Advantages and Disadvantages of a Joint Stock Company

Last Updated :

11 Apr, 2024

An association of different individuals formed to carry out business activities is known as a joint stock company. This form of organization has an independent legal status from its members. Basically, a joint stock company is an artificial individual with a separate legal entity, common seal and perpetual succession. The Joint Stock Company form of organization is governed by the Companies Act, 2013. The shareholders of the company are its owners; however, the Board of Directors is elected by the shareholders and is the chief managing body of the company. Usually, the shareholders or the owners of the company have indirect control over its operations.

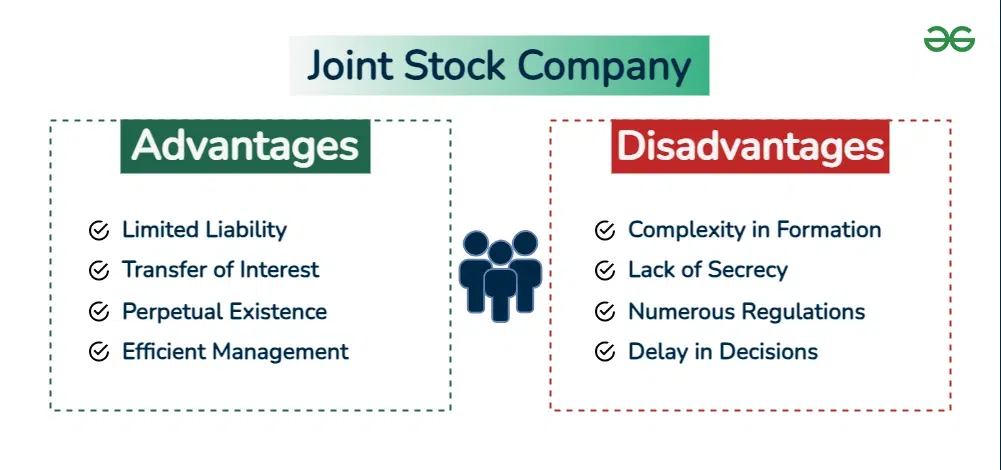

Advantages of Joint Stock Company

The important advantages of a joint stock company are as follows:

1. Limited Liability: The liability of the members of a company is limited to the extent of the share contributed by them in the company. If a company faces a loss, the shareholders of the company do not have to sell off their personal property for repayment. This advantage of a joint stock company attracts people to invest money in the Company Form of Business.

2. Transfer of Interest: As the shares of a company are transferrable and can be easily bought and sold in the market, it brings liquidity of investment in the company. The shareholders can anytime convert their share investment into cash and can use that amount to buy the shares of another company.

3. Perpetual Existence: As the company form of business has a separate legal existence from its members, it enjoys perpetual succession. It means that a company can be formed by law and can end by law through the process of winding up only, i.e., the death, insolvency, and incapacity of the members do not have any effect on the company’s existence.

4. Growth and Expansion: A company has more scope for expansion and growth because it has large financial resources and high profit rates. It means that if a company has retained profits, it can easily use that amount for its growth and expansion.

5. Efficient Management: Every business requires specialised people and experts for better performance and results. As a company has huge funds at its disposal, it can easily hire experts to perform various business activities, and can efficiently improve its working and performance.

6. Large Amount of Capital: As a company can issue shares to the general public, it grabs the biggest advantage of large capital. Besides, the value of a share is very low; therefore, people with less or small savings can also buy shares of a company. Also, a company can raise funds by issue of debentures, raising loans from financial institutions, and other securities.

Disadvantages of Joint Stock Company

The major limitations of a joint stock company are as follows:

1. Complexity in Formation: The process of the formation of a company is quite complicated and lengthy. It requires the completion of various formalities, and various different documents have to be prepared and submitted. It also requires obtaining different kinds of permissions. For all these activities, a company has to hire experts who charge high fees for the same. Besides, registration fees have to be paid to the registrar of companies.

2. Lack of Secrecy: According to the Companies Act, 1956 every company has to share various information about it with the registrar of companies, which is made available to the general public also. This compulsion of sharing information makes it difficult for the company to maintain secrecy about its operations.

3. Impersonal Work Environment: As a company is managed by hired professionals and experts, instead of its owners, and the professionals get a salary in return, there is no direct relationship between the efforts and reward of the business activities. In other words, if there is an increase in the profits of a company, it will not increase the salary of the experts, which results in a lack of motivation and incentive for efficient performance.

4. Numerous Regulations: A company has to fulfil a number of formalities at different stages of the business, and if it fails to meet any of these formalities, it has to bear the penalty. It also has to file annual reports and return every year with the registrar of the companies, which involves a huge amount of money and time of the company. Besides, it also hinders the secrecy of the company as there is regular interference in the operations of the business.

5. Delay in Decisions: The important decisions in a company are taken after consulting with different people or discussing in the board meeting, which is a lengthy process. Also, once a decision is made, communicating the decision to every person at different levels of the company is also a lengthy process. Therefore, making decisions and implementing them can delay things in a company.

6. Oligarchic Management: Although it is said that a democratic setup exists in a company, the truth is that it exists only on paper and not in real life. In reality, the control of a company is in the hands of a few people only, who are known as the directors of the company. The directors take every decision of the company and they do so by keeping their personal benefits and interests in their minds and do not think about the interest of the company and its shareholders.

7. Conflicts in Interests: Various groups of people such as debenture holders, shareholders, directors, employees, managers, etc., are involved in the operations of a company, and every group has its own interest. It is not possible that every group’s interest aligns with a decision, which can result in conflicts of interest between different groups.

After comparing the merits and demerits of a company, it can be said that this form of business organisation is suitable for basic and heavy industries, businesses requiring a huge amount of funds with heavy risks, and businesses with large-scale operations.

Share your thoughts in the comments

Please Login to comment...