Types of Financial Aid for Students in US

Last Updated :

16 Apr, 2024

What is Financial Aid?

Financial aid will include the financial assistance provided by the government, educational institutions, or private organizations to help students pay for their education. Eligibility for availing of this will be determined by completing the FAFSA (Free Application for Federal Student Aid), and the factors considered will be citizenship, academic progress, and program enrollment. Financial aid aims to ease the financial burden of tuition costs for eligible students pursuing higher education.

Geeky Takeaways:

- Financial aid encompasses various forms of assistance provided by government entities, private firms, and educational institutions to support students in financing their higher education.

- Financial aid aims to reduce the financial burden of tuition costs for eligible students pursuing higher education.

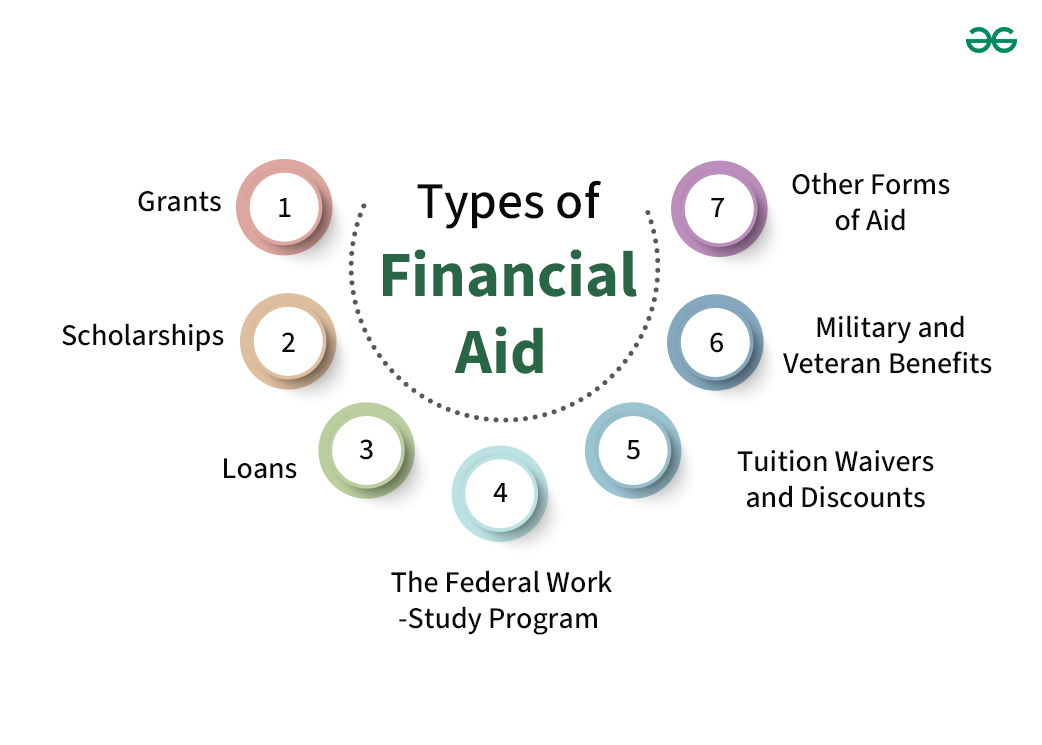

- Types of financial aid include grants, scholarships, loans, work-study programs, tuition waivers, military and veteran benefits, and other alternative assistance options.

- Eligibility for financial aid is determined based on factors such as financial need, academic performance, program enrollment, and citizenship status.

Types of Financial Aid

1. Grants

Grants represent a valuable form of financial assistance that students receive without the obligation of repayment. This funding option is highly sought-after by students seeking support for educational expenses. They are often awarded based on criteria such as financial need or academic achievement. Grants are allocated to students considering diverse factors, including disability status, school expenses, family income, and other eligibility criteria.

Features

- Need-Based Assistance: Grants are allocated based on the student’s financial situation and their capacity to afford higher education expenses.

- No Repayment Obligation: Grants differ from student loans in that they do not require repayment and provide students with financial support without accumulating debt.

- Sources of Grants: Grants are provided by a range of entities, including the federal government, state governments, and educational institutions, offering diverse opportunities for financial aid.

Advantages

- Cost Reduction: Grants offer significant financial relief for students pursuing higher education, lowering the overall expenses associated with attending college or university.

- Enhanced Reputation: Securing a grant can strengthen a firm’s reputation and credibility, attracting new supporters and collaborators drawn to the organization’s elevated standing and trustworthiness.

