A unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,000 and is divided into 10,000 units of ₹100 each. Each unit of ₹100 will be called a share. To easily identify the shares, it is essential to give them numbers. The share of a company is moveable in nature and can be moved through the process stated by the Articles of Association of the Company.

According to Indian Companies Act, 2013, “Shares means shares in share capital of the company and includes stock except where the distinction between stock and share is expressed or implied.”

Issue of Shares for Consideration other than Cash:

A company can issue shares not only for cash but also for a consideration other than cash. The shares of a company can be issued for a consideration other than cash to vendors and promoters also.

1. Issue of Shares to Vendors:

When a company buys some assets and business from vendors, the company can issue them shares in exchange, which is Purchase Consideration.

The amount paid by a purchasing company in consideration for the purchase of assets or business from another enterprise is known as Purchase Consideration. Unless it is stated otherwise, the purchase consideration on Net Assets basis is derived as follows:

Purchase Consideration = Agreed value of all assets taken over – Agreed amount of liabilities assumed

For example, Sahil Ltd. has acquired the assets and liabilities of Kashish Ltd. worth ₹80,00,000 and ₹60,00,000 respectively. Now, the Purchase Consideration in this case will be ₹80,00,000 – ₹60,00,000; i.e, ₹20,00,000.

Treatment of Difference between Purchase Consideration and Net Assets acquired:

Case

| Accounting Treatment

|

|---|

| If Purchase Consideration > Net Assets | The excess of purchase consideration over net assets acquired should be debited to Goodwill Account.

|

| If Net Assets > Purchase Consideration | The excess of net assets acquired over purchase consideration should be credited to Capital Reserve Account.

|

Disclosure

The number and class of shares issued for consideration other than cash are disclosed in Notes to Accounts ‘Share Capital’ in the company’s Balance Sheet.

Journal Entries:

1. On purchase of Business/Assets:

*The journal entry will include either Goodwill or Capital Reserve

2. When Assets are purchased:

3. On part payment to Vendor:

4. On Issue of Shares:

A. If Shares are issued to Vendors at Par:

(b) If Shares are issued to Vendors at Premium:

Note:

The number of shares to be given to the vendors in each of the case will be calulcated. The vendor will get the share equal to the asset’s purchase price. It means that if the shares are issued at premium, then the vendor will get less shares.

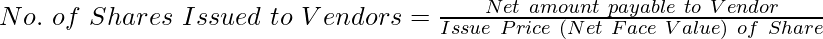

Formula to determine the Number of Shares to be Issued:

Illustration 1:

Gaurav Ltd. purchased Machinery costing ₹4,00,000 from Vaibhav Ltd. Payment for the same was made as under:

i) ₹1,00,000 in cash

ii) Balance was payable by issuing shares of ₹10 each at Par.

Pass the necessary Journal Entries.

Solution:

Working Note:

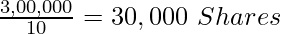

No. of Shares of Vendors:

Net amount payable = Total amount payable – Paid in Cash

Net amount payable = 4,00,000 – 1,00,000

Net amount payable = ₹3,00,000

Therefore, No. of shares issued =

Illustration 2:

Gaurav Ltd. purchased Machinery costing ₹4,00,000 from Vaibhav Ltd. Payment for the same was made as under:

i) ₹1,00,000 in cash

ii) Balance was payable by issuing shares of ₹10 each at a Premium of 25%.

Pass the necessary Journal Entries.

Solution:

Working Note:

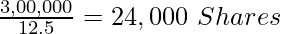

No. of Shares of Vendors:

Net amount payable = Total amount payable – Paid in Cash

Net amount payable = 4,00,000 – 1,00,000

Net amount payable = ₹3,00,000

Therefore, No. of shares issued at Premium =

2. Issue of Shares to Promoters:

A company can issue shares to its promoters in return for their services towards the creation and establishment of the company. It is the promoter’s efforts that play a major role in the creation of the company and its goodwill. Therefore, when the promoters of the company are allotted shares as remuneration, then the Goodwill A/c or Incorporation Cost A/c is debited.

Journal Entries:

1. Allotment of shares as remuneration to the Promoters:

2. On Issue of Shares:

A. If Shares are issued to Promoters at Par:

B. If Shares are issued to Promoters at Premium:

Illustration:

Nisha Ltd. issued 5,000 shares @ ₹12 each credited as fully paid to the promoters of the company for their services. Journalise the transaction.

Solution:

3. Issue of Shares to Underwriters:

Underwriting is an agreement in which companies enter before the issue and are brought before the public. It is done so that if the shares or debentures are not taken up by the public in full, the underwriters will have to take up and pay for such part of the shares or debentures for which the public has not applied for. Therefore, the underwriters are the persons or institutions who or which guarantee or undertake the issue. For the guarantee given by the underwriters or the services rendered by them, they charge the company with an agreed commission known as Underwriting Commission. Instead of paying cash for the commission, the company may allot shares to the underwriters.

Journal Entries:

1. On making the commission payable to underwriters:

2. On payment of commission in the form of shares:

3. On Issue of Shares:

A. If Shares are issued to Underwriters at Par:

B. If Shares are issued to Underwriters at Premium:

Illustration:

Shreya Ltd. issued 8,000 shares @ ₹15 each as fully paid to the Underwriters of the company for their underwriting services. Journalise the transaction.

Solution:

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...