The term solvency in accounting refers to the state of being able to pay off one’s dues. Solvency ratios are those financial metrics that measure an enterprise’s capability to meet its long-term obligations. Such a measure is made using parameters like the value of long-term debt, the assets available within the organisation, the funds invested in the firm, etc. Such ratios determine whether the firm has enough cash flows to pay off its long-term dues or not. As such, these ratios are used by the firm’s lenders to examine the safety of their credit and to determine whether further credit should be extended to the said firm or not.

Solvency ratios are of four types:

1. Debt-Equity Ratio:

This ratio determines the proportion of debt and equity in the total amount of capital employed in a firm. In other words, this ratio is used to express a relationship between the long-term debt of a firm and the money raised through share capital. The objective is to measure the extent to which each of these sources has been used to fund the assets in the firm. A higher debt-equity ratio would imply that the firm owes more to outsiders than its shareholders, which might lead to bankruptcy in the near future. It also lowers the creditworthiness of the firm and degrades the lenders’ confidence in the safety of their investments. A low debt-to-equity ratio means the equity of the company’s shareholders is bigger, and it does not require any money to finance its business and operations for growth.

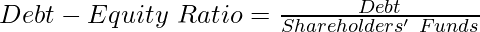

Debt-Equity Ratio is calculated as:

Debt and shareholders’ funds are explained below:

Debt: Such obligations which can be settled in subsequent operating cycles of the company, and not just in the one in which they were incurred, i.e., whose repayment period exceeds the period they were secured in are called debt. Examples include debentures, long-term loans from banks, capital leases, deferred income taxes, etc.

- Debt = Redeemable Debentures + Interest on Debentures + Long- term loans from banks + Capital leases + Deferred income taxes

Shareholders’ Equity: These refer to the amount invested by the shareholders/owners in the business. It comprises two types of share capital: equity as well as preference share capital, and is listed on the liabilities side of the Balance Sheet under the heading ‘Equity’.

- Shareholders’ Equity = Equity Share Capital + Preference Share Capital + Reserves and Surplus (Excluding fictitious Assets) + Money received against share warrants

Significance: This ratio calculates the amount of debt a business has incurred in relation to the amount of equity. Even in the case of insolvency, debt has to be returned, interest costs have to be incurred without deferral, which could diminish the value of equity. Therefore, a high D/E ratio indicates that a company relies heavily on debt funding and is frequently linked to high investment risk. A debt-equity ratio of 2:1 is considered ideal.

2. Total Assets to Debt Ratio:

The total-debt to total-assets ratio expresses a relationship between the total resources of the organisation and the long-term dues owed by such organisations to outsiders. This ratio is used to measure the proportion of assets that have been funded by outside debt in an organisation. Say if the total-debt to total-assets ratio is 50%, it would mean that half of the assets owned by the firm were funded by debt, and the other half by shareholders’ funds. A higher asset-to-debt ratio implies a risky situation since it means that a higher proportion of assets has been funded through borrowing.

Total Assets to Debt Ratio is calculated as:

Total Assets: It is the conglomeration of all kinds of assets owned by the company; fixed (tangible and intangible), current, deferred revenue expenses, etc.

- Total Assets = Current Assets + Non- Current Assets(including deferred revenue expenses)

Debt: Such obligations which can be settled in subsequent operating cycles of the company, and not just in the one in which they were incurred, i.e., whose repayment period exceeds the period they were secured are called debt. Examples include debentures, long-term loans from banks, capital leases, deferred income taxes, etc.

- Debt = Redeemable Debentures + Interest on Debentures + Long- term loans from banks + Capital leases + Deferred income taxes

Significance: Total Assets to debt ratio depicts the composition of debt in the assets owned by a business. When this ratio is calculated over a number of years, it depicts how such an organisation has acquired its assets over a period of time, and the way it has grown and furthered its operations. Creditors use this ratio to determine the amount of debt the firm already owes and whether it would be able to repay it, which further helps determine whether additional credit can be allowed or not. Investors use this ratio to check whether the firm has enough funds to meet its obligations and to pay a sufficient return on investment.

3. Proprietary Ratio:

A proprietary ratio is a financial metric used to express a relationship between the proprietors’ funds and assets of the firm. In simple terms, the proprietary ratio calculates how much of the funding for assets comes from the owner’s capital. It indicates the portion of an organisation’s assets that are backed by investor money. This ratio helps analyze the risk factor, capital stability, and cost of raising capital.

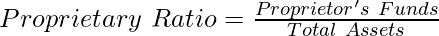

Proprietary Ratio is calculated as:

Proprietors’ Funds: These refer to the amount invested by the shareholders/owners in the business. It comprises two types of share capital: equity as well as preference share capital, and is listed on the liabilities side of the Balance Sheet under the heading ‘Equity’.

- Proprietors’ Funds = Equity Share Capital + Preference Share Capital + Reserves and Surplus (Excluding fictitious Assets) + Money received against share warrants

Total Assets: It is the conglomeration of all kinds of assets owned by the company; fixed (tangible and intangible), current, deferred revenue expenses, etc.

- Total Assets = Current Assets + Non-Current Assets (including deferred revenue expenses)

Significance: This ratio is extremely useful to the lenders of an organisation since it informs them of the level of its dependence on outside funding. Simply put, a larger proprietary ratio is advantageous since it indicates a smaller reliance on outside sources of funding, which enhances the firm’s legitimacy and inspires confidence among creditors. This makes getting credit whenever needed simple and affordable. The likelihood of the company filing for bankruptcy also considerably decreases.

4. Interest Coverage Ratio:

The interest coverage ratio is used to determine whether a firm would be able to pay off the accumulated interest on its borrowings or debt. In other terms, the interest coverage ratio calculates how frequently a business can pay off its debt using EBIT, or profits before interest and taxes. The Times Interest Earned Ratio, or TIE ratio, is another name for it. Generally, a higher interest coverage ratio is considered positive since it means that the firm is earning enough to be able to cover the interest expense. A lower interest coverage ratio, on the other hand, is questionable since it depicts a high debt burden and hence, higher chances of bankruptcy.

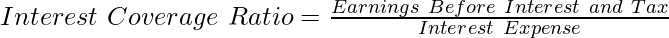

Interest Coverage Ratio is calculated as:

Earnings Before Interest and Taxes: This refers to the earnings made by an organisation net of its operating expenses, i.e., gross of non-operating expenses.

- Earnings Before Interest and Taxes = Gross Revenue – Cost of goods sold – Administrative expenses – Office expenses- Selling and Distribution expenses

Interest Expense: It refers to the interest payable by the organisation to various parties. Such interest may be levied on debentures, preference shares, bank loans, bank overdrafts, bills payable, etc.

- Interest Expense = Debenture Interest + Preference Share Interest + Interest on Bank Overdraft + Interest on Bank Loan

Significance: It serves as a solvency check for the business organisation, allowing banks, industry experts, and investment advisors to assess a company’s or firm’s capacity to pay off the accrued interest on the loan it’s holding.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...