New Income Tax Slab for FY 2023-24 and AY 2024-25

Last Updated :

26 Mar, 2024

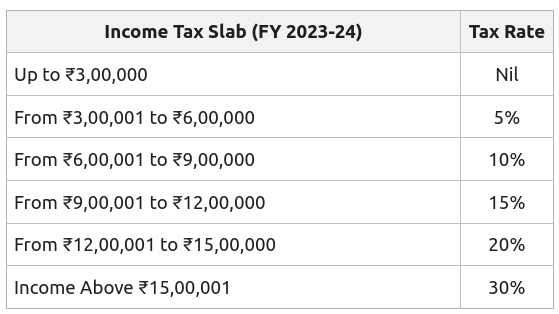

Income Tax is a direct tax that is levied on any individual’s or entity’s income during a financial year. It is directly paid to the government, like all the other direct taxes. The Income Tax Slab for FY 2023-24 was announced by Finance Minister Nirmala Sitharaman on 1st February 2023 in the Union Budget 2023-24 presented by her.

The major highlight of the Budget related to taxpayers was the Rebate under Section 87A being increased to ₹7 Lakh, earlier which was ₹5 Lakh, i.e., Income up to ₹7 Lakh p.a. will be exempted from paying any Income Tax.

.png)

What is the Income Tax Slab?

An Income Tax Slab is a system where different tax rates are applied to different ranges of income. These slabs are designed to ensure a progressive tax system, where the tax rate increases as the taxable income increases, making higher earners pay a larger percentage of their income in taxes.

Each slab specifies a range of incomes and the tax rate that applies to that range, allowing individuals to calculate their tax liability based on their total annual income.

How to Calculate Income Tax?

The Net Taxable Income is considered to calculate the tax liability of the individual or entity based on the income slabs provided by the Income-tax Department for the current financial year. The amount of tax paid depends on the money earned by the individual in that particular financial year.

Income Tax for the financial year 2023-24 applies to all residents residing in the country whose annual income exceeds ₹3 Lakh p.a. Income Tax payment, TDS/TCS payment, and Non-TDS/TCS payments can be done to file income tax online.

Comparison of New Tax Regime and Old Tax Regime for FY 2023-24 (AY 2024-25)

Here is a list of the comparison of Tax Rates under the New Tax Regime and Old Tax Regime for FY 2023-24 (AY 2024-25):

|

|

Old Tax Regime (FY 2022-23 and FY 2023-24)

|

New Tax Regime

|

|

Income Slabs

|

Age < 60 years & NRIs

|

Age of 60 Years to 80 years

|

Age above 80 Years

|

FY 2022-23

|

FY 2023-24

|

|

Up to ₹2,50,000

|

NIL

|

NIL

|

NIL

|

NIL

|

NIL

|

|

₹2,50,001 – ₹3,00,000

|

5%

|

NIL

|

NIL

|

5%

|

NIL

|

|

₹3,00,001 – ₹5,00,000

|

5%

|

5%

|

NIL

|

5%

|

5%

|

|

₹5,00,001 – ₹6,00,000

|

20%

|

20%

|

20%

|

10%

|

5%

|

|

₹6,00,001 – ₹7,50,000

|

20%

|

20%

|

20%

|

10%

|

10%

|

|

₹7,50,001 – ₹9,00,000

|

20%

|

20%

|

20%

|

15%

|

10%

|

|

₹9,00,001 – ₹10,00,000

|

20%

|

20%

|

20%

|

15%

|

15%

|

|

₹10,00,001 – ₹12,00,000

|

30%

|

30%

|

30%

|

20%

|

15%

|

|

₹12,00,001 – ₹12,50,000

|

30%

|

30%

|

30%

|

20%

|

20%

|

|

₹12,50,001 – ₹15,00,000

|

30%

|

30%

|

30%

|

25%

|

20%

|

|

₹15,00,000 and above

|

30%

|

30%

|

30%

|

30%

|

30%

|

Income Tax Slab Rates for FY 2023-24 (AY 2024-25)

The amount of tax one needs to pay depends upon the income tax bracket the person is falling into. In the Union Budget 2023, a new income tax slab has been announced by the Finance Minister of India. Currently, one can choose between the new tax regime and the old tax regime to file for Income Tax according to their convenience.

1. New Tax Regime applicable for all Individuals and Hindu Undivided Families (HUFs)

Major points in the New Income Tax Regime for FY 2023-24:

- The basic exemption limit was increased to ₹3 Lakh earlier, which was ₹2.5 Lakh.

- Rebate under Section 87A is increased to ₹7 Lakh earlier, which was ₹5 Lakh, i.e., Income up to ₹7 Lakh will be exempted from paying any Income Tax.

- A Standard Deduction of ₹50,000 was introduced for salaried and individual taxpayers under the New Income Tax Regime earlier, which was only applicable to the Old Income Tax Regime.

- A deduction from the family pension up to ₹15,000 was introduced for individual taxpayers under the New Income Tax Regime earlier, which was only applicable to the Old Income Tax Regime.

- The Highest Surcharge Rate levied on individuals having income above ₹2 Crore, but below ₹5 Crore is reduced to 25% earlier, which was 37%.

- The New Income Tax Regime will be the default regime from now on. Taxpayers will still have the option to choose the old tax regime.

As compared to the old tax regime, the new tax regime has a lower tax slab rate, but it eradicates most of the deductions available in the old tax regime.

