Multiple linear regression is widely used in machine learning and data science. In this article, We will discuss the Multiple linear regression by building a step-by-step project on a Real estate data set.

Multiple linear regression

Multiple Linear Regression is a statistical method used to model the relationship between a dependent variable (or target variable) and two or more independent variables (or predictor variables). It’s a valuable tool for understanding how multiple factors influence a particular outcome. In the context of real estate data, multiple linear regression can help us predict real estate prices based on various factors.

Here’s a step-by-step explanation of how to perform Multiple Linear Regression using R Programming Language for a Real Estate Sales dataset.

Multiple linear regression using R for the Real estate data set

Install the Required Libraries

Install xlsx R package

install.packages("xlsx")

Load the Required Libraries

Before starting the analysis, you need to load the necessary R libraries. In this case, you might use libraries like readxl for reading data from Excel files and lm for fitting the regression model.

Load the Dataset

Dataset Link: REAL ESTATE SALES DATA

Import the Real Estate dataset into your R environment. You can use functions like read.xlsx or read.csv to read data from Excel or CSV files, respectively. Ensure that the dataset is structured with columns representing variables of interest, such as property price, size, number of bedrooms, number of bathrooms, and other relevant factors.

R

data<- read.xlsx("UNFILTERED DATA Vanderburgh 2013 PROPERTY SALES DATA.xlsx",

sheetIndex = 1)

head(data)

|

Output:

OBJECTID NAME StatePIN

1 1 12-180-34-217-037 82-05-12-034-217.037-020

2 2 10-080-18-116-003 82-05-23-018-116.003-025

3 3 11-350-25-040-006 82-06-20-025-040.006-029

4 4 11-440-26-059-013 82-06-20-026-059.013-029

5 5 09-610-16-049-002 82-06-33-016-049.002-027

6 6 11-020-20-050-014 82-06-30-020-050.014-029

legal_description property_addr

1 SMITHLAND LOTS 37,38,39,40 BLK 1 3100 N FULTON AVE

2 WESTHOLME LOTS 4 & 5 BLK 2 612 N ST JOSEPH AVE

3 HEIDELBACH & ELSAS ENLG LOTS 26 & 27 BLK 35 15 W FRANKLIN ST

4 GARVIN PARK LOTS 12 13 & PT LOT 14 BLK 7 216 E TENNESSEE ST

5 WOODHAVEN LOTS 2 & 3 1403 MONROE AVE

6 EASTERN ENLARGEMENT PT L 13,14,15,BL 2 419 SE THIRD ST

cert_land_value cert_improvement_value cert_total_value

1 30700 21300 52000

2 43800 3700 47500

3 9500 37600 47100

4 10900 54500 65400

5 15200 80200 95400

6 6700 0 6700

owner1 owner2 owner_street owner_city

1 TAYLOR, CHARLES ROBERT <NA> 4810 TECUMSEH LN EVANSVILLE

2 SCHMITT, STEVE <NA> 3220 ORCHARD RD EVANSVILLE

3 SCHEESSELE, SCOTT <NA> 1811 N HEIDELBACH AVE EVANSVILLE

4 HARBOUR PORTFOLIO VII LP <NA> 8214 WESTCHESTER STE 635 DALLAS

5 SCHOOLER, REGINALD K SR <NA> 1403 MONROE AVE EVANSVILLE

6 MICHAEL S MARTIN REALTY VI LLC <NA> PO BOX 3908 EVANSVILLE

owner_state owner_zip grade year_built condition neighborhood property_class

1 IN 47715 N/A 0 <NA> AV 499

2 IN 47720 N/A 0 <NA> <NA> 400

3 IN 47711 N/A 0 <NA> <NA> 447

4 TX 75225 D 1909 AV <NA> 510

5 IN 47714 D 1954 AV <NA> 510

6 IN 47737 N/A 0 <NA> AV 400

nbhd SoldPrice ConveyanceDate legal_ac RentalProperty

1 456 77500 2013/09/18 00:00:00+00 0.3530 0

2 478 75000 2013/06/26 00:00:00+00 0.1545 0

3 456 35000 2013/04/03 00:00:00+00 0.1460 0

4 110704 32200 2013/05/28 00:00:00+00 0.1930 0

5 90807 69900 2013/01/04 00:00:00+00 0.0860 0

6 468 10 2013/04/02 00:00:00+00 0.0684 -1

SpecialCircumstances2

1 13P14 COMB PARCELS 82-05-12-034-217.032 THRU 035-020 WITH PARCEL 82-05-12-034-217.037-020. PARCEL 82-05-12-034-217.037-020 WAS IMP ONLY CODE UNTIL OTHER CODES WERE COMB.

