Loan Eligibility prediction using Machine Learning Models in Python

Last Updated :

21 Mar, 2024

Have you ever thought about the apps that can predict whether you will get your loan approved or not? In this article, we are going to develop one such model that can predict whether a person will get his/her loan approved or not by using some of the background information of the applicant like the applicant’s gender, marital status, income, etc.

Importing Libraries

In this step, we will be importing libraries like NumPy, Pandas, Matplotlib, etc.

Python3

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sb

from sklearn.model_selection import train_test_split

from sklearn.preprocessing import LabelEncoder, StandardScaler

from sklearn import metrics

from sklearn.svm import SVC

from imblearn.over_sampling import RandomOverSampler

import warnings

warnings.filterwarnings('ignore')

|

Loading Dataset

Python3

df = pd.read_csv('loan_data.csv')

df.head()

|

Output:

To see the shape of the dataset, we can use shape method.

Output:

(577, 5)

To print the information of the dataset, we can use info() method

Output:

To get values like the mean, count and min of the column we can use describe() method.

Output:

Exploratory Data Analysis

EDA refers to the detailed analysis of the dataset which uses plots like distplot, barplots, etc.

Let’s start by plotting the piechart for LoanStatus column.

Python3

temp = df['Loan_Status'].value_counts()

plt.pie(temp.values,

labels=temp.index,

autopct='%1.1f%%')

plt.show()

|

Output:

Here we have an imbalanced dataset. We will have to balance it before training any model on this data.

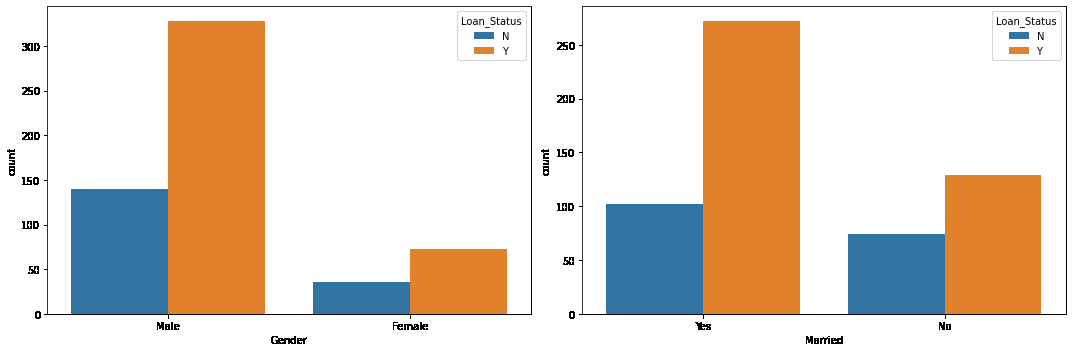

We specify the DataFrame df as the data source for the sb.countplot() function. The x parameter is set to the column name from which the count plot is to be created, and hue is set to ‘Loan_Status’ to create count bars based on the ‘Loan_Status’ categories.

Python3

plt.subplots(figsize=(15, 5))

for i, col in enumerate(['Gender', 'Married']):

plt.subplot(1, 2, i+1)

sb.countplot(data=df, x=col, hue='Loan_Status')

plt.tight_layout()

plt.show()

|

Output:

One of the main observations we can draw here is that the chances of getting a loan approved for married people are quite low compared to those who are not married.

