Are you feeling the pinch of the pandemic, with jobs disappearing and savings taking a hit? Well, fret not! It’s time to explore some digital money-making opportunities and grow that wealth of yours. And guess what? Investing can be your superhero in this financial adventure! Check out our handpicked list of the 19 best investment apps that will supercharge your financial game. Each app offers something unique, so let’s dive into the reviews and find the perfect one for you!

19 Best Investment Apps

Introducing the 19 best investment apps. In today’s digital age, managing and growing your wealth has never been easier. With a abundance of investment apps at your disposal, you can take charge of your financial future right from the palm of your hand.

These 19 best investment apps offer an array of features, from user-friendly interfaces and real-time market updates to diverse investment options and intelligent portfolio management.

1. Fidelity

Looking to dive into the world of investing but feeling overwhelmed? Fidelity has got you covered! As a top-notch financial solution and one of the best investment apps for investors, Fidelity offers simple investing options, handy financial planning tools, up-to-the-minute trade market news, and so much more.

Top Features:

- Self-Directed & Professionally Managed Accounts

- Plan your financial future with ease using Fidelity’s intuitive planning tools.

- Fidelity’s experts will help you make the right investment choices.

- Digital Estate Planning

Pros:

- You don’t need a truckload of money to start investing with Fidelity.

- Trade without worrying about hefty commission fees eating into your profits.

- Stay ahead of the game with the latest insights from seasoned professionals.

Cons:

- Fidelity is exclusively for the U.S. citizens

- While it’s great to have some expert advice, keep in mind that this service comes with a cost.

2. Robinhood

Ever heard of Robinhood? No, not the guy in tights stealing from the rich! We’re talking about the investing app that’s revolutionizing the game in the West for over 6 million Americans!

Top features:

- With as little as $1, you can kickstart your investing journey.

- Ready to dip your toes into the crypto world? Robinhood lets you do just that!

- Access research reports on a whopping 1700 stocks – now that’s information at your fingertips!

- Robinhood lets you handle your paycheck, rent, and more – all in one app!

Pros:

- Trade without those pesky commission fees taking a bite out of your profits.

- No need to pinch pennies to maintain an account balance.

Cons:

- No 401(k)s available here.

- Mutual funds, too, aren’t on the menu at Robinhood.

3. Invstr

If you’re new to investing or have limited funds, Invstr is the ideal investment app for you! With a user-friendly interface and commission-free investing, it’s a great choice to get started on your investment journey. The app comes with a built-in advisor that provides guidance to help you build a strong portfolio.

Minimum balance required: $0

Top Features:

- Commission-free investing and banking services

- Invest in US stocks, ETFs, and fractional shares

- Trade cryptocurrencies to diversify your investments

- Portfolio builder to enhance your investment performance

Pros:

- No minimum balance is required to get started

- No annoying monthly fees eating into your profits

- Trade cryptocurrencies hassle-free

- Optimize your investments with the portfolio builder

Cons:

- Currently available only for iOS devices

4. Betterment

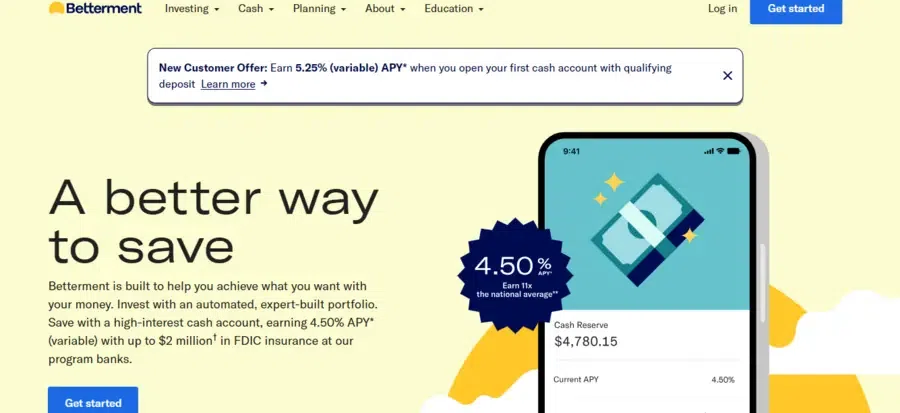

If you want a hassle-free investment experience with the best investment apps, look no further than Betterment! As one of the largest and most popular robo-advisors, Betterment manages your portfolio professionally, tailored to your risk tolerance and financial goals. Plus, it offers socially responsible portfolios focused on climate change and social impact.

