Issue of Debentures for Consideration other than Cash

Last Updated :

05 Apr, 2023

Issue of Debentures for consideration other than cash means that the company has not received amount (in cash or by cheque) against the debentures issued. Debentures may be issued for consideration other than cash in the following situations:

- To promoters of the company for rendering services for incorporating the company and/or incurring expenses

- To underwriters for undertaking to subscribe the unsubscribed debentures;

- To vendors of assets against purchase;

- For purchase of business

Let us discuss the above situation in detail:

(i) Issue of Debentures to Promoters: A company may allot debentures to the promoters for rendering services to incorporate the company and/or incurring expenses, if any, in place of payment of amount to them. The entries passes are:

(ii) Issue of Debentures to Underwriters: Underwriters undertake to subscribe the securities that remain unsubscribed by public and charge fee for it. A company may allot Debentures in place of payment of amount to them against the fees. The entries passed are:

(iii) Issue of Debentures to Vendors: Debentures may also be issued to vendors against the purchase of assets or business. The journal entries passed are:

When assets are purchased:

(iv) Issue of Debentures for purchase of business: When a business is purchased, it means assets and also liabilities have been taken over. The purchase consideration payable may be:

- equal to the Net Assets; or

- more than the Net Assets; or

- less than the Net Assets

Case

| Accounting Treatment

|

|---|

| (i) When Purchase Consideration is more than Net Assets | Excess of purchase consideration over Net Assets is debited to Goodwill Account.

|

| (ii) When Net Assets are more than Purchase Consideration | Excess of Net Assets over purchase consideration is credited to Capital Reserve Account.

|

Accounting Entries:

Accounting entries in each of the above situations are as follows:

(i) When purchase consideration is equal to the net assets:

(ii) When purchase consideration is more or less than the net assets(i.e., difference between the value of assets and value of liabilities), the difference (if Purchase Consideration is more than Net Assets) is debited to Goodwill Account or the difference (if Purchase Consideration is less than Net Assets) is credited to Capital Reserve. The entry will be:

*Either Goodwill or Capital Reserve will appear.

(Goodwill is recognised in the books of account since consideration (debentures) is paid and thus is Purchased Goodwill.)

Vendor may be issued Debentures at (i) par, (ii) premium or (iii) discount.

Accounting Entries for issue of Debentures to Vendor:

(i) When Debentures are issued at Par:

(ii) When Debentures are issued at Premium:

(iii) When Debentures are issued at Discount:

Calculation of Number of Debentures to be issued against Purchase Consideration:

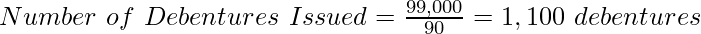

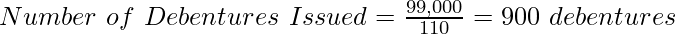

Suppose the purchase consideration is ₹1,10,000. What will be the number of debentures to be issued in the following cases when the face value of a debenture is ₹100:

(i) When debentures are issued at par

(ii) When debentures are issued at 10% premium

(iii) When debentures are issued at 10% discount.

Debentures cannot be issued in fractions. In case (iii), the number of debentures to be issued are 1,222.22. So,1,222 debentures will be issued, and the balance amount will be paid in cash i.e. ₹20 (₹1,10,000-1,09,000) will be paid in cash to the vendor.

Illustration:

Chinki Ltd. purchased assets of a book value of ₹ 99,000 from another company. It was agreed that the purchase consideration be paid by issuing 13% Debentures of ₹ 100 each. Assume that the debentures have been issued (i) at par (ii) at a discount of 10%, and (iii) at a premium of 10%. Pass the necessary journal entries in the books of the purchasing company.

Solution:

Case i. When Debentures are issued at par:

Case ii) When Debentures are issued at Discount:

*

Case iii) When debentures are issued at premium:

*

When purchase consideration is more than net assets:

Illustration 1:

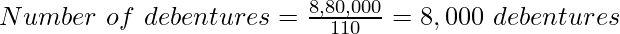

A company purchased and took over assets of ₹ 12,00,000 and liabilities of ‘1,50,000 of another company for the purchase consideration of ‘8,80, 000. The purchase consideration was paid by the company by issuing its 17% Debentures of ‘100 each at 10% premium. Provide the journal entries.

Solution:

*

When purchase consideration is less than net assets:

Illustration 2:

Mona Ltd. purchased assets from Don Ltd. as:

Plant and Machinery: ₹ 20,00,000 at ₹ 18,00,000; Land and Building: ₹ 30,00,000 at ₹ 42,00,000 for purchase consideration of ₹ 55,00,000 and paid ₹10,00,000 in cash and the remaining amount by issue of 10% Debentures of ₹100 each at a premium of 20%. Pass the necessary journal entries.

*

Share your thoughts in the comments

Please Login to comment...