Types of Financial Swaps

Last Updated :

16 Apr, 2024

What are Financial Swaps?

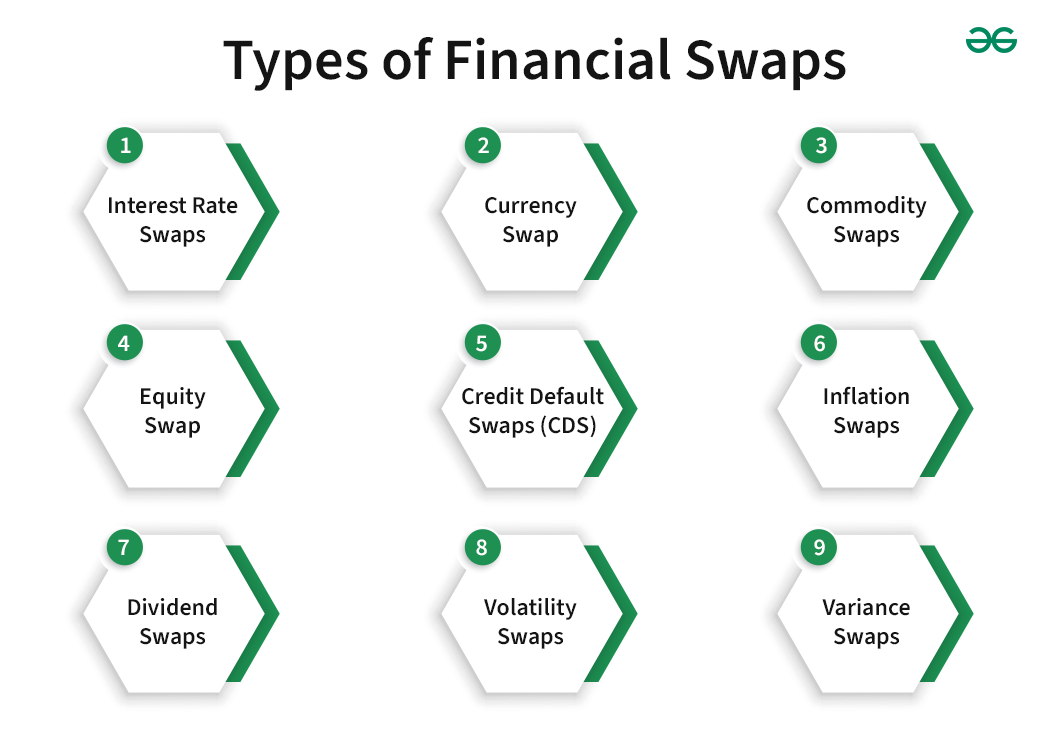

Financial swaps are bilateral agreements between any two parties to exchange financial instruments, cash flows, or payments for a certain period. While the assets can vary widely, most swaps will include cash flows based on a notional principal amount. These contracts are traded over-the-counter (OTC) and are highly customizable to meet the specific requirements of the involved parties. Types of financial swaps include interest rate swaps, currency swaps, commodity swaps, equity swaps, dividend swaps, volatility swaps, credit default swaps, inflation swaps, and variance swaps.

Geeky Takeaways:

- Financial swaps are versatile derivative agreements facilitating the exchange of cash flows, financial instruments, or payments over a specified period.

- Each type of financial swap offers distinct features, perks, and disadvantages tailored to address specific financial risks and objectives.

- Despite counterparty risk, contractual complexity, and liquidity concerns, financial swaps are pivotal tools financial institutions, corporations, and investors use.

Types of Financial Swaps

1. Interest Rate Swaps

Interest rate swaps represent financial agreements between two entities, facilitating the exchange of future interest payments based on fixed and floating interest rates. Widely utilized in commercial real estate financing, these swaps enable borrowers with floating-rate loans to convert into fixed-rate financing arrangements.

Features

- Interest Rate Exchange Mechanism: Interest rate swaps include the interchange of fixed-rate and floating-rate interest payments between two parties, facilitating the management of interest rate exposure.

- Non-Exchange of Principal: Here the principal amount remains unchanged, with only the interest payments being exchanged over the agreed-upon period.

- Risk Management Tool: These swaps are commonly employed as tools to mitigate interest rate risk or capitalize on favorable market conditions, providing flexibility in managing financial obligations.

Advantages

- Risk Mitigation: These swaps offer a means for parties to hedge against fluctuations in interest rates, thereby limiting the impact of adverse market movements on their financial positions.

