Financial Statement with Adjustment with Examples – IV

Last Updated :

22 Apr, 2024

Through adjustments in the financial statement, we consider all the accounting items which are relevant to the current financial year, but not recorded in the books due to any reason or wrongly recorded. This helps us in getting the actual profit or loss for the year and the accurate financial position of the company. Five basic adjustments, like Provision for Discount on Debtors, Provision for Discount on Creditors, Loss of Insured Goods & Assets, Goods given away as Charity or Free Samples, and Goods used for Personal Purposes are discussed below.

Provision for Discount on Debtors is created to settle up the amount of discount that the business will be offering to its debtors at the time of making the payment in the future. Discount is provided to the debtors to make payments as early as possible.

Adjustment:

A. If Provision for Discount on Debtors is given outside the trial balance:

In such a case, two effects will take place:

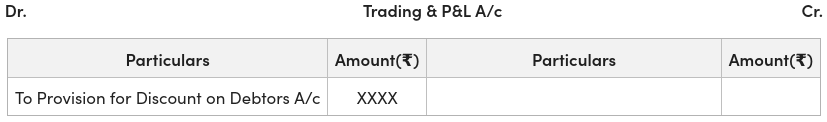

- Provision for Discount on Debtors is shown on the Dr. side of the Profit & Loss A/c.

- Amount of Provision for Discount on Debtors is deducted from the Debtors in the Assets side of the Balance Sheet.

B. If Provision for Discount on Debtors is given inside the trial balance:

If Provision for Discount on Debtors is given in the trial balance, it will be recorded only once on the Debit side of the Profit and Loss A/c.

Provision for Discount on Creditors is created on the basis of the assumption of the amount of discount the business will get from its creditors at the time of payment in the future.

Adjustment:

A. If Provision for Discount on Creditors is given outside the trial balance:

In such case, wo effects will take place:

- In the Cr. side of the Profit & Loss A/c.

- Amount of Provision for Discount on Creditors is deducted from the Creditors A/c in the Liabilities side of the Balance Sheet.

B. If Provision for Discount on Creditors is given inside the trial balance

If Provision for Discount on Creditors is given in the trial balance, it will be recorded only once on the Credit side of the Profit and Loss A/c.

Sometimes businessman faces the loss of Goods or Assets due to fire, flood, earthquake, etc. This type of loss is called abnormal loss. Mostly all the goods and assets are insured.

Adjustment

A. If Loss on Insured Goods and Assets is given outside the trial balance:

In such a case, the following effects will take place:

- In the Cr. side of Trading A/c with the total amount of loss or deducted from purchases if given.

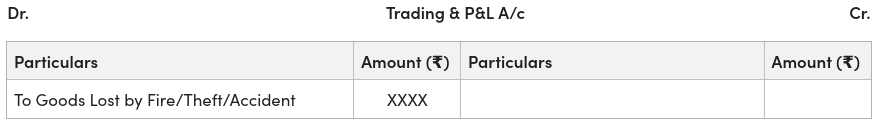

- In the Dr. side of Profit and Loss A/c with the actual amount of loss.

- Amount to be received from the Insurance company as an Asset in the Balance sheet.

B. If Loss on Insured Goods and Assets is given outside the trial balance

In such a case, it will be recorded only once on the Dr. side of Trading & P&L A/c.

Sometimes Goods are given as charity or free sample. In such a case, the following effects will take place:

Adjustment

A. If Charity/Free Sample is given outside the trial balance:

In such case, two entries will take place:

- On the Dr. side of the Profit & Loss A/c.

- Amount of Goods given as Charity/Free Sample will be deducted from Purchases A/c in the Trading A/c.

B. If Charity/Free Sample is given inside the trial balance:

If the goods are given away as charity/ free samples, then these are recorded only once in the Dr. side of the Profit & Loss A/c.

When the businessman withdraws the goods out of business for their personal use then these are treated as Drawings and is treated as an asset that is recoverable in future.

Adjustment

A. If Goods used for Personal Purpose are given outside the trial balance

In such case, two entries will take place:

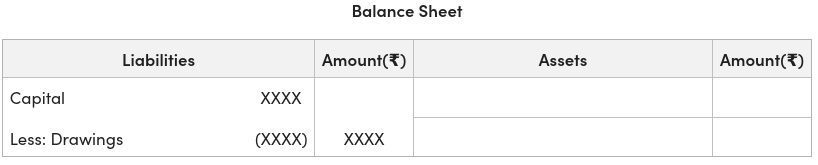

- Deducted from Purchases A/c in the Trading A/c.

- Deducted from Capital A/c in the Liabilities side of the Balance Sheet.

B. If Goods used for Personal Purpose are given inside the trial balance

In such a case, these are deducted only once from the Capital A/c in the Liabilities side of the Balance Sheet.

Illustration:

Following are some of the balances that appear in the books of Mr Haider.

The following adjustments have to be made:

1. Further bad debts amount to ₹2,500, Provision for Bad debts to be made at 5%, Provision for Discount to debtors @2%.

2. Goods are given away as charity amounting to ₹10,000.

3. Goods drawn for personal use ₹5,000.

4. Goods amounting to ₹15,000 were destroyed by fire and the insurance company admitted the claim for only ₹10,000.

5. Closing Stock amounts to ₹10,000

Solution:

Share your thoughts in the comments

Please Login to comment...