What is Indirect Tax?

The tax imposed by the government on goods and services purchased by anyone in the country is called Indirect Tax. Indirect Tax can be defined as a type of tax in which the incidence and impact of the tax are passed on to another individual or entity i.e. the end consumer of the product.

Unlike direct taxes, It is not levied on the income of the person but on the value of goods or services purchased. Generally, Indirect Tax is levied on sellers (Manufacturers, retailers, etc.) on the purchase of raw materials or goods purchased for resale and then they pass it onto the end consumer of the product who has purchased it for final consumption.

Indirect taxation in India is imposed and regulated by the Central Board of Indirect Taxes and Customs (CBIC). CBIC has all the authority to frame rules for the purpose of levying indirect tax in the country. CBIC was constituted under the Central Board of Revenue Act, 1963 for matters relating to the levy and collection of Customs and Central Excise duties and other Indirect Taxes.

Features of Indirect Tax

The features of Indirect Tax are as follows:

1. Tax Liability: In Indirect Tax, the tax liability is borne by the consumer of the product or service. The tax is collected by the manufacturer and seller from the consumer.

2. Payment of Tax: The responsibility of payment of tax to the government under indirect tax is on the seller of the product who collects tax on the behalf of the consumer.

3. Nature: Before the implementation of GST, the nature of indirect taxes was regressive. After the introduction of GST, it became progressive.

4. Saving & Investment: Indirect Tax encourages saving and investment as it is not charged directly on income but on consumer’s expenditure.

5. Tax Evasion: It is very difficult to evade tax in this because it is directly charged on the purchase of goods and services and not on income.

Indirect Tax in India

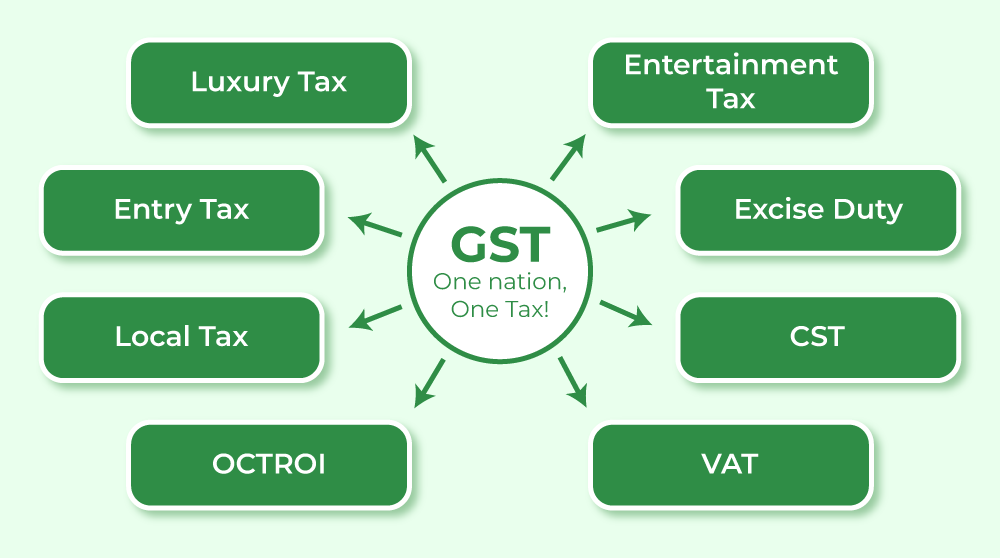

In India, before July 2017, there were many different Indirect Taxes that were applicable on the sale and purchase of goods and services in the country. For Example, Service Tax was levied on any type of service, Excise Duty was levied on the manufacturing of goods, Customs Duty was levied on the import of goods, etc. On 29th March 2017, the GST Act was passed in the Parliament of India, which came into effect on 1st July 2017. This was done to merge all the indirect taxes into a single tax, i.e., Goods and Services Tax (GST) that can replace multiple layers of taxation in India. It has replaced 17 indirect taxes (9 State-level taxes and 8 Central level taxes) and 23 cesses of the States and Centres that existed earlier, including Central excise duty, Service tax, Value Added Tax (VAT), Luxury Tax, etc.

Types of Indirect Tax

Before GST there were many taxes prevailing in the market. Here is the list of major taxes that were merged into the Goods and Services Tax:

1. Service Tax: This tax was levied by any entity specifically on any service provided by them. All the services offered by any company if taxable in nature were considered under this.

2. Excise Duty: It was a form of Indirect Tax levied on the production, sale, or license of certain products. It was replaced by GST in July 2017. Currently, only specific items like petrol & diesel, etc., are charged with excise duty.

3. Value-Added Tax: All the movable products that are directly sold to customers was taken into consideration under Value-added Tax. VAT was collected by the respective state government in the scenario of intra-state sales. Currently, only specific items, like petrol & diesel, etc., are charged with VAT.