- Renewable Support: Many grants are renewable for multiple years, ensuring continuous financial assistance throughout a student’s academic journey.

Disadvantages

- Limited Availability: Grants are often scarce and highly competitive, with a limited number of opportunities available to applicants.

- Stringent Eligibility: Grant eligibility criteria can be rigorous, requiring students to fulfill specific prerequisites to qualify for funding.

- Incomplete Coverage: Grants may not cover all expenses related to attendance, leaving students to seek additional financial aid options to bridge the remaining gap.

Examples

- Federal Pell Grant: It is a need-based grant provided by the U.S. Department of Education, assisting undergraduate students with exceptional financial needs in funding their education.

- Federal Supplemental Educational Opportunity Grant (FSEOG): It is a need-based grant awarded by colleges and universities to undergraduate students with the most significant financial need, supplementing their educational expenses.

- State-Based Grants: These are grants offered by individual state governments, such as the California Cal Grant program, providing financial aid to eligible students pursuing higher education within the state.

2. Scholarships

A scholarship represents financial assistance provided to students to support their pursuit of further education, based on criteria like athletic prowess, diversity, academic achievement, and financial circumstances. Scholarships encompass diverse categories, including those based on college affiliations, athletic abilities, financial need, specific student demographics, creative competitions, merit, career interests, brand affiliations, and more.

Features

- Merit-Based Selection: Scholarships are commonly awarded based on the student’s academic achievements, talents, or other distinct qualifications, emphasizing merit as a criterion for eligibility.

- Variety of Providers: Scholarships can originate from distinct sources, including colleges, private organizations, universities, or individual donors, offering diverse opportunities for financial assistance.

- Diverse Selection Criteria: The criteria for selecting scholarship recipients can vary widely, encompassing factors such as athletic prowess, leadership skills, community involvement, academic excellence, or other specific attributes.

Advantages

- Financial Relief: Scholarships play a crucial role in limiting the financial burden associated with higher education, offering substantial support to students pursuing their academic goals.

- No Repayment Required: Unlike student loans, scholarships do not require repayment, offering students a significant financial advantage and limiting the long-term financial obligations associated with educational funding.

- Renewable Support: Many scholarships offer the possibility of renewal for multiple years, ensuring continuous assistance throughout a student’s academic journey and facilitating sustained educational pursuits.

Disadvantages

- Limited Availability: Scholarships are often limited in availability and highly competitive, making it challenging for students to secure funding due to the large pool of applicants vying for limited resources.

- Stringent Eligibility Requirements: Eligibility criteria for scholarships are strict, as they require students to meet specific academic, extracurricular, or demographic criteria to qualify for funding, which may restrict access for some individuals.

- Incomplete Coverage: While scholarships can significantly offset educational expenses, they may not cover the full cost of attendance, leaving students to explore additional avenues of financial aid to meet their remaining financial obligations.

Examples

- Athletic Scholarships: It acknowledge students’ outstanding athletic abilities and participation in varsity sports, providing support for student-athletes pursuing higher education.

- Talent-Based Scholarships: These honor students’ demonstrated talents in areas like art, music, or leadership, nurturing their skills and fostering their academic pursuits.

- Need-based Scholarships: These scholarships will be awarded to students with demonstrated financial need.

3. Loans

Student loans represent a form of assistance available to students to finance their education expenses, constituting borrowed funds that necessitate repayment along with accrued interest. Federal student loans comprise two primary categories: subsidized and unsubsidized. Subsidized loans entail the government covering interest charges while the student is in school, thereby offering a financial reprieve, while unsubsidized loans accumulate interest from the time of disbursement, requiring borrowers to either pay the interest while in school or let it capitalize onto the principal amount.

Features

- Repayment Requirement: Student loans necessitate repayment, with interest accruing over time, contributing to the total amount owed.

- Loan Providers: These loans can be sourced from distinct entities, including the federal government, educational institutions, or private lenders.

- Eligibility Criteria: Eligibility criteria for obtaining loans may rely on factors such as credit history, financial need, or academic performance.

Advantages

- Comprehensive Financial Coverage: Student loans offer a financial lifeline, enabling students to finance their entire educational expenses, encompassing tuition, fees, and other related costs.

- Repayment Flexibility: They provide repayment flexibility, accommodating various circumstances through options like income-driven repayment plans or deferment during financial hardships.

- Tax-Deductible Interest: The interest paid on student loans can potentially be tax-deductible, offering a financial incentive.

