Annual Recurring Revenue (ARR) is a key financial metric that serves as the heartbeat of subscription-based businesses. It captures the recurring and predictable income that a business expects to receive over a given time frame, usually a year, from its subscription services. For companies that use subscription models to sell goods or services, such as software-as-a-service (SaaS) providers, streaming platforms, and other subscription-based businesses, annual revenue (ARR) is crucial.

In the ever-evolving realm of business and technology, staying ahead requires not only innovative products but also a deep understanding of the financial metrics that drive sustainable growth. One such pivotal metric in the context of subscription-based businesses is Annual Recurring Revenue (ARR). As product management becomes increasingly intertwined with the subscription economy, the ability to grasp, leverage, and optimize ARR becomes a critical skill for businesses seeking long-term success.

Annual Recurring Revenue | Definition, Importance, Calculation, and Example

What is Annual Recurring Revenue (ARR)?

Annual Recurring Revenue (ARR) is a key financial metric that serves as the heartbeat of subscription-based businesses. It captures the recurring and predictable income that a business expects to receive over a given time frame, usually a year, from its subscription services. For companies that use subscription models to sell goods or services, such as software-as-a-service (SaaS) providers, streaming platforms, and other subscription-based businesses, annual revenue (ARR) is crucial.

What is Annual Recurring Revenue (ARR)

ARR goes beyond traditional revenue metrics by focusing on the recurring nature of subscription-based income. Unlike one-time transactions, subscription models involve customers paying a regular fee at predefined intervals for continued access to a product or service. ARR aggregates these recurring revenues, providing a forward-looking indicator that aids in financial planning, strategic decision-making, and overall business health assessment.

Who Should Use the Annual Recurring Revenue Model?

ARR is a crucial model for companies that provide subscription services. This covers, among other things, streaming platforms, software-as-a-service (SaaS) companies, subscription box services, and any other company where clients pay a regular fee for a good or service. The ARR model is an essential tool for executives, finance teams, and product managers alike because it provides vital insights to a wide range of stakeholders. ARR gives product managers a window into the viability and performance of subscription-based services, which helps with strategic product development and optimization. ARR is a crucial performance metric that finance teams utilize for precise financial planning and forecasting, and which executives utilize to assess the general well-being and room for expansion of the company.

Annual Recurring Revenue (ARR) Vs. Monthly Recurring Revenue (MRR):

The monthly recurring revenue (MRR) metric and the ARR metric are very similar. The normalization period (year vs. month) is the only distinction between the two metrics. As a result, while MRR is useful for determining a company’s short-term evolution, ARR offers a long-term perspective of that evolution.

ARR is a crucial indicator for investors and management of a business. The metric can be used by managers to assess the general state of the company. Furthermore, ARR can be used to evaluate the company’s long-term business plans.

From the standpoint of investors, ARR’s stability and predictability guarantee that the metric can be used to assess how well a company is performing both internally and in relation to its peers.

-Vs-Monthly-Recurring-Revenue-(MRR).webp)

Annual Recurring Revenue (ARR) Vs. Monthly Recurring Revenue (MRR)

Here’s a tabular comparison between Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR):

| Definition |

The total anticipated annual revenue from subscription contracts. It is often used for businesses with annual subscription models. |

The total anticipated monthly revenue from subscription contracts. Commonly used for businesses with monthly subscription models. |

| Calculation |

ARR = (Average Monthly Revenue) x 12 |

MRR = Average Monthly Revenue |

| Billing Frequency Consideration |

Typically suitable for businesses with annual billing cycles. |

Well-suited for businesses with monthly billing cycles. |

| Flexibility |

Less flexible, as changes to subscription plans or pricing may take longer to impact revenue. |

More flexible, as changes to subscription plans or pricing can have a quicker impact on revenue. |

| Granularity of Data |

Provides a higher-level overview, making it less granular for tracking revenue fluctuations. |

Offers a more granular view, allowing for better tracking of revenue changes on a month-to-month basis. |

| Use Cases |

Commonly used in industries where customers prefer longer-term commitments and contracts. |