- Debt Restructuring: Borrowers can utilize interest rate swaps to restructure their debt from fixed-rate to floating-rate or vice versa.

- Access to Diverse Markets: Swaps provide participants with access to a broader range of interest rate markets, enabling them to diversify funding sources and potentially lower borrowing costs.

Disadvantages

- Counterparty Credit Exposure: Interest rate swaps are commonly exchanged off-exchange, presenting participants with counterparty credit risk.

- Collateral Obligations: The collateral obligations linked to interest rate swaps, detailed in the credit support annex, may mandate parties to provide collateral if the swap’s fair value falls below a specified threshold.

- Liquidity Concerns: There exists a liquidity risk in the swap market, where positions may be challenging to unwind due to limited liquidity.

Examples

- Plain Vanilla Interest Rate Swap: In this type, one party agrees to pay a fixed interest rate in exchange for receiving a floating interest rate.

- Basis Swap: A basis swap involves exchanging payments based on different floating-rate indices, such as swapping payments tied to LIBOR (London Interbank Offer Rate) for those tied to the SOFR (Secured Overnight Financing Rate).

- Amortizing Swap: This type of swap features a decreasing nominal principal amount over time.

2. Currency Swap

Currency swaps involve a financial agreement between two parties wherein they exchange equivalent amounts of money in different currencies. The primary purposes of these swaps are to mitigate the potential risks arising from currency exchange rate fluctuations and to secure more favorable loan rates in local currencies.

Features

- Principal and Interest Exchange: Currency swaps involve exchanging principal and interest payments in different currencies, aiding entities in managing currency exposure effectively.

- Initiation and Termination: Principal exchange occurs at the start and end of the swap, ensuring transaction clarity and accountability.

- Risk Management and Capitalization: Firms and institutions use currency swaps to hedge against currency risk or capitalize on interest rate differentials.

Advantages

- Market Access: Currency swaps provide access to foreign currency markets, enabling strategic currency exposure diversification.

- Favorable Financing: Entities secure foreign currency financing at potentially lower rates, fostering cost-effective capital acquisition.

- Risk Mitigation: Swaps help mitigate the risks associated with exchange rate fluctuations, reinforcing financial resilience.

Disadvantages

- Counterparty Risk: Default risk is a concern, necessitating rigorous risk management and due diligence.

- Complexity Challenges: Complexity in swap agreements may lead to misunderstandings, underscoring the need for clear communication.

- Expenses and Support: Currency swap contracts among major financial entities may incur substantial costs, particularly in the event of default by one party.

Examples

- Cross-currency Swap: This type of swap involves the exchange of principal and interest payments in different currencies.

- Asset Swap: Asset swaps combine a fixed-rate bond with an interest rate swap, creating a floating-rate instrument that offers flexibility in managing interest rate risk.

- Currency Option-based Swap: These swaps incorporate currency options, providing parties with additional flexibility to hedge against currency risk.

3. Commodity Swaps

A commodity swap constitutes a financial derivative agreement wherein two parties consent to exchange cash flows contingent on the price fluctuations of an underlying commodity. The primary objective of commodity swaps is to mitigate risk exposure for a designated party involved in the swap, permitting them to establish a fixed price for the underlying commodity.

Features

- Commodity Price Exchange Framework: Commodity swaps include the interchange of a fixed price for a floating price of a particular commodity, facilitating transactions within commodity markets.

- Notional Quantity Specification: The notional amount in commodity swaps represents the quantity of the underlying commodity being exchanged between the parties involved in the agreement.

- Risk Management Instrument: These swaps are deployed to mitigate price risk associated with various facets of commodity-related activities, including production, consumption, or trading.

Advantages

- Price Risk Mitigation: Commodity swaps offer a mechanism for parties to hedge against adverse fluctuations in commodity prices, thereby safeguarding against potential financial losses.

- Price Stability Assurance: Participants can attain price certainty through commodity swaps, which is particularly beneficial for operational producers or consumers.

- Market Participation Opportunities: Swaps provide avenues for speculation or strategic positioning within the commodity market, enabling participants to capitalize on perceived market trends or opportunities.

Disadvantages

- Regulatory Oversight: Commodity swaps are subject to regulations enforced by entities like the Commodity Futures Trading Commission (CFTC) and the International Swaps and Derivatives Association (ISDA). These bodies set rules for swap trading, clearing, and documentation standards.

- Counterparty Risk Exposure: One significant con is the presence of counterparty risk, wherein one party may fail to fulfill its obligations under the swap agreement, leading to financial repercussions for the other party.

