Carriage Inwards : Meaning, Accounting, Examples, Impact & FAQs

Last Updated :

20 Feb, 2024

What is Carriage Inwards?

Carriage inwards, prominently known as freight or transportation inwards, are the costs incurred in shifting products from the supplier’s spot of business to the client’s location. Carriage inward shall be considered a direct expenditure on the income statement and will be credited to the buyer’s trading account’s debit side. It will be a part of the total cost of goods purchased, which also involves the cost of available commodities, the cost of inventory, and the cost of goods sold. In a nutshell, carriage inward is the cost of moving products from the supplier to the customer. Furthermore, the purchasing business is responsible for these shipping and handling fees. To determine the total price of acquired products, involving their inclusion in the cost of inventory, the cost of available goods, and the cost of goods sold, it is mandatory to consider them as direct expenses.

Geeky Takeaways:

- Carriage costs are the costs incurred to shift products from the supplier to the customer.

- Carriage inward is recognized as a direct expenditure on the income statement. It is credited to the buyer’s trading account’s debit side.

- The purchasing business will be responsible for shipping and handling fees.

- Carriage inward must be considered a direct expense to determine the total price of acquired products and inclusion in inventory, available goods, and cost of goods sold.

Journal Entry of Carriage Inwards

Journal entry for transportation inward is dependent upon the object and purpose of use. The phrase “inwards” indicates that the cost is incurred during the process of bringing the items into the firm, regardless of whether the product is meant for resale.

1. Journal Entry while Purchasing Inventory: The intention is to employ the goods for operations; hence, in this instance, transportation inwards is considered a direct operating expenditure. On the trading account’s debit side, the amount is listed. So, the journal entry for carriage inwards at the time of purchasing inventory can be written as,

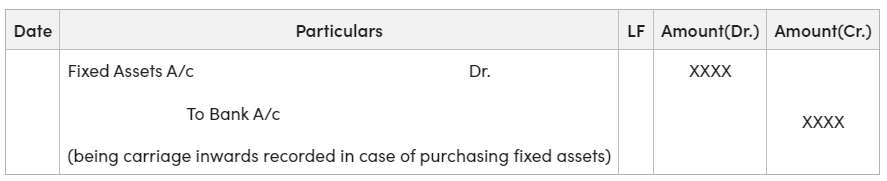

2. Journal Entry while Purchasing a Fixed Asset: When carriage is incurred during the purchase of fixed assets for an individual’s use, it gets counted as a capital expenditure. Carriage inward is not journalized individually in this instance; instead, it shall be included in the asset’s cost. The sum paid for carriage inwards will be included in the amount deducted and credited. So, the journal entry while purchasing fixed assets can be written as,

Examples of Carriage Inwards

Example 1:

What might the journal entry for the ₹15,000 that was paid in cash for freight costs toward the ₹2,00,000 worth of products that were purchased be?

Solution:

Example 2:

Record a journal entry of paying freight costs worth ₹150 while purchasing a fixed asset amounting to ₹20,000.

Solution:

Accounting Impact of Carriage Inwards and Carriage Outwards

1. Carriage Inwards: A pivotal part of the buyer’s financial transactions is carriage inwards, which includes costs related to receiving the products. These expenses are a significant component of the entire cost structure of the things that were acquired; they are not just incidental expenditures. This factor will affect the cost of inventory, the cost of products sold, and the cost of goods available, among the other elements of accounting. To keep precise financial records, these costs must be crucially documented. Debiting the carriage inwards account is the standard journal entry for carriage inwards. This indicates that these transportation expenses are recognized as a direct cost. The bank account is credited simultaneously, signifying the outflow of funds related to these transportation costs. This methodical technique guarantees financial reporting transparency and helps produce a more accurate depiction of the true expenses associated with purchasing items.

