In the world of finance, knowledge is power, especially when it comes to managing loans. Imagine having a crystal-clear understanding of how each monthly payment chips away at your outstanding balance and covers those annoying interest charges. This is where a loan amortization plan comes into play, offering borrowers a comprehensive breakdown of their loan repayment journey over time. Whether you’re an individual or a business, the ability to visualize the entire lifespan of your loan, from start to finish, is an invaluable asset. And what’s even better? You can create this financial roadmap effortlessly using Excel. In this article, we will learn how to create loan amortization plans, exploring how they work and why they are an essential tool for anyone seeking financial clarity in their loan repayment process.

What is a Loan Amortization Schedule

An amortization schedule is a comprehensive record that outlines all the payments associated with a mortgage or loan, delineating the specific allocation of funds towards the principal amount and interest. The principal amount signifies the initial sum borrowed or invested, while interest represents the cost incurred for the privilege of borrowing money. Its fundamental purpose is to provide a clear depiction of the outstanding balance that remains after each payment. Amortization schedules find utility in various financial scenarios necessitating methodical tracking of long-term payment obligations, including business loans, consumer loans, auto loans, mortgages, long-term rentals, and layaway programs. Typically, early-stage payments primarily consist of interest and fees, gradually shifting towards predominantly repaying the principal loan as the schedule progresses. Upon completion, the amortization schedule documents the borrower’s principal payments and the total interest paid throughout the loan term, offering a valuable tool for financial planning and tracking.

Loan Amortization Schedule Functions in Excel

- The PMT function calculates the fixed amount of each periodic payment throughout the loan term. This payment remains consistent over time.

- Conversely, the PPMT function calculates the portion of each payment allocated to reduce the loan’s principal amount, which is the initial borrowed sum. This principal payment grows with successive payments.

- Lastly, the IPMT function determines the share of each payment designated for covering the interest charges. This interest payment decreases with each payment, reflecting the declining loan balance.

How to Create a Loan Amortization Schedule in Excel

Step 1: Open a new Spreadsheet and Define Input Cells

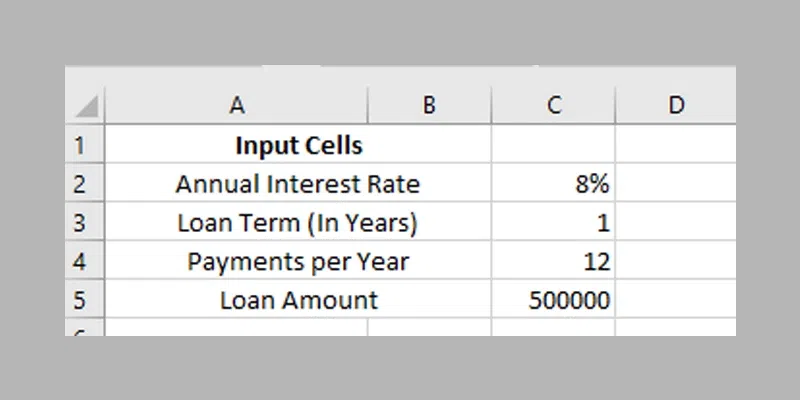

Open a new spreadsheet and add the below components of loans in the mentioned Cells.

- C2 – Annual Interest Rate

- C3 – Loan Term in Years

- C4 – Number of Payments Per Year

- C5 – Loan Amount

Please refer to the below image for easy understanding.