- Basis Risk Concerns: There exists a basis risk in commodity swaps, where the underlying commodity of the swap may not perfectly align with the commodity being hedged, potentially leading to imperfect risk mitigation outcomes.

Examples

- Crude Oil Swap: In a crude oil swap, parties may agree to exchange a fixed price for a floating price of crude oil, enabling risk management.

- Natural Gas Swap: Participants can engage in a natural gas swap, exchanging a fixed price for a floating price of natural gas, thus mitigating the price volatility risk associated with natural gas consumption or production activities.

- Metals Swap: A metals swap involves the exchange of a fixed price for a floating price of a metal commodity, such as gold or copper.

4. Equity Swap

An equity swap constitutes a derivative agreement wherein two entities exchange cash flows associated with equity-based assets linked to a specified notional value against fixed-income cash flows. These swaps are utilized for various purposes, including hedging against equity market risk or gaining exposure to specific stocks or indices.

Features

- Equity Performance Exchange Mechanism: Equity swaps entail the exchange of the performance of one equity instrument for another, facilitating transactions within equity markets.

- Notional Value Specification: The notional amount in equity swaps represents the value of the underlying equity instrument being exchanged between the involved parties.

- Risk Management Tool: These swaps are utilized to manage equity risk or to establish a position in the equity market, offering flexibility in navigating market dynamics.

Advantages

- Diversified Exposure Opportunities: Equity swaps enable parties to acquire exposure to diverse equity instruments or asset classes, broadening investment horizons and diversifying portfolios.

- Risk Mitigation Capability: Participants can utilize equity swaps to hedge against equity market risk or to express views on the relative performance of two equity instruments.

- Market Access Facilitation: Swaps provide avenues for accessing equity markets or investment strategies that may otherwise be challenging to reach.

Disadvantages

- Credit Exposure: Participants in equity swaps face credit risk, where there’s a chance of the counterparty failing to meet payment obligations.

- Transparency Issues: Equity swaps’ OTC nature can result in opacity regarding pricing and terms, potentially leading to unfavorable conditions or misunderstandings for participants.

- Liquidity Concerns: Liquidity risk exists in the swap market, as positions may be difficult to unwind due to limited liquidity, particularly in times of market stress.

Examples

- Total Return Equity Swap: In this, parties exchange the total return, comprising price appreciation and dividends, of one equity instrument for another.

- Index Swap: Participants engage in an index swap, exchanging the performance of one equity index for another, such as the S&P 500 and the FTSE 100, facilitating market exposure management.

- Variance Swap: A variance swap involves the exchange of the realized volatility of an equity instrument for fixed volatility.

5. Credit Default Swaps (CDS)

Credit Default Swaps facilitate the transfer of credit risk among market participants, streamlining credit risk pricing and allocation. In a CDS contract, the protection buyer pays periodic premiums to the protection seller, who agrees to compensate the buyer in the event of default by a specified reference entity.

Features

- Periodic Fee Exchange Mechanism: CDS contracts involve the exchange of a periodic fee, known as the CDS premium, in return for contingent payments triggered by a credit event.

- Diverse Reference Entities: The reference entity in CDS contracts typically encompasses corporations, sovereigns, or other fixed-income instruments, providing flexibility in managing credit risk across various sectors.

- Credit Risk Management Tool: CDS contracts are employed to hedge credit risk exposure or to speculate on the creditworthiness of the reference entity, offering risk management solutions in financial markets.

Advantages

- Exposure Management Flexibility: CDS enables investors to mitigate exposure to credit risk associated with underlying assets without the necessity of holding the assets themselves, enhancing portfolio diversification strategies.

- Short Position Opportunities: Participants can utilize CDS to adopt a short position on the credit quality of a reference entity, facilitating strategies aimed at capitalizing on anticipated credit deterioration.

- Enhanced Market Access: CDS provides a more liquid and efficient avenue for gaining exposure to credit risk compared to direct asset ownership, offering broader market access and increased trading flexibility.

Disadvantages

- Systemic Risk Concerns: The CDS market’s role in contributing to the spread of financial contagion poses systemic risk concerns, potentially exacerbating market instability during periods of heightened volatility.

- Moral Hazard: CDS may encourage market participants to assume undue risk by relying on the perceived safety net of these instruments, potentially resulting in reckless behaviors like excessive leverage or speculation.

- Uncovered CDS: Uncovered CDS, where protection is sought without owning the underlying debt, can intensify market volatility and amplify systemic risks.

Examples

- Single-Name CDS: These contracts will represent a specific corporate or sovereign entity.

- Index CDS: Index CDS contracts will include portfolios of reference entities, such as the CDX or iTraxx indices.