2. Carriage Outwards: Conversely, transportation outwardly addresses the expenses a firm will bear while shipping its products to clients. These expenses, which also include handling and shipping fees, will be significant components of the total expenditures a company incurs while conducting sales activities. Transportation outward is considered an indirect expense, as opposed to transportation inward, which is included in the cost of products sold. As a result, it is included in a more thorough evaluation of the business’s operating expenses and is documented on the negative side of the profit and loss account.

Profitability Impact of Carriage Inwards and Carriage Outwards

1. Carriage Inwards: The detailed accounting for transportation inwards in the cost of goods sold is pivotal to figuring out the buyer’s gross profitability. The profit a business gets after subtracting the direct expenses of manufacturing or acquiring the products it sells is known as gross profitability. A firm may make sure that its profit margins appropriately represent the whole cost of acquiring items by accounting for transportation. Financial statements and profit margins may become biased as a result of ignoring these transportation expenses. Financial planning and strategic decision-making may be adversely affected by inaccurate depictions of gross profitability. Therefore, for firms looking to gain genuine and full knowledge of their financial performance, proper accounting for carriage inwards is not just a question of financial compliance but also a strategic need.

2. Carriage Outwards: Carriage outwards has a maximum effect on the seller’s net profitability, which is the total profit after deducting all costs, notably direct and indirect costs. A firm can learn more about the financial effects of its sales operations by accounting for carriage outward. When evaluating the seller’s actual profitability, handling and shipping expenses related to outbound transportation play a pivotal role. Making wise judgments on pricing tactics, operational effectiveness, and general financial health requires this comprehensive understanding.

Difference Between Carriage Inwards and Carriage Outwards

|

Basis

|

Carriage Inwards

|

Carriage Outwards

|

|

Definition

|

Refers to freight and transportation costs incurred when receiving goods from the supplier to the buyer’s warehouse |

Refers to freight and transportation costs incurred when delivering goods from the seller’s warehouse to the customer |

|

Responsibility

|

The buyer is primarily responsible for the payment |

The seller or supplier is primarily responsible for payment |

|

Treatment

|

Treated as a direct expense |

Treated as an indirect expense |

|

Capitalization

|

May or may not be capitalized, depending on the asset bought |

Not capitalized |

|

Reflection in a Statement

|

Entries posted in the trading account |

Entries posted in the income statement or profit and loss account |

|

Debit/Credit Side

|

Entries on the debit side of the trading account |

Entries on the credit side of the income statement or profit and loss account |

|

Journal Entry

|

Varied based on the element and purpose of use |

Varied based on the element and purpose of use |

|

Also Known as

|

Transportation-Inwards, Transportation-In, Freight-In, Freight-Inwards |

Transportation-Outwards, Freight-Outwards |

Frequently Asked Questions (FAQs)

1. What is the process of carriage inward?

Answer:

The recording of carriage inward includes debiting the carriage inward account in the trading accounts of the buyer. Conversely, carriage outwards shall be recorded in the seller’s books of accounts. In the trading account, carriage inward will be debited, while carriage outward will be credited to the profit and loss account.

2. Give an example of a carriage inward

Answer:

An example of carriage inward occurs when products are sold FOB (free on board). Here, the vendor will be responsible for transportation costs until the product’s shipment, while the purchaser bears additional costs (carriage inward) associated with receiving the products at their location.

3. What does carriage inward entry in the trial balance mean?

Answer:

Carriage inward, representing transportation costs related to merchandise or asset purchases, is treated as an expense and, therefore, has a debit balance in the trial balance.

4. What does return outwards mean?

Answer:

Return outwards involves sending goods back to the supplier or another third party, previously received from the buyer. It is also called as purchase returns in accounting and the same principle applies as with return inwards when documenting outward transactions.

5. What is the journal entry for carriage inward and carriage outward?

Answer:

Carriage inwards is accounted for in the trading account, debiting the carriage account. When the buyer sells goods, incurring further delivery charges known as ‘carriage outwards,’ these costs will be debited to the carriage outwards account in the general ledger.

Share your thoughts in the comments

Please Login to comment...