What is Fixed Capital? | Meaning and Importance

Last Updated :

20 Jul, 2023

The assets which remain in the business for a period of more than one year are known as Fixed Assets. For example, plant, machinery, building, land, furniture, equipment, etc. These assets are not meant for sale. Fixed Capital is the money invested by a company in its fixed assets, which are to be used over a long period of time. Hence, it can be said that fixed capital is used to meet the permanent or long-term needs of the business.

Management of Fixed Capital

Raising fixed capital required by the firm at minimum cost and using it effectively sums up the management of fixed capital. The decision taken by a firm to invest in fixed assets is known as Capital Budgeting Decision. A firm must take capital budgeting decisions carefully as it affects the profitability, growth, and risk of business in the long run. It consists of decisions related to the purchase of land, plant and machinery, building, investing in advanced techniques of production or launching a new product line.

A firm must always finance its fixed assets through long-term sources, like shares, debentures, long-term loans, etc., and not through short-term sources.

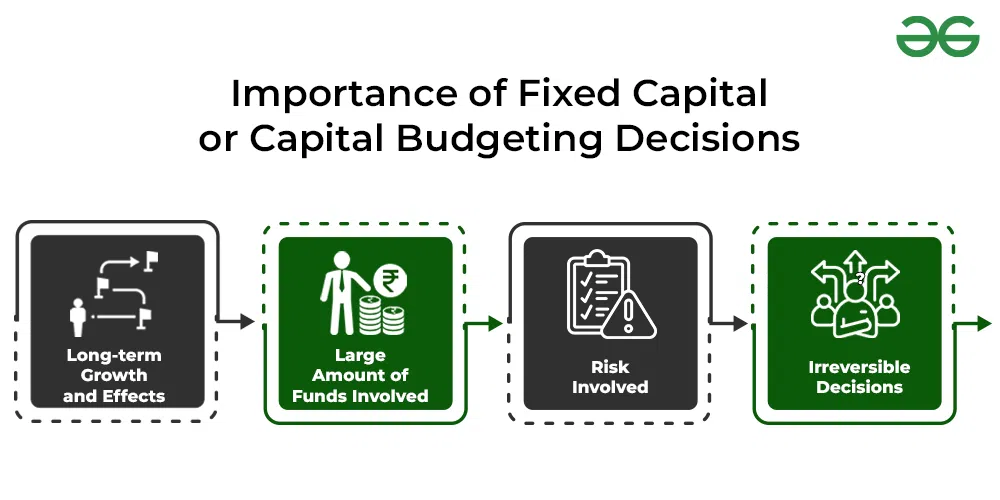

Importance of Fixed Capital or Capital Budgeting Decisions

A capital budgeting decision is one of the most crucial business decisions. It is important for a business because of the following reasons:

1. Long-term Growth and Effects

Decisions regarding the long-term growth and effects of a firm have long-term implications on its business. As the funds invested by the firm in the long-term assets are most likely to yield returns in the future, these decisions affect the growth and future prospects of the business.

2. Large Amount of Funds Involved

A huge outflow of funds is involved in capital budgeting decisions, because of which a substantial portion of capital funds are blocked in long-term projects. The funds will get wasted if the firms get any wrong investment programme. Therefore, decisions regarding the amount of funds are crucial for the firm and it must carefully plan its investment programme.

3. Risk Involved

The capital budgeting decisions of an organisation involve huge funds and a higher degree of risk. These decisions have an impact on long-term profitability as the company has to bear the risk for a long period.

4. Irreversible Decisions

It is not possible to reverse most of the capital budgeting decisions without incurring heavy losses. For instance, if an organisation abandons a project in the middle, it will have an adverse financial consequences on the business. Therefore, every firm should take these decisions after every small detail to avoid heavy losses.

Share your thoughts in the comments

Please Login to comment...