Disadvantages

- Debt Accumulation: The obligation to repay student loans, coupled with accumulating interest, can lead to substantial debt burdens post-graduation.

- Eligibility Challenges: The eligibility for loans may depend on creditworthiness or other financial prerequisites, potentially impeding access for certain student demographics.

- Long-Term Financial Strain: The protracted repayment period of student loans can pose a significant financial strain on borrowers in the long term.

Examples

- Federal Direct Subsidized Loans: These loans, based on financial need, have the federal government covering interest while the student is enrolled.

- Federal Direct Unsubsidized Loans: Unlike subsidized loans, interest will increase on these loans from disbursement, even during enrollment.

- Federal Direct PLUS Loans: These loans are available to parents of dependent undergraduate students or to graduate and professional degree students. They offer additional financial aid options.

4. The Federal Work-Study Program

The Federal Work-Study Program offers part-time employment opportunities to students demonstrating financial need, enabling them to earn income to offset educational expenses. Operating on a need-based framework, the program assists students financially and facilitates the acquisition of valuable work experience during their college years. This initiative serves as a means for students to contribute towards their educational costs while concurrently gaining practical skills and knowledge through employment.

Features

- Funding Sources: The Federal Work-Study program is jointly funded by the federal government and participating educational institutions.

- Job Placement: Students enrolled in the program are assigned to either on-campus or off-campus positions, with work hours tailored to accommodate their academic obligations.

- Eligibility Requirements: To qualify for this Federal Work-Study program, students should submit the FAFSA (Free Application for Federal Student Aid) form. Eligible students receive a financial aid award letter outlining their aid package, which may include work-study opportunities.

Advantages

- Professional Development: Participation in the Federal Work-Study program offers students valuable hands-on work experience, enhancing their professional skills and increasing their employability upon graduation.

- Financial Assistance: By working part-time, students can earn income to help offset educational expenses, potentially limiting their reliance on other forms of financial assistance.

- Flexibility: The program’s flexible work schedules enable students to effectively balance their employment commitments with their academic pursuits, promoting academic success.

Disadvantages

- Limited Availability: Federal work-study positions are often limited, resulting in high competition among applicants for available roles.

- Financial Coverage: While work-study earnings can assist with educational expenses, they may not fully cover all costs incurred during a student’s academic journey.

- Academic Impact: Without proper time management, the demands of work-study employment can potentially impact a student’s academic performance.

Examples

- On-Campus Employment: Students may undertake various roles within the campus environment, such as positions in the dining facilities, library, or administrative offices.

- Off-Campus Opportunities: Some students may secure work-study positions at off-campus locations, including non-profit organizations or government agencies, aligning with their academic interests.

- Institutional Initiatives: Certain colleges and universities offer their work-study programs alongside the federal program, expanding students’ opportunities for employment while pursuing their education.

5. Tuition Waivers and Discounts

Tuition waivers and discounts represent a category of financial assistance aimed at lessening the financial burden of education for students. Typically awarded by colleges or universities, these benefits serve to decrease the tuition fees incurred by students, thereby making higher education more accessible. These provisions play a crucial role in widening access to education and facilitating academic pursuits for students from diverse backgrounds.

Features

- Variety of Sources: Tuition waivers and discounts can be obtained from a range of providers, including government entities, colleges, universities, and employers.

- Eligibility Criteria: Eligibility for these benefits is determined based on factors such as academic achievement, financial need, employment status, or specific requirements set by the granting organization.

- The Extent of Coverage: The extent of the waiver or discount can vary, with some covering only a portion of tuition and related fees, while others may encompass the entire cost.

Advantages

- Cost Reduction: These benefits significantly reduce the overall expense of higher education for eligible students, making it more affordable.

- Renewable Benefits: Many waivers and discounts are renewable, providing continuous financial support throughout the student’s academic journey.

- Complementary Aid: They can be combined with other forms of financial assistance, further alleviating the financial strain on students and their families.

Disadvantages

- Limited Availability: The availability of these benefits is often restricted and highly competitive, with tight eligibility requirements that may exclude certain students.

- Supplementary Funding Needed: Despite receiving waivers or discounts, students may still require additional financial aid to cover remaining expenses.

- Incomplete Coverage: These benefits might not cover the entire cost of attendance, necessitating the pursuit of supplementary funding sources to bridge the gap.

Examples

- Institutional Tuition Waivers: These will be provided by colleges and universities as waivers for employees or their dependents.

- State or Local Government Tuition Waivers: These will be offered by government entities, including waivers for veterans or Native American students.

