System Design Pattern for Recurring Payments

Last Updated :

01 Apr, 2024

Many businesses rely on subscription services, where customers pay regularly for access. Making sure this payment system works well is important. The System Design Pattern for Recurring Payments refers to a structured approach for architecting a payment system specifically designed to handle recurring transactions. It includes various components designed to ensure the smooth and efficient processing of payments that occur regularly, such as subscriptions, memberships, or installment plans.

Important Topics for the System Design Pattern for Recurring Payments

What are Recurring Payments?

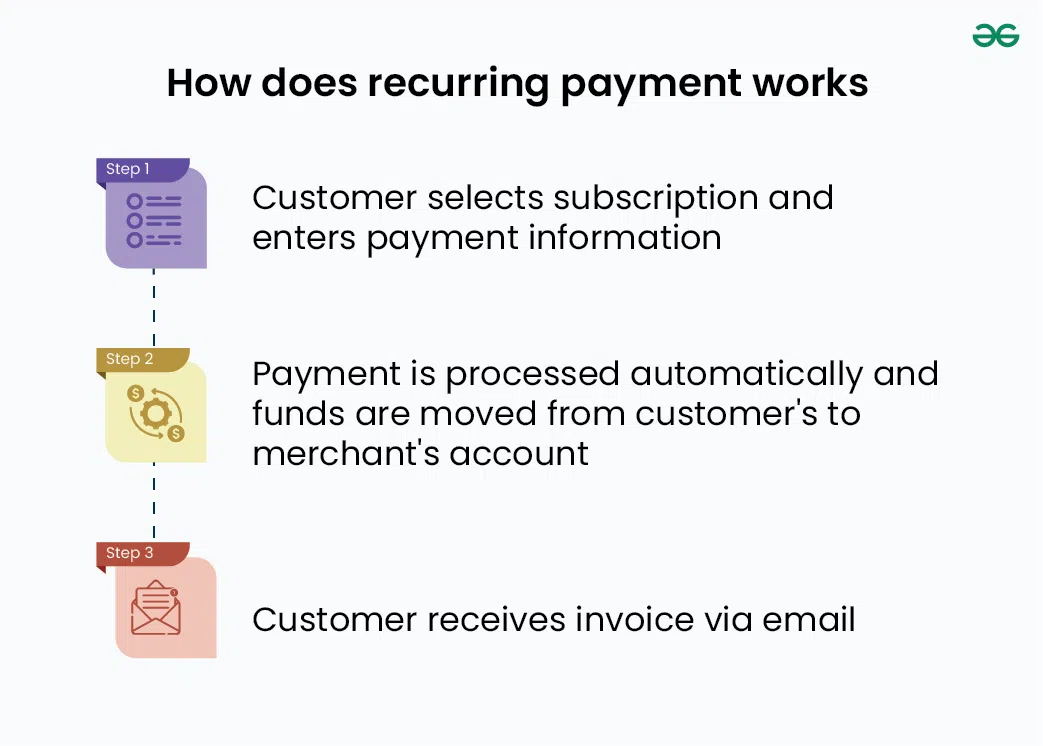

Recurring payments known as subscription-based payments, are a system where a customer authorizes a business to automatically charge their account at fixed regular intervals for a product or service.

Recurring payments are defined as transactions where a customer authorizes a business or service provider to automatically charge their payment method at predetermined intervals for ongoing goods or services.

- These payments occur on a regular schedule, typically weekly, monthly, quarterly, or annually.

- Recurring payments are commonly used for subscription-based services, memberships, utility bills, loan repayments, and other types of recurring expenses.

Types of Recurring Payment

In system design patterns for recurring payments, various types of recurring payment models can be implemented based on the nature of the business and the requirements of customers. Here are some common types of recurring payment models:

1. Fixed Interval Subscriptions

- In fixed interval subscriptions customers pay a fixed amount at regular intervals (e.g., monthly, quarterly, annually) to access a service or product.

- It provides customers with continuous access to the service or product without the need for manual renewals. Businesses can estimate revenue more accurately due to predictable payment schedules.

Example: Subscription-based streaming services (Netflix, Spotify), software subscriptions (Adobe Creative Cloud), membership sites.

2. Usage-Based Billing

- In usage based billing customers are charged based on their usage of a service or product over a specific period of time.

- It offers flexibility for customers who may have variable usage patterns. It can also be advantageous for businesses with fluctuating demand or resource consumption.

Example: Utility bills (electricity, water), cloud computing services (Amazon Web Services, Microsoft Azure), telecommunications services (cellular data usage).

3. Tiered Pricing

- In tiered Pricing different levels of service or features are offered at various price points (tiers), allowing customers to choose the tier(plans) that best fits their needs.

- It provides customers with options to scale their usage based on their requirements and budget. It also encourages customers to buy a higher-end version of a product and can increase customer support.

Examples: SaaS platforms (e.g., Dropbox, Salesforce) offering basic, standard, and premium tiers with varying features and capabilities.

