Forfeiture of Shares : Accounting Entries on Issue of Shares

Last Updated :

01 Aug, 2023

What is Forfeiture of Shares?

Cancellation of shares of a shareholder who fails to pay the amount due on allotment or on any call within the specific time period is known as Forfeiture of Shares.

A company or its directors can forfeit the shares only if its Articles of Association allow for the same. If a company wants to make the forfeiture valid, it has to follow the rules laid down in the Articles of Association. If the Articles of Association is silent about the rules of forfeiture, then the company must give the defaulting shareholder a minimum of 14 days’ notice requiring him to pay the amount unpaid on his shares with the accrued interest thereon. Besides, the notice must state if the shareholder does not pay the unpaid amount within a certain period, his/her shares will be forfeited.

Once the shares are forfeited, the name of the shareholders is removed from the Registrar of Members. Also, the amount already paid by the defaulter shareholder remains with the company.

Over-subscription of Shares:

It is possible that a company receives applications for more shares than the shares offered to the public for subscription. This kind of situation is known as Over-subscription. It is usual that the shares of a sound and well-managed company get oversubscribed. However, a company cannot allot more shares than it has offered to the public for subscription. At times of over-subscription of shares, a company has three alternatives, among which pro-rata allotment is one of them.

Journal Entries on Forfeiture of Shares:

1. Forfeiture of Shares which were Issued at Par:

When the shares of defaulter shareholders are forfeited, the amount of share capital is reduced so their capital account will be debited by the amount already called so far on the forfeited shares. Amount of unpaid calls and/or allotment will be credited along with the amount already paid by the defaulting shareholder (which is credited to Share Forfeiture Account).

Disclosure: The balance of the Forfeited Shares Account is shown in Notes to Accounts under ‘Share Capital’ of the Balance Sheet till the forfeited shares are reissued.

Illustration:

Ankit Ltd. issued 30,000 shares @ ₹10 each payable as ₹4 on Application, ₹2 on Allotment, ₹2 on First Call, and ₹2 on the Second & Final Call. The company received applications for 50,000 shares for which allotment was made as follows:

a) Applicants of 25,000 shares were allotted 20,000 shares

b) Applicants of 15,000 shares were allotted 10,000 shares

c) Applicants of 10,000 shares were refunded

Sayeba who applied for 2000 shares from the category ‘a’ failed to pay allotment money. Sukant to whom 600 shares were allotted from category ‘b’ failed to pay the first call. The second & Final Call was not made and the shares of Sayeba and Sukant were forfeited. Pass the necessary Journal Entries.

Solution:

Working Note 1 (Sayeba):

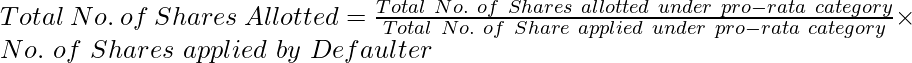

i) Total No. of Shares allotted to Sayeba:

= 1600 Shares

ii) Amount due but not received on allotment:

iii) Allotment Money received later on:

Working Note 2 (Sukant):

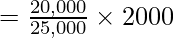

i) Total No. of Shares applied by Sukant:

= 900 Shares

ii) Amount due but not received on allotment from Sukant:

Working Note 3:

First Call Money due but not received on 30,000 shares:

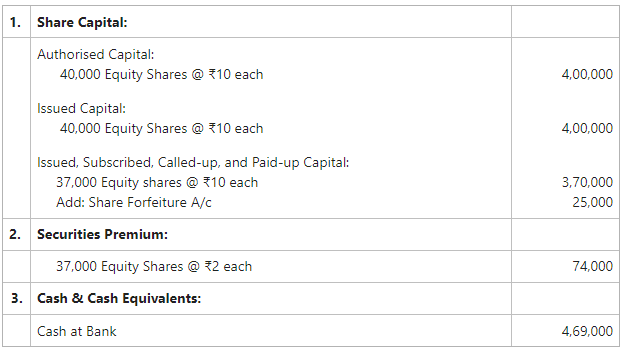

Notes to Accounts:

2. Forfeiture of Shares which were Issued at Premium:

If the shares are issued at premium and the amount of premium has been already paid by the shareholder, then the premium amount will remain in the Securities Premium A/c. The amount of securities premium received will not be cancelled at the time of forfeiture of shares. According to Section 78, Securities Premium A/c can be used for specific purposes only. However, if the amount of Securities Premium has not been paid by the shareholders, Securities Premium A/c will be debited at the time of forfeiture of shares. It is done to cancel the Securities Premium A/c credited at the time of entry of due.

i) If the amount of Securities Premium has not been received:

ii) If the amount of Securities Premium has been received:

Illustration:

Priyank Ltd. issued 40,000 shares @ ₹10 each with ₹2 as Premium payable as ₹4 on Application, ₹5 on Allotment (including premium), and ₹3 on First & Final Call. The company received applications for 90,000 shares for which allotment was made as follows:

a) Applicants of 40,000 shares were given 15,000 shares

b) Applicants of 30,000 shares were given 15,000 shares.

c) Applicants of 20,000 shares were given 10,000 shares.

Animesh to whom 1500 shares were allotted from category ‘a’ failed to pay call money. Hitesh who applied for 3000 shares from category ‘b’ failed to pay allotment and call money. The shares on which money was not received were forfeited. Pass the necessary Journal Entries.

Solution:

Working Note 1 (Animesh):

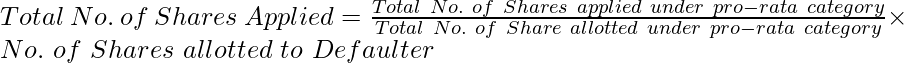

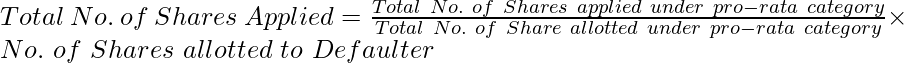

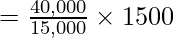

i) Total No. of Shares applied by Animesh:

= 4000 Shares

ii) Amount due but not received on allotment :

iii) First & Final Call Money due but not received:

Working Note 2 (Hitesh):

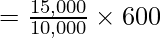

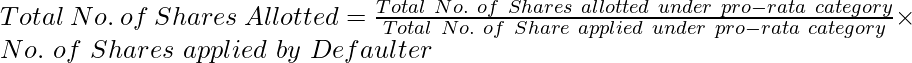

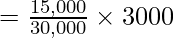

i) Total No. of Shares allotted to Hitesh:

= 1500 Shares

ii) Amount due but not received on allotment from Hitesh:

iii) Allotment Money received later on:

Working Note 3:

First & Final Call Money received:

Notes to Accounts:

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...