Python3

plt.subplots(figsize=(15, 5))

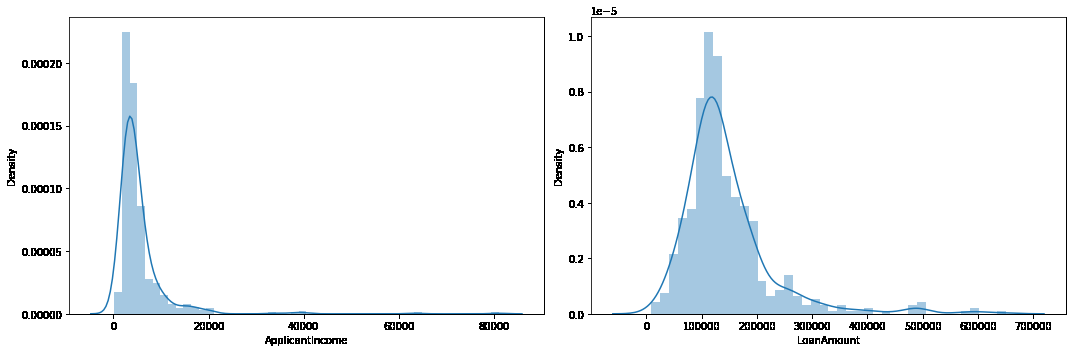

for i, col in enumerate(['ApplicantIncome', 'LoanAmount']):

plt.subplot(1, 2, i+1)

sb.distplot(df[col])

plt.tight_layout()

plt.show()

|

Output:

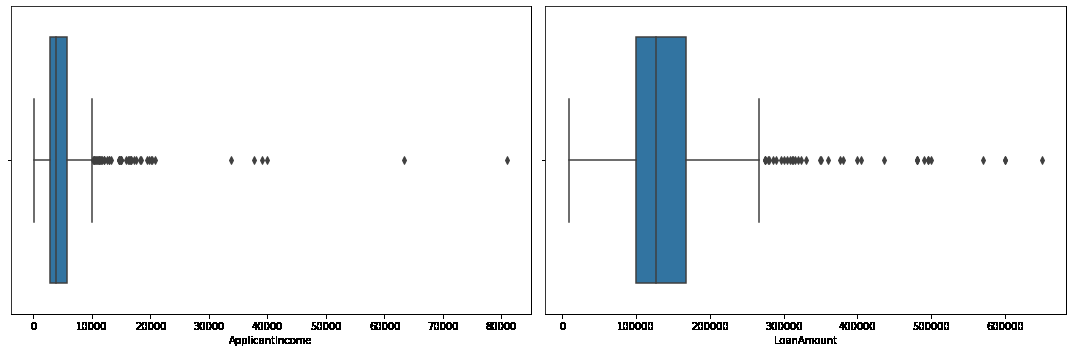

To find out the outliers in the columns, we can use boxplot.

Python3

plt.subplots(figsize=(15, 5))

for i, col in enumerate(['ApplicantIncome', 'LoanAmount']):

plt.subplot(1, 2, i+1)

sb.boxplot(df[col])

plt.tight_layout()

plt.show()

|

Output:

There are some extreme outlier’s in the data we need to remove them.

Python3

df = df[df['ApplicantIncome'] < 25000]

df = df[df['LoanAmount'] < 400000]

|

Let’s see the mean amount of the loan granted to males as well as females. For that, we will use groupyby() method.

Python3

df.groupby('Gender').mean()['LoanAmount']

|

Output:

Gender

Female 118822.429907

Male 139289.823009

Name: LoanAmount, dtype: float64

The loan amount requested by males is higher than what is requested by females.

Python3

df.groupby(['Married', 'Gender']).mean()['LoanAmount']

|

Output:

Married Gender

No Female 116115.384615

Male 126644.628099

Yes Female 126103.448276

Male 143912.386707

Name: LoanAmount, dtype: float64

Here is one more interesting observation in addition to the previous one that the married people requested loan amount is generally higher than that of the unmarried. This may be one of the reason’s that we observe earlier that the chances of getting loan approval for a married person are lower than that compared to an unmarried person.

