Comparative Income Statement: Objectives, Advantages and Preparation and Format of Comparative Income Statement

Last Updated :

05 Apr, 2023

For the estimation of an organisation’s future progress, it is essential to look into its past performance, for which performing a comparative study of two or more years of company financial statements becomes necessary. A statement that helps in the comparative study of the components of a company’s balance sheet and income statement over a period of two or more years, both in absolute and percentage form, is known as a Comparative Statement. It is a horizontal type of analysis and not only provides the absolute figures of various years but also, the columns to indicate any increase or decrease in these figures from one year to another in absolute and in percentage form. One can form an opinion on the progress of an enterprise based on the comparative statements.

What is a Comparative Income Statement (Statement of Profit & Loss)?

A Statement of Profit & Loss or Income Statement shows the profit earned or loss incurred by an organisation during the year. However, a Comparative Income Statement or Comparative Statement of Profit & Loss is a horizontal analysis of the Income Statement showing operating results for more than one accounting year. In simple terms, it shows the absolute change and percentage change in the figures from one period to another.

Objectives of Comparative Income Statement (Statement of Profit & Loss)

Different objectives of a Comparative Income Statement are as follows:

1. The basic objective of a Comparative Income Statement or Statement of Profit & Loss is to analyse every item of Revenue and Expenses for two or more years.

2. It is also prepared to analyse the increase or decrease in every item of Revenue and Expenses in terms of rupees and percentages. With this increase or decrease, the trend of each item is determined.

3. A Comparative Statement of Profit & Loss or Income Statement also compares data of more than one year, showing the overall trend of profit.

4. Lastly, it is prepared to analyse and determine the reasons behind the change in the financial performance of the company.

Advantages of Comparative Income Statement (Statement of Profit & Loss)

The advantages of Comparative Balance sheet are as follows:

1. Comparative Balance sheet helps to identify the increase and decrease in sales.

2. Comparative Balance sheet helps to identify the increase or decrease in the cost of goods sold.

3. Comparative Balance sheet helps to identify the increase or decrease in gross profit.

4. Comparative Balance sheet helps to identify the increase or decrease in operating profit.

5. Comparative Balance sheet helps to identify the increase or decrease in operating expenses.

6. Comparative Balance sheet helps to identify the increase or decrease in non-operating incomes or expenses.

6. Comparative Balance sheet helps to identify the increase or decrease in net profit.

Preparation of Comparative Income Statement (Statement of Profit & Loss)

A Comparative Income Statement has the following six columns:

1. First Column: In the first column, every item of the Statement of Profit & Loss (Revenue and Expenses) is written. Revenue from Operations and Other Income are written separately. Expenses such as Cost of Materials Consumed, Purchase of Stock-in-Trade, Changes in Inventories of Finished Goods, Work-in-Progress and Stock-in-Trade, Employees Benefit Expenses, Depreciation and Amortisation Expenses, Finance Cost, and Other Expenses are written.

2. Second Column: In the second column, Note No. given against the item in the Income Statement is written.

3. Third Column: In the third column, the amounts of the previous year are written.

4. Fourth Column: In the fourth column, the amounts of the current year are written.

5. Fifth Column: In this column, the difference (increase or decrease) in the amounts between the current and previous accounting year is recorded.

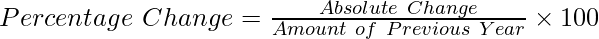

6. Sixth Column: In the last column, the difference determined in the previous column is expressed in percentage form by taking the previous year’s amount as a base. It can be determined with the help of the following formula:

Format of Comparative Income Statement (Statement of Profit & Loss):

Note: If the current year’s value of a company has decreased, then show the Absolute Change and Percentage Change in brackets to reflect the negative item.

Illustration:

Prepare a Comparative Statement of Profit & Loss of Ishika Ltd. from the following information:

Solution:

* As there is a loss, the tax will not be levied.

Working Note:

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...