Calls in Arrear: Accounting Entries on Issue of Shares

Last Updated :

05 Apr, 2023

A unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,000 and is divided into 10,000 units of ₹100 each. Each unit of ₹100 will be called a share. To easily identify the shares, it is essential to give them numbers. The share of a company is moveable in nature and can be moved through the process stated by the Articles of Association of the Company.

According to Indian Companies Act, 2013, “Shares means shares in share capital of the company and includes stock except where the distinction between stock and share is expressed or implied.”

Calls in Arrear:

It is the unpaid amount of shares that shareholders fail to pay due on allotment or on calls. The two methods to deal with Calls in Arrear are as follows:

1. Without Opening Calls in Arrear Account:

Under the first method, the company does not need to open a Calls in Arrear account, and can just credit the actual amount received from shareholders to the call account. The call account, in this case, shows the debit balance equal to the unpaid amount of the call. And when the unpaid amount is received, the Bank A/c is debited, and the relevant Call A/c is credited on that date.

Journal Entries:

A. On making the First Call due:

B. On receipt of the First Call:

C. On making the Final Call due:

D. On receipt of the Final Call:

i. Final call money received without Calls in Arrear:

ii. Final call money received with Calls in Arrear:

Illustration :

Nisha Ltd. issues 10,000 shares of ₹10 each payable as: ₹2 on application, ₹4 on allotment, ₹3 on the First Call, and ₹1 on the Second & Final Call. The shares were fully subscribed and all money was duly received except First Call money on 1,000 shares and Second & Final Call money on 2,000 shares. Pass necessary Journal Entries without opening Calls in Arrear Account.

Solution:

2. By Opening Calls in Arrear Account:

Under this method, the company opens Calls in Arrear A/c and debits the same when some amount of allotment or calls is not received. And once the company receives the amount in arrear, the Bank A/c is debited, and the Calls in Arrear A/c is credited.

Journal Entries:

A. On making the First Call due:

B. On receipt of the First Call:

C. On making the Final Call due:

D. On receipt of the Final Call:

Illustration :

Nisha Ltd. issues 10,000 shares of ₹10 each payable as: ₹2 on application, ₹4 on allotment, ₹3 on the First Call, and ₹1 on the Second & Final Call. The shares were fully subscribed and all money was duly received except First Call money on 1,000 shares and Second & Final Call money on 2,000 shares. Pass necessary Journal Entries by opening Calls in Arrear Account.

Solution:

Interest on Calls in Arrear:

A company is authorised to charge Interest on Calls in Arrears from the due date to the date of actual payment at a rate specified in the articles of the company. However, if the articles of the company are silent, then Table F of Schedule I of the Companies Act, 2013 will be applicable for charging interest at a rate not exceeding 10% p.a. Besides, the directors of the company have the right to waive payments of such interests in part or whole.

Journal Entries:

1. On making due the interest on Calls in Arrear:

2. On receipt of interest on Calls in Arrear:

3. On transfer of interest on Calls in Arrear to Profit & Loss A/c at the end of the accounting period:

Illustration:

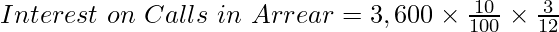

Tanya Ltd. issued 70,000 shares @ ₹10 each payable as ₹4 on Application (1st January 2021), ₹3 on Allotment (1st March 2021), and ₹3 on First and Final Call (1st May 2021). Kashish was allotted 1,200 shares and he failed to pay the First & Final Call money on the due date. But he paid the unpaid first & final call money on 1st August 2021 with the interest of 10% p.a. Pass necessary Journal Entries in the books of Tanya Ltd.

Solution:

Calculation:

= 90

Share your thoughts in the comments

Please Login to comment...