- Basket CDS: Basket CDS will include customized portfolios of reference entities.

6. Inflation Swaps

An inflation swap serves as a financial derivative instrument employed to transfer inflation risk between parties by exchanging cash flows. Under this arrangement, one party pays a fixed rate, while the counterparty pays a floating rate tied to an inflation index.

Features

- Fixed-Floating Inflation Rate Exchange: Inflation swaps entail the swapping of a fixed inflation rate for a floating inflation rate, typically tied to indices like CPI, facilitating the management of inflation-related risks.

- Principal-Based Payment Calculation: The notional amount in inflation swaps serves as the principal sum upon which the inflation-adjusted payments are computed, providing a reference point for determining cash flows.

- Risk Management Tool: Inflation swaps are utilized to hedge against inflation risk exposure or to speculate on future inflation trends, offering risk mitigation solutions in financial markets.

Advantages

- Exposure Control Mechanism: Inflation swaps afford parties the capability to control their exposure to fluctuations in inflation rates, thereby mitigating the impact of inflationary pressures on their financial positions.

- Price Certainty Provision: These swaps offer a means to secure a fixed inflation rate for a specified duration, furnishing participants with price certainty and aiding in budgeting.

- Future Inflation Positioning Opportunity: Participants can utilize inflation swaps to take a stance on the anticipated direction of future inflation.

Disadvantages

- Counterparty Risk: Similar to other OTC derivatives, inflation swaps carry counterparty risk, where the default of one party can lead to substantial losses for the other.

- Legal and Operational Risk: Inflation swaps include legal and operational risks, such as collateral management, counterparty credit assessment, and regulatory compliance.

- Liquidity Constraints: Inflation swaps, especially those tied to longer durations or specific regional indices, might face liquidity constraints, posing challenges for investors seeking swift entry or exit from positions.

Examples

- Zero-Coupon Inflation Swap: This swap involves the exchange of a fixed inflation rate for the realized inflation rate over a predetermined period.

- Year-on-Year Inflation Swap: Participants exchange a fixed inflation rate for the year-over-year inflation rate, enabling tailored risk management strategies.

- Inflation-Linked Bond Swap: In this arrangement, the cash flows of an inflation-linked bond are swapped for fixed-rate payments, offering flexibility in managing inflation exposure or optimizing investment portfolios.

7. Dividend Swaps

Dividend swaps represent financial agreements enabling investors to exchange forthcoming dividend income from a stock with another party. These contracts involve two parties, with one committing to pay the other a fixed or floating rate determined by the dividend disbursements of a designated stock.

Features

- Actual-Fixed Dividend Exchange: Dividend swaps involve the swapping of actual dividends paid on a stock or index for a predetermined fixed dividend rate, facilitating the management of dividend-related risks.

- Underlying Value-Based Calculation: The notional amount in dividend swaps represents the value of the underlying stock or index being exchanged, serving as the basis for determining dividend-related cash flows.

- Risk Management and Speculation Tool: Dividend swaps are employed to hedge against dividend risk exposure or to speculate on the anticipated future dividends of a stock or index.

Advantages

- Dividend Risk Mitigation: Participants in dividend swaps can hedge against fluctuations in dividend payments on a stock or index, minimizing the impact of dividend volatility on their investment portfolios.

- Future Dividend Positioning: Dividend swaps offer a means to speculate on the future trajectory of dividends, enabling strategic positioning based on anticipated changes in dividend levels.

- Synthetic Instrument Creation: Swaps can be utilized to create synthetic dividend-paying instruments, providing flexibility in investment strategies and portfolio management.

Disadvantages

- Risk of Diminished Dividends: If the underlying company or index decreases or suspends dividend payments, the swap purchaser may receive reduced proceeds, resulting in potential losses.

- Regulatory Uncertainty: Dividend swaps are influenced by diverse regulatory stipulations and oversight, introducing intricacy and expenses into the investment venture.

- Market Fluctuation Exposure: Dividend swaps are susceptible to market volatility, potentially causing substantial losses if the underlying assets undergo significant price fluctuations.

Examples

- Single-Stock Dividend Swap: This swap involves the exchange of actual dividends paid on a specific stock for a fixed dividend rate.

- Index Dividend Swap: Participants exchange actual dividends paid on a stock index, such as the S&P 500, for a predetermined fixed dividend rate.

- Quanto Dividend Swap: In this arrangement, a dividend swap is combined with a currency swap to manage both dividend and exchange rate risk.

