Whenever a new partner is admitted, he/she brings an amount as capital either in proportion to his share of profit or the capital of old partners is adjusted to make them proportionate to their share of profits respectively. Such adjustment of capital can be done in either of the following ways:

Case 1: Calculation of capital of the new partner on the basis of the combined capital of old partners

When a new partner brings capital in proportion to his share of profit, the amount of capital to be brought in by the new partner is determined on the basis of the adjusted capital of the old partners.

In order to calculate the new partner’s capital, the following steps shall be taken:

Step 1: Calculating the adjusted capital of the old partners, i.e., capital after making all the adjustments related to goodwill, Reserves, Revaluation of assets and liabilities, and so on.

Step 2: Calculation of Total Capital of the New Firm:

Total Capital of the New Firm = Total of the adjusted capital of the old partners × Reciprocal of the total share of the old partners

Step 3: Calculation of the Capital of the New partner.

Capital of the New partner = Total Capital of the New Firm × Share of the New Partner

Journal Entry:

Illustration:

Amit and Bablu are in Partnership sharing profits and losses in the ratio of 3:2. A new partner Chotu is admitted to the firm and agrees to bring 20% of the total capital of the new firm (after all the adjustments) as his share of the capital. If the Adjusted Capital of Amit and Bablu is ₹34,000 and ₹26,000, respectively, calculate the amount of the capital to be brought in by Chotu, and also pass the necessary Journal Entries.

Solution:

If Chotu acquires 20% of the Capital, i.e., \frac{1}{5}th of the share, then the Remaining Share of Amit and Bablu shall be 80% of that capital, i.e., |\frac{4}{5}

Calculating Chotu’s Capital on the basis of Amit’s Capital and Bablu’s Capital:

Determining the Adjusted Capital of Amit and Bablu:

Adjusted Capital of Amit = ₹ 34,000

Adjusted Capital of Bablu = ₹ 26,000

Total Adjusted Capital = ₹ 60,000

Calculating the Total Capital of the New Firm:

Total Capital of the New Firm = Total of the adjusted capital of the old partners × Reciprocal of the total share of the old partners

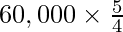

Total Capital of the New Firm =

Total Capital of the New Firm = ₹ 75,000

Calculating the Capital of Chotu:

Capital of the New partner = Total Capital of the New Firm × Share of the New Partner

Capital of Chotu =  (20%)

(20%)

Capital of Chotu = ₹ 15,000

Case 2: Calculation of capital of the old partner on the basis of a new partner:

Under this method of Adjustment of Capital, when a new partner is admitted to a firm the capital of the old partners is adjusted on the basis of the capital of the new partner to make them proportionate to their share of profits, respectively. The following steps are taken under this method:

Step 1: Calculation of Total Capital of the firm on the basis of the new partner’s capital.

Total Capital of the Firm =

Step 2: Dividing Total Capital in the new profit-sharing ratio to determine the new capital of each partner (Proportionate Capital).

Step 3: Determining the adjusted present capital of the old partners.

Step 4: Comparing Proportionate Capital with Present Capital to ascertain the Surplus Capital or Deficit Capital.

Present Capital > Proportionate Capital = Surplus Capital

Present Capital < Proportionate Capital = Deficit Capital

Journal Entries:

(A) In the case of Surplus Capital:

(B) In the case of Deficit Capital:

Illustration:

Yash and Jay share profits and losses in the ratio of 3:1. On 1st April 2022, a new partner Zen is admitted into the Partnership and it is decided that Zen shall pay ₹ 40,000 as capital and the capital of the old partners shall be adjusted on the basis of new partner’s capital. Actual cash is to be brought in or withdrawn by the old partners, as the case may be. Calculate the New Capital of each partner, Surplus or Deficit Capital, and pass the necessary Journal entries when the New Profit Sharing Ratio is 5:3:2 and the Present Capital (after adjustments) of Yash and Jay is ₹85,400 and ₹39,800, respectively.

Solution:

Step 1: Calculation of Total Capital of the firm on the basis of Zen’s capital.

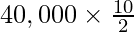

Total Capital of the Firm =

Total Capital of the Firm =

Total Capital of the Firm = 2,00,000.

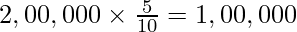

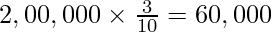

Step 2: Dividing Total Capital in the new profit-sharing ratio to determine the new capital of each partner.

New Capital of Yash =

New Capital of Jay =

New Capital of Zen =

Step 3: Determining the adjusted present capital of the old partners.

Adjusted Present Capital of Yash = ₹ 85,400

Adjusted Present Capital of Jay = ₹ 39,800

Step 4: Ascertaining the Surplus Capital or Deficit Capital.

For Yash:

Present Capital < New Capital (Deficit)

Deficit Capital = ₹1,00,000 – ₹85,400 = ₹14,600

For Jay:

Present Capital < New Capital (Deficit)

Deficit Capital = ₹60,000 – ₹39,800 = ₹20,200

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...