Minimum balance required: $10

Top Features:

- Get a robust cash management account for free

- Let the pros handle your investments after you set up your account

- Set specific financial goals without any minimum account balance requirements

Pros:

- No minimum balance is needed for digital services

- Enjoy professionally managed portfolios at a low cost

Cons:

- A management fee of 0.25 – 0.40 percent of assets annually applies.

5. Acorns

Acorns stand out as one of the most popular savings apps, and it’s easy to see why! This user-friendly app takes the effort out of saving and investing. Once you’ve set it up, you can sit back and relax while Acorns takes care of your investments.

Minimum balance required: $5

Top Features:

- Link your debit or credit card, and Acorns will round up your purchases to the nearest dollar and invest the spare change in ETF portfolios.

- For just $5 per month, you can upgrade to Acorns Family, which includes investment accounts for your children.

- Tailors your portfolio based on your targeted retirement time horizon.

Pros :

- No minimum balance is required to start investing

- Enjoy automated investments to grow your savings effortlessly

Cons:

- Depending on the service tier, a modest monthly charge of $3 or $5 applies.

6. Charles Schwab

Charles Schwab is the best investment app for both seasoned investors and newcomers. One of the reasons it stands out is its wealth of research and educational materials, making it an ideal choice for those new to investing and personal finance.

Minimum balance required: $0

Top Features:

- Fractional Shares: Invest all your money directly into stocks, eliminating idle investment funds.

- Trade stocks and ETFs without worrying about hefty commissions.

- Begin with just a $25,000 deposit and receive a cash bonus.

Pros:

- You don’t need a large sum to start investing.

- Say goodbye to pesky fees eating into your returns.

- Get the support you need when you need it.

Cons:

- Schwab Intelligent Portfolios require a $5,000 minimum investment.

- $100 Minimum for No-Load Funds, while some competitors offer lower minimums.

7. J.P. Morgan Self-Directed Investing

For those seeking a straightforward brokerage account that offers learning tools, portfolio building, and protection from high-risk investments, J.P. Morgan Self-Directed Investing is an affordable and comprehensive choice as the best investment apps.

Minimum balance required: $0

Top Features:

- Benefit from J.P. Morgan research, Morningstar ratings, and CFRA reports, among others.

- Self-Directed Investing Portfolio Builder to build your own portfolio with ease.

Pros:

- No complex interfaces to navigate.

- Trade without worrying about commissions as they are $0 at J.P. Morgan Self-Directed Investing

- Connect your Chase accounts for a holistic view of your finances.

- Start investing without any specific amount in mind.

Cons:

- Research and tools are less extensive than some competitors.

- Portfolio Builder requires a $2,500 minimum balance.

- Limited investment options. No Cryptocurrencies, Futures, Forex, or Fractional Shares

8. M1 Finance

M1 Finance is a feature-packed money management app offering self-directed trading, automated investing, fractional shares, cryptocurrencies, and more. It’s perfect for investors looking to balance multiple financial needs.

Minimum balance required: $100

Top Features:

- DIY and Automated Trading

- Commission-Free Stocks, ETFs, and Cryptocurrencies

- User-friendly interfaces for easy navigation.

Pros:

- Low Minimum Deposit: Start investing with an amount that suits you.

- Choose from over 80 expert-designed portfolios.

- Fractional Shares and Individual Stock/ETF Orders.

- No extra fee for standard accounts.

Cons:

- Limited Investment Options. Stocks, ETFs, and cryptocurrencies are the main choices.

- 24/7 Crypto Trading for M1 Plus Members Only. Basic members have limited access.

- Trades are subject to a specific window.

- No Human Advisor Support.

9. Ellevest

While it started to close the gender gap in investing, it welcomes everyone, including non-binary and gender non-conforming individuals. The platform is perfect for hands-off investors seeking personalized plans for individual investment and retirement accounts. With Ellevest, you get automated IRA and 401(k)/403(b) rollovers and even one-on-one sessions with financial planners.

Minimum balance required: $0

Top features:

- Automated IRA accounts and 401(k)/403(b) rollovers available

- Private wealth management for those with at least $1 million to invest

- Customized recommendations based on gender-specific salary curves and longevity data

Pros:

- Personalized, automated investment advice with no minimum requirement

- Monthly plans offer discounted access to certified financial planners

Cons:

- No active trading opportunities; investments mainly in stock ETFs and bond ETFs

- Only individual investment and retirement accounts are available; no joint or custodial accounts.

- No tax-loss harvesting

10. Webull

Webull is an excellent choice for trading commission-free stocks, options, ETFs, and cryptocurrencies with no minimum deposit. Plus, you can access IPO and fractional shares.

