Choosing the right accounting software is a major decision for any business. The right platform will streamline your financial operations, save time, deliver reliable data for decision-making, and scale alongside your growth. QuickBooks and NetSuite are both top platforms, but determining and picking the best fit can be tough.

QuickBooks, with its user-friendly interface, accessibility, and budget-friendly pricing, is a popular choice for businesses starting out. NetSuite is often favored by larger businesses for its advanced features, robust reporting, customization capabilities, and integrated approach to managing various aspects of a business beyond just finances.

This article is going to help you make a important and best decision for your business, whether to choose QuickBooks or NetSuite. We’ll cover their strengths, weaknesses, and key differences based on features and prices to help you see which aligns best with your business’s everyday needs and future ambitions. By the end, you’ll have the clarity to confidently choose the software that will truly move your business forward.

What is QuickBooks?

Intuit QuickBooks helps businesses of all sizes manage their finances. From tracking income and expenses to creating invoices and generating reports, it offers a variety of tools. QuickBooks offers both a desktop version (installed on your computer) and a cloud-based QuickBooks Online option that can be accessed from anywhere.

QuickBooks remains a popular choice for its ease of use and affordability. It’s a good fit for businesses prioritizing streamlined accounting basics. If your needs become more complex or your team grows rapidly, you might find its limitations frustrating.

Key Features

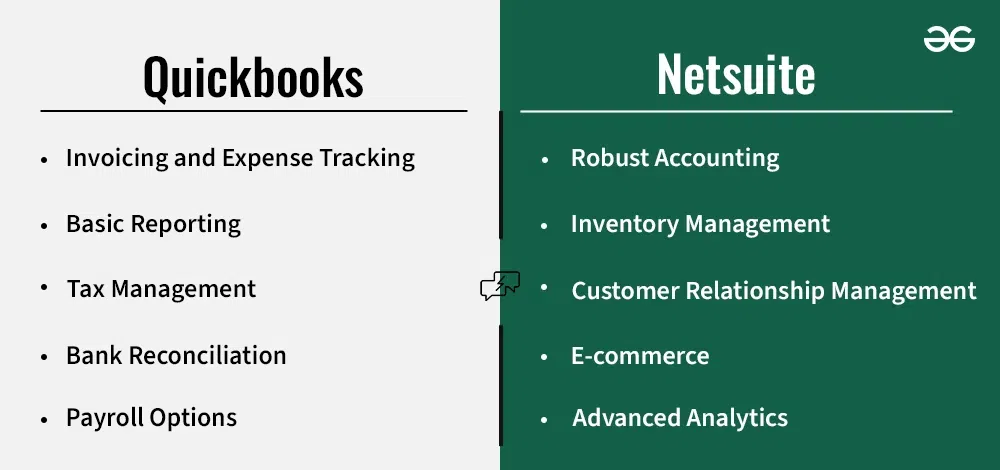

- Invoicing and Expense Tracking: Easily create and send invoices, track bills, and manage vendor payments.

- Basic Reporting: QuickBooks offers standard financial reports like profit and loss (P&L), balance sheets, and cash flow statements.

- Tax Management: Simplified tools to Organise, calculate and file sales tax.

- Bank Reconciliation: Connect your bank accounts to automatically match transactions and keep your books accurate.

- Payroll Options: Add-on payroll services allow you to process payroll directly within the software.

Pros and Cons

|

Pros

|

Cons

|

- User-friendly interface with minimal training needed

- Affordable pricing plans (QuickBooks Online starts at $15/month for the first three months)

- Widely used, making it easy to find support and accountants familiar with the software

- Unlimited billable clients (in certain plans)

- Easy to sign up without needing to speak to sales

- Online version allows access from anywhere

- Hundreds of app integrations available (for QuickBooks Online)

|

- Can become sluggish with large datasets or many users

- Limited inventory management capabilities

- Advanced reporting or customization may require third-party tools

- Most plans charge extra for additional users

- Payroll is an additional cost

- Limits on how many users can access data simultaneously (more restrictive in Desktop versions)

|

What is NetSuite?

NetSuite (from Oracle) is a cloud-based Enterprise Resource Planning (ERP) system. It goes far beyond basic accounting, designed to be an all-in-one business management solution. Alongside financials, NetSuite includes modules for customer relationship management (CRM), e-commerce, inventory management, global business management and more. It aims to streamline operations and centralize data for powerful insights.

NetSuite excels when your business needs outstrip traditional accounting software. It’s particularly powerful for companies with complex inventory, international operations, or those looking to unify multiple business functions into a single platform. However, understand that this power comes with a higher price tag and the likelihood of needing dedicated implementation support.

Key Features

- Advance Accounting: Covering invoicing, expense management, financial reporting, tax compliance, and global accounting rules for multinational businesses.

- Inventory Management: Real-time inventory tracking, demand planning, and warehouse management tools.

