Evaluation of Risk in Investments

Last Updated :

21 Dec, 2022

Given two investment options A and B, we have to find the less risky investment of the two. The two investments A and B are each represented by an array. Each element in the array is a probable investment outcome. Thus each element in the array is a pair of two values. The first value is the amount of money received and the second value is the probability that this money can be received. For instance, if A = [ (100,0.1), (200,0.2) (300,0.7) ], it means that there is 10 % probability to earn Rs 100, 20% probability to earn Rs 200, and 70% chance to earn Rs 300 from investment A.

We have to use a statistical approach to solve the problem. For each investment, we first calculate the average amount of money that can be earned from it. Secondly, we also calculate the standard deviation in the money earned. Then we need to normalize this standard deviation by dividing it by the mean.

Each probable outcome is an observation. The probability for each amount of money is its frequency. Since the observations are given with frequencies we need to apply the following formulas to calculate the mean and standard deviation

If  denotes the set of observations

denotes the set of observations  .

.

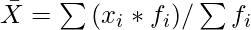

Mean =

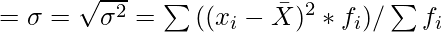

Standard deviation

Let us take an example to demonstrate how to apply this method.

Example:

Input: A = [(0,0.1), (100,0.1), (200,0.2), (333,0.3), (400,0.3) ]

B = [ (100,0.1), (200,0.5), (700,0.4) ]

Explanation:

Mean Investment of A

Index | Outcome | Probability | Probability*Outcome

(i) (xi) (fi) xi*fi

----------------------------------------------------------

1 0 0.1 0

2 100 0.1 10

3 200 0.2 40

4 333 0.3 99.9

5 400 0.3 120

----------------------------------------------------------

Total: 1.0 269.1

Mean = 269.1/1 = 269.1

Mean Investment of B:

Index | Outcome | Probability | Probability*Outcome

(i) (xi) (fi) xi*fi

----------------------------------------------------------

1 100 0.1 10

2 200 0.5 100

3 700 0.4 280

----------------------------------------------------------

Total: 1.0 390

Mean = 390/1 = 390.1

Standard Deviation of A

Mean = 269.1

Index | Outcome | Probability | (xi-Mean)^2 | A*fi

(i) (xi) (fi) (A)

----------------------------------------------------------

1 0 0.1 72414.81 7241.481

2 100 0.1 28594.81 2859.481

3 200 0.2 4774.81 954.962

4 333 0.3 4083.21 1224.963

5 400 0.3 17134.81 5140.443

----------------------------------------------------------

Total: 1.0 17421.33

Standard Deviation = sqrt(17421.33/1) = 131.989

Normalized Standard Deviation = 131.989/269.1 = 0.49

Standard Deviation of B

Mean = 390.1

Index | Outcome | Probability | (xi-Mean)^2 | A*fi

(i) (xi) (fi) (A)

----------------------------------------------------------

1 100 0.1 84158.01 8415.801

2 200 0.5 36138.01 18069.005

3 700 0.4 96100.00 38440.000

----------------------------------------------------------

Total: 1.0 64924.801

Standard Deviation = sqrt(64924.801/1) = 254.803

Normalized Standard Deviation: 254.803 / 390.1 = 0.65

Since Investment A has lesser normalized standard deviation,

it is less risky.

Input: A = [(0,0.1), (100,0.1), (200,0.2), (333,0.3), (400,0.3) ]

B = [ (100,0.1), (200,0.5), (700,0.4) ]

Explanation:

For Investment A

Average: 269.9

Standard Deviation: 131.987

Normalised Std: 0.489024

For Investment B

Average: 258.333

Standard Deviation: 44.8764

Normalised Std: 0.173715

Investment B is less risky

The implementation of the problem is given below

C++

#include <iostream>

#include <vector>

#include <algorithm>

#include <cmath>

using namespace std;

typedef pair<float,float> Data;

typedef vector<Data> Vector;

float sigma_fx(const Vector & v)

{

float sum = 0;

for ( auto i : v) {

sum += i.first * i.second;

}

return sum;

}

float sigma_f(const Vector & v)

{

float sum = 0.0;

for ( auto i : v) {

sum += i.second;

}

return sum;

}

float calculate_mean(const Vector & v)

{

return sigma_fx(v) / sigma_f(v);

}

float calculate_std(const Vector & v)

