What is Net Banking?

Net banking, also called online banking or Internet banking, is a service offered by banks and financial institutions, allowing individuals to perform a wide range of banking transactions and activities through the Internet. With net banking, customers can conveniently access their check balances, transfer funds, and bank accounts; view transaction history; pay bills; and conduct other banking tasks using a computer, smartphone, or tablet. This service provides flexibility and accessibility, enabling users to manage their finances from anywhere and anytime without needing to visit a physical bank branch.

Geeky Takeaways:

- Net banking enables individuals to perform a wide range of banking transactions and activities through the Internet, offered by banks and financial institutions.

- To ensure the security of transactions, net banking employs encryption and authentication protocols.

- Net banking offers convenient access to banking services, efficient online bill payments, convenient fund transfers, a secure environment for transactions, streamlined loan and insurance applications, effortless debit and credit card management, and facilitation of non-financial activities.

- Challenges for new users, dependency on internet connectivity, and the need for regular password changes for security are some limitations associated with net banking.

How does Net Banking Work?

Internet banking offers a convenient way to manage your finances by allowing you to perform various transactions without visiting a bank branch. These transactions include fund transfers, checking account balances and statements, ordering checkbooks and bank cards, and even investing in securities. By using net banking, you can access most of the banking services from your home. When you open a bank account, your bank provides you with a unique Internet banking user ID and password. To get started, simply visit your bank’s internet banking website on your computer or smartphone and log in using the provided credentials. Upon logging in, you’ll have the option to change your password for added security. Once logged in, you can access a wide range of financial services offered by your bank.

Features of Net Banking

1. Convenient Access to Banking Services: Net banking provides customers with convenient access to a variety of banking services online. With just a few clicks, customers can check their transaction history, review account balances, and monitor their finances from anywhere with an internet connection.

2. Efficient Online Bill Payments: Customers can easily pay bills online through net banking, simplifying the payment process and eliminating the need for physical visits to payment centers or banks. This makes bill payments efficient, hassle-free, and convenient for customers. Additionally, customers can schedule recurring payments for regular bills, saving time and effort.

3. Convenient Fund Transfers: Net banking enables customers to transfer funds online using services like RTGS, NEFT, and IMPS at any time of the day or night. This allows for quick and convenient money transfers between accounts, whether it’s for personal transactions or business purposes.

4. Secure Environment for Transactions: Net banking provides a secure platform for conducting banking transactions, ensuring the safety and privacy of customer data and financial information. Advanced security measures such as encryption and multi-factor authentication are employed to safeguard customer accounts from unauthorized access and fraudulent activities.

5. Enhanced Security with Unique Login Credentials: Customers are provided with unique login credentials, including a user ID and password, for their net banking account. This enhances security and privacy, ensuring that only authorized individuals can access their accounts and perform transactions. Furthermore, customers can opt for additional security features, such as biometric authentication or one-time passwords, for added protection.

6. Streamlined Loan and Insurance Applications: Net banking allows customers to apply for loans or insurance online, streamlining the application process and eliminating the need for lengthy paperwork. This saves time for customers while providing a convenient way to access financial products and services.

7. Effortless Debit/Credit Card Management: Customers can manage their debit and credit cards conveniently through net banking platforms. This includes activities such as updating addresses, setting spending limits, and blocking lost or stolen cards, providing customers with greater control over their card transactions. Moreover, customers can easily view their card statements and transaction history online, ensuring transparency and accountability.

8. Facilitation of Non-Financial Activities: In addition to financial transactions, net banking platforms facilitate various non-financial activities such as ordering a checkbook, checking account balances, obtaining a passbook, and more. This comprehensive range of services makes net banking a one-stop solution for all banking needs.

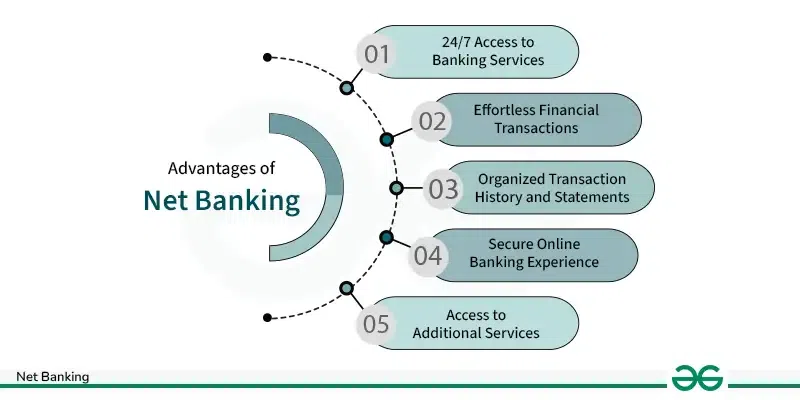

Advantages of Net Banking

1. 24/7 Access to Banking Services: Net banking offers customers the convenience of accessing banking services anytime, anywhere. This means that customers are not limited by banking hours and can manage their accounts and perform transactions at their convenience, whether it’s early morning, late at night, or during weekends.

