What is Branch Accounting?

Branch Accounting is defined as a bookkeeping system of accounting that allows a business with multiple locations or branches to keep track of financial transactions at each branch individually, while also consolidating them at the main or head office. This helps in monitoring the performance and financial position of each branch separately. These branches are divided by geographical location, and each department has its profit and cost centers. In this accounting system, separate Trial Balance, Profit and Loss Statements, and Balance Sheets are prepared by each branch. Branches operate independently in terms of day-to-day transactions but still are part of the larger organizational structure, so the financial results of each branch are consolidated at the head office to prepare overall financial statements for the entire organisation.

Geeky Takeaways:

- Branch Accounting is a system of recording the financial transactions and reporting of a branch or a division of a business located in a different location from the main or head office.

- Branch Accounting is suitable for a multi-location business i.e., the head office and its branches may be in different cities, regions, or even countries.

- Each branch maintains its own set of accounting books that are consolidated at the head office to prepare the overall financial statements of the whole business as one.

Types of Branches

1. Dependent Branch: This type of branch has limited authority and depends heavily on the head office for decisions regarding pricing, purchasing, and sales. Transactions are recorded directly in the books of the head office.

2. Independent Branch: An independent branch has more autonomy and maintains its own set of books. It has the authority to make significant decisions without constant approval from the head office.

Types of Accounts

In Branch Accounting, like other businesses, coordination of all the accounts like Journal, Ledger, Financial, and Position Statements are prepared. Some of the basic accounts under the branch account have been discussed below,

1. Branch Stock/Inventory Account: This account records the value of stock held at the branch. It is important for assessing the profitability and financial health of the branch.

2. Branch Debtors Account: The branch debtors account maintains records of amounts receivable from debtors at the branch including sales on credit and also tracks payments received from debtors.

3. Branch Expenses Account: All expenses incurred at the branch are recorded in this accounting including rent, utilities, salaries, and other direct – indirect costs.

4. Branch Revenue Account: This account records the revenue generated by the branch, including sales revenue and any other income generated at the branch level.

5. Branch Profit and Loss Account: The branch profit and loss account shows the profit or loss generated by the branch, by summarising all the revenue and expenses of a specific period.

6. Branch Capital Account: The branch capital account reflects the capital investment in the branch by the head office. It may include the initial capital and any additional investments or withdrawals.

Advantages of Branch Accounting

1. Performance Evaluation: Branch accounting allows for the assessment of the individual performance of each branch. This helps in identifying profitable and underperforming branches.

2. Localized Decision-Making: Independent branches have the autonomy to decide pricing, purchasing, and sales based on local market conditions. This can lead to more effective strategies tailored to specific regions.

3. Market Expansion: It facilitates the expansion of business into different geographical areas. This can help in reaching a wider customer base and tapping into new markets. Multiple locations can give a business a competitive edge over rivals that operate in a single location.

4. Customer-Centric Approach: Branches can adapt their operations to better serve local customer preferences and demands. This enhances customer satisfaction and loyalty.

5. Reduced Transportation Costs: By having branches in different locations, businesses can reduce transportation costs for both raw materials and finished products, as goods can be sourced and distributed locally.

6. Improved Customer Service: Having a physical presence in different areas allows for better customer service, as customers can visit branches for inquiries, support, and purchases. Branches serve as valuable sources of market feedback. They can provide insights into local market trends, customer behavior, and preferences.

Disadvantages of Branch Accounting

1. Complexity and Administrative Burden: Managing separate sets of accounts for each branch can be complex and time-consuming. This includes maintaining records, preparing financial statements, and ensuring compliance with accounting standards at each branch.

2. Costs: Setting up and maintaining separate accounting systems for each branch can be expensive. This includes the costs of software, personnel, training, and infrastructure.

3. Potential for Errors and Inconsistencies: With multiple locations and sets of records, there is an increased likelihood of errors or discrepancies in recording transactions. These errors can lead to inaccuracies in financial reporting.

