What is Indian Money Market?

The Indian money market is an essential element of India’s financial system, facilitating short-term borrowing and lending among financial institutions and individuals. Its primary function is to ensure efficient fund allocation and provide liquidity to participants, contributing to the smooth functioning of the economy. The Indian money market serves as a platform for liquidity management and price discovery.

.webp)

What is Money Market?

A market or a segment of the financial market in which lending and borrowing of short-term funds take place is known as a Money Market. A money market primarily deals with highly liquid and low-risk instruments having maturity, usually with a range from overnight to one year. In a money market, the short-term surplus investible funds with the banks and other financial institutions are bid by borrowers. It plays a crucial role in facilitating efficient fund allocation. It also helps meet short-term fund requirements of different participants of an economy. The basic objectives of the Money Market include short-term financing, liquidity management, low-risk investments, benchmark interest rates, market stability and transparency, and monetary policy implementation.

A Money Market is not the same as a Capital Market. The former is a market that deals with borrowing and lending of short-term funds; however, the latter is a market that deals with long-term funds. Even though these markets are different from each other, they are closely related as there is some overlapping between the short-term and long-term loan transactions. A money market is a part or segment of the financial market. A financial market includes a money market, capital market, government securities market, and foreign exchange market.

Structure of the Indian Money Market

The Indian Money Market can be categorised into two sectors; viz., Organised or Modern Sector, and Unorganised or Indigenous Sector.

The banks included in the organised or modern sector of the Indian Money Market are SBI, RBI, Private Scheduled Commercial Banks, Non-scheduled Commercial Banks, Nationalised Banks, Foreign Exchange Banks, and Cooperative Banks. However, the participants included in the unorganised or indigenous sector of the Indian Money Market are Sarrafs, Mahajans, Sahukars, Chettiars, and Seths. These participants carry on the moneylending business in the rural and semi-urban areas of India. The organised and the unorganised sectors of the Indian Money Market have little contact between them.

The Reserve Bank of India has more or less complete control over the modern sector of the Indian Money Market. However, despite the fact that a major portion of the trade credit and industry credit is provided by the unorganised sector, RBI does not have control over it.

Characteristics of the Indian Money Market

Some of the key characteristics or features of the Indian Money Market are as follows:

1. Segmented Structure: The Indian money market can be categorised into organised and unorganised sectors. The organised sector includes institutions like the Reserve Bank of India (RBI), commercial banks, cooperative banks, and other financial institutions. However, the unorganised sector comprises indigenous bankers and money lenders.

2. Regulatory Oversight by the RBI: The Reserve Bank of India plays a pivotal role in regulating and supervising the Indian money market. It controls the money supply in the economy, manages liquidity, and ensures the stability of the financial system.

3. Focus on Short-Term Financing: The Indian money market predominantly deals with short-term financial instruments having maturities of up to one year. It enables participants to fulfil their short-term funding requirements and efficiently manage liquidity.

4. Diverse Array of Instruments: The Indian money market offers a wide range of instruments, including treasury bills, certificates of deposit, commercial papers, call money, etc. These instruments serve as avenues for short-term borrowing, lending, and investment activities.

5. High Liquidity: The Indian money market is known for its high liquidity due to the presence of diverse participants and instruments. Market participants can readily buy or sell their holdings without significant price fluctuations.

6. Low-risk Instruments: Instruments in the Indian money market are generally considered low-risk because of their short maturities and backing by credible issuers such as the government, banks, and financial institutions. Consequently, they are attractive to risk-averse investors.

7. Significance in Monetary Policy Transmission: The money market plays a critical role in transmitting monetary policy decisions. The RBI employs various tools, such as open market operations, repo rate, and reverse repo rate, to regulate liquidity in the money market and influence overall interest rates in the economy.

8. Dominance of Institutional Investors: Institutional investors, including banks, financial institutions, and mutual funds, primarily dominate the Indian money market. Individual retail investors have limited direct participation, although they can indirectly access the money market through mutual funds and other investment vehicles.

9. Interconnectedness with Other Financial Markets: The Indian money market exhibits interconnections with other segments of the financial market, such as the capital market and foreign exchange market. Funds from the money market can flow into long-term investments or be utilised for currency trading.

10. Ongoing Infrastructure Development: The Indian money market has experienced significant growth and development in recent years. Efforts have been made to enhance market infrastructure, improve transparency, and introduce new instruments to cater to the evolving needs of participants.