Define Input Cells

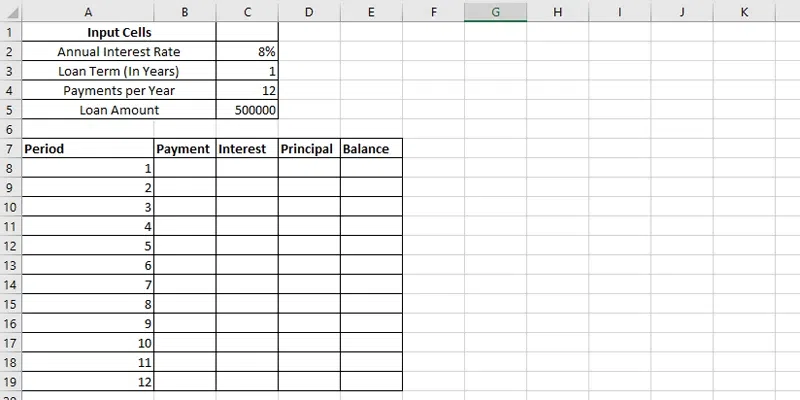

Step 2: Create an Amortization Table with Labels

Now create an amortization table with the labels (Period, Payment, Interest, Principal, Balance) in A7:E7. Now enter the series number equal to the total number of payments (1-12), for this simply enter 1,2 & 3 in A8, A9 & A10 and drag the cell until A19.

Create an Amortization Table > Fill Number of Period

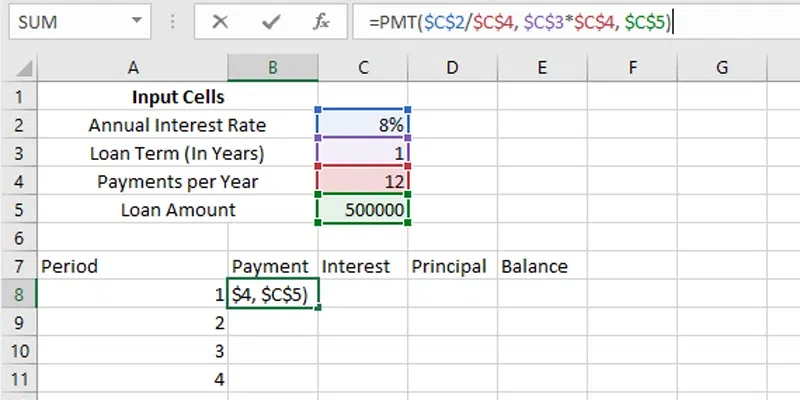

Step 3: Calculate Total Payments (PMT Formulae)

To calculate total payments use PMT Function PMT (rate, nper, pv, [fv], [type])

Rate: Calculate the interest rate per payment period by dividing the annual interest rate by the number of payment periods within a year.

Nper: Determine the total number of payment periods by multiplying the number of years by the number of payment periods per year.

pv: Enter the Total Loan Amount

PMT FORMULAE: =PMT($C$2/$C$4, $C$3*$C$4, $C$5) in B8 and then drag the column until A19.

Calculate Total Payment

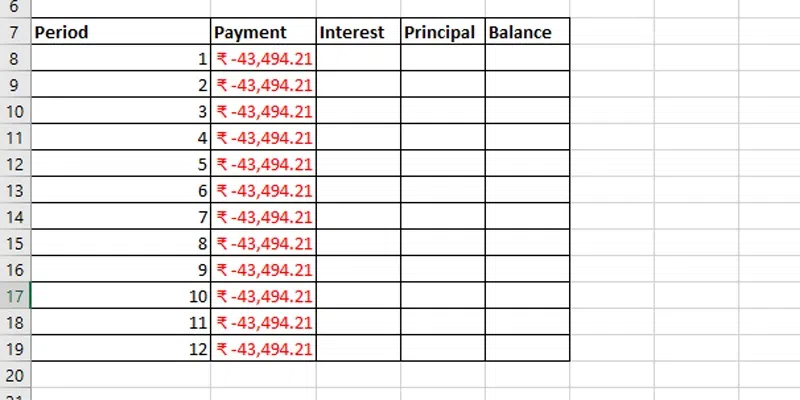

After entering the formulae in B8 and till B19, you will see the same payment amount for all the periods.

