ACCOUNTANCY

Class 12

Time Allowed : 3 Hours

Maximum Marks : 80

Paper Code : 67/2/2(CBSE 2020)

General Instructions :

Read the following instructions very carefully and strictly follow them :

(i) This question paper comprises two Parts – A and B. There are 32 questions in the question paper. All questions are compulsory.

(ii) Part A is compulsory for all candidates.

(iii) Part B has two options i.e. (1) Analysis of Financial Statements and (2) Computerized Accounting. You have to attempt only one of the given options.

(iv) Heading of the option opted must be written on the Answer-Book before attempting the questions of that particular OPTION.

(v) Question nos. 1 to 13 and 23 to 29 are very short answer type questions carrying 1 mark each.

(vi) Question nos. 14 and 30 are short answer type–I questions carrying 3 marks each.

(vii) Question nos. 15 to 18 and 31 are short answer type–II questions carrying 4 marks each.

(viii) Question nos. 19, 20, and 32 are long answer type–I questions carrying 6 marks each.

(ix) Question nos. 21 and 22 are long answer type–II questions carrying 8 marks each.

(x) Answers should be brief and to the point. The answer of each part should be written at one place.

(xi) There is no overall choice. However, an internal choice has been provided in 2 questions of three marks, 2 questions of four marks, 1 question of six marks, and 2 questions of eight marks. You have to attempt only one of the choices in such questions.

(xii) However, separate instructions are given with each part and question, wherever necessary.

PART A

(Accounting for Not-for-Profit Organizations, Partnership Firms and Companies)

1. At the time of admission of a new partner in the firm, the new partner compensates the old partners for their loss of share in the superprofits of the firm for which he brings in an additional amount which is known as ___________ .

Answer: Premium for Goodwill

2. Divya Ltd. forfeited 7,000 equity shares of ₹ 100 each issued at a premium of 10%, for non-payment of first and final call of ₹ 40 per share. The maximum amount of discount at which these shares can be reissued will be:

(A) ₹ 2,80,000

(B) ₹ 4,20,000

(C) ₹ 4,90,000

(D) ₹ 3,50,000

Answer: ₹ 4,20,000

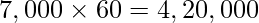

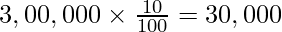

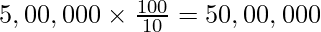

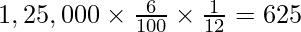

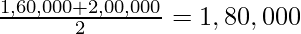

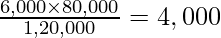

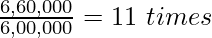

Explanation:

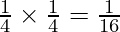

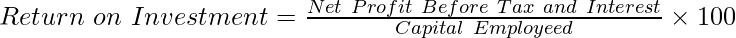

Balance in the forfeiture Account =

The maximum amount of discount on re-issue can be provided up to an extend of amount in the forfeiture Account.

3. What is meant by ‘Issue of Debentures as a Collateral Security’?

Answer: ‘Issue of Debentures as a Collateral Security’ means that the company issued debentures as secondary securities against the loan taken by the company.

4. Shobha Ltd. decided to redeem its 8,000, 9% debentures of ₹ 100 each, issued at a discount of 9%, redeemable at a premium of 10%. The minimum amount that can be transferred to Debenture Redemption Reserve will be :

(A) ₹ 8,00,000

(B) ₹ 2,20,000

(C) ₹ 2,00,000

(D) ₹ 8,80,000

Answer: (C) ₹ 2,00,000

Explanation:

As per SEBI Guidelines, a company shall create DRR equal to 25% of the amount of debentures issued before starting the redemption process.

Therefore, in this question amount transferred to Debenture Redemption Reserve = 25% of 8,00,000 = ₹ 2,00,000.

5. ‘Interest paid on debentures is a charge against the profits of the company.’ Is this statement correct? Give reason in support of your answer.

Answer: Yes, because Interest on debentures has to be paid even in the case of loss incurred by the company.

6. From the given extracts obtained from the Receipts and Payments Account of Cheema Club for the year ended 31st March, 2019 and additional information, calculate the amount of subscription in arrears as on 31st March, 2019.