Minimum balance required: $0

Top features:

- Customizable desktop version for bigger screen trading

- Extended trading hours before and after the market closes

Pros:

- $0 minimum deposit to open an account

- Commission-free trading and access to tax-advantaged IRAs

- Free stock welcome bonus

- Plenty of investment options for active traders

Cons:

- Additional fees may apply

- Users must rely on their own knowledge for portfolio building

- Limited educational tools

11. Wealthfront

If you’re new to investing, Wealthfront might be perfect for you. The app offers straightforward portfolio management at a fee of 0.25% per year. It tailors and adjusts your portfolio based on your risk tolerance and financial goals.

Minimum balance required: $500

Top features:

- Diverse investment options, including stocks, bonds, and ETFs

- Useful financial planning tools like retirement and college savings planners

- Automated transfers from external checking or Wealthfront Cash Account to your investment account

Pros:

- Low management fees

- 529 college savings plan available

- Taxable accounts come with tax-loss harvesting

Cons:

- No access to actual cryptocurrencies

- $500 account minimum

- No fractional shares

12. SoFi Invest

SoFi Invest stands out with its automated and active investing options, along with access to unique opportunities like IPO investing and cryptocurrencies. You can start fractional investing with just $5 and benefit from free financial counseling and other perks which makes it the best investment apps in the lot.

Minimum balance required: $0

Top features:

- Retirement accounts and taxable brokerage accounts are available

- Easy fractional investing with as little as $5

- Access to SoFi’s bank account and lending products

Pros:

- User-friendly app

- Strong customer service and free financial and career coaching

- Unique products like IPO investing and cryptocurrencies

Cons:

- No mutual funds or bonds are available

- Limited features and tools on the trading platform

- Fee for outgoing transfers to another brokerage

13. Stash

Are you looking for a simple and effective way to invest for your future? Meet Stash! With Stash, you can effortlessly set up automated recurring investments, including dividend reinvestment, ensuring your wealth grows steadily over time. Plus, getting started is a breeze – you can begin investing with as little as $5! Now it does look the best investment apps of all time. Isn’t it?

Minimum balance required: $0

Top Features:

- Monthly plans that offer financial advice, banking products, and life insurance

- The higher plan includes custodial accounts for minor children and Stock-BackⓇ rewards for the debit product.

Pros:

- Score a fantastic $203 sign-up bonus!

- Enjoy automatic investing and dividend reinvestment.

- Access to retirement accounts and custodial accounts

Cons:

- A monthly subscription fee ranging from The public.

- No interest on its banking product

- Personalized advice isn’t from a human

14. Public

Looking for a commission-free and also best investment apps that also lets you connect with other traders and financial advisors? The Public is the answer! You can trade stocks, ETFs, and even crypto, all while engaging with a vibrant community.

Minimum balance required: $4.31

Top Features:

- Buy fractional shares with as little as $1

- No need to link a bank account; simply use a debit card to fund your account

Pros:

- No commission on stocks and ETFs trades

- Access to trading over 25 cryptos

- Connect and share insights with fellow traders

Cons:

- Limited tradable assets (no mutual funds, options, or bonds)

- A relatively new app launched in 2019

15. TD Ameritrade

For all types of investors, TD Ameritrade offers two user-friendly apps – TD Ameritrade Mobile and thinkorswim – along with a plethora of educational resources. From demos and courses to webcasts and videos, you’ll have all the tools you need to make informed investment decisions.

Minimum balance required: $0

Top Features:

- Advanced tools for placing orders, creating watchlists, and tracking preferred stocks

- Customizable charts for in-depth stock performance analysis

Pros:

- Wide variety of tradable assets, including forex, mutual funds, and futures

- Extensive educational tools and resources to boost your investment knowledge

- Enjoy 24/7 customer support for any assistance you need

Cons:

- $0.65 fee per options contract

- No fractional shares

16. Fundrise

Fundrise is Americas’s largest stockmarket place for investments founded in 2012 and hailed as the one of the best investment apps. It has deployed over $1 billion captial annually in 2021 and 2022. This is trading high growth private technology company. The software allows to acheive the scale of institutions without bureaucracy.

The headquarters are in Washington, DC, and one of the leading real estate investment plaform. Its internal software allows to manage hundreds of thousands of individual investor accounts, including handling tax reporting, fund administration, transaction management, all at a fraction of the cost.

Minimum Balance Required: $10

Top Features:

- It is fully integrated technology platform.

- Always deliver improved performance management.

- An operating system provides servicing and management for investors.

- Has modern data infrastructure tool to unlock real-time information and automate reporting.

Pros:

- The platform is open to all investors.

- It is easy to use.

- Allows very low investment.

Cons:

- Fees can be difficult to understand.

- They are highly illiquid.