- Global Business Management: Manage complex financials with support for multiple subsidiaries, currencies, tax regulations, and streamlined consolidation.

- CRM: Customer relationship management tools to manage sales pipelines, marketing campaigns, and customer support.

- E-commerce: Integrated online storefront and order management for seamless online sales.

- Advanced Analytics: Customizable dashboards, reporting, and business intelligence tools.

Pros and Cons

|

Pros

|

Cons

|

- All-in-one solution replacing fragmented software systems

- Handles complex accounting and multi-currency needs with ease

- Highly scalable for rapidly growing businesses

- Real-time data and insights for better decision-making

- Cloud-based accessibility and flexibility

|

- Complex setup and potential for a steep learning curve

- Pricing lacks transparency, requiring a custom quote

- Overkill for businesses with simple accounting requirements

- Ongoing implementation and support costs

|

Difference between Quickbooks and Netsuite

On the basis of Features:

On the basis of features, we can have the following points of distinctions:

| Feature |

QuickBooks |

NetSuite |

| General Ledger |

QuickBooks is simpler if straightforward reporting is sufficient. |

NetSuite offers more customization here, useful for complex or international accounting needs. |

| Accounts Receivable |

QuickBooks offers invoicing and tracking payments. |

NetSuite offers more automation, allowing you to set payment terms, streamline billing, and manage collections processes. |

| Accounts Payable |

QuickBooks keeps things simpler for managing vendor bills. |

NetSuite provides greater automation with approval workflows and the ability to handle payments in multiple currencies (important for international operations). |

| Cash Management |

QuickBooks streamlines tracking cash flow and reconciling bank accounts. |

NetSuite adds real-time visibility and forecasting for better financial planning. |

| Inventory Management |

QuickBooks offers Basic tracking Inventory, in real time, |

If inventory is core to your business, NetSuite’s real-time tracking, purchase order management, and multi-location capabilities are a huge advantage over QuickBooks. |

| Project Profitability |

QuickBooks provides project tracking that allows your to track project profitability, cost, and revenue. |

NetSuite excels here for businesses heavily focused on projects, providing automated tracking and tools to manage profitability on a per-project basis. |

| Tax Management |

QuickBooks is less customizable, but still covers the basics like tax calculation tools. |

NetSuite’s tools are more robust for businesses with complex tax needs, offering automated tax calculations and tax schedule management. |

|

Fixed Assets Management

|

QuickBooks does not provide fixed assets management.

|

Only NetSuite provides dedicated tools to track and manage depreciation of assets like equipment or buildings over time.

|

| Payroll |

QuickBooks has built-in payroll (with added costs for some features). |

NetSuite can be integrated with its SuitePeople Payroll system or third-party providers. |

| Batch Invoices and Expenses |

QuickBooks makes it easy to create and send multiple invoices or expense reports at once |

NetSuite offers this through a separate paid add-on. |

On the Basis of Pricing and Value

QuickBooks’ strength lies in its upfront pricing. There plans starts at $30/month. Its tiered plans make it easy to estimate costs based on your team size and the features you need. However, this model has limits as your business grows more complex. NetSuite uses custom quotes that it estimated to be started at $10,000/per year or more – this might seem daunting at first. Yet, it’s designed for scalability. Instead of hitting a feature ceiling and paying for various add-ons, NetSuite can often streamline things within its customizable structure.

Quickbooks vs Netsuite Pricing

|

|

Quickbooks

|

|

|

|

Netsuite

|

|

Plans

|

Simple Start

|

Essentials

|

Plus

|

Advanced

|

Offers Custom Plans

|

|

Price

|

$30/month

|

$60/month

|

$90/month

|

$200/month

|

Custom

|

|

Users

|

1

|

3

|

5

|

25

|

Custom

|

|

Sales Channel

|

1

|

3

|

All

|

All

|

Custom

|

|

Bill Management

|

Yes

|

Yes

|

Yes

|

Yes

|

Custom

|

|

Multiple Currencies

|

No

|

Yes

|

Yes

|

Yes

|

Custom

|

|

Inventory

|

No

|

No

|

Yes

|

Yes

|

Custom

|

|

Workflow Management

|

No

|

No

|

No

|

Yes

|

Custom

|

Support and Ease of Use

NetSuite’s power comes with a steeper learning curve. They offer training and support, but it will likely take more investment to get your team up to speed compared to QuickBooks. QuickBooks advantage its intuitive design and readily available support make it a great choice for those prioritizing immediate usability, especially if your accounting team is small.

Quickbooks or NetSuite: Best Choice for Your Business

Choosing accounting software isn’t a one-size-fits-all decision. The “best” choice depends heavily on your business current size, complexity, goals and where you are headed. Let’s understand some key factors to consider:

- Business Size Factor: Generally, small businesses with straightforward accounting needs and limited staff will grow with QuickBooks. But, if you are approaching the upper limits of the software (in terms of users, transactions, etc.), it’s time to start seriously looking at NetSuite.