4. Custom Duty: Any goods imported to India from foreign countries was charged with Custom Duty by the Government of India. It depends on the value and type of goods imported.

5. Stamp Duty: Stamp Duty was levied on the transfer of any immovable property in a state of India. It included all the legal documents also.

6. Entertainment Tax: Any product or transaction related to entertainment, i.e., purchase of any video games, movie shows, sports activities, arcades, amusement parks, etc., were subjected to be charged with Entertainment Tax by the State government of any state of India.

Advantages of Indirect Tax

- Collectibility: Compared to direct taxes, indirect taxes are simpler to collect. The government should not worry about the collection of indirect taxes because they are only collected at the time of making purchases.

- Convenience: Since indirect taxes are only paid when a purchase is made, they are easy on the taxpayer and handy. Furthermore, because indirect taxes are collected directly at the stores or factories, state authorities find it convenient to levy them. This helps to save a great deal of time and work.

- Fair contributions: Costs of goods and services and indirect taxes are closely related. This basically means that luxury things are taxed at higher rates while fundamental requirements are taxed at lower rates, ensuring that contributions are fair.

- Reduce Negative Consumption: Products like alcohol, cigarettes, and other comparable ones that are harmful to human health are subject to the greatest indirect taxation.

Disadvantages of Indirect Tax

- Regressive: The nature of indirect tax can be regressive. For instance, the salt tax is the same for rich and poor people, but if a rich person doesn’t pay, there will be bigger fines as well.

- Financial Burden: There may be cumulative indirect taxes charged at times. As a result, middlemen in a point-based transaction system are likely to add their own service tax, which could raise the final price of the goods.

- Hindrance: Industry-unfriendly indirect taxes exist. Taxes on commodities and raw materials raise the cost of production, preventing industries from growing because their ability to compete is constrained.

Goods and Services Tax (GST)

The Goods and Services Tax or GST is a single, indirect tax that integrates all indirect taxes within the Indian economy. The GST Act was passed on 29th March 2017 in the Parliament of India and came into effect on 1st July 2017. The idea behind it was to replace multiple layers of taxation with one tax (GST). It has replaced 17 indirect taxes (9 State-level taxes and 8 Central level taxes) and 23 cesses of the States and Centres that existed earlier, including Central excise duty, Service tax, Value Added Tax (VAT), Luxury Tax, etc. The aim behind implementing the GST Act was ‘One Nation and One Tax’. When GST was implemented, 1300 goods and 500 services were taken into consideration.

GST is a destination-based consumption tax as it is charged at every stage, wherever some value is added to the goods or services, and the supplier of the good or service offsets the charge on its inputs of the previous stages. The charge is offset through the tax credit mechanism. Ultimately, the last dealer passes on the added GST to the consumer of the goods or services. The reason behind charging input credit at every stage of the value chain is to avoid the cascading effect. Cascading effect means charging tax on tax. The Government of India has eliminated the cascading effect with the expectation of reducing the prices of goods or services and benefiting the consumers.

The three types of taxes under GST are:

- Central Goods and Services Tax (CGST): GST levied by the Centre on the Intra-State supply of goods or services.

- State Goods and Services Tax (SGST): GST levied by the State (including Union Territories with legislatures) on the Intra-State supply of goods or services by the State.

- Integrated Goods and Services Tax (IGST): GST collected by the Centre and levied on the Intra-State supply of goods or services. In other terms, IGST is the total of CGST and SGST.

Features of GST

The features of GST are:

1. GST Rates: The States and Centres have mutually decided upon the GST rates levied on goods or services through CGST, SGST, and IGST under the aegis of the GST Council. The four tax slabs under GST are 5% (for consumer durables), 12% (general rate), 18% (general rate), and 28%(luxurious goods). However, the rate of GST for exports and supplies to the Special Economic Zones (SEZs) is 0%.

2. Applicability of GST: The Goods and Services Tax applies to the whole country (India).

3. Consumption-Based Tax: Earlier, the taxes were based on the principle of origin-based taxation. However, the Goods and Services Tax is a destination-based consumption tax, which means that the taxes will be received by the states in which the goods or services have been consumed. As the tax is received by the consumer State, the losses faced by Producer States are compensated by the Centre.

4. Applicable on Supply of Goods and Services: Earlier, the taxes were charged on the basis of tax on the manufacture or sale of goods or on the provision of services; however, the Goods and Services Tax is charged on the basis of Supply of Goods and Services.

5. GST on Imports: The imports of goods and services come under IGST and is treated as Inter-State Supplies. IGST is charged on the imports of goods and services in addition to the applicable customs duties.

6. Payment of GST: The taxpayers can make payment of GST through different modes, like Internet Banking, NEFT (National Electronic Funds Transfer)/RTGS (Real Time Gross Settlement), and debit/credit cards.

Share your thoughts in the comments

Please Login to comment...