Commonly used in industries where flexibility and shorter commitment periods are valued. |

| Reporting Period |

Typically reviewed on an annual or quarterly basis. |

Reviewed on a monthly basis. |

How to calculate Annual Recurring Revenue (ARR):

Calculate Annual Recurring Revenue (ARR) involves summing up the recurring revenue generated from all active subscriptions over a specific period, usually a year. The process typically follows a sequence of steps:

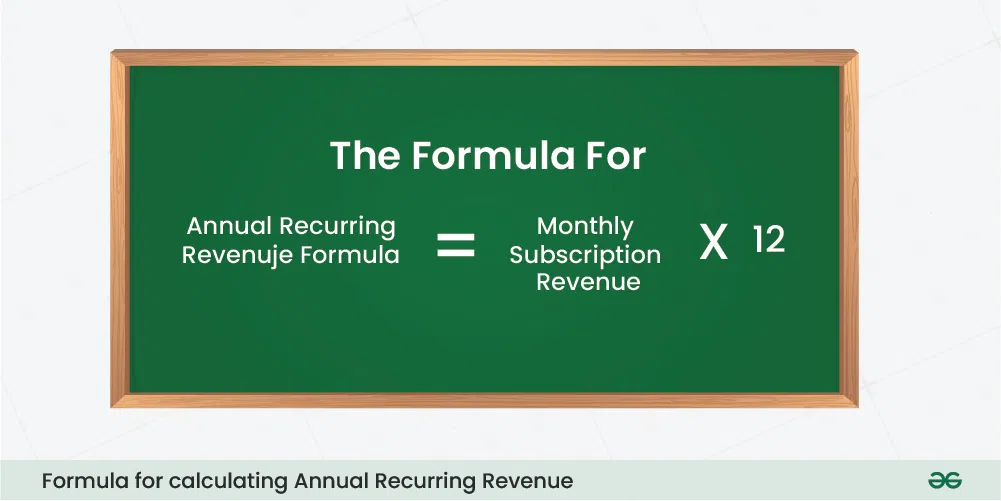

Formula for Calculating Annual Recurring Revenue (ARR)

1. Determine the Average Revenue per User (ARPU):

Calculate the Average Revenue per User by dividing the total revenue generated from subscriptions by the number of subscribers.

The formula is:

ARPU = Total Subscription Revenue/Number of Subscribes

2. Calculate Monthly Subscription Revenue:

Multiply the ARPU by the total number of subscribers to determine the Monthly Subscription Revenue.

The formula is:

Monthly Subscription Revenue = ARPU * Number of Subscribers

3. Compute Annual Recurring Revenue (ARR):

Multiply the Monthly Subscription Revenue by 12 (the number of months in a year) to obtain the ARR.

The formula is:

ARR = Monthly Subscription Revenue * 12

Example:

Assume a software company, XYZ Tech, has 1,500 active subscribers, and the average monthly revenue per user (ARPU) is $75.

1. Calculate ARPU:

ARPU = $75,000/1,500 = $50

2. Calculate Monthly Subscription Revenue:

Monthly Subscription Revenue = $50 * 1,500 = $75,000

3. Compute ARR:

ARR = $75,000 * 12 = $9,00,000

Therefore, XYZ Tech has an Annual Recurring Revenue (ARR) of $9,00,000, representing the anticipated recurring revenue from its current subscriber base over the next year.

It’s essential to note that while this is a simplified example, real-world scenarios may involve additional complexities, such as factoring in churn rates, upsells, or changes in pricing. Additionally, consistent monitoring and updates are crucial, especially for businesses with dynamic subscription models. Regularly recalculating ARR allows for agility in responding to changes in subscriber numbers or pricing structures, ensuring the metric remains a reliable a reliable indicator of the business’s financial health.

Why is Annual Recurring Revenue Important?

1. Predictability and Stability:

- ARR provides a stable and predictable measure of a company’s revenue stream. This stability is particularly valuable for subscription-based businesses, as it allows for better long-term planning and strategic decision-making.

