Writing a check can be confusing! People who are regularly indulged in banking or any other financial activity know the process, but if you are a newbie, then it can be difficult.

But honestly, in this digital age, where online transactions dominate the financial landscape, writing a check seems like a lost art. However, it is a fundamental skill that can come in handy in various situations.

Although, many people do not use checks these days but it is one of the secure ways of doing payment and if not written properly, they may be rejected by the bank. Thus, it is essential that one must know the complete process of “How to write a check” and be familiar with all its components.

So, in order to help you with the same, we have written this article where you will be guided through the complete process.

Whether you need to pay bills, make donations, or settle personal debts, understanding how to write a check is a valuable skill to possess.

For those unfamiliar, a check is a written order instructing a bank to pay a specific amount of money to a designated recipient or payee. And lucky for you, we will take you through the step-by-step process of writing a check, ensuring that you master this essential aspect of personal finance.

Before You Write the Check

Remember, every masterpiece requires careful planning. So, before diving into the mechanics of writing a check, there are a few crucial aspects to consider. Keeping these in mind will help ensure accuracy and efficiency in your check-writing efforts. These are few things to consider before you set pen to paper:

Never Leave Blank Spaces:

It is crucial never to leave any blank spaces on your check, as doing so increases the risk of forgery. Always remember to fill out the check entirely, providing the payee’s information accurately.

Double-Check Recipient Preferences:

Some recipients may have specific instructions for how they want the check to be written, such as writing out the full name or including a reference number. Pay attention to such details to ensure a seamless transaction.

Verify Your Account Balance:

Picasso wouldn’t start a painting without knowing he had enough paint, and you shouldn’t start writing a check without ensuring sufficient funds in your account.

It’s essential to have sufficient funds in your account to cover the check amount. A bounced check can lead to penalties and a tarnished financial reputation.

Maintain Clear and Legible Handwriting:

Write neatly and legibly, ensuring that all information on the check is easily readable. Illegible checks can cause confusion and delays.

Use a Reliable Pen:

To prevent alteration or tampering, use a pen with permanent ink, such as a ballpoint or gel pen. Avoid using pencils or erasable pens.

How to Write a Check?

Follow these easy steps to know how to write a check:

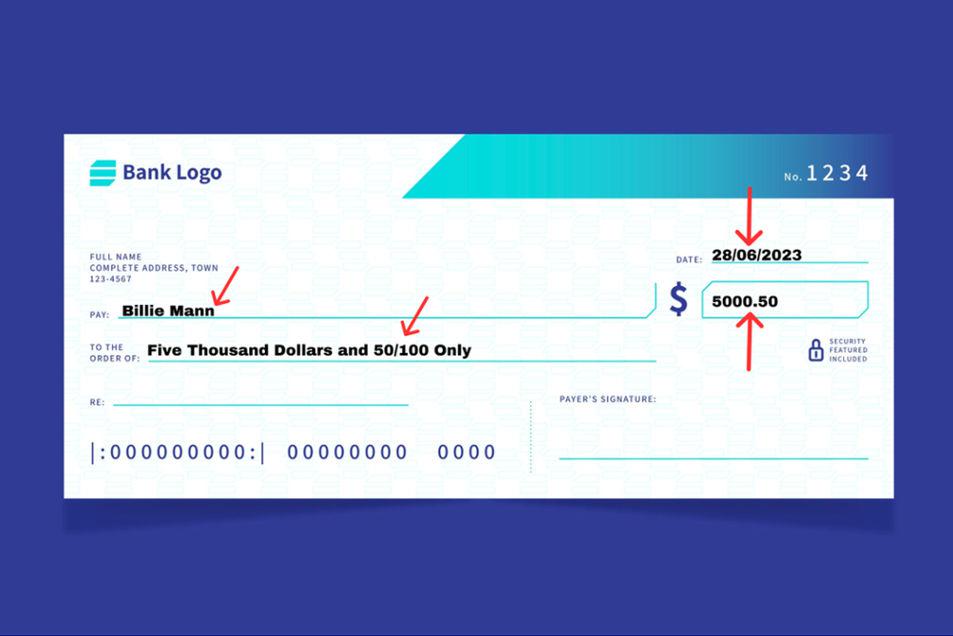

Step 1: Date the Check

Start by writing the current date on the line provided in the upper-right corner of the check. Use the standard date format, which is typically “DD/MM/YYYY.”