{

float f = sigma_f(v);

float mean = sigma_fx(v) / f;

float sum = 0;

for (auto i: v) {

sum += (i.first-mean)*

(i.first-mean)*i.second;

}

return sqrt(sum/f);

}

int main()

{

Vector A = { {0,0.1}, {100,0.1},

{200,0.2}, {333,0.3}, {400,0.3}};

Vector B = { {100,0.1}, {200,0.5}, {700,0.4}};

float avg_A = calculate_mean(A);

float avg_B = calculate_mean(B);

float std_A = calculate_std(A);

float std_B = calculate_std(B);

cout << "For Investment A" << endl;

cout << "Average: " << avg_A << endl;

cout << "Standard Deviation: " <<

std_A << endl;

cout << "Normalised Std: " <<

std_A / avg_A << endl;

cout << "For Investment B" << endl;

cout << "Average: " << avg_B << endl;

cout << "Standard Deviation: " <<

std_B << endl;

cout << "Normalised Std: " << std_B /

avg_B << endl;

(std_B/avg_B) < (std_A/avg_A) ? cout <<

"Investment B is less risky\n":

cout << "Investment A is less risky\n";

return 0;

}

|

Java

import java.util.*;

import java.io.*;

public class GFG

{

static class pair

{

float first, second;

public pair(float first, float second)

{

this.first = first;

this.second = second;

}

}

static Vector<pair> Vector;

static float sigma_fx(pair[] a)

{

float sum = 0;

for (pair i : a)

{

sum += i.first * i.second;

}

return sum;

}

static float sigma_f(pair[] a)

{

float sum = 0.0f;

for (pair i : a)

{

sum += i.second;

}

return sum;

}

static float calculate_mean(pair[] a)

{

return sigma_fx(a) / sigma_f(a);

}

static float calculate_std(pair[] a)

{

float f = sigma_f(a);

float mean = sigma_fx(a) / f;

float sum = 0;

for (pair i : a)

{

sum += (i.first - mean) *

(i.first - mean) * i.second;

}

return (float) Math.sqrt(sum / f);

}

public static void main(String[] args)

{

pair[] A = { new pair(0f, 0.1f),

new pair(100f, 0.1f),

new pair(200f, 0.2f),

new pair(333f, 0.3f),

new pair(400f, 0.3f) };

pair[] B = { new pair(100f, 0.1f),

new pair(200f, 0.5f),

new pair(700f, 0.4f) };

float avg_A = calculate_mean(A);

float avg_B = calculate_mean(B);

float std_A = calculate_std(A);

float std_B = calculate_std(B);

System.out.print("For Investment A" + "\n");

System.out.print("Average: " + avg_A + "\n");

System.out.print("Standard Deviation: " +

std_A + "\n");

System.out.print("Normalised Std: " +

std_A / avg_A + "\n");

System.out.print("For Investment B" + "\n");

System.out.print("Average: " + avg_B + "\n");

System.out.print("Standard Deviation: " +

std_B + "\n");

System.out.print("Normalised Std: " +

std_B / avg_B + "\n");

if ((std_B / avg_B) < (std_A / avg_A))

System.out.print("Investment B is less risky\n");

else

System.out.print("Investment A is less risky\n");

}

}

|

Python3

class Data:

def __init__(self, x, y):

self.first = x

self.second = y

Vector = []

def sigma_fx(v):

sum = 0

for i in v:

sum += i.first * i.second

return sum

def sigma_f(v):

sum = 0.0

for i in v:

sum += i.second

return sum

def calculate_mean(v):

return sigma_fx(v) / sigma_f(v)

def calculate_std(v):

f = sigma_f(v)

mean = sigma_fx(v) / f

sum = 0

for i in v:

sum += (i.first-mean) * (i.first-mean)*i.second

return (sum/f) ** 0.5

A = [Data(0, 0.1), Data(100, 0.1), Data(

200, 0.2), Data(333, 0.3), Data(400, 0.3)]

