Income Tax is a direct tax that is levied on any individual’s or entity’s income during a financial year. It is directly paid to the government, like all the other direct taxes.

Calculation of Income Tax?

The net taxable income is considered to calculate the tax liability of the individual or entity based on the income slabs provided by the Income-tax Department for the current financial year. The amount of tax paid depends on the money earned by the individual in that particular financial year. Income Tax for the financial year 2023-24 applies to all residents residing in the country whose annual income exceeds Rs. 2.5 lakh p.a. Income Tax payment, TDS/TCS payment, and Non-TDS/TCS payments can be done to file income tax online.

Income Tax is paid by?

Any individual whose gross total income is over Rs.2,50,000 in a financial year should compulsorily file Income Tax Return (ITR). For senior citizens, the limit is Rs.3,00,000, and for super senior citizens, it is Rs.5,00,000. These are required to pay taxes and file their income tax returns:

- Artificial Judicial Person

- Corporate Firms

- Association of Persons (AOPs)

- Hindu Undivided Families (HUFs)

- Companies

- Local Authorities

- Body of Individuals (BOIs)

Types of Income Based on Income Tax Criteria

Every type of income that is earned by any individual or firm residing in India is taxable if it comes under the tax slab according to the Income Tax Act 1961. The Revenue Tax Department of India has divided income into 5 different categories:

1. Property Income: Any income generated from renting a property for the purpose of business, profession, or carrying out freelancing work comes under the category of Property Income.

2. Salary Income: The compensation received against services provided in connection with employment by an employee from a current or former employer is termed as Salary. Section 15 of the Income Tax Act provides for the tax levied on salary. According to Income Tax Act, the term Salary includes Wages, Annuity or Pension, Gratuity, Fees, Commissions, Perquisites or Profits (In addition to salary/wages), Advance of Salary, Encashed Earned Leaves, Contribution in Provident Fund (up to the extent it is taxable), Contribution in Pension Scheme (refer to section 80CCD, i.e., NPS), etc.

Taxability of Various Salary Components

3. Business or Profession Income: Business can be defined as an economic activity, including activities related to sales and purchase of goods and services on a regular basis with the objective of earning profit. A profession is something that includes activities requiring special skills and knowledge in their occupation. Income generated from business and profession is taxed under the head of Business or Profession Income. Self-employed people, business houses, contractors, and professionals, such as insurance agents, chartered accountants, doctors, lawyers, private tutors, etc., belong to this category.

4. Capital Gain Income: Profit earned from the sale of capital assets is known as Capital Gain. Property, Plant and Equipment are all examples of capital assets. Gain on the sale of capital assets is categorised as an income, so they are liable for taxation. Capital Gain tax is levied on the capital gain. It is levied when such an asset is transferred from one owner to another.

Types of Capital Gain Tax:

- Short-term Capital Gain Tax: Short-term assets can be defined as an asset that is held for less than 36 months. For immovable properties, the duration is 24 months. Short-term capital gain tax is charged on profit generated from the sale of those short-term capital assets. The short-term capital gain is taxed at 20%.

- Long-term Capital Gain Tax: Long-term assets can be defined as an asset that is held for over 36 months. Long-term capital gain tax is charged on profit generated from the sale of those long-term capital assets. The long-term capital gain is taxed at 10%.

All capital gains are liable for taxation but the approach for long-term and short-term capital gain is different.

5. Income from Other Sources: Any other income that does not come under any of the above-mentioned categories are termed as Income from Other Sources. Income generated as interest from saving bank accounts, fixed deposits, lottery winnings, etc., comes under this category.

Income Tax Slab Rates

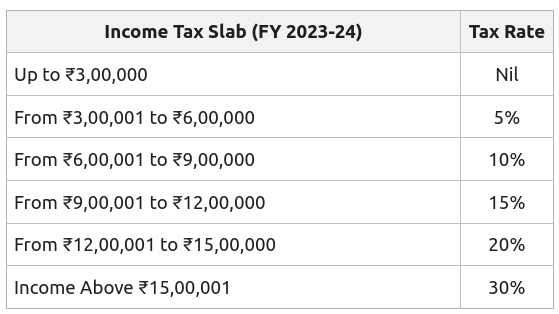

The amount of tax one needs to pay depends upon the income tax bracket the person is falling into. Any individual with an annual income of more than ₹3 Lakh in the New Income Tax Regime and ₹2.5 Lakh in the Old Income Tax Regime needs to pay Income tax to the government according to the Income Tax Act.

