A Long-Term Capital Gain refers to any profit or gain arising from the transfer of a capital asset, that has been held by an assessee (tax-payer) for more than 36 months in case of unlisted securities, units of Mutual Funds (other than Equity Oriented), other assets, or for more than 12 months in the case of listed securities, Equity Oriented Units, and Zero Coupon Bonds, and for more than 24 months in case of unlisted shares. In simple words, Short-Term Capital gain is a profit earned through the sale of assets that had been held for more than 12 months.

What are Capital Assets ?

For the purpose of taxation, Capital Assets include all of the following:

1. Any asset being movable or immovable, tangible or intangible held personally or professionally by an assessee;

2. Any securities held by Foreign Institutional Investors who have invested in such securities in accordance with the regulations made under the SEBI Act, 1992.

but does not include:

- Stock-in-trade and raw materials held by businesses and professionals.

- Personal movable assets like jewelry (gold, silver, platinum, precious stones, or any other precious metal), paintings, sculptures, and archaeological collections.

- Rural agricultural land in India. (Condition applied)

- 6.5% Gold Bonds, 1977, 7% Gold Bonds 1980, National Defense Gold Bond, 1980.

- Special Bearer Bonds 1991.

- Gold Deposit Bond issued under Gold Deposit Scheme 1999.

- Deposit certificates issued under the Gold Monetisation Scheme, 2015.

Note: Capital Gains for the purpose of taxation are deemed to be the income of the previous year in which the transfer took place.

How Long-term Capital Gains are Taxed ?

Taxes on long-term capital gain are imposed according to the nature of the capital assets being transferred. In order to provide relief to the taxpayer against the inflation. The benefit of Indexation adjusts the price against the rise in inflation that lowers the tax burden. The tax rates are as the followings:

1. A tax of 20% is imposed on Long-term Capital Gain earned through the transfer of Real estate, debt securities, and bonds.

2. Tax on long-term Capital Gain earned on the transfer of listed securities, units of Mutual Funds or UTI, or Zero Coupon Bonds not covered under Section 112A shall be the lower of the following:

- Availing the benefit of Indexation: After availing the benefit of Indexation, a tax of 20% is levied on such gains (plus surcharge and cess).

- Not availing the benefit of Indexation: A tax of 10% is applicable on any long-term capital gain with the benefit of Indexation.

Note: After computing tax liability under both options, the option with lower tax liability is opted for.

3. Tax on long-term Capital Gain earned on the transfer of listed equity shares, units of the equity-oriented fund, or a unit of a business trust covered under Section 112A shall be levied at a rate of 10% in excess of ₹1 Lakh.

Note: The benefit of Indexation cannot be claimed under section 112A.

Calculation of Long-Term Capital Gain Tax

To levy taxes on Long-term Capital Gain, it is compulsory to evaluate the amount of capital gain. The following table shows the computation of Total Taxable Long-term Gain and Tax liability on the same:

Particulars

| Amount(₹)

|

|---|

| Full Value of Consideration | XXXX

|

| Less: Expenses incurred on transfer of asset | (XXXX)

|

Net Consideration

| XXXX

|

| Less: Indexed Cost of Acquisition | (XXXX)

|

| Less: Indexed Cost of Improvement | (XXXX)

|

Long-Term Capital Gain

| XXXX

|

| Less: Exemption under section 10/54 | (XXXX)

|

Total taxable Long-term Capital Gain

| XXXX

|

| Tax on Total taxable Long-term Capital Gain (@ 10% or 20%) | XXXX

|

| Add: Health and Education Cess (4% on tax) | XXXX

|

Total Tax Liability

| XXXX

|

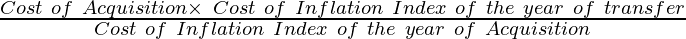

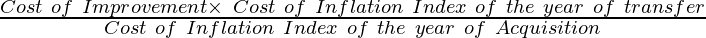

Formula to Compute Indexed Cost of Acquisition and Indexed Cost of Improvement:

Indexed Cost of Acquisition =

Indexed Cost of Improvement =

NOTE:

- As per Section 55, the Cost of Acquisition of assets acquired before 1.4.2001 shall be allowed to be taken as fair market value as on 1.4.2001 and the Cost of Improvement shall include only those capital expenses which are incurred after 1.4.2001.

- The benefit of Indexation shall not apply to long-term capital gain earned on the transfer of bonds or debentures, other than capital-indexed bonds issued by the government.

- Deductions under Section 80C-80U shall not be provided in this regard.

Illustration:

Rahul sold 10,000 equity shares at a recognized stock exchange for ₹ 50,00,000 after holding them for 10 years. The cost of the acquisition of shares was ₹ 10,00,000. The brokerage paid by Rahul at the time of sale was ₹ 2,00,000. Calculate his tax liability on long-term capital gain.