Additional Information :

The Club had 130 members paying an annual subscription of ₹ 1,000 each. Subscriptions in arrears at the beginning of the year were ₹ 16,000. 10 members paid subscriptions for 2018-19 in 2017-18.

Answer:

Explanation:

Subscription to be received in 2018-19 = 1,30,000

Less: Subscription actually received in 2018-19 = 1,20,000

Less: Subscription in Advance = 10,000

So, there is no arrear for the subscription of 2018-19

7. The Directors of Unim Ltd. forfeited 30,000 shares of ₹ 10 each, for non-payment of final call of ₹ 3 per share. Half of the forfeited shares were reissued as fully paid-up for ₹ 12 per share. The amount to be transferred to the Capital Reserve Account will be:

(A) ₹ 2,70,000

(B) ₹ 2,10,000

(C) ₹ 1,05,000

(D) ₹ 1,80,000

Answer: (C) ₹ 1,05,000

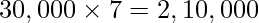

Explanation:

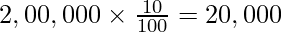

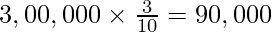

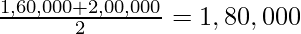

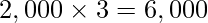

Total amount in forfeiture account=

No. of shares re-issued = 15,000. So, Amount to be transferred to Capital Reserve =

8. Sunaina, Rohan and Rina were partners in a firm sharing profits and losses in the ratio of 4 : 3 : 1. Sunaina retired, selling her share of profits to Rohan and Rina in the ratio of 3 : 1. The new profit-sharing ratio between Rohan and Rina will be:

(A) 4 : 3

(B) 4 : 1

(C) 2 : 1

(D) 3 : 1

Answer: (D) 3 : 1

Explanation:

Old Ratio = 4 : 3 : 1

Acquiring Ratio of Rohan and Rina = 3 : 1

Share Acquired by Rohan =

Share Acquired By Rina =

New Share of Rohan =

New Share of Rina =

9. Which of the following is NOT a revenue receipt?

(A) Admission Fees

(B) Government Grants

(C) Locker Rent

(D) Legacies

Answer: (D) Legacies

10. Nominal share capital is:

(A) That part of authorised capital which is issued by the company.

(B) The amount of capital which is actually applied by prospective shareholders.

(C) The amount of capital which is paid by the shareholders.

(D) The maximum amount of share capital that a company is authorised to issue.

Answer: (D) The maximum amount of share capital that a company is authorised to issue.

11. Mita and Sumit are partners in a firm with capitals of ₹ 6,00,000 and ₹ 4,00,000 respectively. Keshav was admitted as a new partner for 1/5th share in the profits of the firm. Keshav brought ₹ 40,000 as his share of goodwill premium and ₹ 3,00,000 as his capital. The amount of goodwill premium credited to Sumit will be:

(A) ₹ 20,000

(B) ₹ 24,000

(C) ₹ 16,000

(D) ₹ 40,000

Answer: (A) ₹ 20,000

Explanation:

Question is silent regarding the Old profit-sharing ratio, so it is assumed that Old Ratio is 1 : 1.

Since the share of a new partner is given, but no information about the sacrificing ratio of old partners is given, it is assumed that the new partner has acquired the share from the old partners in their old profit-sharing ratio,i.e., 1 : 1.

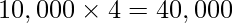

Therefore, the Premium for Goodwill is distributed equally between Aditya and Shiv,i.e.,

12. Distinguish between Income and Expenditure Account and Receipts and Payments Account on the basis of ‘Period’.

Answer: Income and Expenditure Account records items related only to the current period, whereas the Receipts and Payments Account records items related to the previous and future periods as well.