4. Metered Billing

- In metered billing customers are charged based on specific metrics or usage points, often with a pricing structure that scales with usage.

- It allows businesses to align pricing with the value delivered to customers. It can also motivate efficient usage while ensuring fair billing.

Example: Cloud storage providers charging based on data storage volume (Google Drive, Dropbox), internet service providers charging based on data usage.

5. Installment Plans

- In installment plans customers pay for a product or service in multiple installments over a fixed period, typically with interest or fees added.

- It makes high-value purchases more accessible by spreading payments over time. It also provides businesses with a steady stream of revenue.

Example: Financing plans for furniture, electronics, appliances, educational courses.

5. Membership Renewals

- In membership renewals members renew their membership at regular intervals to maintain access to benefits and services.

- It Ensures continuity of benefits for members and provides a predictable revenue stream for the organization.

Example: Gym memberships, professional association memberships, loyalty programs.

6. Prepaid Subscriptions

- In prepaid subscriptions customers pay in advance for a set period of service, with payments recurring automatically at the end of each prepaid period unless canceled or renewed.

- It provides customers with convenience and upfront savings. It offers businesses improved cash flow and reduced churn rate.

Example: Prepaid mobile phone plans, annual software licenses, magazine subscriptions.

Key Components of a Recurring Payment System

In a recurring payment system designed, several key components work together to ensure seamless and efficient processing of recurring transactions. Here are the key components:

- User Interface (UI)

- The user interface allows customers to manage their subscriptions, view payment history, update payment methods, and make changes to their accounts. It should be spontaneous, accessible, and secure.

- Subscription Management Module

- This module handles the creation, modification, and cancellation of subscriptions. It stores subscription details such as subscription plans, billing intervals, payment amounts, and customer information.

- Payment Gateway Integration

- Payment gateway integration facilitates the secure transmission of payment data between the customer, merchant, and financial institutions. It handles authorization, processing, and settlement of transactions. Integration with multiple payment gateways may be necessary to support various payment methods and currencies.

- Billing Engine

- The billing engine automates the generation of invoices and recurring charges based on subscription details. It calculates charges, applies discounts or promotions, and generates billing statements for customers.

- Payment Processing Logic

- This component adapt the payment processing workflow, including authorization, capture settlement, and resolution of payments. It handles scenarios such as failed payments, retries, and the process of communicating with customers about failed payments.

- Customer Communication Module

- This module sends notifications and reminders to customers regarding upcoming payments, billing statements, subscription renewals, and payment failures. It may include email, SMS, or in-app messaging features.

- Reporting and Analytics Tools

- Reporting and analytics tools provide insights into payment trends, revenue performance, customer churn, and subscription metrics. They help businesses track key performance indicators (KPIs) and make data-driven decisions to optimize their recurring payment strategies.

- Security Infrastructure

- Security infrastructure includes measures to protect sensitive payment data, work with industry regulations (such as PCI DSS), and prevent fraud activities. It encompasses encryption, tokenization, secure authentication, and regular security audits.

Challenges in Designing Recurring Payment Systems

Designing recurring payment systems comes with its own set of challenges. Here are some key hurdles to consider:

- Scalability and Performance:

- Recurring billing systems need to handle a growing number of subscribers and transactions efficiently. The chosen design patterns and underlying infrastructure should be able to scale to meet increasing demands without compromising performance or reliability.

- Security:

- Security is very important. Payment information (credit card details, etc.) needs to be stored securely using encryption and tokenization to prevent unauthorized access. The system should be robust against security vulnerabilities like injection attacks or data breaches.

- Payment Gateways and Integrations:

- Integrating with various payment gateways (credit card processors, PayPal, etc.) can be complex. The system design should accommodate different APIs and authorization flows used by each gateway. Maintaining compatibility with evolving payment gateway standards requires ongoing effort.

- Failed Payments and Involuntary Churn:

- Failed payments due to expired cards, insufficient funds, or network issues can disrupt subscriptions and lead to customer decrease. The system needs to handle failed payments gracefully, including retries, notifications, and clear communication with the customer. Strategies to minimize involuntary churn rate, such as automatic update requests for expired cards, can be implemented.

- Flexibility and Future Needs:

- The system should be flexible enough to accommodate future changes. New subscription plans, pricing models, or payment methods might need to be integrated seamlessly. The design patterns chosen should be adaptable to handle these evolving requirements.

- Regulatory Compliance:

- Recurring billing systems might need to comply with various regulations depending on the industry and geographic location. Data privacy regulations (like GDPR) and payment security standards (like PCI DSS) need to be factored into the design.

- Data Management and Reporting:

- Managing a large volume of customer data and subscription details requires a well-designed database structure. The chosen database pattern should facilitate efficient data retrieval for reporting and analysis of customer behavior and subscription trends.

By carefully considering these challenges and choosing appropriate design patterns with scalability, security, and flexibility in mind, you can create a robust recurring payment system that supports the sustainable growth of your subscription-based business.

