A journal is a book of original entries in which transactions are recorded, as and when they occur. The journal provides data-wise records of all the transactions and the amount of each transaction. Everyday transactions are recorded in a journal chronologically, giving a complete picture of the transaction in one entry. A journal recording is based on a double-entry system so the total of the debit column is equal to the credit column.

Rules of Journalizing

The three golden rules of journalizing are based on the nature of the account, i.e., Personal Account, Real Account, or Nominal Account.

Rule 1. Personal Account

‘Debit the receiver and Credit the giver’.

Rule 2. Real Account

‘Debit what comes in and Credit what goes out’.

Rule 3. Nominal Account

‘Debit all the expenses and losses and Credit all the incomes and gains.

Journal Entry Questions and Solutions

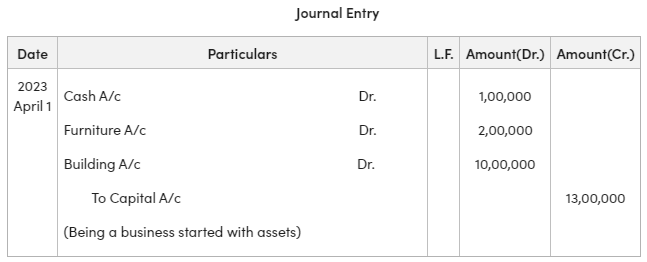

Example 1

Pass the necessary journal entries related to the ‘Opening Entry’.

(a) On 1st April 2023, Ram started a business with cash ₹5,00,000.

(b) On 1st April 2023, Vinod started business with cash ₹1,00,000, furniture ₹2,00,000, and Building ₹10,00,000.

(c) On 1st April 2023, Mohan’s Books of Account shows Cash ₹16,000, Stock ₹54,000, Debtors ₹47,000, Furniture ₹42,000, Creditors ₹37,000, and Capital ₹1,22,000.

(d) On 1st April 2023, Amit’s Books of Account shows Cash ₹4,000, Bank ₹10,000, Stock ₹27,000, Debtors ₹23,500, Land and building ₹30,000, Creditors ₹10,000, and Capital ₹1,00,000.

(e) On 1st April 2023, Vikas’s Books of Account show, Cash ₹30,000, Bank ₹10,000, Stock ₹80,000, Debtors ₹48,000, Furniture ₹7,200, Creditors ₹25,000, and Bank Loan ₹20,000.

Example 2

Pass the necessary journal entries in the books of Reshi Raj,

(a) On 1 April 2023, Cash Purchases ₹20,000.

(b) On 9 April 2023, Sold goods to Rama at the list price of ₹60,000 at a trade discount of 10%.

(c) On 11 April 2023, Vinod sold goods to us worth ₹30,000 at a 10% trade discount.

(d) On 18 April 2023, Returned goods to Vinod at the list price of ₹2,000.

(e) On 22 April 2023, Paid cash to Vinod ₹24,000 in full settlement.

(f) On 25 April 2023, Rama returned goods of list price ₹10,000.

(g) On 28 April 2023, Rama paid ₹43,000 in full settlement of his account.

Solution:

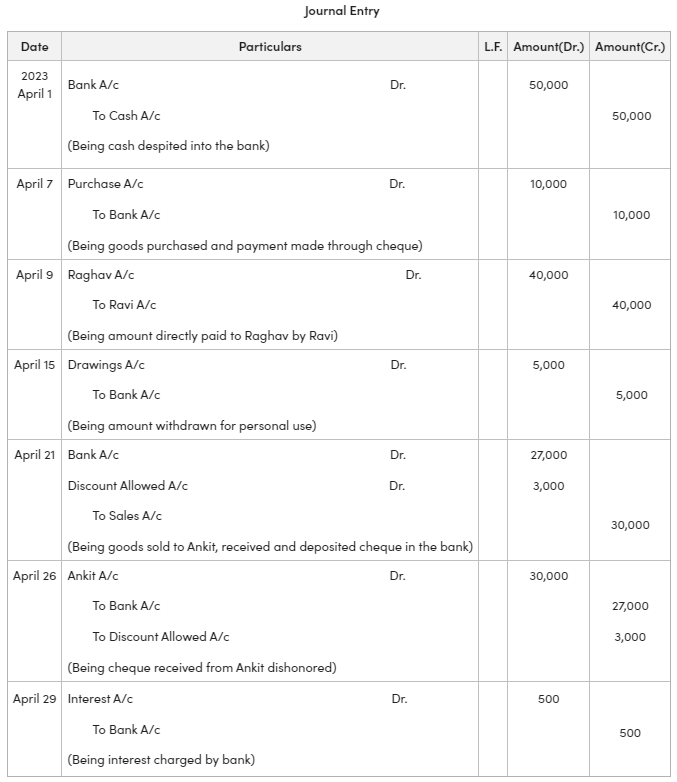

Example 3

Pass the necessary journal entries in the book of Raghav from the following transactions:

(a) On 1 April 2023, Opened a Bank Account by depositing ₹50,000.

