Bank Reconciliation Statement Format with Example | BRS Format

Last Updated :

09 Aug, 2023

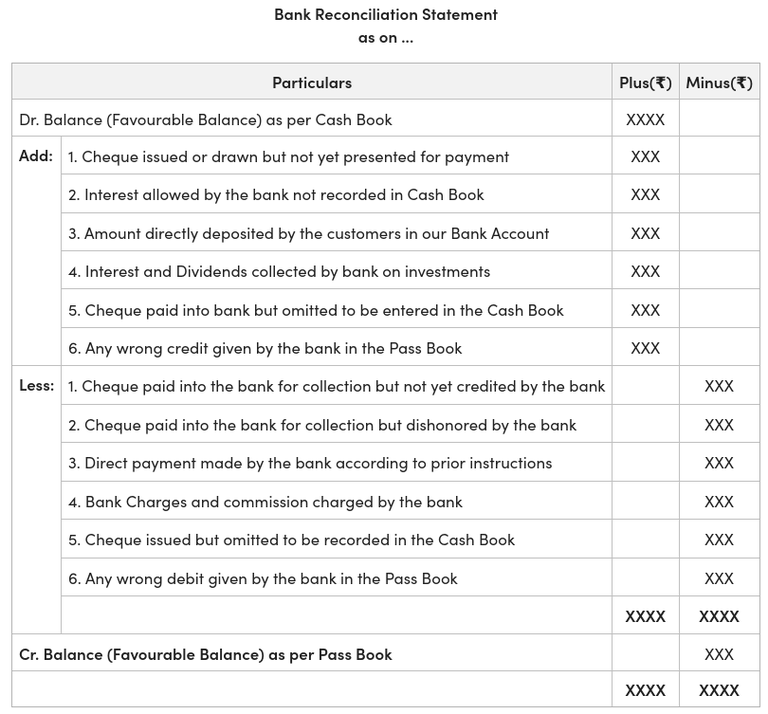

Bank Reconciliation Statement is prepared to compare the balances of the cash book and passbook and correct the mistakes recorded in them. Bank Reconciliation Statement Format is prepared with 3 columns starting with particulars and two amount columns in which the amount that needs to be added back and the amount that needs to be deducted are recorded.

Format of Bank Reconciliation Statement (BRS)

Illustration:

The balance of cash at bank as shown in the Cash Book of Sahil & Co. on 31st December 2021 was ₹8,200. On comparing it with the pass book, the following differences were noted:

- Cheque sent for collection amounting to ₹6,400 have not been cleared by the bank so far.

- Cheque issued but not presented for payment ₹4,000.

- Bank charges ₹200 not entered in the Cash Book.

- Credit of ₹500 in the pass book in respect of interest was not recorded in the Cash Book.

- A vendor deposited ₹2,000 directly in our bank account which was only recorded in the pass book.

- As per standing instructions of Sahil & Co., the bank has made the following payments:

- Insurance premium: ₹1,200

- Club Fees: ₹1,000

Prepare a Bank Reconciliation Statement as on 31st December 2021.

Solution:

Share your thoughts in the comments

Please Login to comment...