B = [Data(100, 0.1), Data(200, 0.5), Data(700, 0.4)]

avg_A = calculate_mean(A)

avg_B = calculate_mean(B)

std_A = calculate_std(A)

std_B = calculate_std(B)

print("For Investment A")

print("Average:", avg_A)

print("Standard Deviation:", std_A)

print("Normalised Std:", std_A / avg_A)

print("For Investment B")

print("Average:", avg_B)

print("Standard Deviation:", std_B)

print("Normalised Std:", std_B / avg_B)

if (std_B/avg_B) < (std_A/avg_A):

print("Investment B is less risky")

else:

print("Investment A is less risky")

|

C#

using System;

using System.Collections.Generic;

class GFG

{

class pair

{

public float first, second;

public pair(float first,

float second)

{

this.first = first;

this.second = second;

}

}

static List<pair> List;

static float sigma_fx(pair[] a)

{

float sum = 0;

foreach (pair i in a)

{

sum += i.first * i.second;

}

return sum;

}

static float sigma_f(pair[] a)

{

float sum = 0.0f;

foreach (pair i in a)

{

sum += i.second;

}

return sum;

}

static float calculate_mean(pair[] a)

{

return sigma_fx(a) / sigma_f(a);

}

static float calculate_std(pair[] a)

{

float f = sigma_f(a);

float mean = sigma_fx(a) / f;

float sum = 0;

foreach (pair i in a)

{

sum += (i.first - mean) *

(i.first - mean) * i.second;

}

return (float) Math.Sqrt(sum / f);

}

public static void Main(String[] args)

{

pair[] A = {new pair(0f, 0.1f),

new pair(100f, 0.1f),

new pair(200f, 0.2f),

new pair(333f, 0.3f),

new pair(400f, 0.3f)};

pair[] B = {new pair(100f, 0.1f),

new pair(200f, 0.5f),

new pair(700f, 0.4f)};

float avg_A = calculate_mean(A);

float avg_B = calculate_mean(B);

float std_A = calculate_std(A);

float std_B = calculate_std(B);

Console.Write("For Investment A" + "\n");

Console.Write("Average: " + avg_A + "\n");

Console.Write("Standard Deviation: " +

std_A + "\n");

Console.Write("Normalised Std: " +

std_A / avg_A + "\n");

Console.Write("For Investment B" + "\n");

Console.Write("Average: " + avg_B + "\n");

Console.Write("Standard Deviation: " +

std_B + "\n");

Console.Write("Normalised Std: " +

std_B / avg_B + "\n");

if ((std_B / avg_B) < (std_A / avg_A))

Console.Write("Investment B is less risky\n");

else

Console.Write("Investment A is less risky\n");

}

}

|

Javascript

class Data

{

constructor(x, y)

{

this.first = x;

this.second = y;

}

}

let Vector = new Array();

function sigma_fx(v)

{

let sum = 0;

for (var i of v) {

sum += i.first * i.second;

}

return sum;

}

function sigma_f(v)

{

let sum = 0.0;

for (let i of v) {

sum += i.second;

}

return sum;

}

function calculate_mean(v)

{

return sigma_fx(v) / sigma_f(v);

}

function calculate_std(v)

{

let f = sigma_f(v);

let mean = sigma_fx(v) / f;

let sum = 0;

for (var i of v) {

sum += (i.first-mean)*

(i.first-mean)*i.second;

}

return Math.sqrt(sum/f);

}

let A = [new Data(0,0.1), new Data(100,0.1),

new Data(200,0.2), new Data(333,0.3), new Data(400,0.3)];

let B = [ new Data(100,0.1), new Data(200,0.5), new Data(700,0.4)];

let avg_A = calculate_mean(A);

let avg_B = calculate_mean(B);

let std_A = calculate_std(A);

let std_B = calculate_std(B);

console.log("For Investment A");

console.log("Average: " + avg_A);

console.log("Standard Deviation: " + std_A);

console.log("Normalised Std: " + std_A / avg_A);

console.log("For Investment B");

console.log("Average: " + avg_B);

console.log("Standard Deviation: " + std_B);

console.log("Normalised Std: " + std_B / avg_B);

((std_B/avg_B) < (std_A/avg_A)) ? console.log("Investment B is less risky"):

console.log("Investment A is less risky");

|

OutputFor Investment A

Average: 269.9

Standard Deviation: 131.987

Normalised Std: 0.489024

For Investment B

Average: 390

Standard Deviation: 254.755

Normalised Std: 0.653217

Investment A is less risky

Time complexity: O(n)

Auxiliary Space: O(1)

References:

https://www.statcan.gc.ca/edu/power-pouvoir/ch12/5214891-eng.htm

std::accumulate cppreference.com

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...