17. WealthBase

Wealthbase is a simlated online investing game and one of the best investment apps if you want to start your trading journey. This platform allow users to learn, play and compete with others. The app can be accessible through web, iOS, and Android. It does not charge a participant in trading game. Players can trade the stocks, ETFs, and cryptos. Players can get $100,000 in virtual cash and track their performance to win the prizes with friends.

Minimum Balance Required: $2.00

Top Features:

- It provides good performance among stocks, ,mutual funds and more.

- This platform helps users to plan their financial goals.

- Ensures safety for users among financial transactions and personal information.

Pros:

- It solves a lot of problems for investors.

- ETFs provide lower capital-gains taxes than mutual funds.

Cons:

- Exchange trade funds(ETFs) are generally cheaper than mutual funds, but not always.

- This is limited for personal finance tools.

18. Interactive Brokers

Interactive Brokers is a trading platform for every investor from beginner to advanced on mobile, web and desktop. Discovered investment oppurtunities with over 200 free and premium research and new providers in this best investment apps. It is a free access trading tool including client portal, IBKR mobile and trade workstation(TWS). A global brand providing a solution for Indian residents to invest in global as well as Indian markets.

Minimum Balance Required: $0

Top Features:

- Provides financial instruments like stocks, options, future, forex, bonds, and mutual funds.

- Helps users to research reports, news, tools, and make decisions for investments.

- Allows clients to access international markets and exchanges in 33 countries to trade over 135 markets.

Pros:

- It provides a great services at low fees.

- Offers trading platforms with functionality and advanced research.

Cons:

- New users face challeging issues while investing.

- Minimum deposit is required to open an account.

19. Tastytrade

Tastytrade is a online trading platform and one of the best investment apps for learning to be smart, creative and resilent with finance. This is named as best online stock broker in 2021. The office headquarters lives in the growing center for tech in the West Loop, Chicago. The team helps through email and occasional phone communication with new and existing customers, where questions on day-to-day account items are answered and resolved. It always focus on practicality and performance to grow their business.

Minimum Balance Required: $0

Top Features:

- This platform allow users to watch their trading directly during market hours.

- Traders can learn about concepts, strategies, research and market movements.

Pros:

- It is easy to use and reliable platform with real-time quotes and advanced tools.

- The team works together to provide better services for customers.

- Allows for more collaboration and communication across the company.

Cons:

- Does not provide any scripts and upsells.

- It is not authorized to do business like products and services.

- This is not suitable for all investors because many risks are involved.

Conclusion

Even individuals with limited or no expertise in the investing market are increasingly taking the initiative and seeking tools to assist them in investing their hard-earned money and expanding their wealth. So don’t hesitate any longer; seize the opportunity and explore these best investment apps today!

19 Best Investment Apps – FAQs

What are the benefits of using Trading Apps?

- Users can easily place their trades through online platforms.

- Traders can open their account digitally.

- This provides real-time information about stockmarket.

- Cost effective environment for investors.

- It collects very low fees compared to traditional service brokers.

- Investors can watch their profit and loss remotely.

- It deals with financial goals.

How to pick the best investing app?

To select the best investing app, we need to do proper research of each and every app. Ensure the security features should be end-to-end. See all the reviews, ratings and user experiences. Check whether the app provides investment tutorials, education content and resources to make a decision. Also check the minimum deposit requirement. Compare the features and fees with other apps for the best one. We have provided some of the best investing apps that are useful to you:

How much do investing apps cost?

The cost of investing apps is based on features of each app which includes premium services, market analysis, research tools and services. Evaluates the fees structure of each investing app which varies from one app to another.

It is a low cost trading and makes investors interested in trading international markets. Most of traditional service brokers charge 1% to 2% for stocks but the investor apps do not collect any broker charges. It allows investors to plan their finanical goals and make transactions for clients with lower amounts.

What is the Difference Between Finance Apps and Investing Apps?

The difference between finance apps and investing apps is that the finance apps allows to manage your financial challenges, where as investing apps allow you to buy and sell investments. The goal of both investment and finance apps is to maximize shareholder value.

Here is a table showing the key differences between finance apps and investing apps:

|

Finance Apps

|

Investing Apps

|

|

Finance apps take care of your complete financial situation, including monitoring your expenditures, creating budgets, and saving money.

|

Investing apps helps you to buy and sell investments, such as stocks, bonds, and mutual funds

|

|

Offer features such as budgeting tools, bill pay, and credit score monitoring

|

Offer features such as research tools, trading platforms, and portfolio tracking

|

|

Can charge fees for some features, such as bill pay

|

Can charge fees for trading, such as commissions or spreads

|

Related Articles

Share your thoughts in the comments

Please Login to comment...