Design Patterns for Recurring Payments

- Observer Pattern

- The Observer pattern facilitates a one-to-many dependency relationship between objects.

- In the context of recurring payments, it can be used to notify subscribers of payment-related events such as successful payments, failed payments, or upcoming renewals.

- Subscribers register with the payment system as observers and receive notifications when relevant events occur.

- Factory Method Pattern

- The Factory Method pattern provides an interface for creating objects in a superclass but allows subclasses to alter the type of objects that will be created.

- In a recurring payment system, this pattern can be used to create different types of subscription objects based on user preferences, subscription plans, or other criteria.

- For example, a factory method can create instances of monthly, quarterly, or annual subscription objects based on user selection.

- State Pattern

- The State pattern allows an object to change its behavior when its internal state changes.

- In the context of recurring payments, subscriptions can transition between different states such as active, pending, canceled, or expired.

- By using the State pattern, the payment system can encapsulate the logic for handling each state transition, ensuring that subscriptions behave correctly throughout their lifecycle.

- Strategy Pattern

- The Strategy pattern defines a family of algorithms, encapsulates each one, and makes them interchangeable.

- This pattern can be applied to handle different payment processing strategies, such as processing payments through different payment gateways or using different payment methods (credit card, PayPal, etc.).

- By encapsulating payment processing logic in separate strategy objects, the payment system can easily switch between strategies without modifying the core payment processing code.

Architectural Considerations for Recurring Payments

1. Microservices Architecture

Microservices architecture breaks down the system into a set of loosely coupled, independently deployable services. Each service is responsible for a specific business function, such as subscription management, payment processing, or user authentication. Microservices architecture enables scalability, agility, and fault isolation, but it also introduces challenges such as service discovery, inter-service communication, and data consistency.

2. Event-Driven Architecture

Event-driven architecture (EDA) is a design pattern in which the flow of information between software components is based on the occurrence of events. In the context of recurring payments, EDA can be used to handle asynchronous communication between system components. Events such as payment success, failure, or subscription renewal trigger corresponding actions, allowing the system to react to changes in real-time.

3. API Gateway

An API gateway is a central entry point for clients to access backend services. It provides features such as request routing, authentication, rate limiting, and logging. In a recurring payment system, an API gateway can simplify client interactions by aggregating multiple backend services into a single API. It also provides a layer of security and governance by enforcing access control policies and monitoring API usage.

4. Data Partitioning

Data partitioning involves dividing large datasets into smaller partitions distributed across multiple nodes or storage devices. In a recurring payment system, data partitioning can be used to improve scalability, performance, and fault tolerance. For example, subscription data can be partitioned based on customer IDs or subscription IDs, allowing the system to handle large volumes of data efficiently.

Implementation Strategies for Recurring Payments

- Idempotent Payment Processing:

- It ensures that multiple identical payment requests have the same effect as a single request.

- This property is important for handling duplicate requests caused by network timeouts, retries, or client errors.

- Automated Retry Mechanisms:

- Automated retry mechanisms are used to handle transient failures in payment processing, such as network errors, service outages, or temporary issues with payment gateways.

- Distributed Locking:

- It ensures data consistency and prevents concurrent access to shared resources across multiple nodes or threads.

- In a recurring payment system, distributed locking can be used to synchronize access to critical resources such as subscription data, payment queues, or billing records.

- Consistent Hashing:

- It is a technique used to distribute data evenly across a set of nodes in a distributed system.

- In a recurring payment system, consistent hashing can be used to partition payment processing tasks among multiple nodes or worker threads, improving throughput and resource utilization.

- Caching involves storing frequently accessed data in memory to reduce latency and improve performance.

- In a recurring payment system, caching can be used to cache subscription details, payment statuses, pricing information, or authentication tokens.

- By caching data at various layers of the system (e.g., application, database, CDN), the system can reduce the number of expensive database queries or external API calls, speeding up response times and improving scalability.

2. Asynchronous Processing

- Asynchronous processing involves offloading non-blocking tasks to background workers or queues to improve responsiveness and resource utilization.

- In a recurring payment system, asynchronous processing can be used to handle tasks such as notification delivery, report generation, or batch processing.

- Horizontal scaling involves adding more instances of services or resources to handle increased load.

- In a recurring payment system, horizontal scaling can be achieved by deploying multiple instances of payment processing services, subscription management services, or database nodes.

- By distributing workload across multiple nodes and balancing traffic using load balancers or service meshes, the system can scale dynamically in response to changing demand while maintaining high availability and fault tolerance.

- Load balancing involves distributing incoming traffic across multiple instances of services or resources to optimize resource utilization and improve performance.

- In a recurring payment system, load balancing can be used to evenly distribute payment requests, API calls, or database queries across multiple backend servers or clusters.

- By monitoring server health, adjusting routing rules dynamically, and implementing failover mechanisms, load balancers can ensure optimal performance, fault tolerance, and scalability for the system.

Share your thoughts in the comments

Please Login to comment...