2. Financial Planning and Forecasting:

- ARR serves as a critical input for financial planning and forecasting. It enables product managers and finance teams to project future revenue, allocate resources, and set realistic growth.

3. Valuation and Investor Confidence:

- Investors often use ARR as a key metric when evaluating the health and potential of a subscription-based business. A growing ARR signals a healthy and scalable business model, instilling confidence in current and potential investors.

4. Customer Lifetime Value (CLV):

- ARR is instrumental in calculating Customer Lifetime Value, another essential metric in the subscription economy. By understanding the recurring revenue generated from each customer, product managers can make informed decisions about customer acquisition and retention strategies.

5. Subscription Model Optimization:

- Analyzing ARR allows product managers to identify trends and patterns in subscriber behaviour. This insight can be leveraged to optimize subscription models, pricing strategies, and feature offerings to maximize revenue customer satisfaction.

Example of Annual Recurring Revenue:

Netflix primarily operates on a subscription model. However, we can provide a simplified illustration using hypothetical figures to demonstrate how ARR might be calculated for a streaming service like Netflix.

Assumptions:

Let’s make some assumptions for the sake of this example:

- Netflix has 150 million active subscribers worldwide.

- The average monthly subscription fee per user (ARPU) is $12.

Calculation:

1. Calculate ARPU:

ARPU = $12/subscriber

2. Calculate Monthly Subscription Revenue:

Monthly Subscription Revenue = ARPU * Number of Subscribers

3. Compute Annual Recurring Revenue (ARR):

ARR = Monthly Subscription Revenue * 12

Example Calculation:

ARPU = $12/subscriber = $12

Monthly Subscription Revenue = $12 * 150,000,000 = $1,800,000,000

ARR = $1,800,000,000 * 12 = $21,600,000,000

This hypothetical calculation suggests that, based on the assumed figures, Netflix could have an Annual Recurring Revenue of approximately $21.6 billion. However, it’s important to emphasize that these figures are speculative, and the actual financials of Netflix may differ significantly.

In reality, ARR calculations for a company like Netflix would be more complex, factoring in variations in subscription plans, regional pricing, changes in subscriber numbers, and other dynamic elements. To obtain accurate figures, one would need access to Netflix’s detailed financial reports, which are typically not disclosed in public filings.

Conclusion: Annual Recurring Revenue (ARR)

Annual Recurring Revenue (ARR) stands as a linchpin in the financial health and strategic planning of subscription-based businesses, providing a forward-looking view of revenue and enabling better decision-making. As product managers navigate the complexities of the product landscape, a keen understanding of ARR empowers them to optimize subscription models, plan for sustained growth, and attract investor confidence.

By comprehending the definition, significance, and calculation methods of ARR, product managers can harness this metric to unlock insights into customer behavior, improve financial forecasting, and position their products for long-term success in the competitive world of subscription-based business models. In an era where subscription services continue to thrive, ARR remains an indispensable tool for those steering the ship of product management toward prosperous horizons.

FAQs : Annual Recurring Revenue (ARR)

1. How do you calculate Annual Recurring Revenue?

The formula for calculating Annual Recurring Revenue is ARR = Monthly Subscription Revenue * 12

2. What is an example of ARR?

Netflix primarily operates on a subscription model. However, we can provide a simplified illustration using hypothetical figures to demonstrate how ARR might be calculated for a streaming service like Netflix.

3. What is an example of monthly recurring revenue?

Monthly Recurring Revenue is or MRR. It is a normalised indicator of the steady income a company anticipates bringing in each month. As an illustration, suppose you have ten clients who each pay you fifty dollars a month. $500 would be your MRR.

4. What is Annual Recurring Revenue (ARR)

Annual Recurring Revenue (ARR) is a key financial metric that serves as the heartbeat of subscription-based businesses. It captures the recurring and predictable income that a business expects to receive over a given time frame, usually a year, from its subscription services. For companies that use subscription models to sell goods or services, such as software-as-a-service (SaaS) providers, streaming platforms, and other subscription-based businesses, annual revenue (ARR) is crucial.

Share your thoughts in the comments

Please Login to comment...