PMT Calculated for all the period

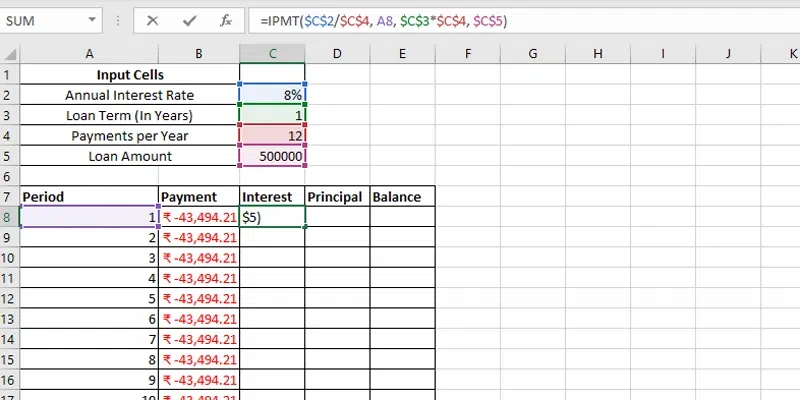

Step 4: Calculate interest (IPMT formulae)

Now find out the interest of each periodic payment by using the IPMT Function formulae in C8.

IPMT Formulae: =IPMT($C$2/$C$4, A8, $C$3*$C$4, $C$5)

Enter IPMT Formulae in C8

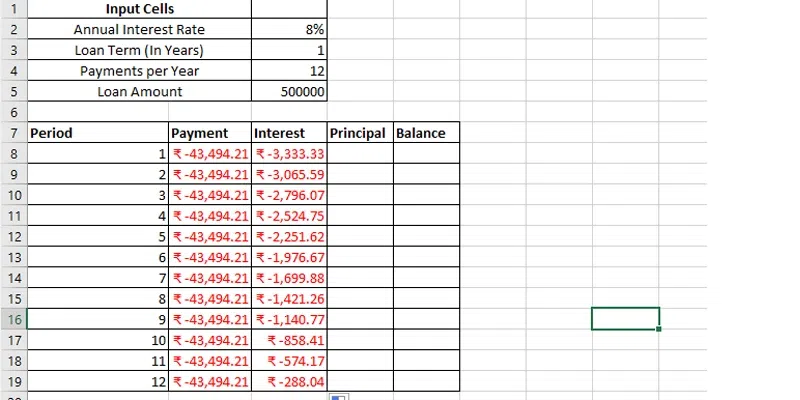

After entering the formulae in C8, drag the column until C19

IPMT Calculated

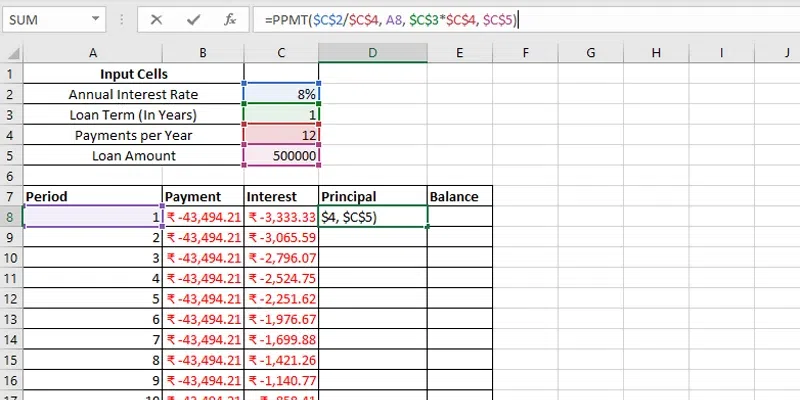

Step 5: Calculate Principal (PPMT Formulae)

Now calculate the using the PPMT Function in D8.