2. Effortless Financial Transactions: With net banking, customers can effortlessly conduct various financial transactions, such as fund transfers, bill payments, and mobile recharges. This eliminates the need to visit a physical bank branch or payment center, saving customers valuable time and effort. Whether it’s transferring money to a friend, paying utility bills, or topping up mobile phone credits, net banking provides a convenient and hassle-free way to handle financial tasks.

3. Organized Transaction History and Statements: Net banking platforms offer well-organized transaction histories and statements, allowing customers to track their financial activities and account balances with ease. By providing clear and detailed records of transactions, net banking helps customers stay informed about their spending, income, and overall financial health. This organized approach simplifies financial management and decision-making for customers.

4. Secure Online Banking Experience: Net banking prioritizes the security of customer accounts and financial transactions. Robust security measures such as password protection, encryption, and sometimes two-factor authentication are employed to safeguard sensitive information and prevent unauthorized access. This ensures that customers can conduct their banking activities online with confidence, knowing that their personal and financial data is protected against cyber threats and fraud.

5. Access to Additional Services: In addition to financial transactions, net banking platforms offer access to a range of non-financial services that further enhance the banking experience. Customers can conveniently check their account balances, request demand drafts, apply for loans, open fixed deposits, and much more, all from the comfort of their homes or offices.

Limitations of Net Banking

1. Challenges Faced by New Users: For individuals new to online banking, getting accustomed to online banking platforms may present some initial hurdles. Navigating through the digital interface, understanding various features, and learning how to perform transactions online can require time and patience. However, with some guidance and practice, new users can quickly overcome these challenges and become proficient in using net banking for their financial needs.

2. Dependency on Internet Connectivity: A significant aspect of net banking is its reliance on a stable Internet connection. This dependency on internet connectivity can sometimes pose a limitation, especially in areas with unreliable or limited internet access. Disruptions in internet service may temporarily hinder users’ ability to access their accounts, conduct transactions, or view account information. However, as internet infrastructure continues to improve globally, such disruptions are becoming less frequent and less severe.

3. Ensuring Security Measures: While net banking platforms strive to provide a secure environment for conducting financial transactions, customers must remain vigilant about cybersecurity practices. This includes regularly updating passwords, using strong and unique passwords, avoiding sharing sensitive information online, and being cautious of phishing attempts and fraudulent activities. By staying informed and implementing necessary security measures, customers can mitigate potential risks and safeguard their accounts from unauthorized access and fraudulent activities.

How to Register for Net Banking?

I. Offline Method to Register for Net Banking

- Locate the nearest branch of your bank where you hold an account.

- Approach a bank staff member and request the net banking registration form.

- Complete all required fields on the registration form accurately and legibly.

- Provide personal information such as name, address, account number, and contact details.

- Attach any documents requested by the bank, such as identity proof, address proof, and account-related documents. Ensure that all documents are valid and up-to-date.

- Depending on the bank’s procedure, you may need to undergo identity verification. This could involve providing biometric data, signatures, or any other form of identification verification.

- Once your registration form and documents are submitted and verified, you will receive confirmation from the bank.

- The bank will provide you with a unique username and password for accessing your net banking account. These credentials may be given to you immediately or sent to your registered address via mail.

- Follow the instructions provided by the bank to activate your net banking account. This may involve logging in for the first time and setting up security features such as security questions or two-factor authentication.

- Once activated, you can access your net banking account using the provided credentials. Log in securely to explore the various features and services available through the net banking portal.

- If you encounter any issues during the registration process or while accessing your net banking account, don’t hesitate to contact the bank’s customer support for assistance.

II. Online Method to Register for Net Banking

- Access the official website of your bank through a web browser on your computer or mobile device.

- Look for a section or link related to net banking registration on the bank’s website homepage or navigation menu.

- Click on the option that allows you to register for net banking as a new user.

- Complete the online registration form with accurate and up-to-date information. Provide details such as your account number, name, date of birth, contact information, and any other required information.