Step 2: Fill in the Recipient’s Name

On the line that says “Pay,” write the full name of the person or organization that will receive the payment. It’s important to write the name clearly and accurately to avoid any confusion.

.jpg)

Step 3: Write the Check Amount in Numbers

On the line next to the dollar symbol ($), write the exact amount you want to pay using numerals. Include any cents, if applicable, by separating them from the dollars with a decimal point.

Step 4: Write the Check Amount in Words

On the line below the recipient’s name, write out the payment amount in words. Begin with the dollar amount, followed by the word “and,” and then mention the cents as a fraction over 100.

FUN FACT: Do you want to know something funny (or maybe not so funny)? An entrepreneur added extra zeros to the check after getting one from Shark Tank!

So, what do we learn from this?

It is crucial to emphasize the word “only” at the end to indicate that the amount specified in the words is the only amount that should be paid.

For example, if the amount is $5,000 and 50 cents, you would write “Five thousand and 55/100 only.”

Writing “only” at the end acts as a safeguard against fraudulent activities, as it clearly indicates that no additional amounts should be added to the written amount.

Step 5: Add a Memo

This is your opportunity to leave a personalized message or a cryptic note on the check. So, if desired, you can write a brief memo or note in the designated section of the check to indicate the purpose of the payment or provide any additional information.

Step 6: Sign the Check

At the bottom-right corner of the check, sign your name using the signature associated with your bank account. Your signature serves as validation and confirms the authenticity of the check.

After You Write the Check

You must be wondering,” What now?”. Well, the job doesn’t end here.

Once you have completed writing the check, make sure to keep a record of it for future reference. Consider making a copy or noting down the check details in your checkbook register or financial management system. This helps in tracking your expenses and maintaining accurate records.

Tips For Writing A Check

We get it that no matter how much you read before writing your first check, it’ll still be just theoretical knowledge. And probably, it won’t make a difference until you write one. So, here are some tips that might make your work easier:

1. Maintain a Balanced Checkbook

Just like maintaining a balanced diet keeps your body healthy, maintaining a balanced checkbook keeps your finances in shape. Regularly revise your checkbook to ensure that your records align with your bank statements. This prevents any discrepancies and helps you stay on top of your finances.

2. Store Unused Checks Securely

You must treat your blank checks like precious treasures. So, keep your blank checks in a safe and secure location to prevent unauthorized use or theft. Only carry the necessary number of checks when needed.

3. Be Mindful of Check Fraud

Ah, the art of deception! Don’t let those blank spaces on the check become a canvas for con men. Always avoid leaving blank spaces on the check, as they can be manipulated. Also, refrain from signing checks in advance unless absolutely necessary.

4. Practice Caution With Voided Checks

Mistakes happen, my friend! But when it comes to checks, try not to make a mess. Moreover, avoid using correction fluids or overwriting even when you make a mistake while writing a check. Instead, mark it as void. (Just tear it up and start fresh with a new check).

Key Takeaway

Now that you know how to fill out a check like a pro, you’re equipped with a valuable financial skill that sets you apart in this digital era. As a parting gift from our side, here’s a bonus tip to make your check-writing journey even more delightful!

Handle the check with Clean Hands and Use a Single Pen.

While writing a check, make sure your hands are clean and dry before handling the check. Oils, dirt, or moisture can smudge the ink, making the check challenging to read or process.

Additionally, using a single pen throughout the check-writing process is recommended. Using different pens or ink colors may raise suspicion and make it appear as if the check has been tampered with or altered.

We hope this helps!

FAQs on How to Write a Check

1. Can I Write a Check in Any Currency?

Answer:

No, you cannot write a check in any currency. Checks are generally written in the currency of the country where the bank account is located.

2. Can I Post-Date a Check?

Answer:

Yes, you can post-date a check. Post-dating means writing a future date on the check instead of the current date.

3. What Should I Do if my Check Gets Lost or Stolen?

Answer:

If your check gets lost or stolen, taking immediate action is important. Contact your bank as soon as possible to report the situation and ask for a stop payment on the check.

4. How Long AreDo Checks Valid?

Answer:

Checks are valid for a certain period of time, usually six months. However, it also depends on the bank and country.

Share your thoughts in the comments

Please Login to comment...