4. Inter-Branch Transactions: Handling transactions between branches can be tricky. It requires careful accounting to ensure that these transactions are appropriately recorded and eliminated during consolidation.

5. Coordination and Communication: Effective communication and coordination between the head office and branches are crucial. Without it, there may be delays or misunderstandings in reporting, which can impact decision-making.

6. Risk of Fraud and Mismanagement: With multiple locations, there is a greater risk of fraud or mismanagement at individual branches. This could include issues like embezzlement, theft, or improper handling of funds. Moreover, in independent branches, the head office may have limited control over day-to-day operations.

Examples of Branch Accounting

Example 1:

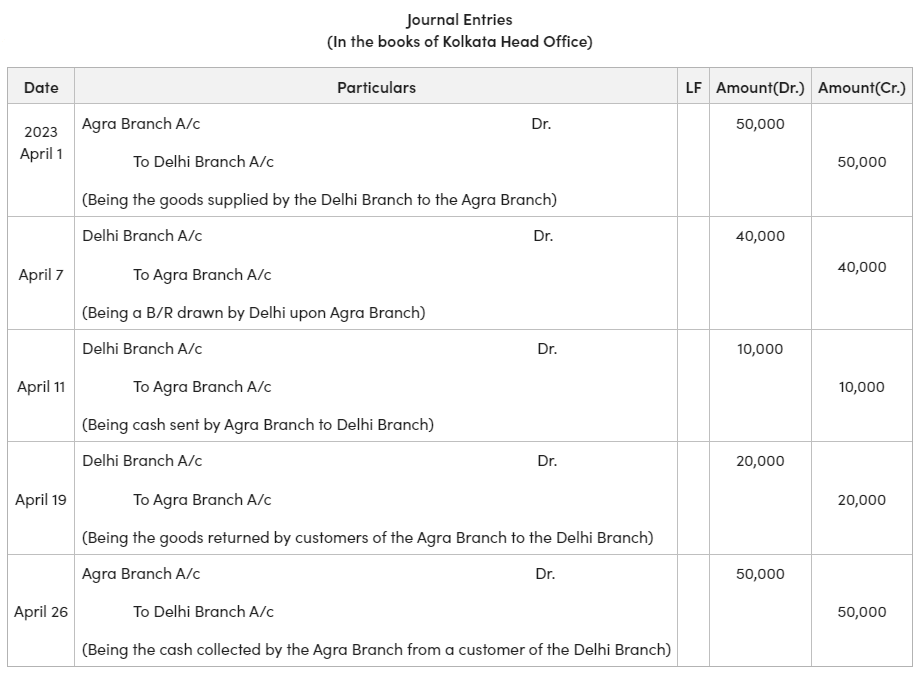

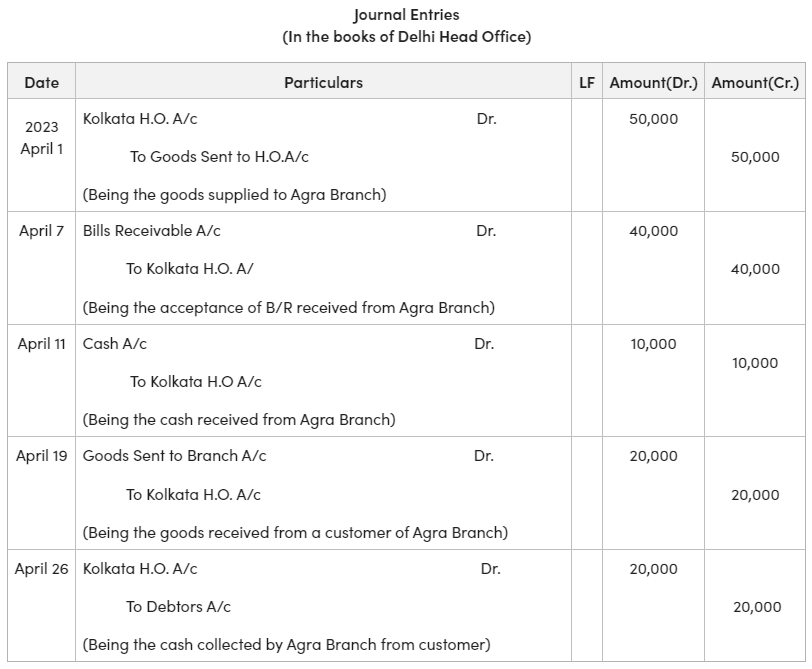

Journalise the following transactions in the books of the Kolkata Head Office, Delhi Branch, and Agra Branch:

(a) On April 1, 2023, Goods worth ₹50,000 are supplied by the Delhi Branch to the Agra Branch under the instructions of the Head Office.

(b) On April 7, 2023, The Delhi Branch draws a bill receivable for ₹40,000 on the Agra Branch which sends its acceptance.

(c) On April 11, 2023, The Delhi Branch received ₹10,000 from the Agra Branch.

(d) On April 19, 2023, Goods worth ₹20,000 were returned by a customer of the Agra Branch to the Delhi Branch.

(e) On April 26, 2023, The Agra Branch collected ₹20,000 from a customer of the Delhi Branch.

Solution:

Example 2:

DK Traders of Assam has a branch in Mumbai. The branch receives all supply of goods from the head office (Assam). From the following particulars relating to the Mumbai Branch for the year ending March 31, 2022. Prepare a Branch Accounts in the books of the Head office.

Solution:

Example 3:

Prepare a Branch account in the books of Head Office from the following particulars for the year ended 31st March 2023 assuming that H.O. sold goods at a cost price of 25%.

Solution:

Difference between Branch Accounting and Departmental Accounting

| Basis of Organisation |

- Branch Accounting is based on geographical locations or separate business units that operate as semi-independent entities.

- Each branch has its own set of books and accounts.

- Suitable for businesses with physically distinct locations, such as retail stores or sales offices.

|