Solution:

Particulars

| Amount(₹)

|

|---|

| Full Value of Consideration | 50,00,000

|

| Less: Expenses incurred on transfer of asset | (2,00,000)

|

Net Consideration

| 48,00,000

|

| Less: Cost of Acquisition | (10,00,000)

|

Long-term Capital Gain

| 38,00,000

|

| Less: Exemption under section 10/54 | NIL

|

Total taxable Long-term Capital Gain

| 38,00,000

|

| Tax on Total taxable Long-term Capital Gain (@ 10%) | 3,80,000

|

| Add: Health and Education Cess (4% on tax) | 15,200

|

Total Tax Liability

| 3,95,200

|

Note: In the above case, Section 112A is applicable since listed equity shares are transferred, hence tax of 10% is applicable on Long-term capital gain and no benefit of indexation shall be provided.

Exemptions on Long-Term Capital Gains Tax

1. Exemption on Long-Term Capital Gain arising on transfer of Residential Property (Section 54)

- Applicable for: Individual and Hindu Undivided Families (HUF).

- Capital Asset Covered: A residential house property held by the assessee for at least 24 months or more before the date of transfer.

- Exemption Applicability: Exemption can be claimed if an assessee uses the amount of capital gain to purchase or construct the new residential house, 1 year prior to the date of transfer or within a period of 2 years from the date of transfer. In case of construction, construction shall be completed within 3 years after the date of transfer.

- Exemption Amount: Cost of a new house or Amount of Capital Gain, whichever is lower. With effect from Assessment Year 2020-21, a taxpayer has the option to make an investment in two residential house properties in India. This can be claimed once in a lifetime if the amount of long-term capital gain does not exceed 2 crores.

- Exemption Limit: 10 crores.

- Lock-in period: 3 years. Any transfer of a new house within 3 years shall result in the withdrawal of the exemption.

- Capital Gain Account Scheme (CGAS): If an assessee fails to use full or part of the amount to purchase new agricultural land before the due date, such amount shall be deposited in the Capital Gains Deposit Account Scheme (CGAS) before the due date.

2. Exemption on Long-Term Capital Gain arising on transfer of Agriculture Land (Section 54B)

- Applicable for: Individual and Hindu Undivided Families (HUF).

- Capital Asset Covered: Agriculture land held and used for agricultural purposes by the assessee or his parents for at least 24 months or more before the date of transfer.

- Exemption Applicability: Exemption can be claimed if an assessee uses the amount of capital gain to purchase the new agricultural land within a period of 2 years from the date of transfer.

- Exemption Amount: Cost of new land or Amount of Capital Gain, whichever is lower.

- Lock-in period: 3 years. Any transfer of new land within 3 years shall result in the withdrawal of the exemption.

- Capital Gain Account Scheme (CGAS): If an assessee fails to use full or part of the amount to purchase new agricultural land before the due date, such amount shall be deposited in the Capital Gains Deposit Account Scheme (CGAS) before the due date.

3. Exemption on Short-Term Capital Gain on compulsory acquisition of property used for industrial purposes (Section 54D)

- Applicable for: All Assessee

- Capital Asset Covered: Transfer of Land or Building used for industrial purposes by way of compulsory acquisition, which the assessee uses for industrial purposes for at least 24 months.

- Exemption Applicability: Exemption can be claimed if an assessee uses the amount of capital gain to purchase any land or building or construct any building within 3 years from the date of receipt of compensation for shifting or reestablishing the industrial undertaking.

- Exemption Amount: Cost of new land or building or Amount of Capital Gain, whichever is lower.

- Lock-in period: 3 years.

- Capital Gain Account Scheme (CGAS): If an assessee fails to use full or part of the amount for the purchase of new industrial land or building before the due date, such amount shall be deposited in the Capital Gains Deposit Account Scheme (CGAS) before the due date.

4. Exemption on Long-Term Capital Gain arising on transfer of any capital asset (Section 54EC)

- Applicable for: All Assessee

- Capital Asset Covered: Transfer of any Land or Building or both or any asset that falls under the criteria of Long-term Capital assets.

- Exemption Applicability: Exemption can be claimed if an assessee within 6 months from the date of transfer invests the whole to part of the capital gain in a long-term specified asset. The total investment amount cannot exceed ₹ 50 lakhs during the current financial year and the subsequent financial year. Here long-term specified asset means any bond redeemable after 3 years:

a) A bond issued by the National Highway Authority of India on or after 1.4.2006.

b) A bond issued by Rural Electrification Corporation Ltd.

c) A bond issued by Power Finance Corporation Ltd.

d)A bond issued by Railway Finance Corporation Ltd.