- Employer Tuition Assistance or Reimbursement: These shall be extended by employers as a benefit to assist employees with higher education costs.

6. Military and Veteran Benefits

Military and veteran benefits encompass a range of financial aid options accessible to active-duty service members, veterans, and their dependents, offering diverse educational support such as tuition assistance, GI Bill benefits, and scholarships for dependents. These benefits aim to facilitate access to higher education for those who have served or are currently serving in the military, as well as their family members.

Features

- Targeted Recipients: Military and veteran benefits are designed to support individuals who have served or are currently serving in the U.S. armed forces.

- Comprehensive Assistance: These benefits encompass various forms of educational aid, including tuition assistance programs for GI Bill benefits for veterans, active-duty personnel, and scholarships for dependents of service members.

- Eligibility Criteria: Eligibility for these benefits is determined based on factors such as the individual’s military service history, current status, and other specific criteria.

Advantages

- Financial Relief: Military and veteran benefits can substantially lower the financial burden of pursuing higher education by covering a significant portion if not the entire cost.

- Tailored Support: In addition to financial aid, these benefits often provide supplementary support and resources customized to meet the unique needs of military-affiliated students.

- Renewable Assistance: Many benefits, such as the GI Bill, offer renewable assistance for multiple years, ensuring ongoing support throughout the individual’s educational journey.

Disadvantages

- Limited Eligibility: Eligibility for military and veteran benefits is restricted to individuals with active or prior military service or their dependents, thereby excluding those without military connections.

- Complex Requirements: The intricate requirements and limitations associated with these benefits may impede flexibility for some students in utilizing them effectively.

- Potential Funding Gaps: Despite the benefits provided, some students may still need to seek additional financial aid, as these benefits may not cover the entire cost of attendance.

Examples

- GI Bill Variants: Examples include the Montgomery GI Bill and the Post-9/11 GI Bill, which offer educational assistance to veterans, service members, and their dependents.

- Tuition Assistance Programs: Programs like tuition assistance provide financial support to active-duty military personnel pursuing higher education while fulfilling their service obligations.

- Veteran Dependent Scholarships: These scholarships, such as the Fry Scholarship, are specifically designated for the dependents of veterans, providing them with educational opportunities.

In addition to conventional financial aid avenues, students have access to a range of alternative assistance options to support their educational pursuits. These include tuition payment plans, which enable students to spread out the cost of tuition over time, reducing immediate financial strain. Furthermore, fellowships or assistantships offer financial support in exchange for academic or research responsibilities, aiding students in covering expenses while gaining valuable experience in their field of study.

Features

- Tuition Payment Plans: These plans allow students to divide the cost of tuition and fees into manageable installments over a specified period, typically without accruing interest.

- Crowdfunding Campaigns: Through online platforms like Kickstarter or GoFundMe, students can solicit funds from individual donors to support their educational expenses.

- Employer Tuition Assistance: Many employers offer financial support or reimbursement programs to assist employees in pursuing higher education.

Advantages

- Supplementary Funding: Alternative forms of aid provide additional financial resources beyond traditional options such as scholarships, grants, and loans.

- Flexible Payment Options: They offer more flexibility in payment arrangements, accommodating varying financial circumstances and easing the burden of upfront costs.

- Combinable Aid: These alternatives can often be combined with other forms of financial assistance, further reducing the financial burden on students.

Disadvantages

- Limited Availability: The availability and eligibility criteria for these alternatives may be restrictive or competitive, limiting access for some students.

- Additional Commitments: Some options, like fellowships or assistantships, may require students to take on additional responsibilities, potentially affecting their academic performance.

- Incomplete Coverage: These alternatives may not cover the entirety of educational expenses, necessitating the exploration of additional financial aid sources.

Examples

- Tuition Payment Plans: These plans are offered by many educational institutions and allow students to spread tuition payments over time.

- Employer Tuition Assistance: Many firms provide financial support or reimbursement for employees seeking to advance their education.

- Fellowships and Assistantships: Graduate students may receive financial aid in exchange for research or teaching duties, though these often require time commitments.

Conclusion

Financial aid encompasses various forms of assistance provided by private organizations, government entities, and educational institutions to support students in financing their higher education. From grants and scholarships to loans, work-study programs, and tuition waivers, these resources aim to alleviate the financial burden of tuition costs for eligible students. By providing diverse avenues of financial support, financial aid enables students from various backgrounds to pursue their academic aspirations.

Share your thoughts in the comments

Please Login to comment...