- Departmental Accounting is based on functions or departments within a single business location or entity.

- Different departments within the same organization have their own accounts.

- Suitable for businesses with different functional areas like production, marketing, finance, etc., all operating within a single location.

|

| Degree of Autonomy |

- Branches often have a higher degree of autonomy and may make certain operational decisions independently.

- Each branch maintains its own financial records, and the head office consolidates them periodically.

|

- Departments operate under the direct control and authority of the main or head office.

- Decisions and policies are typically centralized, and departments do not have significant decision-making power.

|

| Level of Integration |

- Branches are often more integrated with the local market and adapt to specific customer needs in their respective locations.

- May have varying pricing strategies, product offerings, and marketing campaigns.

|

- Departments are typically integrated with the overall business strategy and may work together to achieve common organizational goals.

- There is often a higher level of co-ordination and sharing of resources among departments.

|

| Accounting Treatment |

- Each branch maintains its own set of books, including cash book, sales book, and ledger accounts.

- Inter-branch transactions are recorded separately and eliminated during consolidation.

|

- Departments maintain their own accounts for expenses, revenues, and assets, but they are all part of the larger entity’s financial statements.

|

| Scope of Operations |

Typically involves branches that are located in different physical locations, often in different cities or regions. |

Involves various functional departments operating within the same business location or entity. |

| Cost Allocation |

Costs and expenses incurred at each branch are recorded separately, allowing for a detailed assessment of branch profitability. |

Costs are allocated to specific departments, helping in evaluating the performance and efficiency of each department. |

| Examples |

- A retail chain with stores in different cities or countries.

- A bank with branches in different regions.

|

- A manufacturing company with departments for production, marketing, finance, and human resources.

- A large hospital with departments for different specialties (e.g., cardiology, pediatrics, surgery).

|

Share your thoughts in the comments

Please Login to comment...