13. Asha and Deepti were partners in a firm sharing profits and losses in the ratio of 3: 1. Their fixed capitals were ₹ 3,00,000 and ₹ 2,00,000 respectively. They were entitled to interest on capital @ 10% p.a. The firm earned a profit of ₹ 20,000 during the year. The amount of interest on capital credited to Deepti will be:

(A) ₹ 12,000

(B) ₹ 8,000

(C) ₹ 20,000

(D) ₹ 5,000

Answer: (B) ₹ 8,000

Explanation:

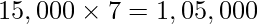

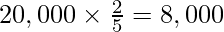

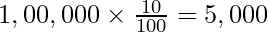

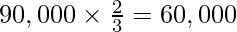

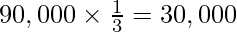

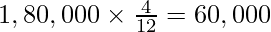

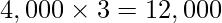

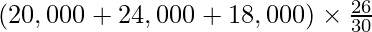

Interest on Capital of Asha =

Interest on Capital of Deepti =

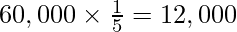

Total Interest on Capital of both the partners,i.e., ₹ 50,000 is more than the profit earned by the firm,i.e.,₹ 20,000, therefore Interest is allowed only to the extent of profit in the ratio of interest on capital of each partner, i.e., 3 : 2.

Now, Interest on Capital of Deepti =

14. How will the following information of Royal Sports Club be presented in the Income and Expenditure Account for the year ended 31st March, 2019 and its Balance Sheet as on that date?

Answer:

Explanation:

Tournament Expenses exceed the balance in the Tournament Fund by ₹ 30,000, so this amount is debited to Income and Expenditure A/c.

OR

From the following particulars relating to Ganesh Charitable Society, prepare a Receipts and Payments Account for the year ending 31st March, 2019:

Answer:

15. From the given Receipts and Payments Account and additional information of Premier Club for the year ended 31st March, 2019, prepare Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheet as on that date.

Additional Information :

(i) On 1st April, 2018, the Club had the following balance of assets and liabilities :

Furniture and Equipment ₹ 1,80,000, Subscriptions in arrears ₹ 15,000, and Outstanding Salary ₹ 13,000.

(ii) Charge depreciation on Furniture and Equipment @ 10% p.a.

(iii) The Club had 90 members, each paying an annual subscription of ₹ 1,000.

Answer:

Working Notes:

1. Balance Sheet (opening)

2. Calculation of Depreciation:

1 April’18 – 31 March’19:

1 Oct’18 – 31 March’19:

16. Yash and Karan were partners in an interior designer firm. Their fixed capitals were ₹ 6,00,000 and ₹ 4,00,000 respectively. There were credit balances in their current accounts of ₹ 4,00,000 and ₹ 5,00,000, respectively. The firm had a balance of ₹ 1,00,000 in General Reserve. The firm did not have any liability. They admitted Radhika into a partnership for  th share in the profits of the firm. The average profits of the firm for the last five years were ₹ 5,00,000. Calculate the value of goodwill of the firm by a capitalization of the average profits method. The normal rate of return in the business is 10%.

th share in the profits of the firm. The average profits of the firm for the last five years were ₹ 5,00,000. Calculate the value of goodwill of the firm by a capitalization of the average profits method. The normal rate of return in the business is 10%.

Answer:

Average Profit = ₹ 5,00,000.

Capitalised Value of the Average Profit =

Capital Employed = Capital and Current account balances of both the partners and General Reserve.

Capital Employed = 6,00,000 + 4,00,000 + 4,00,000 + 5,00,000 + 1,00,000 = ₹ 20,00,000

Goodwill = Capitalised Value of the Average Profit − Capital Employed (Net Assets)

Goodwill = 50,00,000 − 20,00,000 = ₹30,00,000

OR

Samiksha, Ash, and Divya were partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. With effect from 1st April, 2019, they agreed to share future profits and losses in the ratio of 2 : 5 : 3. Their Balance Sheet showed a debit balance of ₹ 50,000 in the Profit and Loss Account and a balance of ₹ 40,000 in the Investment Fluctuation Fund. For this purpose, it was agreed that :

(i) Goodwill of the firm is valued at ₹ 3,00,000.

(ii) Investments of the book value of ₹ 5,00,000 be valued at ₹ 4,80,000.

Pass the necessary journal entries to record the above transactions in the books of the firm.