(b) On 7 April 2023, Goods were brought for ₹10,000, and payment was made by cheque.

(c) On 9 April 2023, Ravi (the debtor) directly deposited an amount of ₹40,000 in Raghav’s account.

(d) On 15 April 2023, cash withdrawn ₹5,000 for personal use.

(e) On 21 April 2023, Sold goods to Ankit for ₹30,000 at a cash discount of 10% and received a cheque for the full amount deposited into the bank the same day.

(f) On 26 April 2023, The cheque received from Ankit was dishonored.

(g) On 29 April 2023, the Bank charged interest for ₹500.

Solution:

Example 4

Pass the necessary journal entries related to the following transactions in the book of R.K. Pvt Ltd.

(a) On 1 April 2023, Purchased goods for cash ₹40,000 and paid ₹2,000 for their carriage.

(b) On 11 April 2023, Amar who owned ₹20,000 declared insolvent.

(c) On 16 April 2023, Machinery bought for ₹5,00,000 and paid ₹25,000 for its installation.

(d) On 19 April 2023, Further paid ₹5,000 on the carriage of the machine bought.

(e) On 24 April 2023, Purchased bricks and timber for ₹10,00,000 for construction of the building and made payment through cheque.

(f) On 29 April 2023, Amar who was earlier declared insolvent paid 30 paise in Rupee.

Solution:

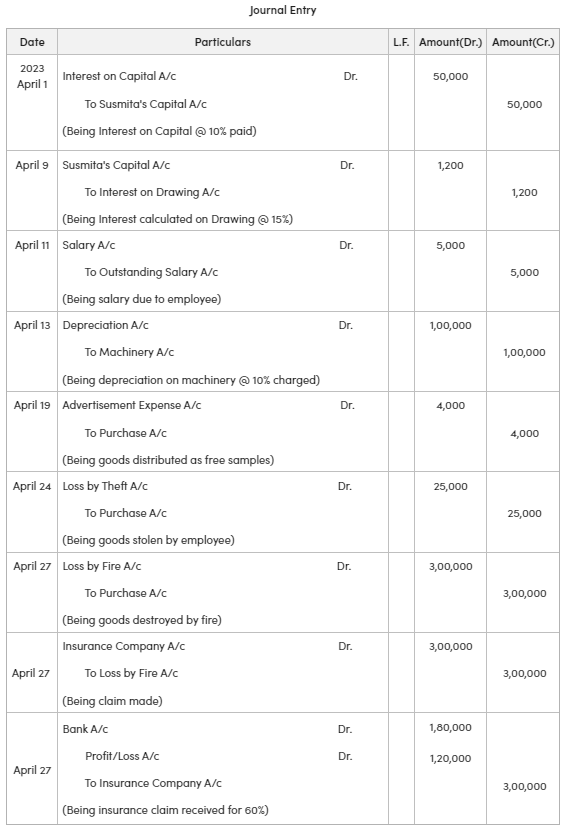

Example 5

Pass Journal Entries in book Susmita Ltd.:

(a) On 1 April 2023, Susmita got 10% interest on the capital of ₹5,00,000.

(b) On 9 April 2023, Susmita paid 15% interest on drawings of ₹8,000.

(c) On 11 April 2023, the Salary of an employee is due for ₹5,000.

(d) On 13 April 2023, Provide 10% depreciation on machinery costing ₹10,00,000.

(e) On 19 April 2023, Goods for ₹4,000 were distributed as free samples.

(f) On 24 April 2023, Goods worth ₹25,000 were stolen by an employee.

(g) On 27 April 2023, Goods worth ₹3,00,000 were destroyed by fire, and the insurance company paid a claim for 60% amount.

Solution:

Share your thoughts in the comments

Please Login to comment...