PPMT Formulae: =PPMT($C$2/$C$4, A8, $C$3*$C$4, $C$5)

Find the Principal Amount

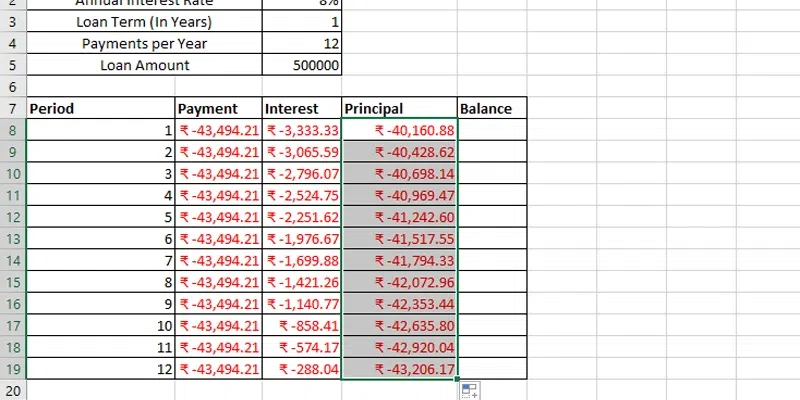

After entering the formulae in D8, drag the column until D19.

PPMT Calculated

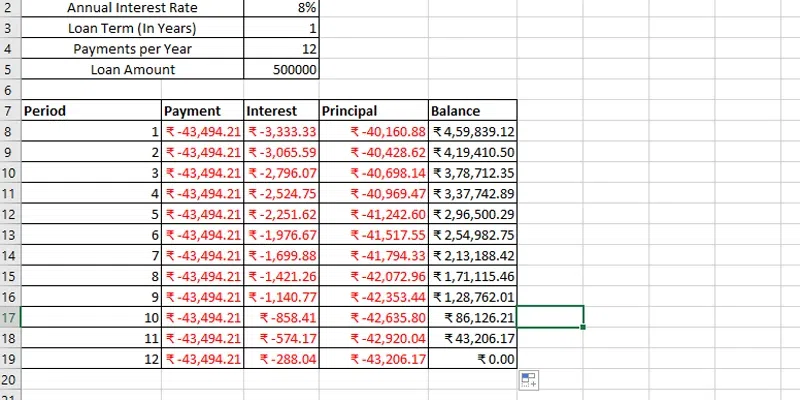

Step 6: Calculate the Remaining Balance

Now to calculate the Remaining Balance for each period we’ll apply two separate formulas.

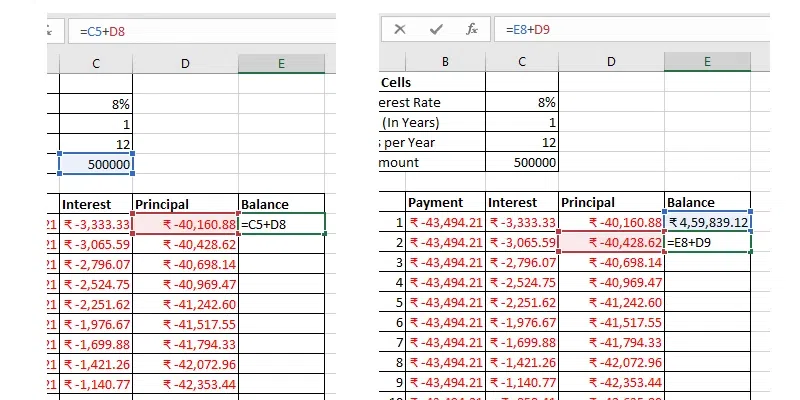

To determine the balance after the initial payment, located in cell E8, sum the loan amount (C5) and the principal of the first period (D8): =E8+C5+D8

Note: since the loan amount is represented as a positive number and the principal as a negative number, the latter is effectively deducted from the former.

For the second period onwards, find the balance by adding the previous balance to the principal for the current period: =E8+D9

Calculating Remaining Balance

Now drag down the column till E19, and you will get the periodic remaining balance figures.

Remaining Balance Calculated

Important Note: As shown in the image, by default, the values are visually represented with a red font and enclosed within parentheses. However, if you prefer to display all results as positive numbers, you can easily do this by adding a minus sign before using the PMT, IPMT, and PPMT functions.