Answer:

Working Note:

Calculation of Sacrificing/Gaining Ratio:

Samiksha:  (Sacrifice)

(Sacrifice)

Ash:  (Gain)

(Gain)

Divya:  (Gain)

(Gain)

Goodwill to be brought in =

Ash’s share of Goodwill =

Divya’s share of Goodwill =

17. The capital accounts of Alka and Archana showed credit balances of ₹ 4,00,000 and ₹ 3,00,000 respectively, after taking into account drawings and net profit of ₹ 2,00,000. The drawings of the partners during the year 2018-19 were :

(i) Alka withdrew ₹ 10,000 at the end of each quarter.

(ii) Archana’s drawings were :

Calculate interest on partners’ capitals @ 10% p.a. and interest on partners’ drawings @ 6% p.a. for the year ended 31st March 2019.

Answer:

Calculation of Opening Capital :

Interest on Capital:

Alka’s Interest on Capital:

Archana’s Interest on Capital:

Interest on Drawing:

Alka’s Total Drawing =

Alka’s Interest on Drawing =

Archana’s Interest on Drawing:

Archana’s Interest on Drawing:

18. Harsh, Kavya and Nitin were partners sharing profits and losses in the ratio of 2 : 2 : 1. On 31 st July, 2019, Nitin died. The Balance Sheet of the firm as at 31st March, 2019 was as follows:

According to the Partnership deed, in addition to the deceased partner’s capital, his executor is entitled to :

(i) Share in profits on the basis of average profits of the last two years. Profit for the year 2017-18 was ₹ 1,60,000.

(ii) His share in the goodwill of the firm. Goodwill will be valued on the basis of three years’ purchase of the average profits of the last two years.

(iii) Nitin withdrew ₹ 20,000 on 1st May, 2019. Prepare Nitin’s Capital Account which is to be rendered to his executor.

Answer:

Workings:

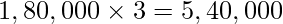

1. Average profit of last 2 years =

Profit up to 31st July, 2019 =

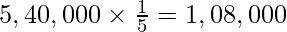

Nitin’s share of goodwill =

2. Average profit of last 2 years =

Firm’s Goodwill =

Nitin’s share of profit =

₹1,08,000 will be contributed by Harsh and Kavya equally.

19. Disha, Preeti and Ritvik were partners in a firm sharing profits and losses in the ratio of 3 : 2 : 1. The firm was dissolved on 31 st March, 2019. After transfer of assets (other than cash) and external liabilities to the Realization Account, the following transactions took place :

(i) A debtor, whose debt of ₹ 70,000 was written off as bad, paid ₹ 68,000 in full settlement.

(ii) A creditor, to whom ₹ 1,00,000 were due to be paid, accepted furniture at ₹ 56,000 and the balance was paid to him by cheque.

(iii) Ritvik had given a loan of ₹ 21,000 to the firm. He accepted ₹ 19,000 in full settlement of his loan.

(iv) Stock was worth ₹ 88,000 out of which stock worth ₹ 78,000 was taken over by Disha at ₹ 60,000 and the balance of the stock was sold for ₹ 12,000.

(v) Expenses on dissolution amounted to ₹ 23,000 and were paid by the firm.

(vi) Profit on dissolution amounted to ₹ 18,000.

Pass the necessary journal entries for the above transactions in the books of the firm.

Answer:

20. (i) Kati Ltd. issued 8,000, 9% debentures of ₹ 100 each at a discount of 10%. The full amount was payable on application. Applications were received for 9,000 debentures and allotment was made on a pro-rata basis.

Pass the necessary journal entries for the above transactions in the books of Kati Ltd.

Answer:

(ii) Pivot Ltd. issued 40,000, 11% debentures of ₹ 100 each on 1st April, 2015. Half of the debentures were due for redemption on 31st March, 2019. The company decided to transfer the minimum required amount to Debenture Redemption Reserve on 31st March, 2018 and invested the necessary amount in Debenture Redemption Investments on 30th April, 2018.

Pass the necessary journal entries for Redemption of Debentures.

Answer:

OR

(i) Rama Ltd. took over the following assets and liabilities of Krishna Ltd. on 1st April, 2019:

Land and Building : ₹50,00,000

Furniture : ₹10,00,000

Stock : ₹5,00,000

Creditors : ₹7,00,000

The purchase consideration of ₹ 60,00,000 was paid by issuing 12% debentures of ₹ 100 each at a premium of 20%.