In the Union Budget 2023, a new income tax slab has been announced by the Finance Minister of India. As compared to the old tax regime, the new tax regime has a lower tax slab rate but it eradicates most of the deductions available in the old tax regime. The New Income Tax Regime will be the default regime from now on. Taxpayers will still have the option to choose the old tax regime.

1. Income Tax slab rates for FY 2023-24 applicable for all individuals Hindu Undivided Family (HUFs) [New Tax Regime]:

2. Income Tax slab rates for FY 2023-24 [Old Regime]:

In the old regime of filing Income Tax, individual taxpayers are divided into three categories:

- Individuals below 60 years of age.

- Senior citizens above 60 years but below 80 years of age.

- Super seniors above 80 years of age.

*NRIs: Non-resident Indians

*HUFs: Hindu Undivided Families

Income Tax Deduction Section List

Provisions in the Income Tax Act 1961 also provide for various deductions under specified sections. Deductions can be claimed against Investments, Allowances, etc., which can reduce the taxable amount of an individual. Here is the list of various sections mentioned under the Income Tax Act 1961:

1. Section 80C: A maximum deduction of ₹1,50,000 (including 80CCC and 80 CCD) can be claimed under this section. Certain investments, saving schemes and some expenditures are allowed under this section. Some of them are:

- Amount paid towards premium of life insurance

- Amount paid towards premium or subscription for deferred annuity for self or immediate family

- Contribution made to Employee’s Provident Fund Scheme

- Contribution made to Public Provident Fund

- Contribution made to any recognised provident fund

- Investments done in Post Office Savings Bank (deposits) for 10 years or 15 years

- Investments made to any recognised securities or deposits scheme (Eg. National Savings Scheme)

- Investments made to any notified savings certificate, Unit Linked Savings Certificate (Eg. NSC VIII)

- Investments made to ULIPs (Unit Linked Insurance Plans) of any Mutual Fund

- Contribution made to the fund set up by the National Housing Scheme

- Payments against the principal of any housing loan

- Payments towards the tuition fees of any two children’s full-time education in institutes based in India

2. Section 80CCC: Deductions under this section are mainly:

- Payment of premium to any insurance company towards annuity plans.

- Payment of premium for annuity plan of LIC or any other insurer (maximum cap of ₹1,00,000)

Premium paid in those plans must be kept deposited in order to avail a deduction.

3. Section 80CCD: Any contribution made in a pension scheme notified by the central government by the assessee or the employee comes under this section. The limit under this section is:

- In the case of an employee, 10% of the salary in the previous year.

- 10% of gross total income in any other case.

4. Section 80D: In this section of the Income Tax Act 1961, deductions can be claimed for a maximum amount of ₹40,000 on medical insurance. It further states:

- Deduction allowed for self, spouse and dependent children: ₹15,000 (₹20,000 for senior citizens)

- Deduction allowed for parents (individual or both): ₹ 5000 (₹20,000 for senior citizens)

- Deduction allowed for preventive health check-ups (within the ₹40,000 limit) : ₹ 5000

5. Section 80DDB: In this section, deductions can be claimed on the amount not exceeding ₹40,000 spent on medical expenses that arise for treatment of a disease or ailment mentioned in Rule 11DD of the Act.

6. Section 80E: Under this section, a claim can be made on the amount paid as interest on loans taken for the cause of higher education for self or a relative.

7. Section 80EE: Under this section, first-time homeowners can claim a deduction on their taxable income. Individuals having their first home purchased of value not more than ₹40 Lakh and the loan taken for which is ₹25 Lakh or less are eligible to claim a deduction under this section.

8. Section 80RRB: Under this section, tax can be saved up to an amount of ₹3,00,000 on receiving any income by way of royalties or patents registered under the Patents Act, 1970

9. Section 80TTA: Under this section, any income earned through an interest in a savings bank account, post office, or cooperative society up to ₹10,000 can be claimed for deduction.

10. Section 80U: This section specifically provides a flat deduction on income tax only applied to disabled people. Up to ₹1,00,000 can be claimed for deduction depending on the severity of the disability.

Share your thoughts in the comments

Please Login to comment...