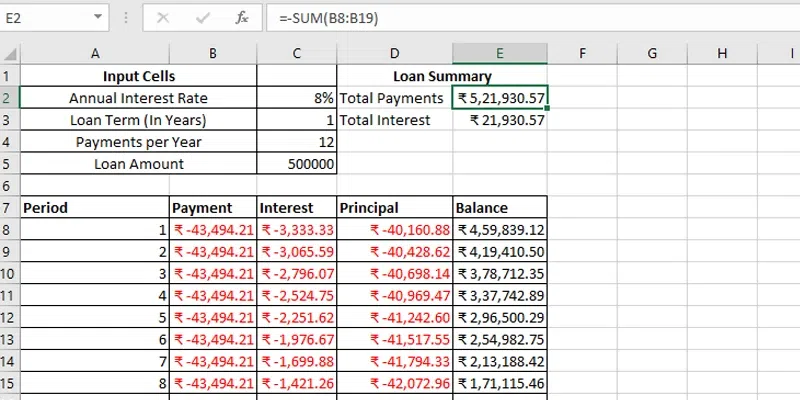

Step 7: Make a Loan Summary

Now create a loan summary to see the exact status of your loan. Create a Loan Summary and Add the Below components in the mentioned Cells.

- Total Payments (E2): =-SUM(B8:B19)

- Total Interest (E3): =-SUM(C8:C19)

Loan Summary Created

Who can Use an Amortization Schedule

Amortization schedules, while commonly associated with long-term loans, possess versatility that extends far beyond traditional mortgages. These financial tools find relevance in a range of scenarios, catering to the needs of various entities. Let’s explore who can benefit from utilizing amortization schedules:

Moneylenders

Moneylenders play a key role in managing amortization schedules, as they are the ones extending loans and overseeing repayment. These schedules enable moneylenders to carefully track their clients’ payment progress, ensuring that borrowers meet their financial commitments.

Student Loan Borrowers

Seeking higher education can be a financially huge cost to face, option student loans for many aspirants. Educational institutions use amortization schedules to efficiently manage monthly payments, ensuring that students can access the education they need.

Car Buyers

Purchasing a vehicle often involves taking out a vehicle loan, particularly if the full purchase price cannot be paid upfront. In such cases, amortization schedules serve as a tool to keep borrowers on track, encouraging timely repayment and reducing the overall interest burden associated with the car loan.

Credit Payers

Individuals using credit cards often carry unpaid balances, which they aim to settle over time. Certain payment plans can be solved through amortization schedules, allowing users to determine how much they should allocate in each payment cycle to maintain a healthy credit standing.

Mortgage Loan Borrowers

For homeowners living with the significant cost of buying a house or property, an amortization schedule becomes an essential partner. It allows them to formulate a structured payment plan, offering insights into the time required to fully own their homes.

Conclusion

Amortization schedules are versatile financial instruments that empower various stakeholders to better manage their financial obligations and achieve their goals, whether it’s homeownership, education, or responsible credit management. By understanding and leveraging the potential of these schedules, individuals and institutions alike can make informed financial decisions and navigate the complexities of debt repayment with confidence.

FAQs

What could be a loan amortization plan in Excel?

A loan amortization plan in Exceeding expectations may be a budgetary instrument that breaks down a loan’s reimbursement into a point-by-point arrangement. It outlines how each installment contributes to diminishing the foremost sum and covers intrigued costs over time. This plan gives clarity on the loan’s loan and helps borrowers oversee their accounts effectively.

Why make a loan amortization plan in Excel?

Making a loan amortization plan in Excel is basic for borrowers to get their loan reimbursement. It permits them to imagine how each installment influences the extraordinary adjustment, empowering educated money-related choices. This device is especially profitable for following loans, investigating diverse installment scenarios, and optimizing loan reimbursement strategies.

How frequently ought I overhaul my loan amortization schedule?

You ought to upgrade your plan at whatever point there are changes to your loan terms, extra installments, or any adjustments to the interest rate. Frequently checking on and upgrading your plan guarantees precise follow-up on your credit loan.

Share your thoughts in the comments

Please Login to comment...