- Follow the bank’s instructions to verify your identity during the registration process. This may involve entering details from your ATM card, providing an OTP (one-time password) sent to your registered mobile number, or answering security questions.

- Choose a unique username and password for accessing your net banking account. Follow any password requirements specified by the bank, such as minimum length or inclusion of special characters.

- Review the information provided and ensure it is accurate before submitting the registration form. Confirm your registration by clicking on the relevant button or link.

- Upon successful registration, you will receive a confirmation message on the screen and/or via email or SMS. This message may contain important information such as your customer ID or reference number.

- Follow the instructions provided in the confirmation message or on the bank’s website to activate your net banking account. This may involve logging in for the first time using the provided credentials and setting up security features.

- Once activated, you can log in to your net banking account using the username and password you created. Explore the various features and services available through the net banking portal, such as checking account balances, transferring funds, paying bills, and more.

Uses of Net Banking

1. Conducting Financial Transactions: Customers can leverage net banking to execute various financial transactions seamlessly. It includes transferring funds between accounts, paying bills, setting up standing instructions for recurring payments, and securely making online purchases.

2. Checking Account Balances: Net banking offers users the convenience of monitoring their finances in real-time. Users can effortlessly check their account balances, review transaction histories, track deposits and withdrawals, and stay updated on their financial activities.

3. Managing Investments: With net banking, customers can efficiently manage their investments from the comfort of their homes. This includes tasks such as buying and selling stocks, opening fixed deposits, setting up recurring deposits, and accessing investment portfolios online.

4. Applying for Loans and Insurance: Net banking streamlines the process of applying for financial products like loans, insurance policies, and credit cards. Customers can complete applications online without the hassle of physical paperwork, saving time and effort.

5. Updating Personal Information: Users can easily keep their personal information up-to-date using net banking platforms. This includes updating addresses, contact details, and email IDs, opting for e-statements, and ensuring that their banking records remain accurate.

6. Requesting Services: Net banking facilitates the request for various banking services with just a few clicks. Customers can order checkbooks, request demand drafts, initiate stop payments on checks, and avail of other essential services conveniently through the online platform.

Net Banking vs E-Banking

|

Basis

|

Net Banking

|

E-Banking

|

|

Definition

|

Net Banking is a service provided by banks that allows customers to access various banking services and perform financial transactions online.

|

E-banking is a broader term that encompasses distinct electronic methods of conducting banking activities.

|

|

Features

|

It enables customers to complete a range of banking tasks, like creating fixed deposits, tracking transactions, money transfers, and more, without visiting a physical bank branch.

|

It includes net banking as one of its components but extends to other electronic banking services like ATM transactions, mobile banking, electronic funds transfer systems (EFTS), and more.

|

|

Advantages

|

It offers 24/7 availability, easy fund transfers, convenience in conducting transactions, a secure environment for banking activities, and access to non-financial services like ordering checkbooks and checking account balances.

|

It provides convenience in accessing banking services electronically without physical visits to branches, offers cost-effective solutions for banks, and enables data-driven decisions.

|

|

Limitations

|

It includes challenges for new users, dependency on internet connectivity, and the need for regular password changes for security.

|

Not all account holders may have access to e-banking services; registration may be required to use the facility.

|

Conclusion

Net banking simplifies banking by allowing customers to manage their finances conveniently from any location using digital devices. It offers a wide range of services, including financial transactions, account management, and access to non-financial services, all while prioritizing security through encryption and authentication. With its user-friendly interface and round-the-clock availability, net banking enhances the banking experience for customers, making it an indispensable tool for modern banking needs.

Net Banking – FAQs

Is UPI considered net banking?

The Unified Payments Interface is a modern method of transferring funds through net banking, known for its user-friendly approach and convenience. UPI facilitates both peer-to-peer and peer-to-merchant transactions, making it a prominent option among users.

Is UPI faster than traditional net banking methods?

While UPI excels at providing instant and efficient transactions, traditional methods like the National Electronic Funds Transfer (NEFT) are preferred for larger and more secure transfers.

What is the daily transaction limit for UPI?

The daily transaction limit for UPI is capped at Rs 1 lakh, as stipulated by the National Payments Corporation of India (NPCI), the regulatory body authorized by the Reserve Bank of India for managing UPI transactions.

How does net banking differ from mobile banking?

Net banking and mobile banking serve similar purposes but differ in functionality. Internet banking permits users to perform online transactions using a computer or laptop with an Internet connection. In contrast, mobile banking can be accessed via smartphones or feature phones, with or without an internet connection, offering greater flexibility and accessibility.

Share your thoughts in the comments

Please Login to comment...