Capital Accounts of the Partner: Fluctuating Capital Method

Last Updated :

05 Apr, 2023

The Partner’s Capital Account is an account that records all the transactions between the Partnership firm and the partners. The Capital Account is prepared to determine the partners’ share in the firm at the end of the accounting period. Every item of the partner’s concern, right from their initial capital investment to their share in the profit of the firm is recorded in the capital account. The Capital Account aims to promote transparency and accuracy between the firm and the partners and among the partners. The capital investments are credited, and drawings are debited in the Capital Account. Similarly, the Incomes and profits of the partners are recorded on the Credit side of the capital Account and the expenses/ losses are debited.

Methods of maintaining Capital Account:

There are two methods to maintain the Capital Account:

1. Fixed Capital Method: Under Fixed Capital Method, the initial capital introduced by the partners at the beginning is considered to be fixed throughout the lifespan of the firm, except in the event of Additional capital introduced and permanent withdrawal of the capital (drawings). A separate account known as a Current Account is prepared to record other transactions like Interest on Capital, Interest on Drawings, Salary, Commission, Share of profit, etc.

2. Fluctuating Capital Method: Under this method, the capital balance of each of the partners goes on changing from time to time and is not fixed. The capital account is affected by every transaction between the firm and the partners, such as Interest on Capital, Interest on Drawings, Salary, Commission, and so on.

Meaning of Fluctuating Capital Method:

Under the Fluctuating method of maintaining partners’ capital accounts, the capital balance of each of the partners fluctuates continuously and is not fixed. The reason behind such continuous fluctuation is that no separate account (Current Account) is prepared to record the income and expenses and profits/ losses of the partners. Every item of concern, such as Interest on Capital, Interest on Drawings, Salary, Commission, Share of profit, etc., is recorded in the capital account itself. In case of no instruction is provided, the Fluctuating method should be used to prepare the Partner’s Capital Account.

Steps of Fluctuating Capital Method:

Under this method, only Capital Account is prepared following the given steps:

Step 1: A Capital Account is prepared, and the initial capital invested by the partner is credited to the Capital Account. Further, any additional investments made by the partners are also credited, and any drawings from the capital are recorded on the debit side of the capital account.

Step 2: All the Receipts related to partners, such as Interest on capital, the salary of the partner, the profit share of the partner, commission, etc., are recorded on the credit side of the Capital Account.

Step 3: The debit side of a Capital Account records all the expenses or liabilities related to the partner, such as Interest on drawings.

Step 4: The profit is distributed according to the profit sharing ratio among the partners. The profit is credited and the loss is debited, respectively.

Step 5: Then the closing capital of the partner is calculated by subtracting the debit side of the Capital Account from the credit side. The closing balance is then transferred to a Balance sheet as a Partner’s Capital Account.

Formats (When the Capital is Fluctuating):

Illustration:

A and B are the partners sharing profit and loss in the ratio of 2:1 with a capital of ₹5,00,000 and ₹2,50,000, respectively on 1st April, 2020. The Partnership Deed provides the following clause:

- Interest on Capital to be paid to each partner @8% p.a.

- Salary of ₹1,750 per month to be paid to B.

- B is also entitled to receive a commission of 10% of the Net Profit remaining after deducting Interest on Capital and salary and after charging his commission.

- The profit for the year ended 31st March, 2021, after charging B’s salary was ₹2,25,000.

Prepare Partner’s Capital Account under Fluctuating Capital Method.

Solution:

Working Note:

1. Calculation of profit before charging B’s salary:

Profit before charging B’s salary= Profit after charging B’s salary+ B’s salary

Profit before charging B’s salary= 2,25,000+21,000

Profit before charging B’s salary= ₹2,46,000.

2. Calculation of Partner’s Commission:

Profit after charging Interest on Capital= Profit before charging Interest on Capital− Interest on Capital

Profit after charging Interest on Capital= 2,25,000− 60,000

Profit after charging Interest on Capital= ₹1,65,000

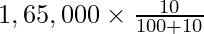

B’s Commission (after charging such commission)=

B’s Commission (after charging such commission)= ₹15,000.

Share your thoughts in the comments

Please Login to comment...