A unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,000 and is divided into 10,000 units of ₹100 each. Each unit of ₹100 will be called a share. To easily identify the shares, it is essential to give them numbers. The share of a company is moveable in nature and can be moved through the process stated by the Articles of Association of the Company.

According to Indian Companies Act, 2013, “Shares means shares in share capital of the company and includes stock except where the distinction between stock and share is expressed or implied.”

Over-subscription of Shares:

It is possible that a company receives applications for more shares than the shares offered to the public for subscription. This kind of situation is known as Over-subscription. It is usual that the shares of a sound and well-managed company get oversubscribed. However, a company cannot allot more shares than it has offered to the public for subscription. At times of oversubscription of shares, a company has three alternatives, among which pro-rata allotment is one of them.

Pro-rata Allotment:

It means allotment of less number of shares to applicants having more number of shares on a proportionate basis. In order to allot the shares to the applicants. the company have to determine the pro-rata ratio. A pro-rata ratio is the ratio of the total number of shares applied to the total number of shares allotted.

The pro-rata ratio is used by a company to determine two things:

- The Number of Shares allotted to an applicant if the Number of Shares applied by him is given.

- The Number of Shares applied by an applicant if the Number of Shares allotted to him is given.

Steps to Calculate the Amount due but not received from Defaulting shareholder to whom shares were allotted or Pro-rata Basis:

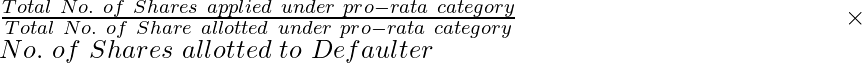

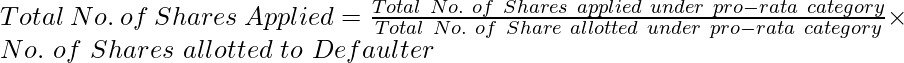

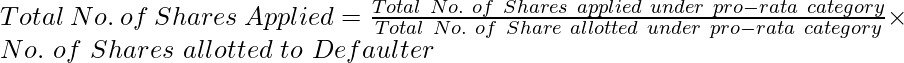

Step 1: Calculate the Total Number of Shares applied for (if not already given in the question) with the help of the following formula:

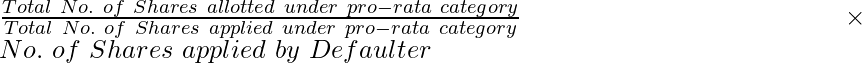

Or

Calculate the Number of Shares allotted (in not already given in the question) with the help of the following formula:

Step 2: Calculate the Total Application Money received on shares applied by Defaulter with the help of the following formula:

Total Application Money received on shares applied by Defaulter = No. of Shares applied by the Defaulter x Application money per share

Step 3: Calculate the Total Application money due on the shares allotted to defaulter with the help of the following formula:

Total Application money due on the shares allotted to defaulter = No. of Shares allotted to defaulter x Application money per share

Step 4: Calculate the Excess Application Money with the help of the following formula:

Excess Application Money = Amount as per Step 2 – Amount as per Step 3

Step 5: Calculate the Allotment or Call Money due but not received with the help of the following formula:

Allotment or Call Money due but not received = No. of Shares allotted to defaulter x Allotment Money/Call Money per share

Step 6: Calculate the Allotment or Call Money due but not received with the help of the following formula:

Allotment or Call Money due but not received = Amount as per Step 5 – Amount as per Step 4

Steps to Calculate the Amount received on Allotment Stage:

Step 1: Calculate the Total Allotment Money due with the help of the following formula:

Total Allotment Money Due = Total No. of Shares Allotted x Allotment Money per Share

Step 2: Deduct Allotment Money already received on the Application stage.

Step 3: Deduct Allotment money not received from Defaulting Shareholders.

Step 4: Add Calls in Advance (if any) received on Allotment Stage.

Step 5: Calculate the Amount Received on the Allotment Stage with the help of the following formula:

Amount Received on Allotment Stage = Amount as per (Step 1 – Step 2 – Step 3 + Step 4)

Illustration 1:

Ashutosh Ltd. issued a prospectus inviting applications for 40,000 shares of ₹10 each at a premium of ₹5 per share payable as:

₹3 on Application

₹4 on Allotment

₹6 on First Call (including premium)

₹2 on Second & Final Call

Applications were received for 70,000 shares. Applicants of 60,000 shares were allotted 40,000 shares on a pro-rata basis and money received on 10,000 shares was returned. It was decided to utilise excess application money towards the amount due on allotment. Kamal to whom 600 shares were allotted failed to pay the allotment money. Calculate the amount due but not received on allotment from Kamal and Calculate Allotment Money received later on.

Solution:

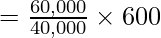

i) Total No. of Shares applied by Kamal:

= 900 Shares

ii) Amount due but not received on allotment from Kamal:

iii) Allotment Money received later on:

Illustration 2:

Manjul Ltd. issued 30,000 shares @ ₹10 each payable as ₹3 on Application, ₹4 on Allotment, ₹1.5 on First Call, and ₹1.5 on Second & Final Call. Applications were received for 60,000 shares and the allotment was made as follows:

a) Applicants of 40,000 shares were allotted 20,000 shares.

b) Applicants of 20,000 shares were allotted 10,000 shares.

Ritesh to whom 700 shares were allotted from category b), failed to pay the allotment money and Raghav to whom 300 shares were allotted from category a), failed to pay both calls. Pass the necessary Journal Entries.

Solution:

Working Notes:

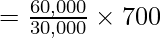

i) Total No. of Shares applied by Kamal:

= 1400 Shares

ii) Amount due but not received on allotment from Kamal:

iii) Allotment Money received later on:

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...