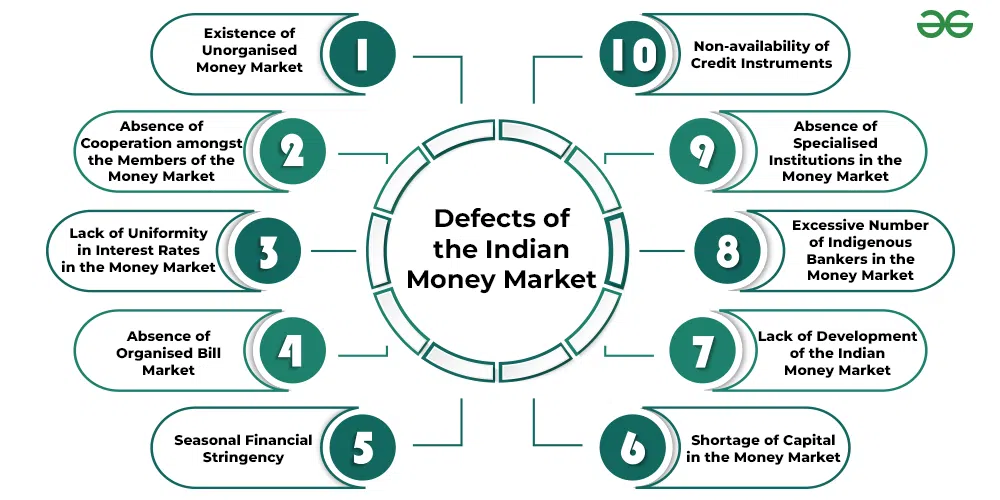

Defects of the Indian Money Market

The Indian money market has been associated with several defects that hinder its efficient functioning. Some of the defects of the Indian money market are as follows:

1. Existence of Unorganised Money Market: The Indian money market consists of both organised and unorganised sectors. The unorganised sector, which includes indigenous bankers and moneylenders, lacks proper regulations and operates outside the purview of RBI. This leads to issues such as lack of transparency, high-interest rates, and exploitation of borrowers. Borrowers may face difficulties in accessing fair and transparent lending practices, affecting the overall efficiency of the market.

2. Absence of Cooperation amongst the Members of the Money Market: The lack of cooperation and coordination among the various participants in the money market, including banks, financial institutions, and the government, hampers the smooth functioning of the market. Without effective collaboration, the market may experience inefficiencies, liquidity problems, and a fragmented structure. Cooperative efforts are necessary to ensure the stability and optimal functioning of the money market.

3. Lack of Uniformity in Interest Rates in the Money Market: In the Indian money market, interest rates are not uniform across different segments and participants. This lack of uniformity creates disparities and uncertainties, making it difficult for market participants to make informed decisions. It also affects the transmission of monetary policy and the overall stability of the market. Transparent and consistent interest rate mechanisms are essential for an efficient money market.

4. Absence of Organised Bill Market: A well-developed bill market is crucial for the functioning of the money market. However, in India, the bill market is not adequately organised. This absence of an organised bill market limits the availability of short-term credit instruments, such as treasury bills and commercial bills, which are essential for liquidity management and financing trade transactions. A well-regulated bill market is necessary to facilitate efficient short-term financing.

5. Seasonal Financial Stringency: The Indian money market experiences seasonal fluctuations in liquidity and financial stringency. This is primarily due to factors like agricultural cycles, festive seasons, and government borrowing patterns. These fluctuations can lead to volatility in interest rates and create uncertainties for market participants. Strategies to manage these seasonal fluctuations are necessary for maintaining stability.

6. Shortage of Capital in the Money Market: The Indian money market faces a shortage of capital to meet trade and industry requirements. The limited availability of capital hampers the development of various sectors and restricts the growth potential of the overall economy. Adequate availability of capital is crucial for sustaining economic growth and meeting the funding needs of businesses and individuals.

7. Lack of Development of the Indian Money Market: The Indian money market is not as developed as other major global money markets. It lacks depth, breadth, and sophistication in terms of financial products and instruments. This hinders the efficient allocation of funds and impedes the overall growth and stability of the financial system. Developing a diverse range of financial products and instruments can enhance the market’s efficiency.

8. Excessive Number of Indigenous Bankers in the Money Market: The presence of a large number of indigenous bankers, such as moneylenders and unregulated non-banking financial entities, creates issues of unfair practices, lack of accountability, and high-interest rates. It also contributes to the unorganised nature of the money market. Proper regulation and oversight are necessary to mitigate these issues and ensure fair and transparent practices.

9. Absence of Specialised Institutions in the Money Market: The Indian money market lacks specialised institutions that can cater to specific financial needs and provide specialised financial services. This absence limits the options available to market participants and hampers the overall efficiency of the money market. The establishment and strengthening of specialised institutions can enhance the market’s ability to meet diverse financial requirements.

10. Non-availability of Credit Instruments: The Indian money market suffers from a lack of diverse and readily available credit instruments. The absence of a wide range of credit instruments restricts the flexibility and effectiveness of financing options for borrowers and lenders. Developing a comprehensive range of credit instruments can provide market participants with more options for managing their financing needs.

Addressing these defects requires various measures. Regulatory reforms are necessary to ensure proper oversight and regulation of all market participants. Improved coordination among market participants, including banks, financial institutions, and the government, is essential for efficient market functioning. Developing organised bill markets and specialised institutions can enhance the availability of credit instruments and cater to specific financial needs. Furthermore, promoting financial literacy among market participants can empower them to make informed decisions and contribute to a more efficient money market.

Share your thoughts in the comments

Please Login to comment...