2. Old Regime Income Tax slab rates for FY 2023-24

In the old regime of filing Income Tax, individual taxpayers are divided into three categories:

- Individuals below 60 years of age.

- Senior citizens above 60 years but below 80 years of age.

- Super seniors above 80 years of age.

a) Income tax slab for Individuals aged below 60 years & HUF

|

Income Tax Slab

|

Tax Rates for Individuals & HUF Below the Age Of 60 Years & NRIs

|

| Up to ₹2,50,000* |

Nil

|

| ₹2,50,001 to ₹5,00,000 |

5%

|

| ₹5,00,001 to ₹10,00,000 |

20%

|

| Above ₹10,00,000 |

30%

|

b) Income tax slab for Senior citizens above 60 years but below 80 years of age

|

Income Tax Slab

|

Tax Rates for Senior citizens aged above 60 Years & Less than 80 Years

|

| Up to ₹ 3,00,000* |

No tax

|

| ₹3,00,000 – ₹5,00,000 |

5%

|

| ₹5,00,000 – ₹10,00,000 |

20%

|

| More than ₹10,00,000 |

30%

|

c) Income tax slab for Super seniors above 80 years of age

|

Income Tax Slab

|

Tax Rates for Super Senior Citizens (Aged 80 Years And Above)

|

| Up to ₹5,00,000* |

No tax

|

| ₹5,00,000 – ₹10,00,000 |

20%

|

| More than ₹10,00,000 |

30%

|

*NRIs: Non-resident Indians

*HUFs: Hindu Undivided Families

Surcharge on Income Tax for FY 2023-24(AY 2024-25)

Below is a list of the surcharge on Income tax for FY 2023-2024 (AY 2024-25):

| Income |

Surcharge Rate in Old Tax Regime |

Surcharge Rate in New Tax Regime |

| Less than Rs.50 lakh |

NIL |

NIL |

| Rs.50 lakh – Rs.1crore |

10% |

10% |

| Rs.1 crore – Rs.2 crore |

15% |

15% |

| Rs.2 crore – Rs.5 crore/span> |

25% |

25% |

| Rs.5 crore – Rs.10 crore |

37% |

25% |

| More than Rs.10 crore |

37% |

25% |

Taxability of Various Salary Components:

The compensation received against services provided in connection with employment by an employee from a current or former employer is termed as Salary. Section 15 of the Income Tax Act provides for the tax levied on salary.

According to the Income Tax Act, the term Salary includes Wages, Annuity or Pension, Gratuity, Fees, Commissions, Perquisites or Profits (In addition to salary/wages), Advance of Salary, Encashed Earned Leaves, Contribution in Provident Fund (up to the extent it is taxable), Contribution in Pension Scheme (refer to section 80CCD, i.e., NPS), etc.

| Component of Salary |

Taxability Criteria under the Income Tax Act |

| Basic Salary |

Taxable |

| Dearness Allowance |

Taxable |

| Advance Salary |

Taxable in the year received |

| Arrears of Salary |

Taxable in the year received, if not taxed on a due basis |

| Leave Encashment at the Time of Retirement |

Taxable – Exempt in some scenarios |

| Salary instead of Notice |

Taxable on receipt |

| Salary to Partner |

Taxable under the head of “Profits and gains of business or profession” |

| Fees and Commission |

Taxable |

| Bonus |

Taxable |

| Gratuity |

Taxable – Exempt in some scenarios |

| Pension |

Taxable – Exempt in some scenarios |

| Annuity from Employer |

Taxable |

| Retrenchment Compensation |

Exempt from tax to a certain extent |

| Remuneration for Extra Work |

Taxable |

| Salary to Foreign Citizens |

Taxable – Exempt in some scenarios |

Conclusion

In conclusion, the new income tax slab for FY 2023-24 and AY 2024-25 brings about several critical changes aimed at offering more flexibility and potential tax savings for individuals.

It is essential for taxpayers to carefully analyze these changes to make informed decisions regarding their tax-saving investments and choose between the old and new tax regimes based on their financial situation.

Also Read:

New Income Tax Slab for FY 2023-24 and AY 2024-25 – FAQs

What is the tax slab for FY 2023-24?

For FY 2023-24, the tax slab rates in India under the new regime offer

- 0% rate up to ₹2.5 lakh income

- 5% for ₹2.5 lakh to ₹5 lakh

- 10% for ₹5 lakh to ₹7.5 lakh

- 15% for ₹7.5 lakh to ₹10 lakh

- 20% for ₹10 lakh to ₹12.5 lakh

- 25% for ₹12.5 lakh to ₹15 lakh

- 30% for income above ₹15 lakh

- No tax is levied on income up to ₹5 lakh after rebate under section 87A.

Is a standard deduction of 50000 applicable in the new tax regime?

The standard deduction of ₹50,000 was not applicable in the new tax regime introduced in India

Is 80C applicable in the new tax regime?

Deductions under Section 80C are not applicable in the new tax regime introduced in India for individual taxpayers.

Which is better old or new tax regime?

The old regime may benefit those with significant investments and deductions, while the new regime could be advantageous for those with minimal deductions.

Which deductions are not allowed in the new tax regime?

In the new tax regime, most of the commonly claimed deductions and exemptions are not allowed, including those under Section 80C (investments like PPF, life insurance), 80D (medical insurance premiums), HRA (House Rent Allowance), LTA (Leave Travel Allowance), and standard deduction, among others.

Share your thoughts in the comments

Please Login to comment...