Journal Entry for Carriage Inwards

Last Updated :

28 Jan, 2024

Carriage inwards refers to the transportation costs incurred by a business to bring goods or materials into its premises. It is considered as part of the cost of inventory and is typically recorded as an expense. Carriage inwards journal entry is recorded either at the time of purchase of goods or assets.

Carriage Inwards Journal Entry

Journal Entry:

1. At the time of Purchase of Goods:

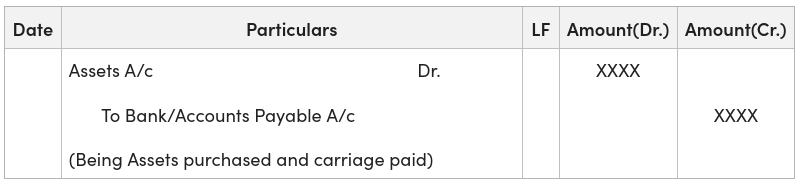

2. At the time of Purchase of Assets:

Note: At the time of Purchase of Asset, Carriage Inwards is added to the cost of the asset and no separate journal entry is made.

Example 1:

Goods purchased for ₹90,000 and carriage paid ₹10,000. Record the necessary journal entry.

Solution:

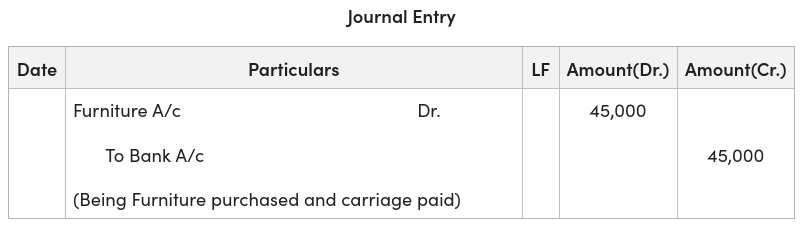

Example 2:

Furniture purchased for ₹40,000 and carriage paid ₹5,000. Record the necessary journal entry.

Solution:

Share your thoughts in the comments

Please Login to comment...