Advantages and Disadvantages of Joint Hindu Family Business

Last Updated :

25 Jul, 2023

Joint Hindu Family Business is a form of business, which is found only in India, and wherein the business is owned and carried on by the members of the Hindu Undivided Family (HUF). It is governed by the Hindu Law (The Hindu Succession Act, 1956). It is stated that the law of inheritance creates the Joint Hindu Family Business. The basis of membership in the business is birth and three successive generations can be members of the business.

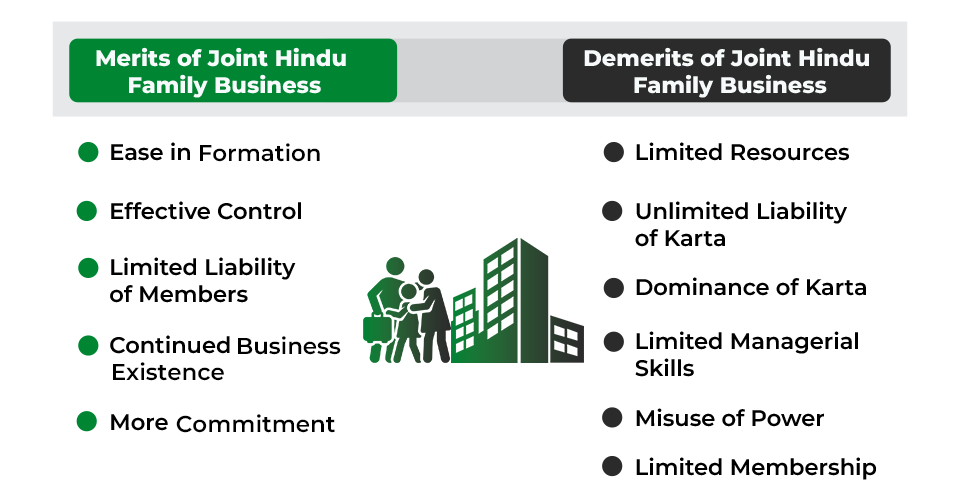

Advantages of Joint Hindu Family Business

The advantages of a Hindu Undivided Family Business are as follows:

1. Ease in formation: It is fairly simple to establish a Joint Hindu Family Business. No legal requirements, such as registration, are necessary. It does not demand agreement.

2. Effective Control: The Karta has complete authority over all decisions, which avoids conflicts among the members as there is no interference from anybody. It also leads to quick decision making.

3. Limited Liability of Members: The liability of all the co-parceners is limited except that of Karta. The liability of the members is limited to the extent of share in the family property. Therefore, the interests of all the members are protected and their risks are well-defined and precise.

4. Continued business existence: The business will continue as usual after the death of the Karta, since the next eldest member will enter into the role of Karta. Hence operations are not terminated and continuity of business is maintained.

5. More commitment: Since the business is controlled by family members, there is a strong loyalty amongst them. Quality in business growth is connected to family achievements, which helps in obtaining improved collaboration from all members.

Disadvantages of Joint Hindu Family Business

The disadvantages of a Hindu Undivided Family Business are as follows:

1. Limited Resources: The Joint Hindu Family Business experiences a financial shortage, since it is mostly dependent on ancestral property. This limits the possibility of business expansion. As a result, the size of the business remains small, and the Karta cannot benefits from large-scale economies.

2. Unlimited Liability of Karta: The Karta carries not just the burden of decision-making and management, but also unlimited liability. His personal belongings might be utilized to pay off business debts.

3. Dominance of Karta: The control and management of the business are vested solely in the hands of the Karta, which may not always be acceptable to the other members, and it may lead to conflicts and breakdown of the family unit.

4. Limited Managerial Skills: Karta cannot be an expert in all areas of management, his poor judgments may affect the business. His failure to make good decisions may even lead to financial difficulties and losses. Also, Hindu Undivided Family do not have adequate funds to hire experts or professionals in several domains such as purchasing, manufacturing, marketing, etc.

5. Misuse of Power: Management of a Joint Hindu Family Business is centered in the hands of the family’s Karta. No other member is allowed to interfere with his management. This may lead to power misuse, with Karta misusing his position for personal benefits.

6. Limited Membership: The membership of the business is restricted to family members exclusively. No one from outside the Joint Hindu Family Business can join the business. Therefore, they face the demerit of limited membership.

Share your thoughts in the comments

Please Login to comment...