Pass the necessary journal entries for the above in the books of Rama Ltd.

Answer:

(ii) On 1st April, 2018, Sakshi Ltd. issued 1,000, 11% Debentures of ₹ 100 each at a discount of 6%, redeemable at a premium of 5% after three years. Pass the necessary journal entries for the issue of debentures in the books of Sakshi Ltd.

Answer:

(iii) On 1st April, 2016, Canara Bank issued 5,000, 9% debentures of ₹ 100 each at a premium of 6%, redeemable on 31st March, 2019, at a premium of 10%. The issue was fully subscribed.

Pass the necessary journal entries for redemption of debentures in the books of Canara Bank.

Answer:

21. Madhuri and Arsh were partners in a firm sharing profits and losses in the ratio of 3 : 1. Their Balance Sheet as at 31st March, 2019, was as follows :

On 1st April, 2019, they admitted Jyoti into a partnership for  th share in the profits of the firm. Jyoti brought proportionate capital and ₹40,000 as her share of the goodwill premium. The following terms were agreed upon :

th share in the profits of the firm. Jyoti brought proportionate capital and ₹40,000 as her share of the goodwill premium. The following terms were agreed upon :

(i) Provision for doubtful debts was to be maintained at 10% on debtors.

(ii) Stock was undervalued by ₹ 10,000.

(iii) An old customer whose account was written off as bad, paid ₹ 15,000.

(iv) 20% of the investments were taken over by Arsh at book value.

(v) Claim on account of workmen’s compensation amounted to ₹ 70,000.

(vi) Creditors included a sum of ₹ 27,000 which was not likely to be claimed.

Prepare the Revaluation Account, Partners’ Capital Accounts, and the Balance Sheet of the reconstituted firm.

Answer:

Workings:

1. Calculation of Sacrificing Ratio:

Sacrificing ratio of Madhuri =

Sacrificing ratio of Arsh =

So, Sacrificing ratio of Madhuri and Arsh = 3 : 1

2. Calculation of Proportionate Capital of New Partner:

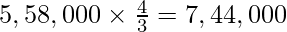

Adjusted Capital of Madhuri and Arsh = 3,60,000 + 1,98,000 = ₹5,58,000

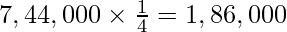

Total Capital of the New firm =

Proportionate Capital of Joyti =

OR

Anita, Gaurav and Sonu were partners in a firm sharing profits and losses in proportion to their capitals. Their Balance Sheet as at 31st March, 2019 was as follows :

On the above date, Anita retired from the firm and the remaining partners decided to carry on the business. It was agreed to revalue the assets and reassess the liabilities as follows:

(i) Goodwill of the firm was valued at ₹ 3,00,000 and Anita’s share of goodwill was adjusted in the capital accounts of the remaining partners, Gaurav and Sonu.

(ii) Land and Building was to be brought up to 120% of its book value.

(iii) Bad debts amounted to ₹ 20,000. A provision for doubtful debts was to be maintained at 10% on debtors.

(iv) Market value of investments was ₹ 1,10,000.

(v) ₹ 1,00,000 was paid immediately by cheque to Anita out of the amount due and the balance was to be transferred to her loan account which was to be paid in two equal annual instalments along with interest @ 10% p.a.

Prepare the Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of the reconstituted firm on Anita’s retirement.

Answer:

Workings:

1. Calculation of New Ratio and Gaining Ratio:

New Ratio of Gaurav and Sonu = 2 : 1

Gaining Ratio of Gaurav =

Gaining Ratio of Sonu =

Gaining Ratio of Gaurav and Sonu = 2 : 1

2. Calculation of value of Debtors:

Debtors = 1,50,000 − 20,000 = ₹ 1,30,000

Creating Provision for Doubtful Debts:

Provision for Doubtful Debts =

3. Calculation of Share of Goodwill of Anita:

Anita’s Share of Goodwill =

Goodwill to be paid by Gaurav =

Goodwill to be paid by Sonu =

Note:

(a) Bad Debts worth ₹ 10,000 is adjusted against the Provision for Doubtful Debts.

(b) Decrease in value of investment is adjusted against the Investment Fluctuation Fund.