8. Volatility Swaps

A volatility swap is a financial instrument that allows investors to speculate on the volatility level of an underlying asset, like a stock or index, without directly trading the asset. It functions as a contract between two parties, wherein they agree to swap the actual volatility of the underlying asset for a predetermined fixed rate during a specified timeframe.

Features

- Fixed-Realized Volatility Exchange: Volatility swaps entail swapping a predetermined fixed volatility rate for the realized volatility of the underlying asset, facilitating the management of volatility-related risks.

- Underlying Asset-Value-Based Calculation: The notional amount in volatility swaps represents the value of the underlying asset being exchanged, serving as the basis for determining volatility-related cash flows.

- Risk Management and Speculation Instrument: Volatility swaps are utilized to hedge against volatility risk exposure or to speculate on the anticipated future volatility of an asset.

Advantages

- Volatility Risk Mitigation: Participants in volatility swaps can hedge against fluctuations in the volatility of an underlying asset, limiting the impact of volatility changes on their investment portfolios.

- Future Volatility Positioning: Volatility swaps offer a means to speculate on the future trajectory of asset volatility, enabling strategic positioning based on anticipated changes in volatility levels.

- Exposure to Unique Volatility Opportunities: Swaps provide participants with exposure to the volatility of an asset that may not be readily accessible through other financial instruments, offering diversified investment opportunities.

Disadvantages

- Pricing Complexity: Valuing volatility swaps demands a profound comprehension of volatility dynamics and market pricing intricacies.

- Counterparty Risk: Like any swap agreement, there’s a possibility of counterparty default. If this occurs, the owed party may not receive payment, incurring substantial losses.

- Liquidity Risk: Volatility swaps can suffer from illiquidity, complicating finding a trading partner or exiting the contract prematurely.

Examples

- Equity Volatility Swap: This swap involves the exchange of a fixed volatility rate for the realized volatility of a specific stock or index.

- Commodity Volatility Swap: Participants will exchange a fixed volatility rate for the realized volatility of a commodity, such as oil or gold.

- Interest Rate Volatility Swap: In this arrangement, a fixed volatility rate is exchanged for the realized volatility of an interest rate, such as LIBOR or Treasuries.

9. Variance Swaps

A variance swap is a financial derivative tool enabling investors to hedge against or speculate on the variance of an underlying asset. Variance, calculated as the square of an asset’s daily returns, quantifies the extent of price deviation from its average return within a defined period.

Features

- Fixed-Realized Variance Exchange: Variance swaps involve swapping a predetermined fixed variance rate for the realized variance of the underlying asset, facilitating the management of variance-related risks.

- Underlying Asset-Value-Based Calculation: The notional amount in variance swaps represents the value of the underlying asset being exchanged, serving as the basis for determining variance-related cash flows.

- Risk Management and Speculation Instrument: Variance swaps are utilized to hedge against variance risk exposure or to speculate on the anticipated future variance of an asset.

Advantages

- Variance Risk Mitigation: Participants in variance swaps can hedge against fluctuations in the variance (volatility squared) of an underlying asset, limiting the impact of variance changes on their investment portfolios.

- Future Variance Positioning: Variance swaps offer a means to speculate on the future trajectory of asset variance, enabling strategic positioning based on anticipated changes in variance levels.

- Exposure to Unique Variance Opportunities: Swaps provide participants with exposure to the variance of an asset that may not be readily accessible through other financial instruments, offering diversified investment opportunities.

Disadvantages

- Price Spikes: Sudden, unforeseen increases in the underlying asset’s price can distort its variance, posing potential losses for the variance swap holder.

- Liquidity Risk Concerns: The variance swap market may not always exhibit sufficient liquidity, resulting in challenges in entering or exiting swap positions.

- Market Volatility Risk: Variance swaps trading may amplify market volatility if large options portfolios with dynamic delta hedging are used by market-makers to replicate swap payouts.

Examples

- Equity Variance Swap: This swap involves the exchange of a fixed variance rate for the realized variance of a specific stock or index.

- Commodity Variance Swap: Participants exchange a fixed variance rate for the realized variance of a commodity, such as oil or gold.

- Interest Rate Variance Swap: In this arrangement, a fixed variance rate is exchanged for the realized variance of an interest rate, such as LIBOR or Treasuries.

Conclusion

Financial swaps encompass a diverse array of derivative agreements that enable parties to exchange cash flows, financial instruments, or payments over a specified period. These contracts, which are highly customizable and traded over the counter, serve as indispensable tools for managing various types of financial risks and optimizing investment strategies.

Share your thoughts in the comments

Please Login to comment...