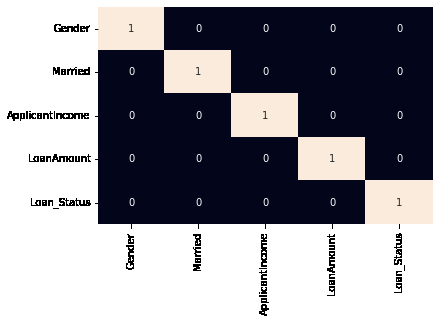

Python3

def encode_labels(data):

for col in data.columns:

if data[col].dtype == 'object':

le = LabelEncoder()

data[col] = le.fit_transform(data[col])

return data

df = encode_labels(df)

sb.heatmap(df.corr() > 0.8, annot=True, cbar=False)

plt.show()

|

Output:

Data Preprocessing

In this step, we will split the data for training and testing. After that, we will preprocess the training data.

Python3

features = df.drop('Loan_Status', axis=1)

target = df['Loan_Status'].values

X_train, X_val,\

Y_train, Y_val = train_test_split(features, target,

test_size=0.2,

random_state=10)

ros = RandomOverSampler(sampling_strategy='minority',

random_state=0)

X, Y = ros.fit_resample(X_train, Y_train)

X_train.shape, X.shape

|

Output:

((447, 4), (616, 4))

We will now use Standard scaling for normalizing the data. To know more about StandardScaler refer this link.

Python3

scaler = StandardScaler()

X = scaler.fit_transform(X)

X_val = scaler.transform(X_val)

|

Model Development

We will use Support Vector Classifier for training the model.

Python3

from sklearn.metrics import roc_auc_score

model = SVC(kernel='rbf')

model.fit(X, Y)

print('Training Accuracy : ', metrics.roc_auc_score(Y, model.predict(X)))

print('Validation Accuracy : ', metrics.roc_auc_score(Y_val, model.predict(X_val)))

print()

|

Output:

Training Accuracy : 0.6136363636363635

Validation Accuracy : 0.4908403026682596

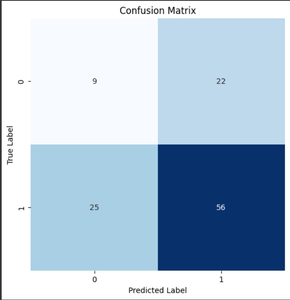

Model Evaluation

Model Evaluation can be done using confusion matrix.

we first train the SVC model using the training data X and Y. Then, we calculate the ROC AUC scores for both the training and validation datasets. The confusion matrix is built for the validation data by using the confusion_matrix function from sklearn.metrics. Finally, we plot the confusion matrix using the plot_confusion_matrix function from the sklearn.metrics.plot_confusion_matrix submodule.

Python3

from sklearn.svm import SVC

from sklearn.metrics import confusion_matrix

training_roc_auc = roc_auc_score(Y, model.predict(X))

validation_roc_auc = roc_auc_score(Y_val, model.predict(X_val))

print('Training ROC AUC Score:', training_roc_auc)

print('Validation ROC AUC Score:', validation_roc_auc)

print()

cm = confusion_matrix(Y_val, model.predict(X_val))

|

Python3

plt.figure(figsize=(6, 6))

sb.heatmap(cm, annot=True, fmt='d', cmap='Blues', cbar=False)

plt.title('Confusion Matrix')

plt.xlabel('Predicted Label')

plt.ylabel('True Label')

plt.show()

|

Output:

Confusion Matrix

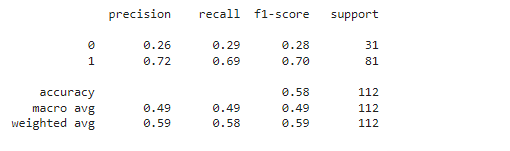

Python3

from sklearn.metrics import classification_report

print(classification_report(Y_val, model.predict(X_val)))

|

Output:

Conclusion

As this dataset contains fewer features the performance of the model is not up to the mark maybe if we will use a better and big dataset we will be able to achieve better accuracy.

You can also refer this article: Loan Approval Prediction using Machine Learning

Share your thoughts in the comments

Please Login to comment...