- Exemption Amount: Cost of Investment or Amount of Capital Gain, whichever is lower.

- Exemption Limit: ₹ 50 Lakhs.

- Lock-in period: 3 years. The exemption shall be revoked if the specified assets are transferred or otherwise converted into money within 3 years from the date of investment.

- Capital Gain Account Scheme (CGAS): Not Applicable.

5. Exemption on Long-Term Capital Gain arising on transfer of any asset other than residential house property (Section 54F)

- Applicable for: Individual and Hindu Undivided Families (HUF).

- Capital Asset Covered: Any capital asset other than a residential house held by the assessee for at least 24 months or more before the date of transfer, provided on the date of transfer taxpayer does not own more than one residential house property

- Exemption Applicability: Exemption can be claimed if an assessee uses the amount of capital gain to purchase or construct the new residential house, 1 year prior to the date of transfer or within a period of 2 years from the date of transfer. In case of construction, construction shall be completed within 3 years after the date of transfer.

- Exemption Amount: Exemption amount = (Long-term capital gain ⨉ Investment) ÷ Net sale consideration.

- Lock-in period: 3 years. The exemption is subject to be revoked if:

a) If a new asset is transferred within 3 years of acquisition,

b) if another residential house is purchased within 2 years of the transfer of the original asset,

c) if another house is constructed within 3 years of the transfer of the original asset

- Capital Gain Account Scheme (CGAS): If an assessee fails to use full or part of the amount to purchase new agricultural land before the due date, such amount shall be deposited in the Capital Gains Deposit Account Scheme (CGAS) before the due date.

6. Exemption on Long-Term Capital Gain arising on transfer of industrial undertaking from an urban area to a rural area (Section 54G)

- Applicable for: All Assessee

- Capital Asset Covered: Transfer of machinery, plant, building, or land or any right in any building and land used for an industrial undertaking in an urban area to a rural area.

- Exemption Applicability: Exemption can be claimed if within a period of 1 year before or 3 years after the date of transfer, the assessee acquires new machinery, plant, building, or land or construct a new building for business purpose in the same area to which the undertaking is shifting or incurs any expense on shifting or transferring the establishment of undertakings to such area.

- Exemption Amount: Cost of new assets including any expenses or Amount of Capital Gain, whichever is lower.

- Lock-in period: 3 years

- Capital Gain Account Scheme (CGAS): If an assessee fails to use full or part of the amount for investment in new assets before the due date, such amount shall be deposited in the Capital Gains Deposit Account Scheme (CGAS) before the due date.

7. Exemption on Long-Term Capital Gain arising on transfer of industrial undertaking from an urban area to a Special Economic Zone (SEZ) (Section 54GA)

- Applicable for: All Assessee

- Capital Asset Covered: Transfer of machinery, plant, building, or land or any right in any building and land used for an industrial undertaking purpose situated in an urban area to a Special Economic Zone (SEZ).

- Exemption Applicability: Exemption can be claimed if within a period of 1 year before or 3 years after the date of transfer, the assessee acquires new machinery, plant, building, or land or construct a new building for business purpose in the SEZ to which the undertaking is shifting or incurs any expense on shifting or transferring the establishment of undertakings to SEZ.

- Exemption Amount: Cost of new assets including any expenses or Amount of Capital Gain, whichever is lower.

- Lock-in period: 3 years

- Capital Gain Account Scheme (CGAS): If an assessee fails to use full or part of the amount for investment in new assets before the due date, such amount shall be deposited in the Capital Gains Deposit Account Scheme (CGAS) before the due date.

8. Exemption on Long-Term Capital Gain arising on transfer of residential property and investing in the equity of new SME company (Section 54GB)

- Applicable for: Individual and Hindu Undivided Families (HUF).

- Capital Asset Covered: A long-term residential house property being a house or plot.

- Exemption Applicability: Exemption can be claimed if an assessee invests the net consideration in equity of the eligible company within the due date of furnishing the return of income and the company uses the full amount of subscription within 1 year from the date of subscription.

- Exemption Amount: Exemption amount = (Long-term capital gain ⨉ Investment in shares) ÷ Net consideration

- Exemption Limit: ₹50 lakhs.

- Lock-in period: 5 years. If equity shares in a company or a new asset acquired by the company are sold or transferred within a period of 5 years from the date of acquisition. However, w.e.f. Assessment Year 2020-21, the restriction on the transfer of new assets is reduced to 3 years in the case of computer or computer software.

- Capital Gain Account Scheme (CGAS): If an assessee fails to use full or part of the amount to purchase new agricultural land before the due date, such amount shall be deposited in the Capital Gains Deposit Account Scheme (CGAS) before the due date.

Share your thoughts in the comments

Please Login to comment...