22. V.D. Ltd. invited applications for issuing 2,00,000 equity shares of ₹ 10 each at a premium of ₹ 6 per share. The amount per share was payable as follows :

On application – ₹ 3 (including premium ₹ 1)

On allotment – ₹ 7 (including premium ₹ 5)

On first and final call – Balance amount

Applications were received for 2,50,000 shares. Applicants for 10,000 shares were sent letters of regret and application money returned to them. Shares were allotted to the remaining applicants on a pro-rata basis. Money overpaid on application was adjusted towards the sums due on allotment. The company received all the money due on allotment except from Agam,who was allotted 1,000 shares. Her shares were forfeited immediately after allotment. Afterwards, the first and final call was made. Seema, the holder of 2,000 shares, did not pay the first and final call on her shares. Her shares were also forfeited. 50% of the forfeited shares, each of Agam and Seema, were reissued as fully paid-up @ ₹ 16 per share.

Pass the necessary journal entries to record the above transactions in the books of V.D. Ltd.

Answer:

Workings:

1. Calculating Agam’s Calls-in-Arrear:

Agam from Category A failed to pay Allotment money:

No. of shares applied by him = x

No. of shares allotted to him = 1,000 shares

therefore, x = shares

shares

Advance paid by him at the time of application =

Amount payable by him on allotment =

so, Calls-in-Arrears of Agam=7,000−600 = ₹6,400.

2. Calculating Seema’s Calls-in-Arrear:

Calls-in-Arrears of Seema =

OR

Konark Ltd. invited applications for issuing 3,00,000 shares of ₹ 10 each. The amount per share was payable as follows : ₹ 3 on application, ₹ 3 on allotment, and ₹ 4 on first and final call. The company received applications for 4,00,000 shares. Allotment was done as follows :

(i) Applicants of 2,40,000 shares were allotted 2,00,000 shares.

(ii) Applicants of 1,20,000 shares were allotted 80,000 shares.

(iii) Remaining applicants were allotted 20,000 shares.

Money overpaid on applications was adjusted towards sums due on allotment. Divij, a shareholder, belonging to group (ii), who had applied for 6,000 shares, failed to pay allotment and call money. Faisal, another shareholder, who was allotted 10,000 shares, paid the call money along with allotment. Faisal belonged to group (i). Divij’s shares were forfeited after the first and final call. Half of the forfeited shares were reissued @ ₹ 10 per share fully paid.

Pass the necessary journal entries to record the above transactions in the books of the company.

Answer:

Workings:

1. Calculating Divij’s Calls-in-Arrear:

Divij from Category (i) failed to pay Allotment money:

No. of shares applied by him = 6,000 shares

No. of shares allotted to him = x

therefore, x =

Advance paid by him at the time of application =

The actual amount payable by him on allotment =

so, Calls-in-Arrears of Divij = 12,000−6,000 = ₹ 6,000.

2. Calls-in-Advance paid by Faisal =

PART-B

OPTION 1

(Analysis of Financial Statements)

23. Which of the following is NOT an item under ‘Current Assets’?

(A) Cash and Cash Equivalents

(B) Capital Advances

(C) Short-term Loans and Advances

(D) Inventories

Answer: (B) Capital Advances

24. ‘Sale of goods ₹ 3,000 for cash will increase the Gross Profit Ratio.’Is this statement correct? Give reason in support of your answer.

Answer: No, this is an incorrect statement because the sales and gross profit will increase by the same percentage so the net effect of sales on the Gross Profit Ratio is nil.

25. Interest received in cash on loans and advances results in cash inflow from ___________ activity.

Answer: Investing

26. Machinery was purchased for ₹ 10,00,000, paying 40% by issue of equity shares of ₹ 10 each and the balance by a cheque. This transaction will result in:

(A) Cash used in investing activities ₹ 6,00,000.

(B) Cash generated from financing activities ₹ 4,00,000.

(C) Decrease in cash and cash equivalents ₹ 10,00,000.

(D) Cash used in investing activities ₹ 10,00,000.

Answer: (A) Cash used in investing activities ₹ 6,00,000.

27. Which of the following is NOT a limitation of ‘Financial Statements Analysis’?

(A) It is affected by personal bias.