- Complexity and Customization: Complex inventory management across locations? Do you need reports QuickBooks can’t provide? If so, NetSuite’s power and flexibility will be essential.

- Growth: If your growth trajectory is explosive, NetSuite can often be a better long-term investment. Constantly outgrowing software and needing workarounds becomes increasingly inefficient.

- Beyond Just Accounting: Do you expect centralizing sales, project management, or e-commerce within your financial system? NetSuite’s strength lies in being a true all-in-one business platform Solution.

Note: Think about where your business wants to be in a year, or three years down the road. Choosing software that accommodates and supports that growth is a smart strategy.

|

QuickBooks Best For?

|

NetSuite Best For?

|

- Startups, Small Businesses and solopreneurs

- Businesses desiring easy-to-use accounting software

- Organizations prioritizing affordability and quick setup

- Companies with straightforward accounting needs

|

- Rapidly growing companies

- Businesses with international operations

- Companies with complex accounting needs (multi-currency, advanced reporting, etc.)

- Businesses requiring extensive inventory management.

- Organizations desiring a single platform for Accounting, CRM, E – Commerce and more.

- Robust platform adapts as your business scales.

|

Established Family Business

Your company has been around for decades, has 30- 40 employees, and uses QuickBooks primarily for basic accounting and payroll. Operations are relatively straightforward, with no immediate plans for major expansion or new product lines.

While NetSuite is impressive, it’s likely overkill in this case. Staying with QuickBooks and potentially adding a few specialized third-party tools (if needed) is probably the most cost-effective option.

E-Commerce Expansion

You run a successful e-commerce store on a separate platform and use QuickBooks for accounting. You’re now considering launching your own website with integrated shopping and order fulfillment but you have a small team.

NetSuite’s e-commerce capabilities make it compelling here. It can streamline order management, inventory syncing, and unify your financials all in one system. While there’s a learning curve, it positions you well for further e-commerce growth.

Freelance/Solopreneur Start

You’re a freelance graphic designer or consultant starting your own business. You need to track income, expenses, generate invoices, and manage tax basics. Your work volume is manageable and you have no employees.

QuickBooks is ideal here. It provides the essentials without overwhelming you with features you won’t use. The focus should be on getting up and running, and QuickBooks’ ease of use is a significant advantage in this stage.

Non-Profit with Budget Constraints

You run a small non-profit with limited funding and rely on a mix of grants and donations. Your accounting needs center around tracking restricted funds, project expenses, and generating reports for donors.

QuickBooks often fits non-profit needs well and they may even qualify for discounted subscription rates. NetSuite’s power is usually not necessary in this case, and the budget savings of QuickBooks can be put towards programs.

NetSuite and QuickBooks Alternatives

While NetSuite and QuickBooks are major players, they’re not the only options. Depending on your business needs or if you are looking for NetSuite and QuickBooks alternatives, here are 8 alternatives that you need to Know:

- Zoho Books

- FreshBooks

- Xero

- Quicken

- Sage Intacct

- Microsoft Dynamics 365 Business Central

- Odoo

- Acumatica

Conclusion

NetSuite and QuickBooks are both great accounting tools, but the best fit for your business depends on your specific business needs. If streamlined accounting and affordability are your top priorities, QuickBooks is a wise choice. For complex operations, international reach, or wanting an all-in-one business platform, NetSuite’s power and scalability are worth considering. Always remember, right software will simplify your finances and boost your business growth!

Quickbooks vs Netsuite FAQs

NetSuite vs. QuickBooks: What Sets them Apart?

NetSuite offers a wider array of advanced features for inventory management, CRM, e-commerce, and enterprise-level reporting. QuickBooks focuses on core accounting essentials. NetSuite is built to handle growing businesses with complex needs. QuickBooks can become limiting if your transactions, users, or reporting requirements increase drastically. NetSuite provides more flexibility for customizing workflows and reports to suit your specific business processes.

NetSuite vs. QuickBooks: The Right Fit for Your Business

Consider QuickBooks if:

- You’re a small business or startup with basic accounting needs

- User-friendliness and a quick learning curve are top priorities

- Your budget is a primary concern

Consider NetSuite if:

- You manage complex inventory or multinational accounting

- Your business is growing rapidly or has international ambitions

- You want to unify sales, project management, etc., with your financials

NetSuite vs. QuickBooks: Which is More Budget-Friendly?

QuickBooks wins with its fixed monthly pricing. NetSuite’s custom quotes make it less predictable. Consider the cost of workarounds, add-ons, and potential staff time savings as your business scales. NetSuite may be a better investment in the long run if its features truly meet your needs.

NetSuite vs. QuickBooks: Which is Easier to Learn?

QuickBooks wins here with its intuitive interface. NetSuite offers more features, which inherently makes it more complex. Plan for a longer onboarding process and the potential need for dedicated training with NetSuite.

Share your thoughts in the comments

Please Login to comment...