2 I/E

3 V/V

4 I/B

5 I/L

6 I/4

ValidForTrending Shape_Area

1 -1 14665.931

2 0 6825.386

3 -1 6322.089

4 0 8168.271

5 0 7561.110

6 0 5357.503

Data Exploration

After loading the dataset, it’s important to explore it to gain an understanding of its structure and content. You can use functions like head, summary, and str to check the first few rows, summary statistics, and data structure.

R

print(dim(data))

print(sum(is.na(data)))

print(colSums(is.na(data)))

|

Output:

[1] 5389 27

[1] 62

OBJECTID NAME StatePIN legal_description

0 0 0 0

property_addr cert_land_value cert_improvement_value cert_total_value

0 12 12 12

owner1 owner2 owner_street owner_city

0 0 0 0

owner_state owner_zip grade year_built

0 0 0 12

condition neighborhood property_class nbhd

0 0 0 12

SoldPrice ConveyanceDate legal_ac RentalProperty

0 0 2 0

SpecialCircumstances2 ValidForTrending Shape_Area

0 0 0

Extract the columns from the dataset those are not required

We can Extract ‘prev_sold_date’ column from the dataset because it is not required for the model building.

R

library(dplyr)

data <- select(data, -c("OBJECTID","NAME","StatePIN","legal_description","property_addr",

"owner1","owner2","owner_street","owner_zip", "grade", "neighborhood"),

"ConveyanceDate","SpecialCircumstances2","ValidForTrending")

dim(data)

data<-na.omit(data)

sum(is.na(data))

|

Output:

[1] 5389 16

[1] 62

[1] 0

Data Preparation

Prepare the data for regression analysis. This includes cleaning the data, handling missing values, and ensuring that the variable names are correct. You may also want to consider feature engineering, creating dummy variables for categorical predictors, and standardizing or normalizing the data if necessary.

Display summary statistics of the cleaned dataset

Using summary function we get the mathematical information of the dataset.

Output:

cert_land_value cert_improvement_value cert_total_value owner_city

Min. : 0 Min. : 0 Min. : 0 EVANSVILLE :4579

1st Qu.: 7100 1st Qu.: 23800 1st Qu.: 34700 NEWBURGH : 152

Median : 14300 Median : 60500 Median : 74800 OWENSBORO : 65

Mean : 21449 Mean : 85543 Mean : 106993 INDIANAPOLIS: 55

3rd Qu.: 23600 3rd Qu.: 107850 3rd Qu.: 130900 DALLAS : 40

Max. :4085500 Max. :12349300 Max. :16434800 ELBERFELD : 30

(Other) : 454

owner_state year_built condition property_class nbhd

IN :4975 Min. : 0 AV :3709 Min. :100.0 Min. : 336

KY : 104 1st Qu.:1910 : 849 1st Qu.:510.0 1st Qu.: 90609

TX : 87 Median :1949 F : 533 Median :510.0 Median : 110500

IL : 51 Mean :1649 P : 110 Mean :503.8 Mean : 270982

CA : 37 3rd Qu.:1985 VP : 86 3rd Qu.:510.0 3rd Qu.: 202074

FL : 20 Max. :2014 G : 82 Max. :800.0 Max. :9151603

(Other): 101 (Other): 6

SoldPrice ConveyanceDate legal_ac

Min. : 0 2013/08/22 00:00:00+00: 234 Min. : 0.0000

1st Qu.: 24000 2013/05/23 00:00:00+00: 62 1st Qu.: 0.1300

Median : 80000 2014/01/30 00:00:00+00: 58 Median : 0.1910

Mean : 129539 2013/06/28 00:00:00+00: 52 Mean : 1.6161

3rd Qu.: 149700 2013/08/09 00:00:00+00: 52 3rd Qu.: 0.3346

Max. :12500000 2014/01/17 00:00:00+00: 51 Max. :2205.0000

(Other) :4866

RentalProperty SpecialCircumstances2 ValidForTrending Shape_Area

Min. :-1.00000 V/V :1515 Min. :-1.0000 Min. : 100

1st Qu.: 0.00000 V : 733 1st Qu.:-1.0000 1st Qu.: 5664

Median : 0.00000 I/Y : 431 Median : 0.0000 Median : 8321

Mean :-0.02902 I/O : 391 Mean :-0.4359 Mean : 34656

3rd Qu.: 0.00000 I/1 : 269 3rd Qu.: 0.0000 3rd Qu.: 14666

Max. : 0.00000 I/L : 225 Max. : 0.0000 Max. :7308625

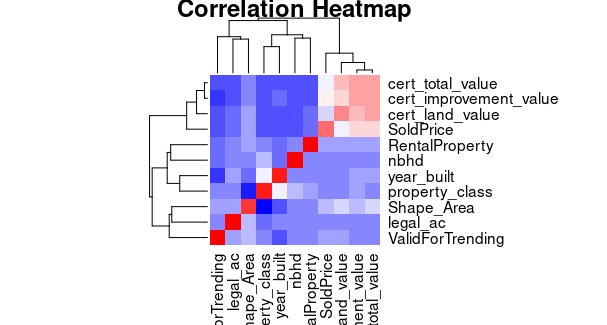

Creating Correlation Heatmap data

R

numeric_columns <- data[sapply(data, is.numeric)]

correlation_matrix <- cor(numeric_columns)

heatmap(correlation_matrix,

col = colorRampPalette(c("blue", "white", "red"))(20),

main = "Correlation Heatmap")

|

Output:

Multiple linear regression using R for the Real estate data set

sapply is used to check the data type of each column in the data frame and retain only the numeric columns. The resulting numeric_columns data frame will include all numeric columns from your original data frame your_data.

A heatmap is ploted to visualize the correlation between different numeric attributes in our dataset. This is useful for understanding how variables are related to each other.

R

library(forecast)

decomposition <- stl(ts(data$SoldPrice, frequency = 12),

s.window = "periodic")

plot(decomposition)

|

Output:

Multiple linear regression using R for the Real estate data set

The code decomposes a time series of ‘SoldPrice’ using the ‘forecast’ package. It separates the time series into three components: trend, seasonality, and residuals, and then visualizes these components in four plots. This helps analyze trends and seasonal patterns in the ‘SoldPrice’ data and identifies irregularities or anomalies.

R

library(plotly)

plot_ly(data = data, x = ~year_built, y = ~SoldPrice, z = ~cert_total_value,

color = ~property_class, type = 'scatter3d', mode = 'markers')

|

Output:

Multiple linear regression using R for the Real estate data set

The ‘plotly’ package to create an interactive 3D scatter plot. It visualizes a dataset called ‘df’ in three dimensions: ‘year_built’ on the x-axis, ‘SoldPrice’ on the y-axis, and ‘cert_total_value’ on the z-axis. Data points are colored according to the ‘property_class’ variable. The plot is interactive, allowing users to zoom, pan, and hover over data points for additional information, making it a powerful tool for exploring multidimensional patterns and relationships within the dataset.

Model building

Fit the multiple linear regression model using the lm function. Specify the dependent variable (in this case, the property price) and the independent variables (predictors, such as property size, number of bedrooms, number of bathrooms, and others). The model will estimate the coefficients for each predictor variable.

R

model <- lm(SoldPrice ~ ., data = data)

summary(model)

|

Output:

[ reached getOption("max.print") -- omitted 567 rows ]

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 97890 on 4649 degrees of freedom

Multiple R-squared: 0.9556, Adjusted R-squared: 0.9487

F-statistic: 138.1 on 725 and 4649 DF, p-value: < 2.2e-16

Use the summary function to view the details of the regression model. This summary will provide information about the coefficients, standard errors, t-statistics, p-values, and the R-squared value, which indicates the goodness of fit.

Assess the quality of the model by examining the coefficients and their significance. A low p-value for a coefficient suggests it has a significant impact on the dependent variable. Also, consider the overall R-squared value, which indicates the proportion of variance in the dependent variable explained by the model.

Conclusion

Multiple Linear Regression is a powerful technique for real estate analysis, allowing you to understand how various factors contribute to property prices and make predictions based on those factors. It’s important to interpret the results carefully and validate the model to ensure its accuracy and reliability for making predictions.

Share your thoughts in the comments

Please Login to comment...