(B) Inter-firm comparative study possible.

(C) Lack of qualitative analysis.

(D) Ignores price level changes.

Answer: (B) Inter-firm comparative study possible.

28. What is meant by ‘Cash Flow Statement’?

Answer: A statement showing flows of cash & cash equivalent during a specified time period is known as a Cash Flow Statement.

29. ‘Security Deposits’ are presented in the Balance Sheet of the company under the subhead:

(A) Other Non-Current Assets

(B) Long-term Loans and Advances

(C) Fixed Assets

(D) Other Current Liabilities

Answer: (B) Long-term Loans and Advances

30. From the following information obtained from the books of P. Ltd., calculate, (i) Return on Investment, and (ii) Debt Equity Ratio:

Information: Net Profit after interest and tax ₹ 6,00,000; 6% Debentures ₹ 10,00,000;

Capital employed ₹ 20,00,000, and Tax rate 40%.

Answer:

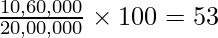

1.

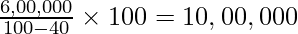

Net Profit before Tax =

Tax Payable =

Net Profit before Tax and interest = 6,00,000 + 4,00,000 + 60,000 = ₹10,60,000

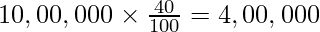

Return on Investment =

2. Debt-Equity Ratio =

Equity = Capital Employed – Debt

= 20,00,000 – 10,00,000

Equity = ₹10,00,000

Debt-Equity Ratio =

OR

(i) Current Liabilities ₹ 1,50,000, Current Assets ₹ 2,80,000, Inventories ₹ 40,000, Advance Tax ₹ 30,000, and Prepaid Rent ₹ 10,000. Calculate Quick Ratio.

Answer:

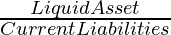

Quick Ratio =

Liquid Asset = Current Assets − Inventory − Prepaid Expenses

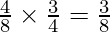

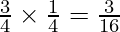

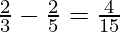

Liquid Assets = 2,80,000 − 40,000 − 40,000 = ₹ 2,00,000

Quick Ratio =  = 4:3 or 1.33:1

= 4:3 or 1.33:1

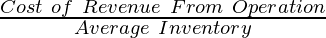

(ii) Average Inventory ₹ 60,000, Revenue from Operations ₹ 6,00,000, the rate of Gross Loss on Sales is 10%. Calculate the Inventory Turnover Ratio.

Answer:

Inventory Turnover Ratio =

Cost of Revenue from Operation = Sales + Gross Loss

Cost of Revenue from Operation =

Inventory Turnover Ratio =

31. From the following particulars obtained from the books of Mark Ltd., prepare a Comparative Statement of Profit and Loss:

Answer:

OR

From the following Balance Sheet of Swaraj Ltd., as at 31st March, 2019, prepare a common-size Balance Sheet:

32. Cash flow from the operating activities of Pinnacle Ltd. for the year ended 31st March, 2019 was ₹ 28,000. The Balance Sheet along with notes to accounts of Pinnacle Ltd. as at 31st March, 2019 is given below:

You are given the following additional information :

(i) A machinery of a book value of ₹ 90,000 (depreciation provided thereon was ₹ 23,000), was sold at a profit of ₹ 12,000.

(ii) 9% debentures were issued on 1st April, 2018.

Prepare the Cash Flow Statement.

Answer:

Working Notes:

PART B

OPTION 2

(Computerised Accounting)

23. A ##### error appears when:

(A) A negative data is used.

(B) Column is not wide enough.

(C) Negative time is used.

(D) All of the above.

Answer: (D) All of the above.

24. The ___________ provides real power to database in terms of its capacities to answer complex requests involving data to be taken from ___________tables.

Answer: The Query provides real power to database in terms of its capacity to answer complex requests involving data to be taken from Multiple tables.

25. A code which consists of alphabet or abbreviation as symbol to codify a piece of information is known as ___________ code.

Answer: A code which consists of alphabet or abbreviation as a symbol to codify a piece of information is known as Mnemonic code.

