital balance of each of the partners goes on changing from time to time and is of fluctuating nature. The capital account itself records all the transactions and is affected by every transaction between the firm and the partners, such as the introduction of additional Capital, drawings, Interest on Capital, Interest on Drawings, Salary, Commission, etc.

Fixed Capital Method:

Under the Fixed Method, the initial capital invested by the partners at the beginning of the partnership remains constant throughout the life span of the firm. The capital is affected only when additional capital is introduced by the partner or the capital is withdrawn by the partner (drawings). Under this method, two accounts are prepared:

- Capital Account: All those transactions that are related to capital or change in the capital (Additional Capital and Drawings) only are recorded in the capital account. The capital invested by the partner is credited, and any drawing is debited.

- Current Account: All the other transactions related to partners, such as Interest on capital, Interest on drawings, salary, Profit/loss share, etc., are recorded in a separate account known as a Current Account or Drawings Account. Any income or profit of the partner is credited, and any expense or loss is debited to the current account.

Steps of Fixed Capital Method:

The preparation of a capital account under the Fixed Capital Method involves the following steps:

Step 1: Prepare a Capital Account, and credit the initial and subsequent capital contribution by the partner. Any permanent drawings from the capital are recorded on the debit side of the capital account.

Step 2: Next, a Current Account is prepared to record all the Receipts and Gains related to partners on the credit side, such as Interest on capital, the salary of the partner, the profit share of the partner, commission, and so on, and the debit side of current account records all the expenses or losses related to the partner, such as Interest on drawings, Loss on Revaluation, etc.

Step 3: At last, the closing capital of the partner is calculated by subtracting the debit side of the current account from the credit side. The closing balance of the retiring partner is either paid in cash or else transferred to his Loan A/c, and the balance of the remaining partners is then transferred to a Balance sheet as a partner capital account.

Formats (When the capital is fixed):

** denotes that the balance of the Current A/c can be either Debited or Credited.

Illustration:

Bloom, Flora, and Alisha were partners sharing profits and losses in the ratio of 5: 3: 2. Their Balance Sheet as on 1st April 2021 was:

Alisha retires on 1st April 2021, and they agreed that:

1. Goodwill is to be valued at 2 years’ purchase of the average profits of the last four years. Profits for the year ending 31st March were:

2. 5% Provision for Doubtful Debts is to be created.

3. Stock to be appreciated by 10%.

4. Patents are valueless.

5. Building to be appreciated by 20%.

6. Creditors to be raised by ₹1,000.

7. Amount due to Alisha is to be paid within 1 year.

Prepare the Revaluation Account, Partner’s Capital Account under the Fixed Capital Method, and Balance Sheet of the New Firm.

Solution:

Working Notes:

1. Gaining Ratio of Bloom and Flora = 5: 3 (There is no information about the New Profit-Sharing Ratio, it is presumed that share of the retiring partner is acquired by the remaining partner in their old profit-sharing ratio.)

2. Calculation of Goodwill:

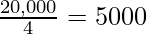

Total of past four years profit = 7,200 + 10,000 + (5,000) +7,800 = ₹ 20,000.

Average Profit =

Goodwill = 5,000 × 2 = ₹10,000

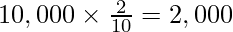

Share of Goodwill of Retiring Partner (Alisha) =

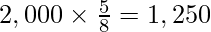

Goodwill amount payable by Bloom to Alisha =

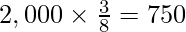

Goodwill amount payable by Flora to Alisha =

3. Employee’s Provident Fund is a liability and not an accumulated profit, hence not distributed among the partners.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...