26. A ___________ voucher is used for adjustment of non-cash transaction in the ledger.

Answer: A Journal voucher is used for adjustment of non-cash transactions in the ledger.

27. Hardware refers to:

(A) System software and application software.

(B) Computer-associated peripherals and their network.

(C) A logical sequence of actions to perform a task.

(D) All of the above.

Answer: (B) Computer-associated peripherals and their network.

28. To safeguard assets and optimise the use of resources, a business:

(A) Keeps internal controls.

(B) Only tries to achieve maximum revenue.

(C) Only ensures accurate accounting records.

(D) Only safeguards assets.

Answer: (A) Keeps internal controls.

29. The existence of data in a ‘primary key’ field is:

(A) Not necessarily required.

(B) Required but need not be unique.

(C) Required and must be unique.

(D) All of the above.

Answer: (C) Required and must be unique.

30. What information is provided by a salary bill?

Answer: A Salary Bill provides the following information:

1. Information related to Employee like Employee’s Name, Number, Attendance, Designation and other details.

2. Dates of Pay Period for which salary bill has been generated.

3. Detailed information about Gross Salary and Net Salary (Showing all the deductions applicable).

4. Employer’s information like Name and contact details, taxes details, if any.

5. Details about the Medical Benefits provided to employees on monthly basis.

6. Detailed information about the incentives or bonuses provided to employees as appreciation for a worker’s efforts.

OR

List the various attributes of a ‘payroll’ database.

Answer: The various attributes of a ‘payroll’ database includes:

1. Employee details: Name, Payroll Number, Designation, Location.

2. Working Hours: Payroll gives details of hours that the employees have worked to accurately calculate the salary.

3. Salary and wages: Payroll shows the salary and wages of the employees along with other benefits like incentives, medical benefits, and so on.

4. Time-Off: Payroll keeps a track of leaves and vacations of employees.

5. Payroll Taxes: Taxes deducted from the salary and wages.

6. Gross and Net Salary: Payroll shows the gross salary and Take-Home salary of the employees.

31. Explain ‘closing entry’ and ‘adjustment entry’ with the help of examples.

Answer: The closing Entry is a journal entry passed for transferring the data of Trial Balance to the Trading and Profit and Loss Account.

Example: Purchase Return Account is closed by transferring the balance to the Purchase Account.

An adjustment Entry is a journal entry passed at the end of the accounting period to have accurate balances of the accounts.

Example: Depreciation on Plant to be charged @ 10% per annum. The adjustment entry at end of the accounting period shall be:

OR

Explain any four advantages expected by the user for paying high price for a chosen server database.

Answer:

Four Advantages of a chosen server database:

1. Scalability: Server database can store a large amount of data and is, therefore, suitable for large-scale applications.

2. Performance: Server database is highly efficient to handle complex queries and large-scale data.

3. Security: Server database ensures various security measures like user authentication and encryption protection. etc.

4. Flexibility: Server database provide access to data from anywhere and anytime, providing flexibility to access.

32. A. Ranjan Ltd. has its offices in Hyderabad and Surat. HRA for Hyderabad is ₹ 21,000 and for Surat it is ₹ 18,000. DA is calculated on Basic Pay (BP) as 12% for BP ≤ ₹ 25,000, and 10% for BP ≤ ₹ 30,000. Standard number of days are taken as 30 days per month. Give the formulae and calculate the amount of Gross Salary using Excel for the following employees:

(i) Vishal is working in Hyderabad office. His Basic Pay is ₹ 40,000. He has not availed any leave without pay.

(ii) Sangeeta is working in Surat office of A. Ranjan Ltd. Her Basic Pay is ₹ 20,000. She availed four days of leave without pay.

Answer:

Keys :

Employee Name = A1

HRA = B1

Basic Pay = C1

DA = D1

1. Calculation of DA:

DA = If (C1 ≤ ₹25,000, 12%, 10% ) * C1

= If (C1 ≥ ₹30,000, 10%, 12% ) * C1

Vishal DA = ₹4,000

Gross Salary = ₹21,000 + ₹4,000 + ₹40,000

= ₹65,000/-

Sangeeta DA = ₹2,400

Gross salary =

=35,013/-

Share your thoughts in the comments

Please Login to comment...